Key Takeaways

RedStone’s unique architecture scales effortlessly, providing swift, secure data to hundreds of blockchains and protocols.

RedStone is integrated with 130+ clients across 70+ chains and is rapidly expanding to serve next-generation blockchain use cases.

RED will debut on Binance Launchpool on February 28th, 2025, with a price cap mechanism during the Pre-Market phase.

What is RedStone Oracles, and why does it matter in a rapidly evolving crypto ecosystem? RedStone is a modular oracle network delivering critical data to various EVM and non-EVM chains. As decentralized finance grows, reliable off-chain data is essential for everything from lending protocols to sophisticated derivatives.

RedStone Network focuses on scalability and flexibility, enabling cross-chain DeFi while ensuring developers have the precise information they need—on any network. In this article, we delve into the fundamental features of RedStone, its approach to addressing the “oracle problem,” and the contributions of the recently launched RED token.

What is RedStone?

RedStone is a cutting-edge Oracle blockchain solution that makes it easier and more efficient for decentralized applications to access off-chain data. The team at RedStone focuses on “modular oracles,” which separate data acquisition from on-chain verification. This separation allows for faster updates, broader coverage of blockchains, and more efficient support for custom data feeds.

RedStone’s approach is already recognized for performance and reliability, serving 130+ clients across more than 70 blockchains. It also supports over 1250 assets including major tokens like LSTs/LRTs, BTC staking, memecoins and more.

Key features

Modular Design: Decouples data gathering from on-chain delivery, improving speed and reducing congestion.

Cross-Chain Compatibility: Integrates with EVM and non-EVM networks, covering platforms like Berachain, TON, Monad, and more.

Custom Data Feeds: Supports tailored solutions, ranging from stablecoin prices to specialized NFT analytics.

Secure Infrastructure: Employs rigorous validation, including collaboration with EigenLayer, to enhance data integrity.

Scalable Growth: Easily onboard new chains, ensuring protocols can expand without facing Oracle bottlenecks.

How Does RedStone Work?

