Shiba Inu (SHIB) has ridden a fresh wave of speculative buying this week, with the token jumping nearly 20% while the broader meme coin sector surged.

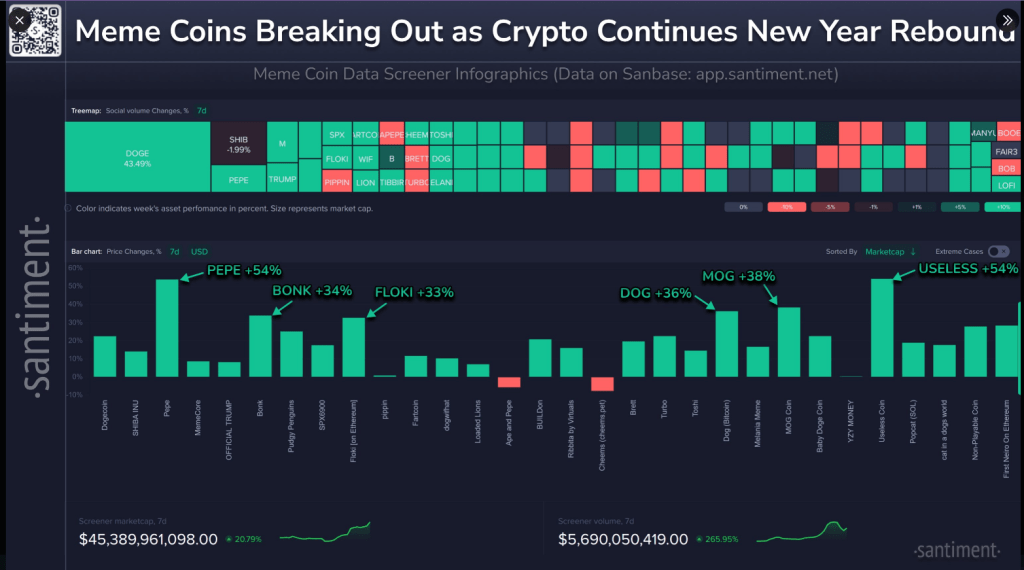

According to Santiment, total meme coin valuation rose by about 23% over the period as traders piled back into higher-risk tokens.

Trading volumes jumped from $2.16 billion to roughly $8.6 billion, a whopping increase that shows how fast money rotated into this corner of the market.

Supply Concentration Raises Eyebrows

Reports have disclosed that supply remains highly concentrated among a handful of wallets. The top 10 holders control over 60% of SHIB’s maximum supply, which equals around 1 quadrillion tokens.

Those wallets together hold about 630 trillion SHIB. Based on Santiment’s figures, the official burn wallet alone holds roughly 40% of the total supply, a stake valued at over $3 billion. This kind of concentration can magnify price swings if large holders move coins onto exchanges or sell.

Technical Setup Points To A Test

Analyst Charting Guy flagged the token’s weekly chart as “looking good” in a January 4 tweet, noting a strong weekly candle that closed up 22%. Based on reports, SHIB started 2026 at $0.000006904 and has since pushed higher.

The meme coin briefly traded above $0.0000093 before a pullback and is currently around $0.000008766. Year-to-date gains sit near 32% and the token was up 5.14% over the past 24 hours and 17.31% over the last week.

Charting Guy’s chart shows SHIB approaching the tip of a long-running descending trendline that traces back to a high of $0.0000334 in December 2024. A break above that line would raise the chance of a larger move higher.

Other tokens have also posted big moves. Dogecoin recorded about a 20% rise while Pepe surged roughly 65% over the same span. The group’s sharp gains came as speculative interest accelerated and traders chased short-term returns.

Market Volume And Trader Behavior

Santiment’s data highlights that trading activity spiked dramatically, signaling a swift return of hot money to meme coins. The jump from $2.17 billion to $8.7 billion in daily traded value shows more participants are active and willing to take bigger risks.

Based on the mix of heavy supply concentration and a crowded technical setup, Shiba Inu’s path could widen in either direction. A decisive breakout above the descending trendline might extend last week’s rally, while heavy selling from large wallets could trigger sharp pullbacks.

Featured image from Gemini, chart from TradingView