Dogecoin price has finally delivered a proper reversal after weeks of failed attempts. The token is up about 33% from its late December low, marking its strongest recovery since November. That move matters because earlier reversal attempts stalled quickly, even when technical signals looked similar.

This time, the rally did not fade immediately. But just as Dogecoin pushes into a key resistance zone near $0.15, a new risk is building beneath the surface. And that risk is being driven by whales.

Dogecoin Finally Delivers a Clean Reversal — Why This Attempt Worked

Between November 4 and December 31, Dogecoin price made a series of lower lows while the Relative Strength Index (RSI) made higher lows. RSI measures momentum. When price falls, but RSI rises, it often signals that selling pressure is weakening.

This bullish divergence (trend reversal indicator) appeared twice before. One attempt led to a roughly 13% rally. Another reached about 17%. Both failed quickly.

Dogecoin Reversal Pattern: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The difference this time was whale behavior.

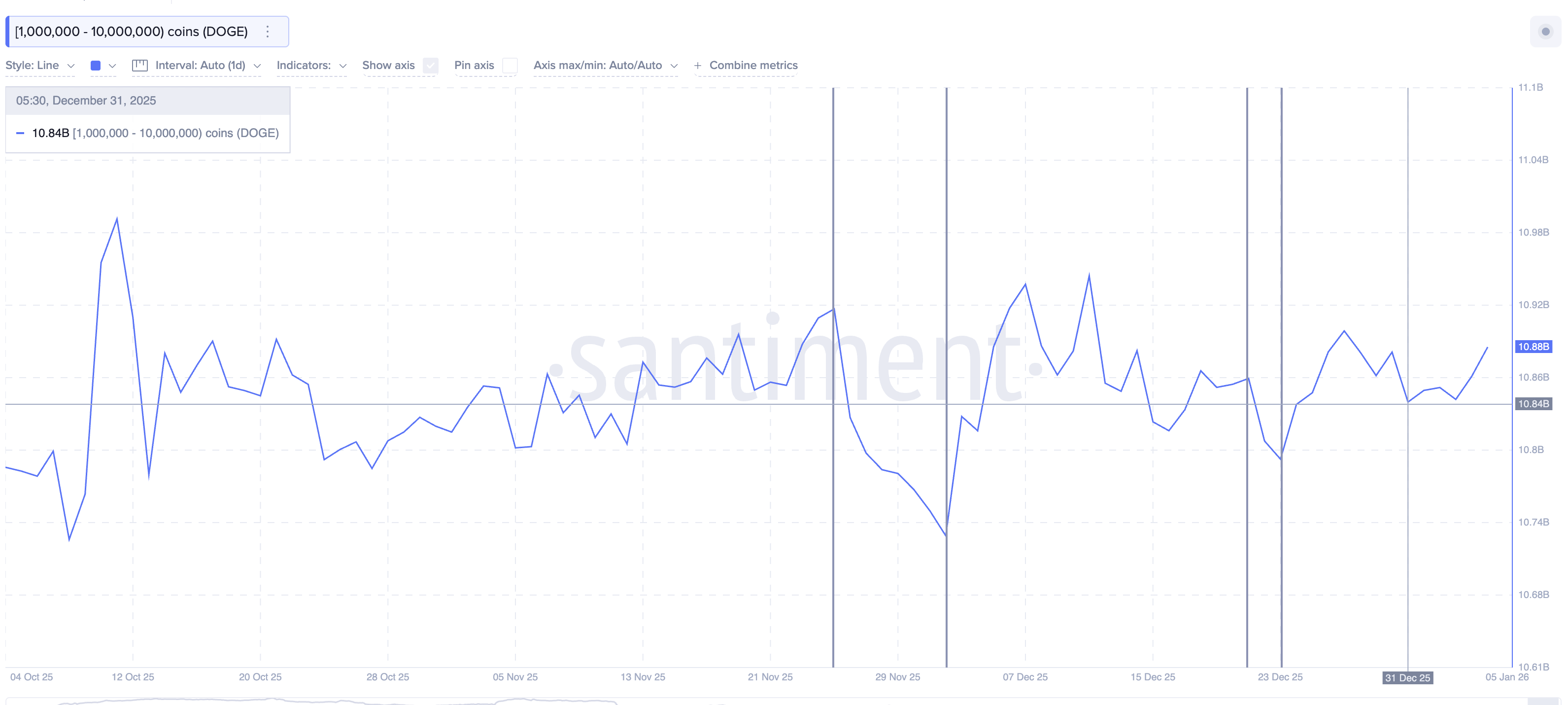

During earlier rallies, mid-tier whales holding between 1 million and 10 million DOGE began selling into strength. That selling capped upside and pushed the price lower again. Here are the selling deets:

Nov 25: whales dropped from 10.91 billion to 10.72 billion: rally failed

Dec 21–22: whales dropped from 10.86 billion to 10.79 billion: rally failed

Smaller Whales Selling: Santiment

This time, they did the opposite.

Since December 31, that same whale group increased holdings from roughly 10.84 billion DOGE to about 10.88 billion DOGE. That is a net addition of around 40 million DOGE, roughly $6 million in accumulation. This group hasn’t started dumping yet.

That steady buying is why this reversal extended to about 33%, instead of stalling early like previous attempts.

So the reversal worked. But that does not mean the rally is safe.

Whale-Led Risk Emerges as Hidden Bearish Divergence Forms

While mid-tier whales remain firm, a new technical warning has emerged.