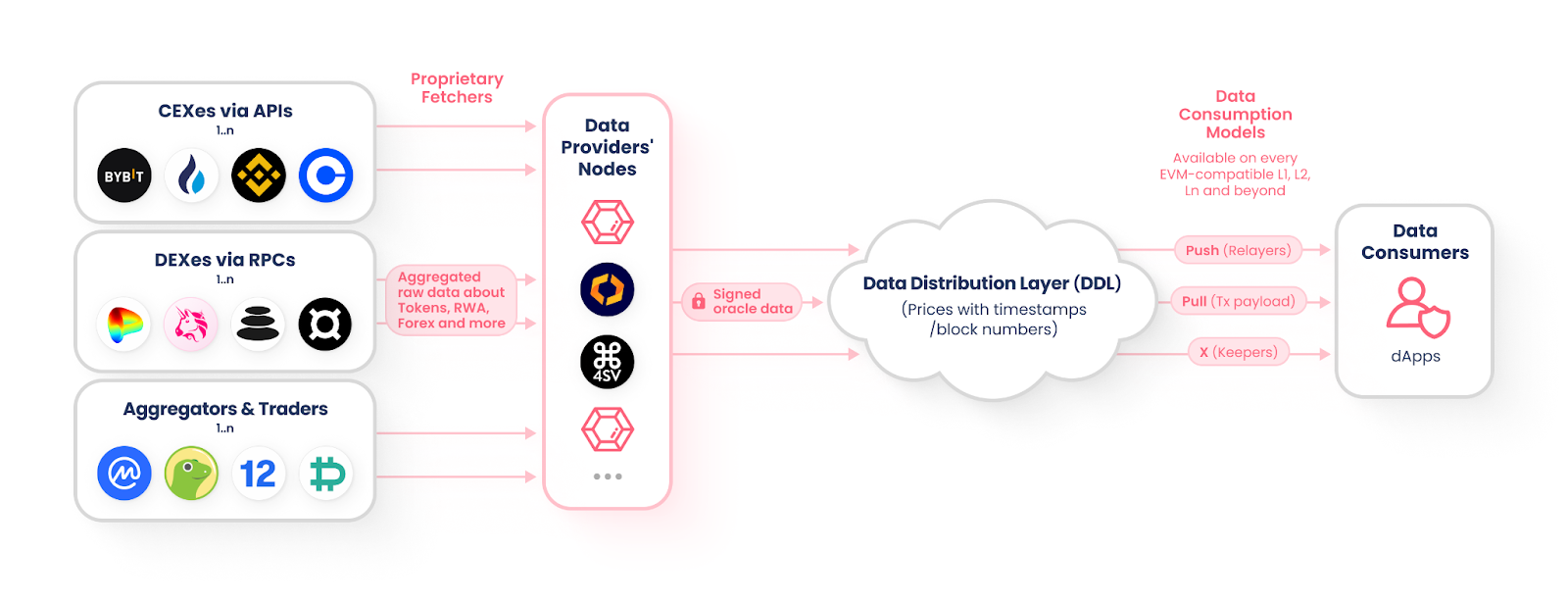

Data providers gather off-chain information from diverse sources, such as centralized exchanges, on-chain DEXs, and specialized APIs. This data is aggregated and fed into RedStone’s distribution layer, then signed and packaged for on-chain verification.

By storing only minimal information on-chain, RedStone reduces transaction bulk and overhead. DApps can tap into RedStone’s network to fetch current prices or reference data at the moment of transaction execution. Developers can customize how frequently new data is pushed, what types of assets are supported, and even how the data might be validated on each specific chain.

Another cornerstone is the use of advanced validation mechanisms like actively validated service (AVS) through EigenLayer. This approach offers robust economic security by letting stakers lock up tokens (including RED) to guarantee honest data reporting.

If data providers deliver inaccurate feeds, they risk losing staked funds. The result is a dynamic ecosystem that benefits from strong incentives for correct and frequent updates, directly supporting cross-chain DeFi and more.

What Oracle Problem does RedStone Solve?

Slow or Inflexible Updates: Traditional oracles can be slow to add new assets or blockchains. RedStone’s modular framework allows for quick expansion and seamless deployment on new networks.

Single-Chain Reliance: Early oracles were designed with only Ethereum or Solana in mind. RedStone’s multi-chain approach ensures data flows to dozens of blockchains simultaneously.

High Latency & Network Congestion: By offloading data storage to its distribution layer, RedStone reduces on-chain transaction load and speeds up data retrieval for dApps.

Limited Custom Feeds: RedStone’s approach lets projects request specialized feeds, such as advanced LST or NFT floor price data.

Security & Reliability: Staked RED tokens on EigenLayer add extra security for oracles, ensuring honest participation and deterring malicious data submissions.

RedStone Investments

RedStone secured $15m during a Series A funding round, showing demonstrable investor interest and confidence in a modular Oracle solution. This funding fuels the platform’s vision to become the most technologically advanced and economically sustainable Oracle provider.

With the war chest from Series A, RedStone can expand its developer support, security audits, and partnerships across a diverse range of blockchains. The round also highlights broader recognition that oracles are essential to DeFi’s growth, requiring scalable, decentralized solutions to help protect billions in on-chain value.

Benefits of Using RedStone

Scalability: Offers quick integration with new or existing chains, preventing performance bottlenecks.

Cost Efficiency: Modular architecture cuts down transaction overhead, resulting in lower fees.

Flexibility: Supports a wide range of data types, from classic token prices to on-chain proof-of-reserves.

Enhanced Security: Employs staked collateral to ensure reliability, reducing the chance of incorrect feeds.

Faster Updates: Delivers data with minimal latency, critical for high-speed DeFi markets.

Multi-Chain Adoption: Developers can integrate once and leverage RedStone’s coverage across 70+ networks.

The RED token

RED unlocks new ways for data providers and community members to secure the network through staking while fostering a sustainable oracle economy. By staking RED, participants help maintain honest and timely data feeds, with the possibility of earning rewards in popular assets such as ETH and USDC.

