Crypto-linked payment cards moved decisively into the mainstream in 2025, with spending activity surging as users increasingly turned digital assets into everyday purchasing power.

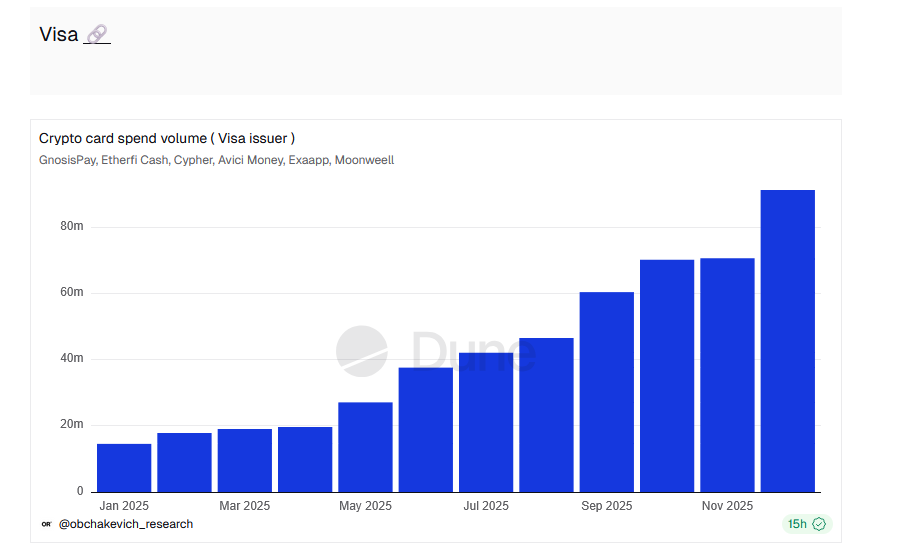

Data compiled from on-chain analytics platforms shows that crypto cards issued through partnerships with Visa experienced explosive growth over the past year. Combined net spending across a small group of blockchain-native cards climbed more than fivefold, rising from roughly $15 million early in the year to over $90 million by December.

Key Takeaways

Net spending on Visa-issued crypto cards surged more than 500% in 2025.

Six crypto-native card programs drove the majority of observed growth.

Stablecoins played a central role in everyday crypto spending.

Visa’s expanding blockchain settlement strategy is accelerating adoption.

The cards behind that growth were issued by a mix of crypto payment services and decentralized finance protocols, including GnosisPay, Cypher, EtherFi, Avici Money, Exa App, and Moonwell. Together, they offer users the ability to spend crypto or stablecoins anywhere Visa is accepted, effectively bridging on-chain assets with traditional point-of-sale systems.

EtherFi pulls ahead as usage accelerates

Among the cards tracked, EtherFi emerged as the clear leader. Its Visa-linked card accounted for more than half of total spending, processing over $55 million in transactions during the year. Cypher followed at a distance, recording just over $20 million in spend, while the remaining platforms contributed smaller but steadily growing volumes.

The widening gap suggests that user experience, incentives, and integration with DeFi yield strategies are becoming key differentiators in the crypto card market, rather than simple access alone.

Stablecoins push crypto payments beyond experimentation

Researchers following the data say the trend reflects a broader shift in how crypto is being used. Instead of sitting idle in wallets or exchanges, digital assets—particularly stablecoins—are increasingly being deployed for routine transactions such as retail purchases and online payments.

Visa’s deeper push into stablecoin infrastructure has played a central role in that transition. Over the past year, the company has expanded settlement options using blockchain rails, positioning crypto cards as a practical extension of its existing payments ecosystem rather than a niche add-on.

As Visa continues to invest in stablecoin support and crypto-native partners refine their card offerings, spending volumes are likely to keep climbing in 2026. What was once viewed as a novelty now appears to be evolving into a permanent fixture of global payments—quietly turning crypto into something consumers can actually use, not just hold.

Visa stock price reflects growing confidence

Visa’s stock has been showing renewed strength as investor confidence builds around the company’s expanding role in digital payments. Shares recently climbed to around $352, posting a solid daily gain of nearly 1.8%, with trading activity picking up alongside the move. The rebound follows a volatile second half of 2025 and suggests the market is responding positively to Visa’s accelerating crypto card adoption and stablecoin strategy. As digital asset payments move from niche to mainstream, investors appear to be pricing in Visa’s ability to capture long-term growth at the intersection of traditional finance and blockchain infrastructure.