MicroStrategy (now Strategy) is in its most consequential phase since adopting Bitcoin as its primary treasury asset. The company’s mNAV (microstrategic net asset value) premium has fallen to 1.04x, effectively erasing the valuation buffer that once powered its dramatic outperformance versus Bitcoin itself.

The shift marks a regime change, with Strategy’s future no longer hinging primarily on Bitcoin’s price trajectory, but on whether capital markets are still willing to fund its increasingly complex Bitcoin-native financial structure.

Strategy mNAV Premium Falls to 1.03x as $17.4 Billion Q4 Loss Challenges Bitcoin Leverage Model

For much of 2023 and 2024, Strategy traded at premiums exceeding 2x, and at times 2.5x, its net asset value (NAV).

That premium allowed the firm to issue equity, convertibles, and preferred stock at favorable terms, recycling capital into additional Bitcoin purchases and amplifying shareholder exposure. With the premium now near parity, that flywheel has stalled.

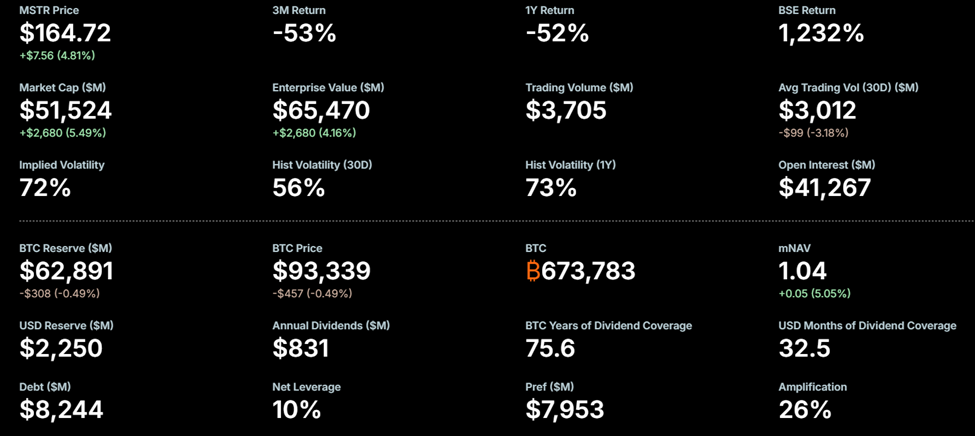

MicroStrategy mNAV. Source: Strategy Website

Strategy currently holds about 673,783 BTC, valued at more than $63 billion at the time of its latest disclosure, alongside approximately $2.25 billion in cash. Yet, its market capitalization metrics are such that:

Basic- $47 billion

Diluted – $53 billion

Enterprise value – $61 billion

This mismatch between its Bitcoin value and market cap raises debate over whether the stock is undervalued or whether markets are finally pricing in the structural risks of the model. Some investors see the compression as an opportunity.

Adam Livingston described the 1.03x mNAV as “the best entry point” he has seen. He argues that a modest 3% premium still offers roughly 26% amplified Bitcoin exposure.

In his view, Strategy’s at-the-market issuance of STRC preferred stock could soon fund another large Bitcoin purchase. This would allow Executive Chairman Michael Saylor to increase Bitcoin per share without relying on extreme premiums.

That optimism rests on a fundamental reframing of Strategy’s business. Rather than a growth equity levered to Bitcoin momentum, Strategy is increasingly positioning itself as a yield-driven Bitcoin accumulator.

Its STRC Variable Rate Series A Perpetual Stretch Preferred Stock now carries an 11% annual dividend, with the next payment expected to be around $0.91 per share later this month.

Supporters argue this transforms the company into a form of Bitcoin-backed fixed-income vehicle. Joe Burnett, Director of Bitcoin Strategy at Semler Scientific, has argued that even if Bitcoin’s price were to remain flat, Strategy could theoretically service its digital credit dividends for decades. In his post, Burnett cites the long-term debasement of fiat currencies.

In this framing, duration, not short-term price action, is the key variable.

Accounting Losses Expose the Fragility of Strategy’s Post-Premium Model

This yield-focused pivot comes as Strategy’s financial statements highlight growing tensions. In its January 5, 2026, Form 8-K, the company disclosed a $17.44 billion unrealized loss on digital assets for the fourth quarter of 2025 and a $5.40 billion unrealized loss for the full year.

While these losses are accounting-based and tied to Bitcoin’s Q4 drawdown, they carry real implications. Under current accounting rules, digital assets are treated as indefinite-lived intangible assets.

This compels companies to recognize impairments during downturns without allowing remeasurement upward during recoveries. Critics argue these optics matter far more now that the premium has vanished.

Analyst Novacula Occami pointed to persistent underperformance, noting that Strategy shares have lagged Bitcoin over one-month, six-month, and one-year horizons. With this, it has broken the core thesis that MSTR should outperform spot BTC exposure.

In his assessment, the collapse in mNAV premium since mid-2025 has undermined Strategy’s ability to issue “cheap” convertibles and “expensive” preferreds, leaving common shareholders exposed to dilution without upside.

Others warn that continued equity issuance below meaningful premiums erodes shareholder value. Among them is Brennan Smithson, who argues that insufficient demand for preferreds could force Strategy to rely on dilution to fund both dividends and Bitcoin purchases.

This debate mirrors the central question facing Strategy in 2026: can Bitcoin-native corporate finance function without speculative premiums?

With mNAV near 1x, every capital raise is scrutinized. Issuing shares or preferreds no longer automatically increases Bitcoin per share. Instead, it risks signaling weakness if demand falters.

The bull case depends on patience. Proponents believe moderate Bitcoin appreciation, sustained dollar debasement, and potential interest rate cuts could gradually restore confidence in Strategy’s yield model.

The bear case warns that without renewed capital market appetite, the experiment could stall. Such an outcome could turn Strategy into a volatile, underperforming proxy rather than a superior alternative to direct Bitcoin or ETFs.

These perspectives make Strategy a live stress test for whether capital markets will continue to fund leveraged Bitcoin exposure when the hype fades, and the premium cushion is gone.