MicroStrategy’s preferred share strategy is drawing fresh attention this week as STRC once again approaches the $100 mark.

The move revives memories of early November when the stock held par for four trading days and generated roughly $100 million in ATM sales.

How STRC Preferreds Let MicroStrategy Grow Bitcoin Holdings with Minimal Dilution

Investors and analysts are closely watching as the Strategy leverages its STRC preferreds to accumulate Bitcoin. This strategy could generate substantial gains for shareholders while maintaining minimal common share dilution.

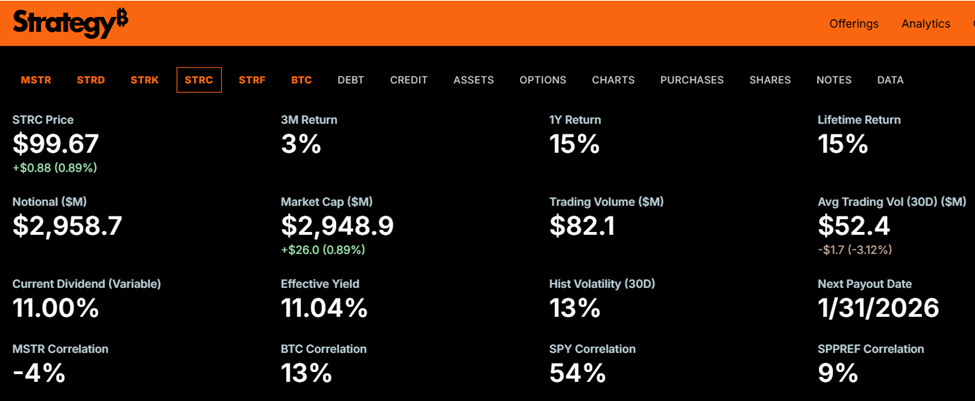

Strategy’s STRC Performance. Source: MicroStrategy Website

“If this BTC price action holds, $STRC will likely be bumping up against $100 for the next nine trading days. Last time $STRC hit par was early November for about four trading days. Resulted in ~ $100M in ATM sales. Amplified Bitcoin is ready to roar,” wrote crypto strategist Jeff Walton, highlighting the significance of the current price action.

His comments reflect the potential for repeated ATM capital raises at favorable premiums, providing MicroStrategy with additional firepower to grow its Bitcoin holdings.

The STRC mechanism is effectively a leveraged Bitcoin play. Shareholders benefit from BTC appreciation while exposure is managed through structured preferred issuance.

With STRC at $100, MicroStrategy appears positioned to repeat the success of early November’s ATM. This could strengthen its Bitcoin balance sheet and maintain investor interest, indicating a firm bullish stance.

“Strategy sells $100K of STRC, yielding 11% and buys 1 BTC at $100K. It now has an annual dividend obligation of $11,000. Five years pass; Bitcoin rises to $ 1 million. MSTR now holds $1 million of BTC, but has paid $ 55,000 to service the STRC dividend. That’s an $845K gain to MSTR shareholders ($900K capital gain – $55K of dividends = $845K),” explained Mark Harvey, a crypto finance analyst.

Harvey emphasizes that this strategy allows MicroStrategy to grow its Bitcoin holdings with minimal common-share dilution. At the same time, it rewards shareholders if BTC outperforms the 11% dividend rate.

Upside Risk, Not Downside: Why Bitcoin’s Rally Drives MSTR Strategy

Meanwhile, Jeff Dorman, CEO of Arca, cautioned that investors may be focusing on the wrong risks, remarks that come amidst MSCI exclusion fears.

“People are worried about the wrong MSTR risk—getting delisted by MSCI—not a big deal (marginally bad for stock, irrelevant for $BTC). BTC crashing—irrelevant for MSTR (they will never be a forced seller. 2+ years of cash & no covenants forcing sales). The biggest risk is actually BTC screaming higher, and MSTR not budging,” wrote Dorman.

According to Dorman, if Strategy’s MSTR stock stops tracking BTC and trades way below mNAV, then the story is over.

“Can’t raise via ATM if mNAV way below $0, and would have to consider selling BTC to buyback stock,” Dorman added.

This insight flips the typical risk narrative, suggesting that it is not Bitcoin’s decline but an inability to match Bitcoin’s upside that could limit MSTR’s strategy. Therefore, the upside may be tangible for bullish investors as Strategy stock rises 5%.

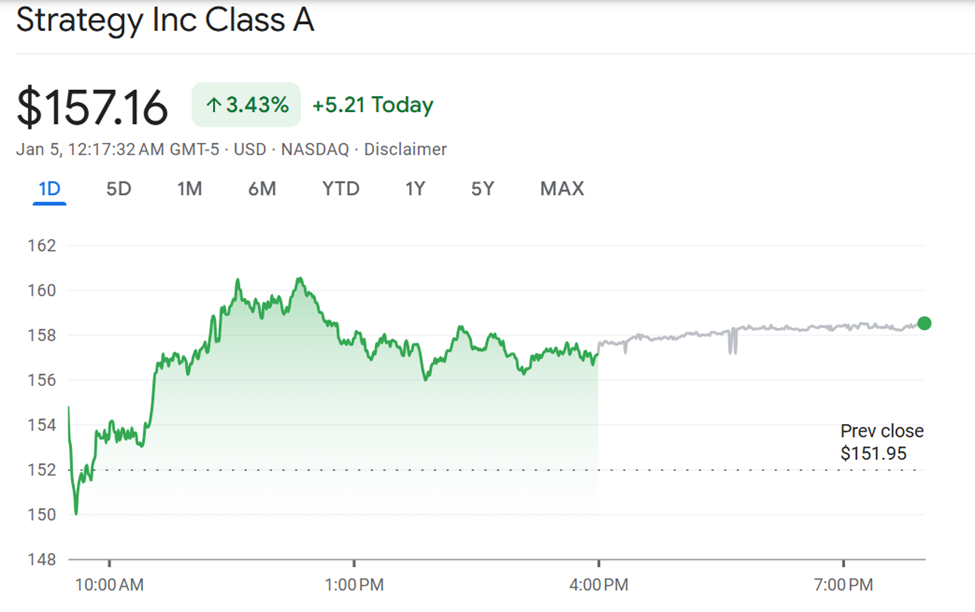

Strategy (MSTR) Stock Performance. Source: Google Finance

“Strategy up 5% overnight. What’s funny is that Saylor can literally take this level of premium handed to him, from one trading session, and raise close to enough cash to pay the dividends for an entire year,” stated Adam Livingston.

Against this backdrop, Livingston says it may be the prime time to accumulate MSTR, with his remarks highlighting how volatility and preferred share premiums can be harnessed to generate cash for dividends and reinvestment without forcing sales of Bitcoin.