XRP and Dogecoin have emerged as early standouts in the first week of 2026, supported by fresh ETF inflows and a renewed risk-on tone across crypto markets.

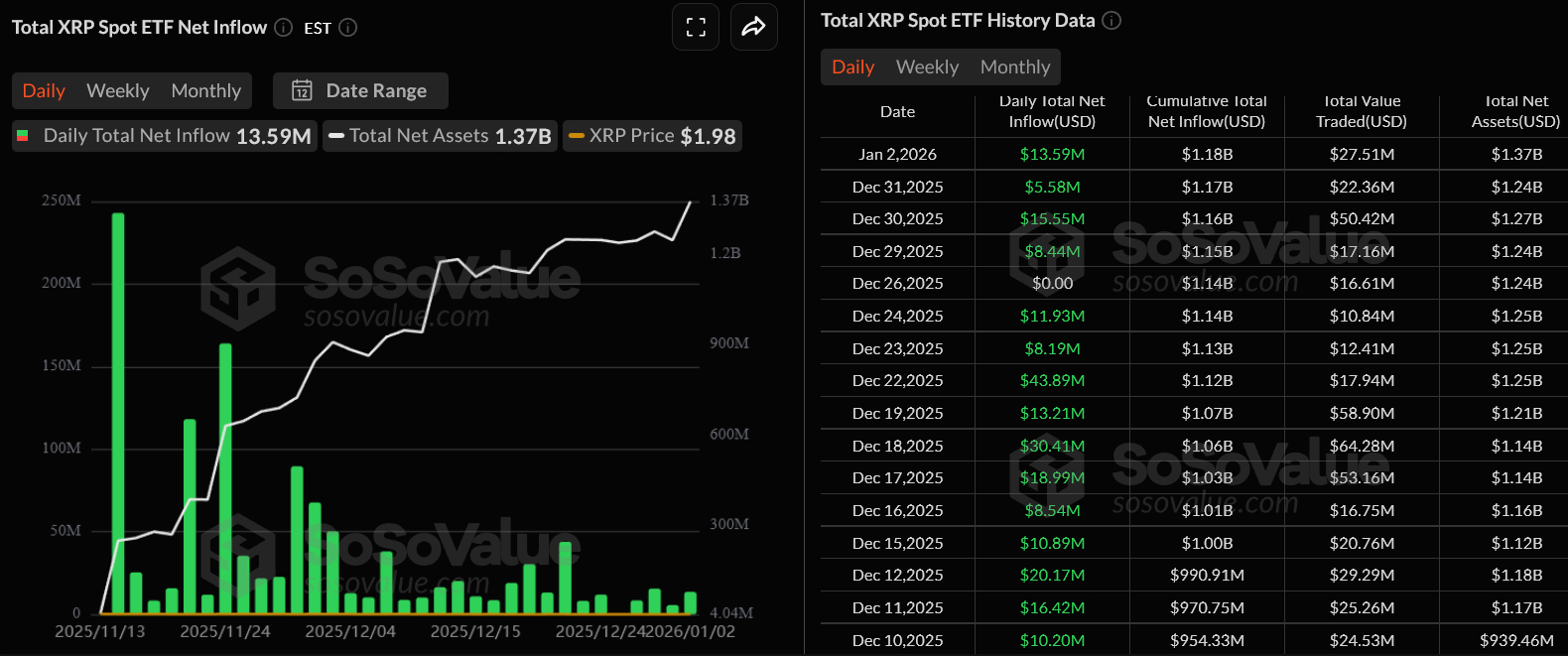

Data from SoSoValue shows XRP spot ETFs extended their inflow streak to 33 consecutive days, while Dogecoin spot ETFs recorded a sharp pickup in activity after weeks of muted flows.

XRP ETFs Remain in Green For 33 Days Since Launch

XRP spot ETFs posted a combined $13.59 million in net inflows on January 2, pushing total net assets to $1.37 billion. The sustained inflow streak stretches back to mid-November, when these funds were first launched.

