A new set of market charts from JPMorgan’s latest Eye on the Market report highlights how structural advantages in US technology are becoming more entrenched, even as global risks around AI infrastructure and semiconductor supply chains intensify.

The data paints a picture of widening gaps – not just between technology and the rest of the market, but also between the US and other major economic regions. From free cash flow margins to returns on equity, US-listed tech firms are pulling further ahead at a time when artificial intelligence is starting to move from promise to measurable financial impact.

Key Takeaways

US companies consistently outperform Europe, Japan, and China on profitability, supporting higher equity valuations

AI is increasingly linked to real financial gains, not just innovation narratives

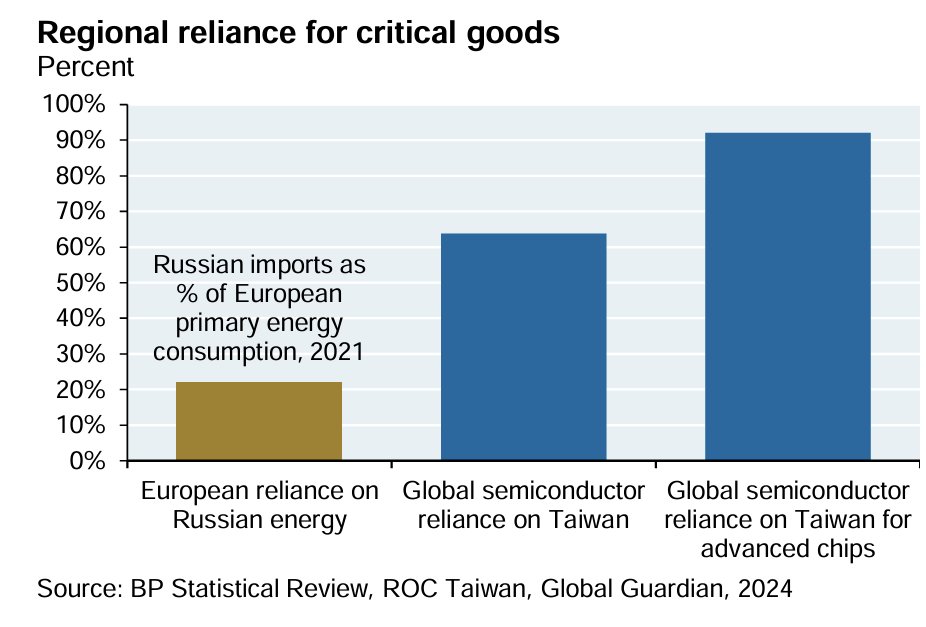

Global reliance on Taiwan for advanced chips is significantly higher than Europe’s former dependence on Russian energy

Tech free cash flow margins have structurally separated from the rest of the market

US Companies Outperform Globally on Profitability

Across sectors, US corporations continue to deliver stronger profitability than peers in Europe, Japan, and China. Returns on assets and returns on equity are consistently higher, particularly in technology, consumer discretionary, and communication services.

This profitability gap helps explain why US equities command valuation premiums. Higher returns are not isolated to one industry but appear across multiple segments, reinforcing the idea that US capital markets remain structurally more efficient and scalable than their global counterparts.

AI Is Now Showing Up in Earnings, Not Just Hype

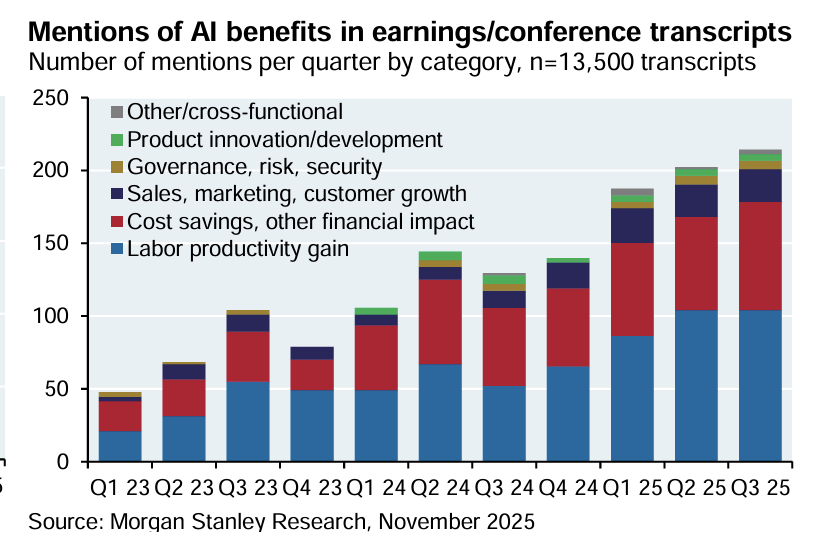

Mentions of AI-related benefits on earnings calls have surged quarter after quarter, according to transcript data covering more than 13,000 company reports. What stands out is the shift in how executives talk about AI.

Early discussions focused on experimentation and governance. More recent calls increasingly emphasize tangible outcomes – labor productivity improvements, cost reductions, and growing contributions to sales, marketing, and customer acquisition. This signals that AI adoption is moving beyond pilot programs and into core business operations.

For equity markets, this matters because sustained margin expansion driven by productivity gains has historically supported long-term valuation reratings. The same dynamic is now being closely watched in crypto markets, where AI-driven demand for compute power and data infrastructure is feeding directly into narratives around tokenized compute, decentralized AI, and blockchain-based data markets.

Global Chip Dependence on Taiwan Remains a Major Risk

One of the most striking comparisons in the report highlights global reliance on Taiwan for semiconductor manufacturing. While Europe’s pre-war dependence on Russian energy peaked around one-fifth of consumption, global dependence on Taiwan for advanced chips exceeds 90%.

This concentration risk has become increasingly central to geopolitical and market discussions. Any disruption would have far-reaching consequences for AI development, cloud infrastructure, and digital asset ecosystems that rely on high-performance computing.

For crypto investors, this is not an abstract concern. Advanced chips underpin everything from AI training to high-throughput blockchain validation, making semiconductor supply chains a hidden but critical factor in long-term digital asset growth.

Tech Cash Flow Has Broken Away From the Pack

Long-term data on S&P 500 free cash flow margins shows a clear structural break. Technology and interactive media companies have steadily expanded margins since the early 2000s, while the rest of the index has remained largely range-bound.

This divergence helps explain why capital continues to concentrate in a small group of mega-cap tech firms. It also reinforces why markets have been willing to tolerate higher valuations, as cash generation – not just revenue growth – continues to improve.