ZCash (ZEC) holders have started unshielding coins. The ZEC vaults are emptying out, potentially signaling an exit from privacy assets.

The previous trend of shielding ZEC tokens in high-privacy vaults reversed in the past weeks. Around 4.86M ZEC remain shielded, but some of the assets were quickly withdrawn.

The value of shielding ZEC was supposed to bring a new era of privacy in decentralized finance. The rapid rise in shielding coincided with last year’s ZEC rally, which brought the asset back to levels not seen since 2018.

ZEC whale unshields over 1% of the supply

In early January, a previous shielded holder removed over 200K ZEC, valued at over $100M, from the highest-security vault of ZCash.

The whale’s holdings are still sitting idle and are now more traceable. The whale used a brand-new wallet with no other on-chain interactions or history. The whale previously shielded 1 ZEC as a test.

The withdrawals from the high-privacy Orchard pool also follow a diminished supply in the Sprout and Sapling pools. Overall, the rush to shield more ZEC and use it as a DeFi asset has diminished.

The whale’s ZEC can now be traded or used as a non-privacy asset, or shielded again if needed. The whale’s move also created concerns for potential selling pressure.

ZEC expansion slows down

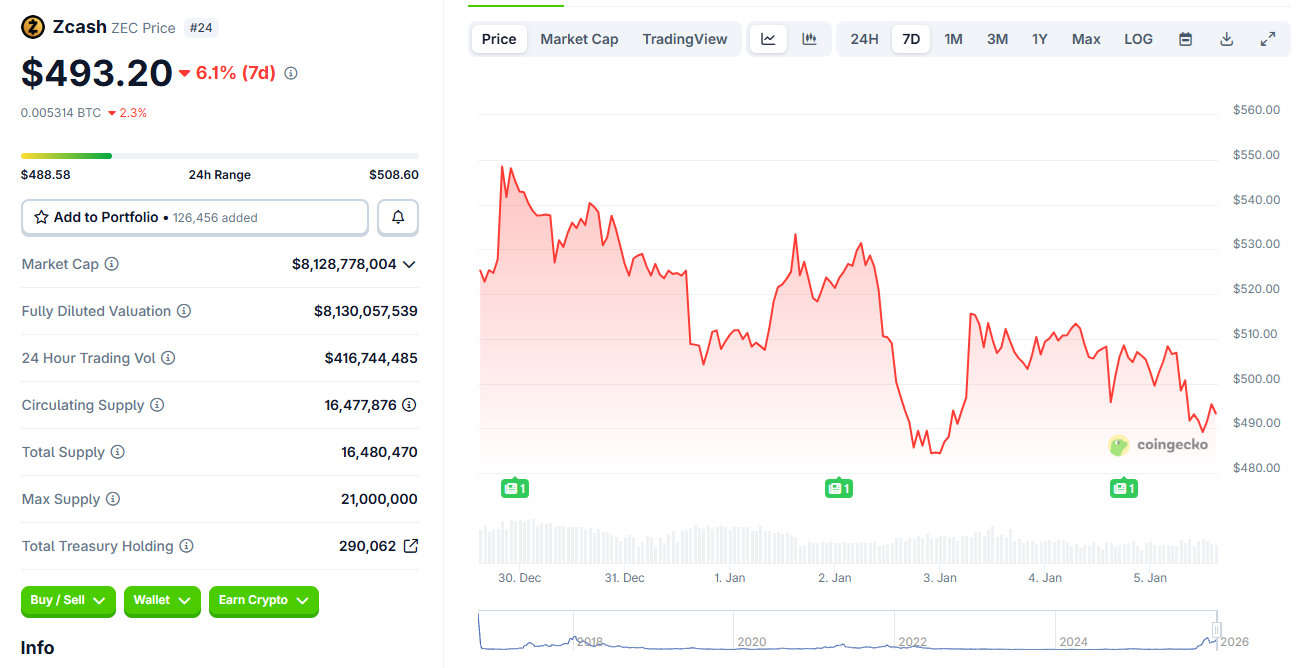

ZEC was among the top-performing altcoins in 2025, briefly causing a rally for all privacy assets. In the past week, ZEC slid to $492.51, down over 6.8%. Immediately following the large-scale unshilelding, the markets entered panic mode, pushing ZEC to a local low of $484.41.

ZEC open interest fell to $764M, down from its 2025 peak of nearly $1B. ZEC is also no longer aggressively shorted, with a more even split of open interest.

Even after the recent market slowdown, ZEC remained the leading privacy coin by market capitalization. XMR consolidated around the $428 range, while most of the legacy private coins were in the red.

For others, ZEC is still preparing for a breakout as soon as traders return in the post-holiday period. One Hyperliquid whale has already made the bet, with a large ZEC spot position and a sell limit order at $509.

Based on the most recent liquidation heatmap, ZEC may dip lower to target the accumulated long positions. The asset may also meet resistance at around $520. The asset is trading with diminished mindshare, recently dropping by 67%, down to 0.3%.

The ZCash community also relied on support from Solana influencers, as the privacy coin was also used in its tokenized form.

ZEC supporters and influencers still drive the narrative of displacing BTC. ZEC is expected to outperform the market, even if BTC fails. Despite the ZEC dollar price slide, the asset is up more than 31% against BTC for the past month.

Sign up to Bybit and start trading with $30,050 in welcome gifts