From mid-October to early January, the Dogecoin price formed a lower high, while the RSI formed a higher high. This creates a hidden bearish divergence. Unlike bullish divergence, this pattern often signals that upside momentum is weakening after a rally.

From a buyer-seller perspective, this tells a simple story. Buyers are still pushing prices higher, but they are doing so with less force. Sellers are beginning to absorb that demand.

Bearish Risk Emerges: TradingView

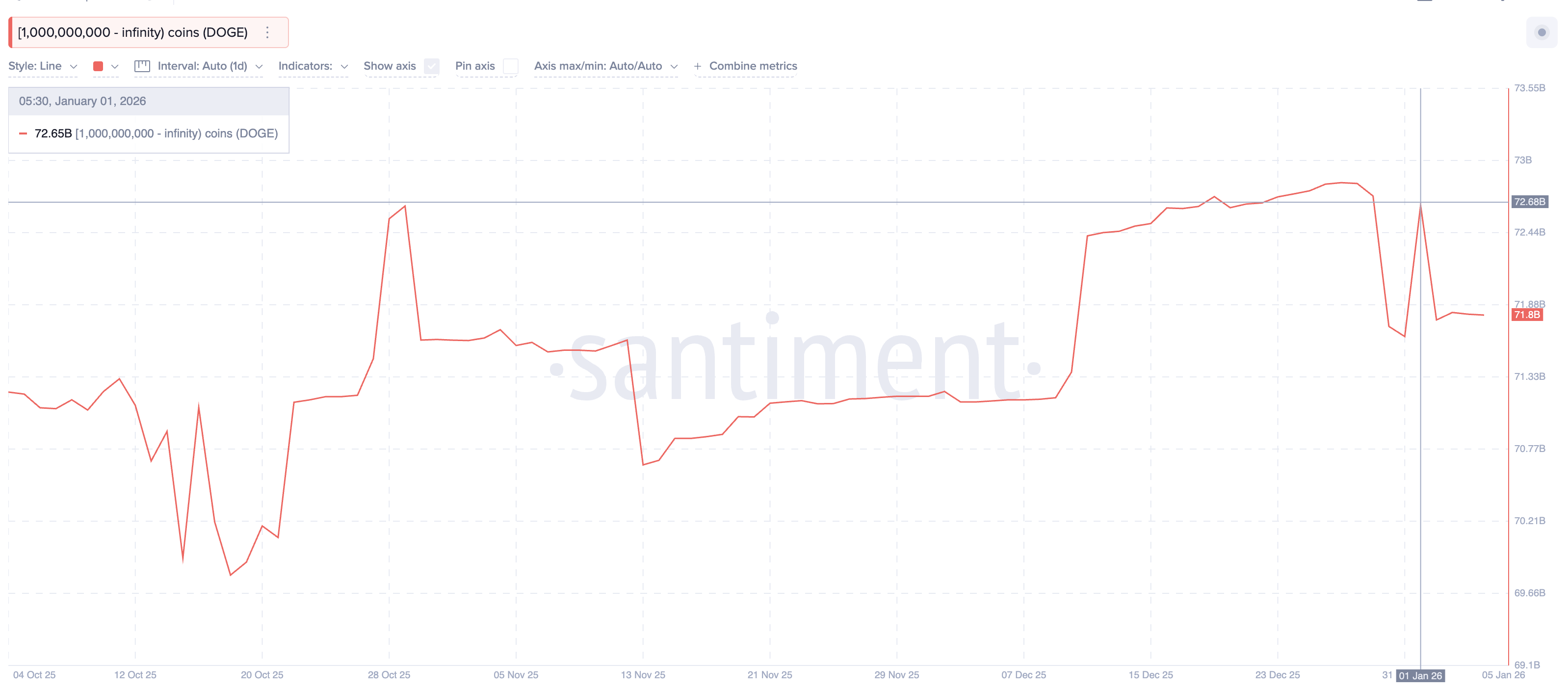

That shift lines up with behavior from the largest holders.

Whales holding more than 1 billion DOGE began reducing exposure on January 1. Since then, their combined holdings have dropped from roughly 72.68 billion DOGE to about 71.80 billion DOGE. That is a net reduction of nearly 880 million DOGE.

At current prices, the selling represents roughly $130 million in supply entering the market.

Mega Whales Selling: Santiment

This does not guarantee an immediate drop. But when hidden bearish divergence appears at the same time large holders start selling, it often signals rally exhaustion rather than continuation.

This is why the current risk is best described as whale-led.

Dogecoin Price Levels Now Decide Whether the Rally Extends or Fades

DOGE price action now matters more than indicators.

Dogecoin is struggling to hold above the $0.151 area. This zone has already rejected the Dogecoin price and remains the key decision point.

If Dogecoin fails to reclaim and hold above $0.151, downside risk increases. In that case, the price could decline to $0.137, representing a near 8% pullback from current levels. Losing that support would expose $0.115 next.

Dogecoin Price Analysis: TradingView

That bearish path would confirm the hidden bearish divergence and align with ongoing large-whale selling.

The bullish case still exists, but it is conditional. A clean daily close above $0.151 would weaken the bearish divergence signal and open the door toward $0.173. That move would suggest that selling pressure has been absorbed and that the rally still has room to run.

For now, Dogecoin price has finally achieved a real reversal. But with large whales selling and momentum slowing, the next move depends entirely on how the price behaves around the $0.15 zone.