Nvidia’s shareholder structure highlights just how concentrated ownership has become as the company cements its position at the center of the global AI boom.

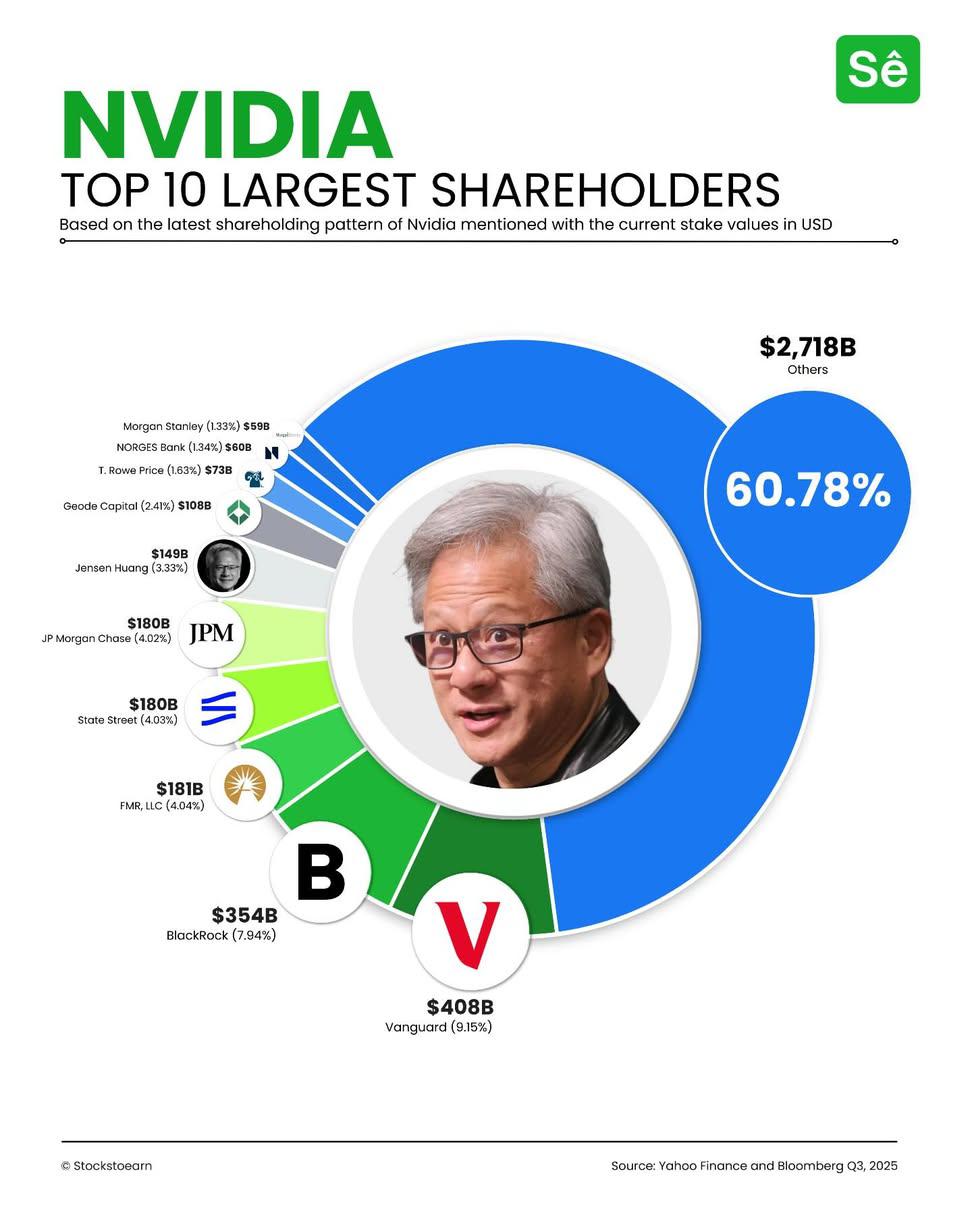

According to data from Yahoo Finance and Bloomberg for Q3 2025, the top 10 shareholders collectively control more than $1.75 trillion worth of Nvidia stock, underscoring the enormous influence of large asset managers and long-term institutional capital.

Key Takeaways

Vanguard and BlackRock dominate Nvidia’s ownership, together controlling over 17% of the company.

The top 10 shareholders hold more than $1.75 trillion in Nvidia stock, underscoring heavy institutional concentration.

Despite this, the majority of shares remain spread across the broader market.

Institutional giants dominate the register

At the top of the list is Vanguard, holding roughly $408 billion worth of Nvidia shares, equivalent to about 9.15% of the company. Close behind is BlackRock with a $354 billion stake, or 7.94%. Together, these two passive investing powerhouses control more than 17% of Nvidia, reflecting how deeply the stock is embedded in global index funds and ETF portfolios.

Other major holders reinforce this institutional dominance. Fidelity (FMR, LLC), State Street Corporation, and JPMorgan Chase each control stakes valued at around $180 billion, signaling broad conviction among traditional financial firms that Nvidia’s leadership in AI chips and data center hardware is structural rather than cyclical.

Insider ownership meets broad market exposure

Founder and CEO Jensen Huang remains one of Nvidia’s largest individual shareholders, with an estimated $149 billion stake representing just over 3.3% of the company. His position places him alongside major institutional names such as Geode Capital, T. Rowe Price, Norges Bank, and Morgan Stanley, blending strong insider alignment with heavyweight external backing.

Despite the concentration at the top, Nvidia’s ownership is far from closed. The remaining shareholders, grouped under “others,” account for about 60.78% of the company, representing roughly $2.7 trillion in market value. This balance between concentrated institutional control and broad market participation highlights Nvidia’s unique status as both a core long-term holding for global funds and one of the most widely held stocks in public markets.

As Nvidia’s valuation continues to reflect its central role in artificial intelligence and advanced computing, its shareholder mix suggests that patient, long-term capital remains firmly in control of the company’s equity narrative.