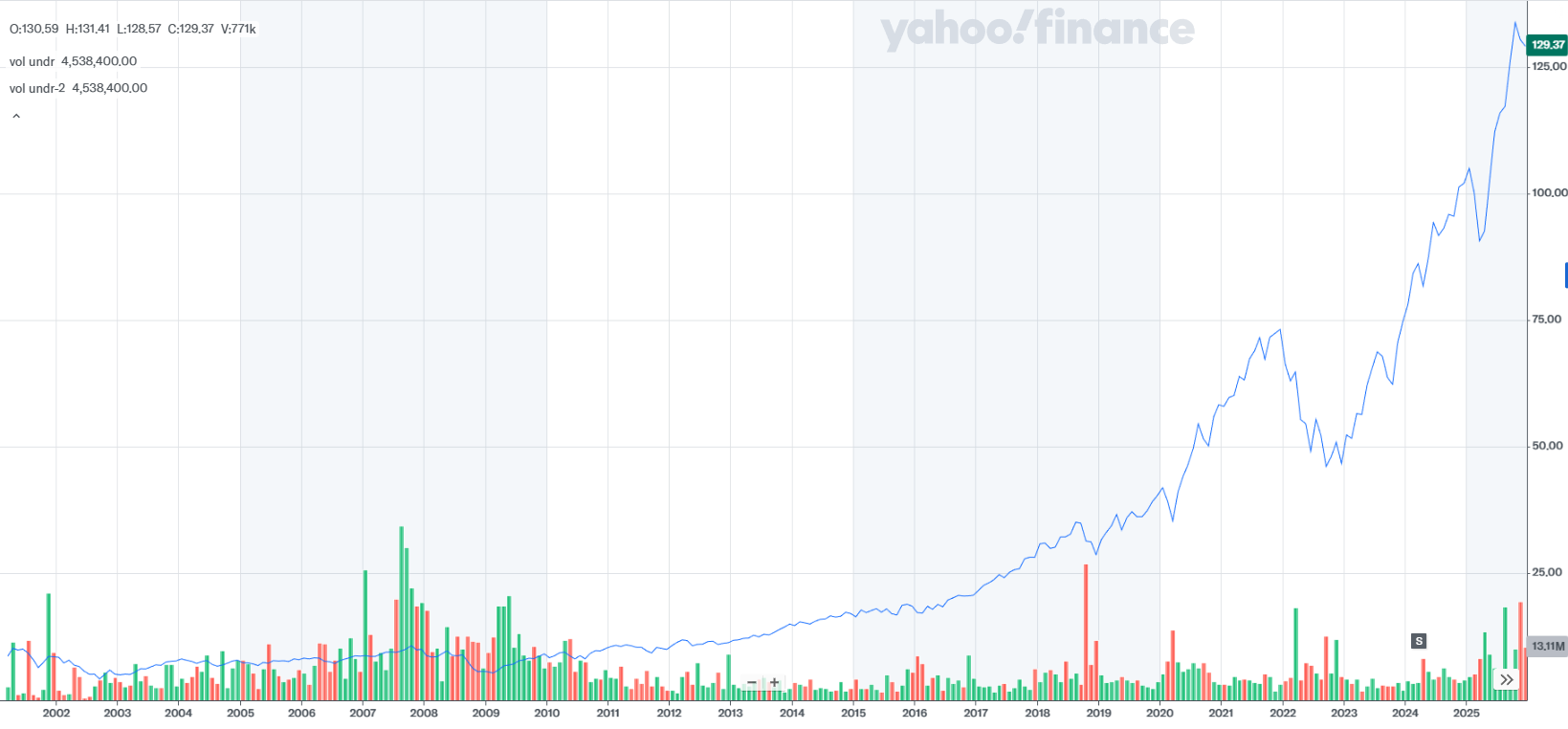

A technology-focused exchange-traded fund managed by BlackRock has quietly delivered one of the most consistent records in U.S. equity markets.

The iShares Expanded Tech Sector ETF has outperformed the S&P 500 every year since 2001, spanning multiple recessions, tech crashes, and aggressive interest-rate cycles.

Key Takeaways

The iShares Expanded Tech Sector ETF has beaten the S&P 500 every year since 2001.

Nvidia, Microsoft, and Apple are the fund’s largest drivers of returns.

Concentration in tech leaders has delivered strong long-term compounding.

Now approaching $9 billion in assets under management, the fund’s long-term performance underscores how sustained exposure to market-leading technology companies has compounded into outsized returns over more than two decades.

Built around the dominant forces in technology

Rather than tracking the broader market, the ETF is heavily weighted toward mega-cap companies that have defined successive waves of technological change. Its largest holdings include Nvidia, Microsoft, and Apple, reflecting strong exposure to artificial intelligence, cloud infrastructure, and platform-based ecosystems.

These firms have not only survived multiple market downturns but have expanded their influence across industries, helping stabilize the ETF during periods of volatility.

Heavy exposure to the semiconductor cycle

Chipmakers play a central role in the fund’s construction. Alongside Nvidia, significant allocations to Broadcom and Advanced Micro Devices tie the ETF’s performance closely to global demand for computing power.

This positioning has benefited from rising investment in data centers, AI workloads, and high-performance chips, turning semiconductor leadership into a key driver of long-term returns.

Capturing digital advertising, media, and data analytics

The ETF also reflects the evolution of the digital economy. Exposure to both share classes of Alphabet anchors the portfolio in online search and advertising, while positions in Meta Platforms and Netflix track shifts in consumer attention and media consumption.

Meanwhile, the inclusion of Palantir Technologies highlights growing demand for large-scale data analysis across enterprises and governments.

Why long-term concentration has paid off

The ETF’s track record suggests that its success has come less from tactical trading and more from holding companies that compounded earnings and market share over time. Even during deep technology sell-offs, the fund has historically rebounded faster than broader indexes, supported by strong balance sheets and durable business models.

As investors look ahead to the next phase of market leadership, the iShares Expanded Tech Sector ETF offers a clear example of how concentrated exposure to structural technology winners can outperform traditional benchmarks across full market cycles.