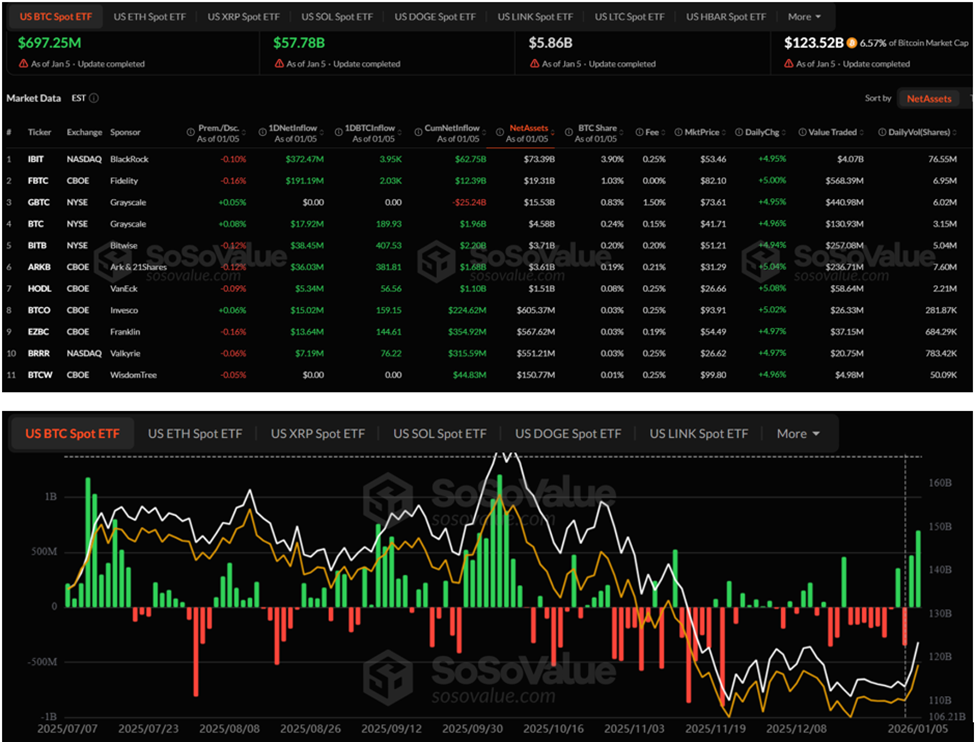

Bitcoin ETFs (exchange-traded funds) recorded their largest single-day inflow in three months on January 5, pulling in nearly $695 million. The positive flows come as institutional demand rebounded sharply at the start of 2026.

The surge was led by BlackRock’s iShares Bitcoin Trust (IBIT), which attracted $371.9 million, followed by Fidelity’s FBTC with $191.2 million, according to data on SoSoValue.

Institutional Inflows Mark Record Day for Bitcoin ETFs

Indeed, institutional demand rebounded sharply at the start of 2026, with Friday, in particular, seeing $671 million in inflows.

The strong inflows marked a broad-based move across the ETF complex rather than a one-off allocation. Bitwise’s BITB added $38.5 million, Ark’s ARKB brought in $36 million, while Invesco, Franklin Templeton, Valkyrie, and VanEck all posted positive net flows.

Notably, Grayscale’s legacy GBTC recorded zero outflows for the day. This marks a significant shift, following more than $25 billion in cumulative withdrawals since its conversion to a trust structure.

Bitcoin ETF Flows. Source: SoSoValue

Trading activity rebounded alongside the inflows, signaling renewed institutional engagement after a quieter December.

The synchronized buying presents as portfolio rebalancing rather than speculative momentum chasing, with Bitcoin holding above the $90,000 level throughout the session.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

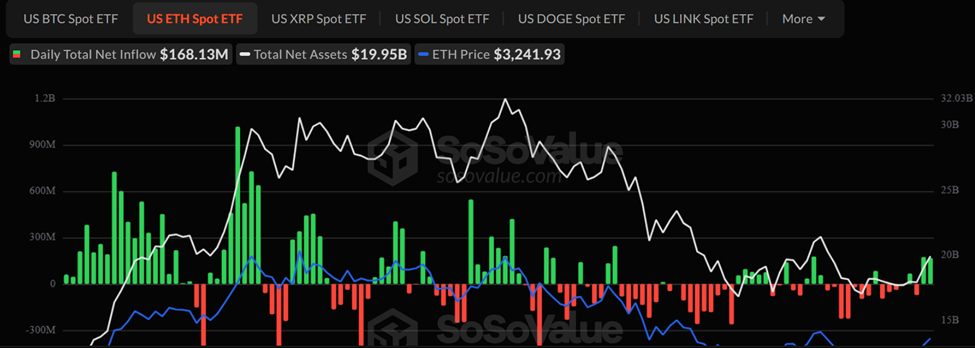

Institutional appetite is also extending beyond Bitcoin. Whale Insider reported that BlackRock clients purchased 31,737 ETH, worth approximately $100.2 million.

