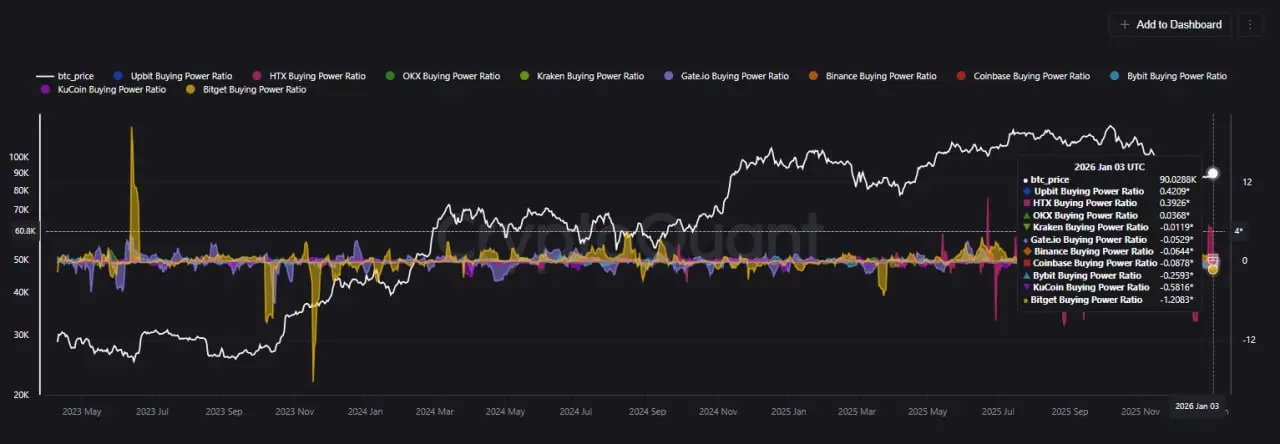

Crypto exchanges are struggling with weak buying power. Data from CryptoQuant, a crypto analytics platform, revealed on January 4 that only OKX (+0.001), Kraken (+0.004), and Upbit (+0.062) showed positive December monthly averages out of the ten top exchanges.

The remaining seven all showed a negative buying power ratio. Bitget showed the lowest buying power ratio of -1.2083. On the favorable buying power ratio. Upbit exchange showed the highest positive buying power ratio of 0.4209.

Buying power weakens as regional capital splits

On-chain data revealed that Upbit barely sustained positive buying strength at 0.4209, while Coinbase advanced recorded -0.0878, and Kraken was near-neutral at -0.0119. In December, regional capital patterns showed divergence. Although there has been a slight improvement in the buying power ratios, deployment is still insufficient to create strong convictions.

As of January 3, Binance posted a modest increase in the buying power ratio from -0.093 in late December to 0.064. Binance recovered in late December, rising from -0.277 to positive 0.059 before falling.

In the month, the weekly decline reached a peak of -0.200 on December 21 before turning around.

CryptoQuant revealed that professionals are lowering exposures rather than increasing positions despite Bitcoin stabilizing at $90,000.

A CryptoQuant expert clarified that the buying power ratio is used to compare the velocity of BTC withdrawals with stablecoin capital inflow. The analyst further explained that the negative buying power ratios indicate that inflow capital is leaving faster than it is arriving.

Stablecoin saw net inflows of $436 million and outflows of $3.7 billion in December of last year, yielding a ratio of 0.117. The ratio of 0.117 was the first positive result since early December, despite being much below the 1.0 level, which indicates a true accumulation zone.

The 30-day ratio remained at -0.126 level. At the -0.126 level, stablecoins experienced $1.96 billion in withdrawals compared to $15.6 billion in BTC withdrawals. Over different periods, the same weakening ratio was seen. In a period of 365 days, the weakening ratio remained at 0.067, and 90 days at 0.105.

Binance saw a mean monthly inflow of 21.7 BTC last month. The monthly inflow has risen from 0.86 in early January 2024, two years ago. The average size of each deposit has increased by 34 times.

Average BTC per incoming transaction metrics revealed that whales are now more active on Binance.

Exchange Bitcoin reserves decrease as consolidation rises

The CryptoQuant data revealed that there has been professional consolidation on leading exchanges and a slight supply reduction at the same time.

On January 4, CryptoQuant reported how exchange reserves movements reflect a comparable pattern of supply concentration, with BTC increasing its move onto top-tier platforms. CryptoQuant analyzed that Coinbase gained while the exchange Bitcoin reserves dropped by 6,650 coins weekly.

The exchange Bitcoin reserves dropped by $612 million as a result of a 6,650 coin decline. Seven out of ten leading exchanges had outflows, according to on-chain statistics, resulting in a net loss of 0.293%. The 0.293% decline indicates a modest tightening of supply that sustains a long-term positive structure without indicating an immediate effect on pricing.

CryptoQuant revealed that Coinbase reported a 1,648 BTC increase by the end of last month. Binance saw a 4,684 BTC absolute decline. At 3,872 BTC, Kraken experienced the second-largest absolute decrease.

Smaller exchanges like KuCoin and Gate.io experienced weekly drops of 3.59% and 3.66%, respectively.

Total exchange reserves are currently at 2.27 million BTC worth $209 billion. Binance, Coinbase, and Kraken are the top 3 exchanges that control almost 82.7% of the total exchange reserves concentration. Coinbase and Binance have structural dominance with a combined reserve of 65.4%.

Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.