Bitcoin price hovers around $93,000 on Tuesday, consolidating below a key resistance zone after its recent rally.

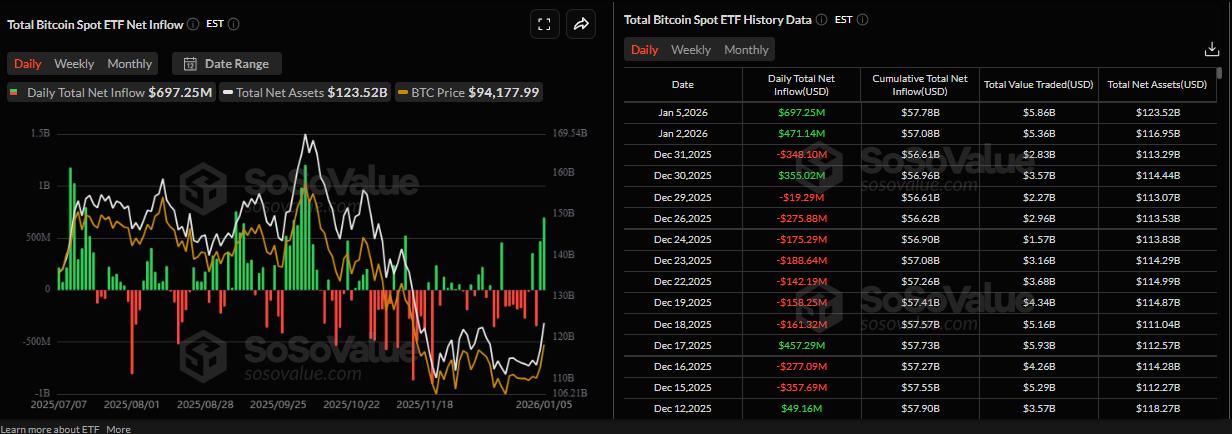

US-listed spot ETFs recorded an inflow of $697.25 million, the highest single-day inflow since October 7.

Strategy added 1,287 BTC to its reserve on Monday while increasing its USD liquidity reserve to $2.25 billion.

Bitcoin (BTC) price trades around $93,000 at the time of writing on Tuesday, pausing near a key resistance zone after its recent advance. Institutional demand remains supportive, with US-listed spot Exchange Traded Funds (ETFs) recording their largest single-day inflow since early October. In addition, Strategy’s (MSTR) Bitcoin purchase on Monday and expanded cash reserves reinforce confidence in the largest cryptocurrency by market capitalization in the near term.

Highest single-day inflow since early October

Institutional demand for Bitcoin continues to strengthen as the week begins. SoSoValue data show that spot Bitcoin ETFs recorded an inflow of $697.25 million on Monday, marking the highest single-day inflow since early October, when BTC reached a new all-time high of $126,199. If these inflows continue and intensify, BTC could see a price rally.

Strategy adds 1,287 BTC to its reserve

On the corporate front, Strategy Executive Chairman Michael Saylor announced on Monday that his company, Strategy Inc., purchased 1,287 Bitcoin, bringing the total reserve to 673,783 BTC, highlighting the firm’s continued aggressive accumulation strategy and long-term conviction in Bitcoin.

In addition, the firm has increased its USD reserve by $62 million to $2.25 billion, indicating a stronger liquidity position and greater flexibility for future Bitcoin acquisitions.

Bitcoin Price Forecast: BTC could extend rally if it closes above $94,200

Bitcoin's price closed above the upper consolidation range of $90,000 on Saturday. BTC rose 3.57%, retesting the 61.8% Fibonacci retracement level (drawn from the April low of $74,508 to October's all-time high of $126,199) at $94,253 on Monday. As of Tuesday, BTC is consolidating below the key resistance level at around $93,000.

If BTC continues its upward trend and closes above the $94,253 resistance, it could extend the rally toward the key psychological level at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 64, above the neutral level of 50, indicating bullish momentum is gaining traction. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

However, if BTC faces a correction, it could extend the decline toward the key support level at $90,000.