The blockchain world is rapidly shifting to a Rollup-Centric future, where Layer 2 (L2) rollups handle transaction execution to provide speed and lower costs, settling back onto Layer 1 (L1) chains like Ethereum for security. AltLayer is at the forefront of this movement, and its native token, ALT, is the core utility and economic engine powering this modular scaling infrastructure.

AltLayer is a decentralized protocol that offers Rollup-as-a-Service (RaaS), allowing developers to launch customized, application-specific rollups in minutes with minimal to no coding. But what sets it apart is its unique implementation of Restaked Rollups, which dramatically enhances security, decentralization, and finality—and the ALT token is intrinsically linked to every one of these enhancements.

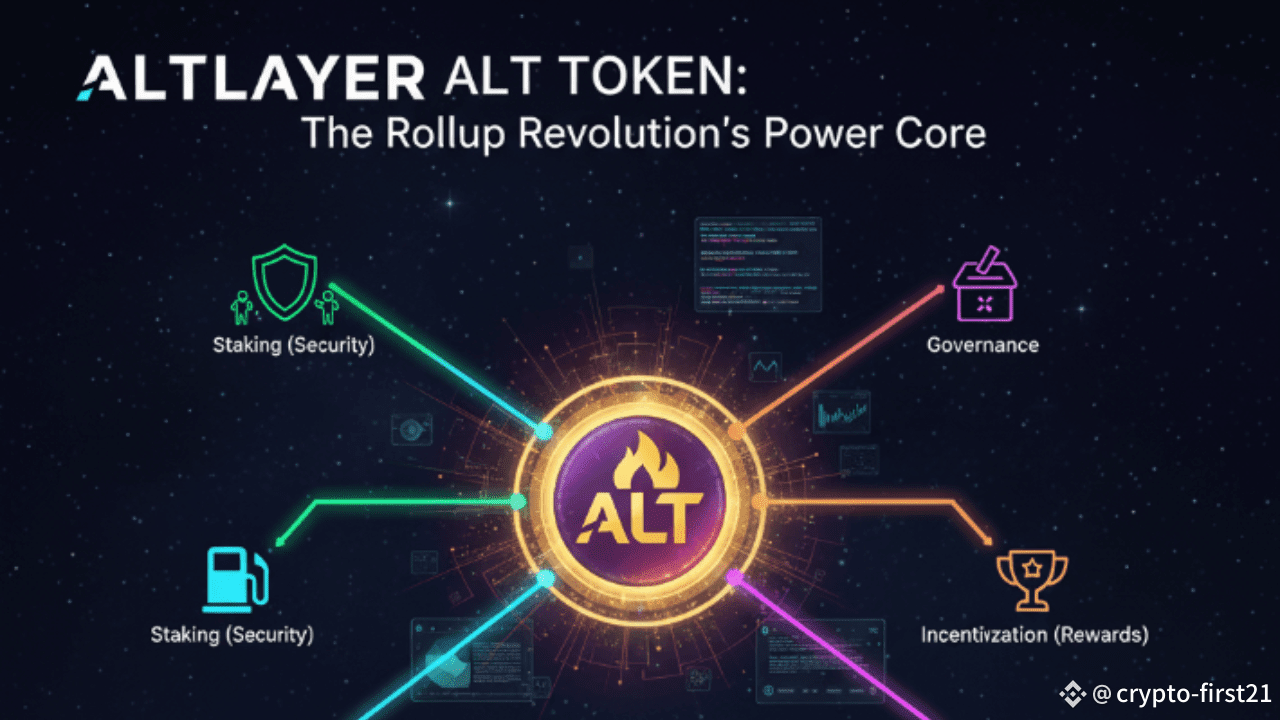

ALT's Four Pillars of Utility

The ALT token is a crucial component of the AltLayer ecosystem, serving multiple, interwoven functions that secure and incentivize the protocol's key services.

The Economic Bond (Staking)

The primary role of the ALT token is to provide economic security for the network.

Restaked Rollups Security: AltLayer rollups utilize EigenLayer's restaking mechanism, allowing staked ETH to be re-staked to secure various decentralized services. ALT tokens are used alongside these restaked assets to create an economic bond.

Slashing: Operators who provide services (like sequencing or verification) must stake ALT. If a malicious behavior is detected (e.g., submitting an incorrect state), the staked ALT tokens can be slashed, providing a strong crypto-economic incentive for honest participation.

Protocol Fees

ALT is the payment currency for services within the AltLayer ecosystem.

Intra-Network Services: Network participants must pay for services like deploying and maintaining a new rollup or utilizing the decentralized security services (VITAL, MACH, SQUAD) using ALT tokens.

Protocol Incentivization

ALT tokens are distributed as rewards to ecosystem contributors.

Operator Rewards: Operators who run the various actively validated services (AVS) that secure the rollups earn ALT tokens for their honest and timely contributions, incentivizing a robust and decentralized service layer.

Governance

ALT holders have a direct say in the future direction of the protocol.

Decentralized Decision-Making: Token holders can vote on governance decisions, including protocol upgrades, parameter adjustments, and other critical matters that shape the evolution of the AltLayer platform.

Powering Restaked Rollups: VITAL, MACH, & SQUAD

AltLayer's most significant innovation is the Restaked Rollup framework, which adds three core, modular, and customizable Actively Validated Services (AVS) to any rollup. The ALT token is the economic lubricant for all three.

VITAL: Decentralized Verification

Rollups must be verified to ensure that the transactions bundled off-chain are executed correctly.

Function: VITAL is the AVS for decentralized verification of a rollup's state. Operators using VITAL check blocks proposed by the sequencer (SQUAD) and can raise fraud proof challenges if an invalid state is detected.

ALT's Role: VITAL operators stake ALT as part of their economic bond, providing a guarantee of honest verification.

MACH: Fast Finality

Finality is the guarantee that a transaction is irreversible. Traditional optimistic rollups can have a lengthy challenge period (up to 7 days).

Function: MACH is the AVS for fast finality, reducing the time for transaction confirmation from potentially minutes/hours to under 10 seconds. It achieves this by allowing operators to use restaked assets (and ALT) to back claims on the rollup state.

ALT's Role: ALT tokens are part of the collateral securing the instant finality claims made through MACH, allowing assets to be withdrawn faster.

SQUAD: Decentralized Sequencing

Most rollups rely on a single, centralized entity (a sequencer) to order and batch transactions, which introduces risks of censorship and single points of failure.

Function: SQUAD is the AVS for decentralized sequencing. It creates a decentralized network of sequencers that order and aggregate transactions, eliminating liveness concerns and reducing the risk of malicious Maximal Extractable Value (MEV) extraction.

ALT's Role: SQUAD operators stake ALT to ensure they behave honestly, as their stake can be slashed for misbehavior in sequencing.

Rollup-as-a-Service (RaaS) and Ephemeral Rollups

AltLayer's RaaS platform democratizes L2 development by providing a no-code dashboard that lets users launch their own rollups based on popular stacks like OP Stack, Arbitrum Orbit, and ZK Stack in minutes.

A key feature of RaaS is Ephemeral Rollups, which are specialized, temporary rollups designed for event-specific high-traffic use cases, such as an NFT mint or a high-stakes gaming tournament. Developers can quickly spin up this high-capacity rollup when needed, use it until the event is over, and then dispose of it by settling the final state on the L1. The ALT token is essential for accessing and paying for this infrastructure.

In summary, the ALT token is not just a cryptocurrency; it is the economic backbone that secures the restaking ecosystem, incentivizes all operators, pays for the modular services, and grants governance power, fundamentally transforming how Layer 2 solutions are deployed, secured, and scaled.