This highlights continued accumulation of Ethereum alongside spot Bitcoin exposure, with spot ETH ETF inflows reaching $168.13 million on Friday.

Spot ETH ETF Flows. Source: SoSoValue

The move suggests large allocators are positioning across multiple digital assets as crypto becomes increasingly embedded in long-term investment strategies.

BlackRock Reframes Crypto as Financial Infrastructure, Not a Trade

The timing of the ETF inflows coincides with BlackRock’s release of a new investment outlook. The asset manager reframes crypto as a core component of the global financial system rather than an experimental asset class.

In the report, BlackRock argues that crypto’s role is shifting away from speculative trading toward infrastructure, specifically:

Settlements

Liquidity rails, and

Tokenization.

Stablecoins feature prominently in that thesis. BlackRock describes them as a bridge between traditional finance and digital liquidity. They note that in some jurisdictions, dollar-backed stablecoins could displace local currencies.

This trend, the firm warns, is already placing pressure on banks as deposits and yield migrate toward crypto-native products.

ETF approvals themselves are framed as institutional validation rather than regulatory curiosity. According to BlackRock, the existence and fast growth of crypto ETFs represent factual acceptance of digital assets by global capital allocators. They are proactively embedding them within standard portfolio construction frameworks.

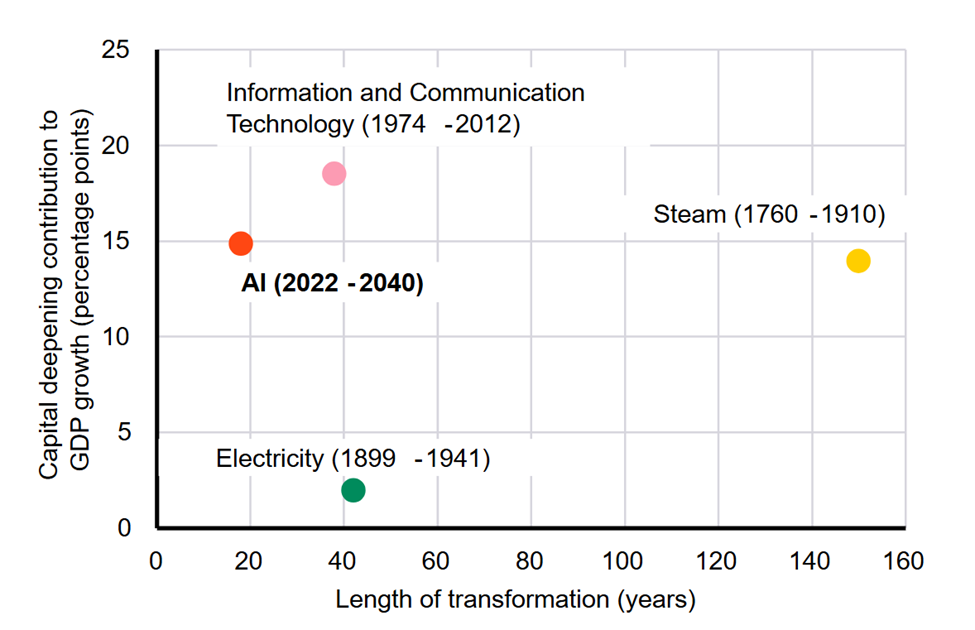

The report also places artificial intelligence at the center of the current macro shift. AI-driven changes in energy demand, productivity, and capital allocation are accelerating structural transformations across markets.

Length and capital deepening of notable innovations, 1760-2040. Source: BlackRock

As a result, BlackRock argues that traditional market cycles are breaking down, giving way to capital concentration and long-duration thematic exposures.

In this environment, BlackRock cautions against the “illusion of diversification,” noting that the same macro forces increasingly drive many traditional assets.

Digital assets, the firm suggests, are emerging as alternative exposures precisely because they operate on different rails.

The January 5 ETF inflows appear to reflect this thinking in real-time. With participation spread across nearly all major issuers and no renewed bleeding from GBTC, the data points to a maturing ETF market where institutions are allocating deliberately.