$RED Tokenomics

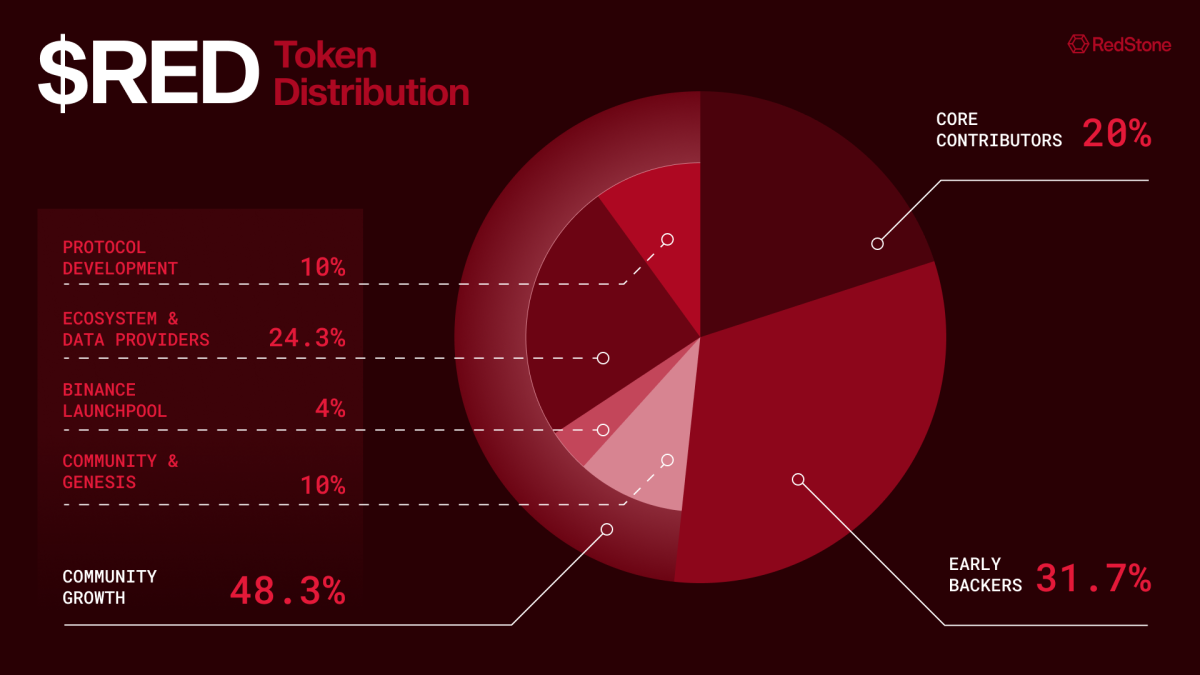

Max Supply: 1,000,000,000 RED

Initial Float: 28%, with 72% locked and released over 4 years

Community Growth: 48.3% of total tokens allocated for ecosystem support, including data providers and protocol development

Staking Model: Data providers and token holders lock RED to support RedStone’s network security. Stakers receive fees from users who rely on RedStone’s data.

Multichain Readiness: Although implemented as ERC-20 on Ethereum, RED can be bridged to other blockchains as RedStone’s coverage expands.

Source: RedStone Blog

RED Utility

RED is more than just a staking token; it is the economic engine that powers the RedStone mission toward deeper decentralization and enhanced security across its modular oracle network. Staking RED in RedStone’s EigenLayer AVS empowers data providers and community participants to safeguard the integrity of real-time price feeds, ensuring reliable data for hundreds of blockchain protocols. In return, stakers earn rewards in widely used assets such as ETH, BTC, and USDC.

This alignment of incentives encourages continuous improvements in data accuracy, as any attempt to manipulate feeds risks penalties and token forfeiture for stakers who supply incorrect information. RedStone makes the validation process less centralized so that there aren’t as many single points of failure or attacks that take advantage of people. This builds trust between decentralized finance projects and their institutional partners.

RED also facilitates community governance. Holders can propose and vote on protocol upgrades, new oracle products, or expanded chain integrations. This inclusive approach keeps the oracle network adaptable, letting it respond quickly to emerging trends in decentralized finance. Simultaneously, the token distribution strategy adds further reinforcement to the cooperation.

RedStone (RED) on Binance Launchpool Details

Scheduled to debut on February 28, 2025, RedStone (RED) will be the 64th project on Binance Launchpool. Farming starts on February 26, 2025, with Pre-Market trading for RED/USDT opening on February 28, 2025.

Binance is instituting a price cap mechanism during the initial 72 hours to prevent extreme volatility.

Launchpool Allocation: 4% of the total supply (40,000,000 RED) set aside for participants.

Supported Pools: BNB (80% of rewards), FDUSD (10%), USDC (10%).

Price Cap Mechanism: Keeps the price within a set range of the initial opening price for the first 72 hours in Binance Pre-Market.

No Spot Listing Yet: Full spot listing date will be announced after the initial Pre-Market phase.

Source: Binance

The Future of RedStone and the Oracle Landscape

As more DeFi projects demand near-instant data, RedStone’s modular design positions it as a leading force in oracle innovation. The network’s mission—to serve any data, on any chain—aligns with the cross-chain DeFi movement, which seeks frictionless liquidity across multiple networks.

With advanced security via EigenLayer, a focus on stable and fast data delivery, and the introduction of RED tokenomics, RedStone is poised to support trillion-dollar markets spanning lending, derivatives, gaming, and beyond.