Whale trades are returning as the main influence on exchanges. Inflows and activity point to the engagement of large-scale traders, rather than retail investors.

Whale activity and influence on exchanges have increased to a 10-month peak. Overall, the whale activity trend has emerged in place of retail interest.

The expansion of whale influence peaked close to a 10-month high, just as the crypto market started a tentative recovery in the new year.

For all exchanges, the BTC exchange whale ratio climbed to 0.504, a level not seen since March 2025. The ratio means whales are potentially putting selling pressure on BTC, and increasing the supply of available reserves.

The whale metric takes into account the top 10 inflows relative to total exchange deposits. In January, the metric had a sharp increase, signaling the entrance of large market players. Historically, moves such as those have emerged as a source of selling pressure.

The inflows coincided with a recovery for BTC above $92,000. The coin movement is happening on all exchanges and is not an isolated event.

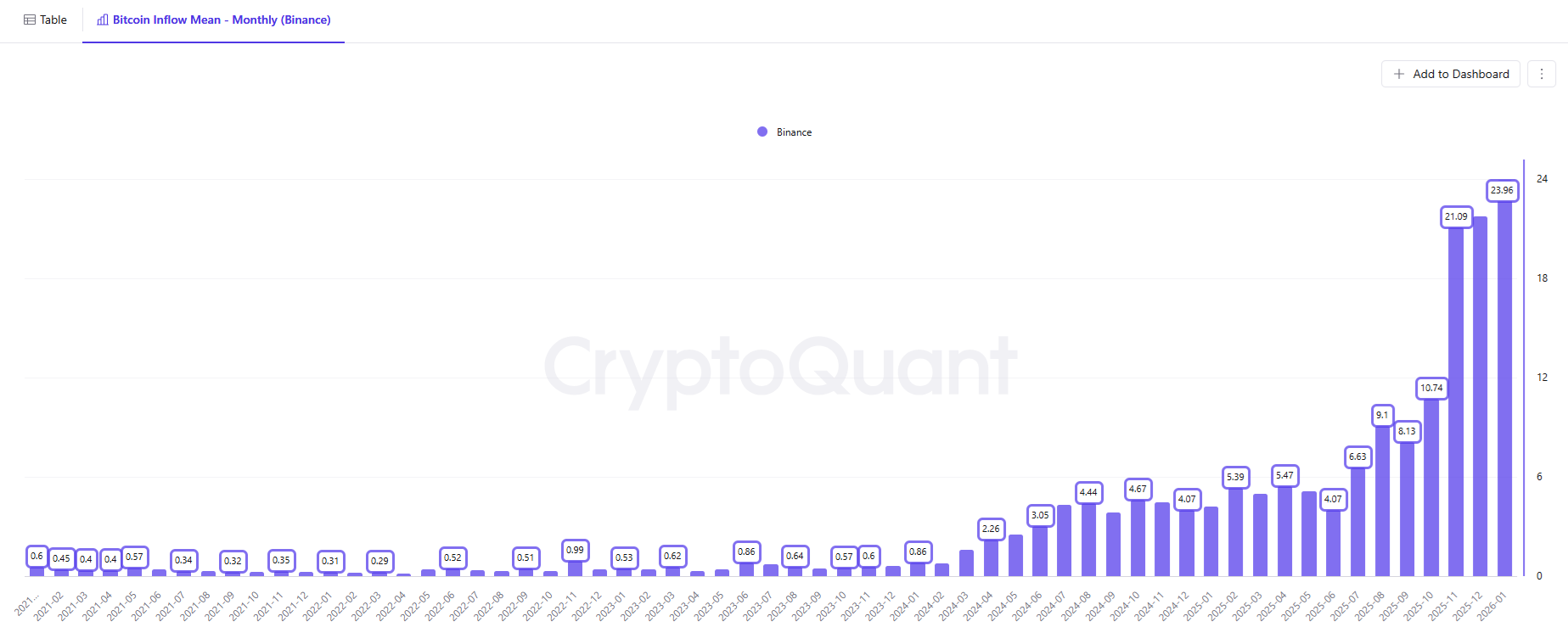

Binance consolidated whale traffic

Binance remained the center of crypto inflows, now holding over 71% of stablecoin deposits. The exchange also draws in BTC deposits, with native BTC remaining one of the most active assets.

The exchange is also showing a trend of growing mean inflows, signaling the general prevalence of larger players. Binance is now the target of large-scale whale deposits. The inflows accelerated after the launch of multiple ETFs, signaling the exchange may be one of the trading venues for the funds.

Whale activity may also signal an attempt to use the exchange’s liquidity and take profits during the short-term rallies. While Binance has been a retail venue, now the main centralized exchange has transformed into a hub for large players. Retail has moved to other platforms in Binance’s ecosystem, especially in-wallet activity and decentralized trading.

Does whale activity signal BTC risk?

Increased BTC whale activity may be a cautionary flag, especially as BTC returned to bullish momentum. Whales have taken profits near local market tops, and may be preparing to sell if BTC breaks out higher.

The presence of whales may create price resistance for the leading coin. Other metrics may indicate better readiness for a rally, as BTC is also showing signs of reaching a local low.

The current exchange whale ratio increase recalls previous selling periods, including the summer of 2025. Whales also moved in right after the October liquidation event, aiming to take profits before BTC had a more significant slide.

Conditions may quickly shift on the BTC market, as there are also signs that whales are buying more coins through Binance.

BTC is still showing signs of being in a bear market after a 30% cycle drawdown, but accumulation continues into new wallets, treasuries, and ETF inflows.

Join Bybit now and claim a $50 bonus in minutes