This shows persistent institutional demand for XRP even as broader crypto ETFs experienced intermittent outflows late last year.

XRP ETFs Inflow Streak Continues. Source: SoSoValue

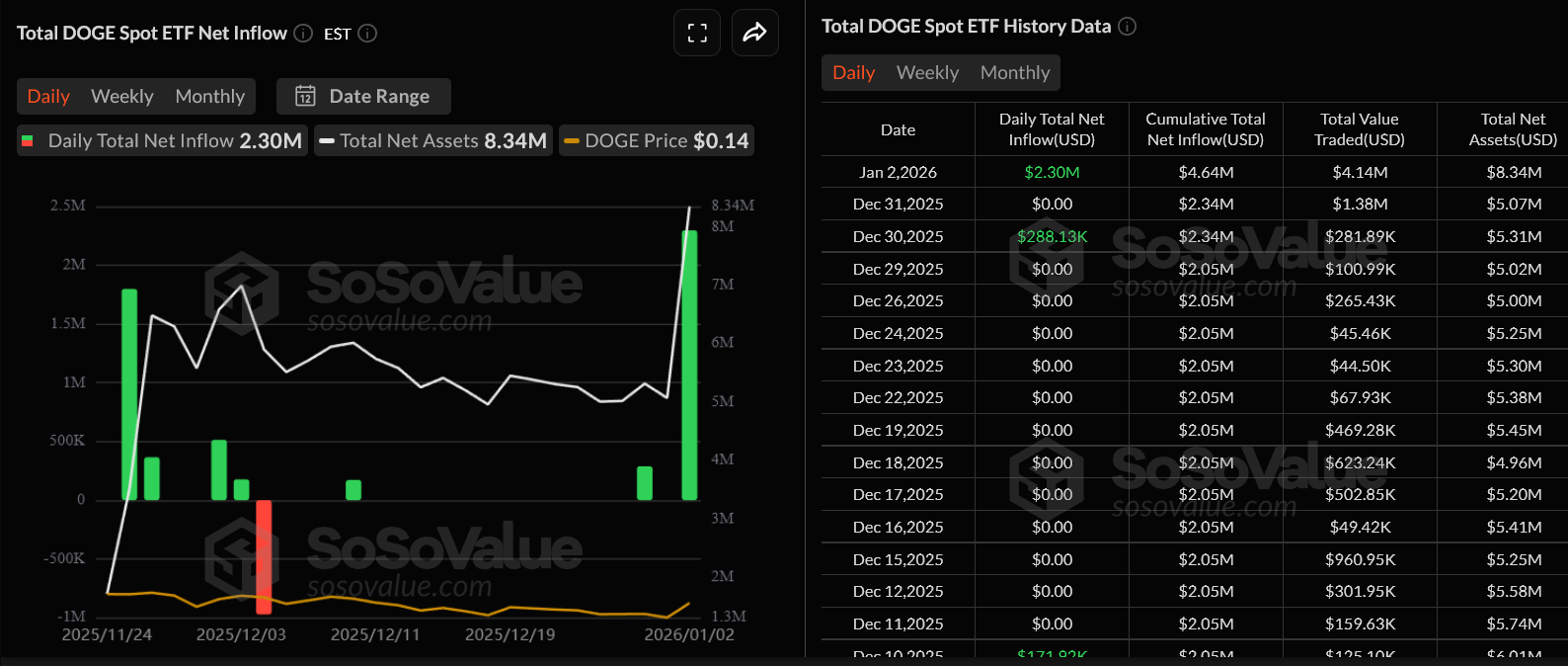

Meanwhile, Dogecoin spot ETFs saw a notable shift. After days of flat activity, net inflows jumped by $2.3 million on January 2, lifting total DOGE ETF assets to $8.34 million.

While the absolute figures remain small compared with XRP, the move marks a clear acceleration relative to December’s low-volume trading.

US Spot Dogecoin ETF Inflow. Source: SoSoValue

Price action has followed the same direction. XRP traded in a tight range earlier in the week before pushing toward the $2.30 level.

The move came after XRP reclaimed key short-term support zones around $2, easing sell pressure that defined late 2025.

Leveraged Dogecoin ETFs are Leading the US Markets

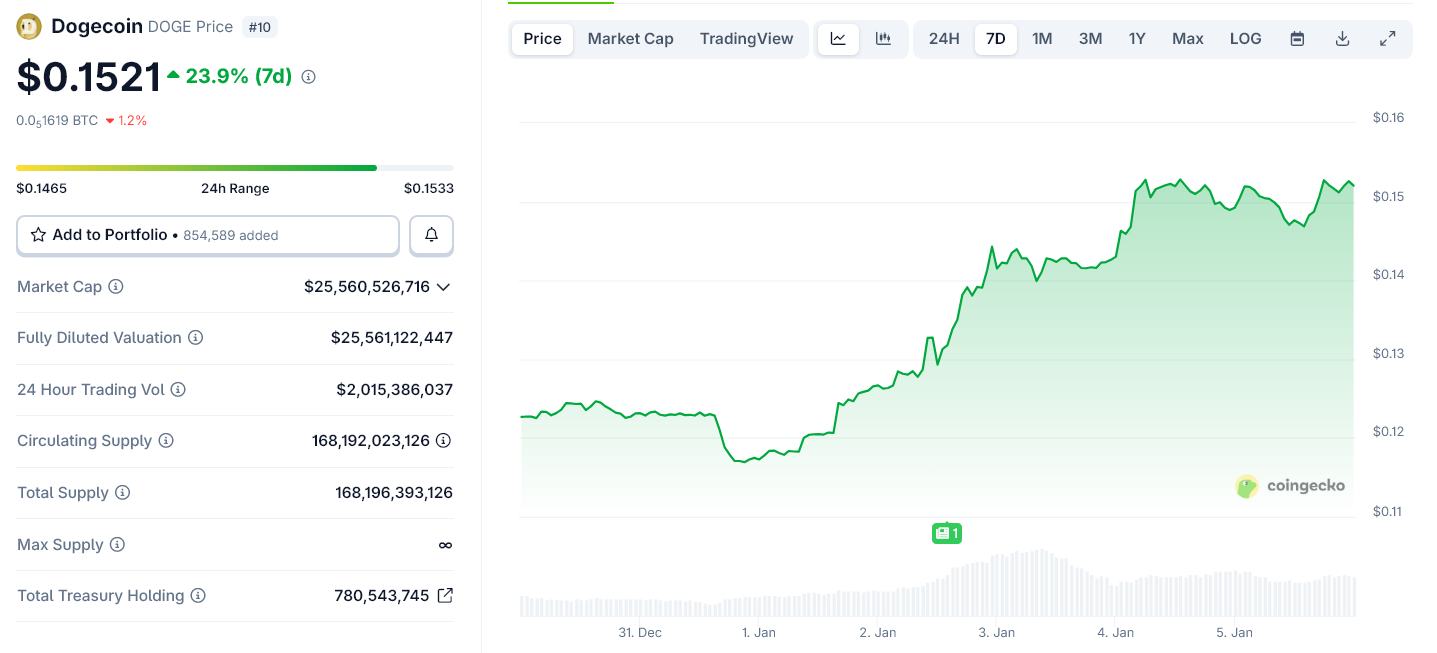

Dogecoin also extended its weekly rally. DOGE climbed from the low-$0.13 range to around $0.14, supported by broader memecoin strength and improving market sentiment.

Technical momentum played a role, with short-term breakouts drawing traders back into high-beta assets.

Dogecoin Weekly Price Chart. Source: CoinGecko

Leverage has amplified those moves. According to ETF data highlighted by Bloomberg analyst Eric Balchunas, 2x leveraged Dogecoin ETFs ranked among the best-performing ETFs of early 2026, posting outsized gains within days.

Taken together, the data points to two parallel trends. XRP continues to attract steady institutional capital through spot ETFs, tightening liquidity over time.

Dogecoin, by contrast, is seeing shorter-term momentum flows, magnified by leverage and retail participation.