The AI trade is no longer moving as a single theme. As capital rotates into companies that control physical bottlenecks such as power, compute capacity, cooling, and automation, performance across AI-linked equities is diverging sharply.

New forecasts and operational updates heading into 2026 highlight which business models are gaining traction – and which are being repriced.

Key Takeaways

AI stocks are no longer moving together, with investors favoring companies that control power, compute, cooling, and infrastructure bottlenecks.

Nebius and IREN stand out as capacity-driven plays, while KULR targets AI’s growing heat-density problem as a potential turnaround.

UiPath and Amazon benefit from AI adoption, but their scale points to steadier, more measured growth rather than explosive upside.

Nebius Group

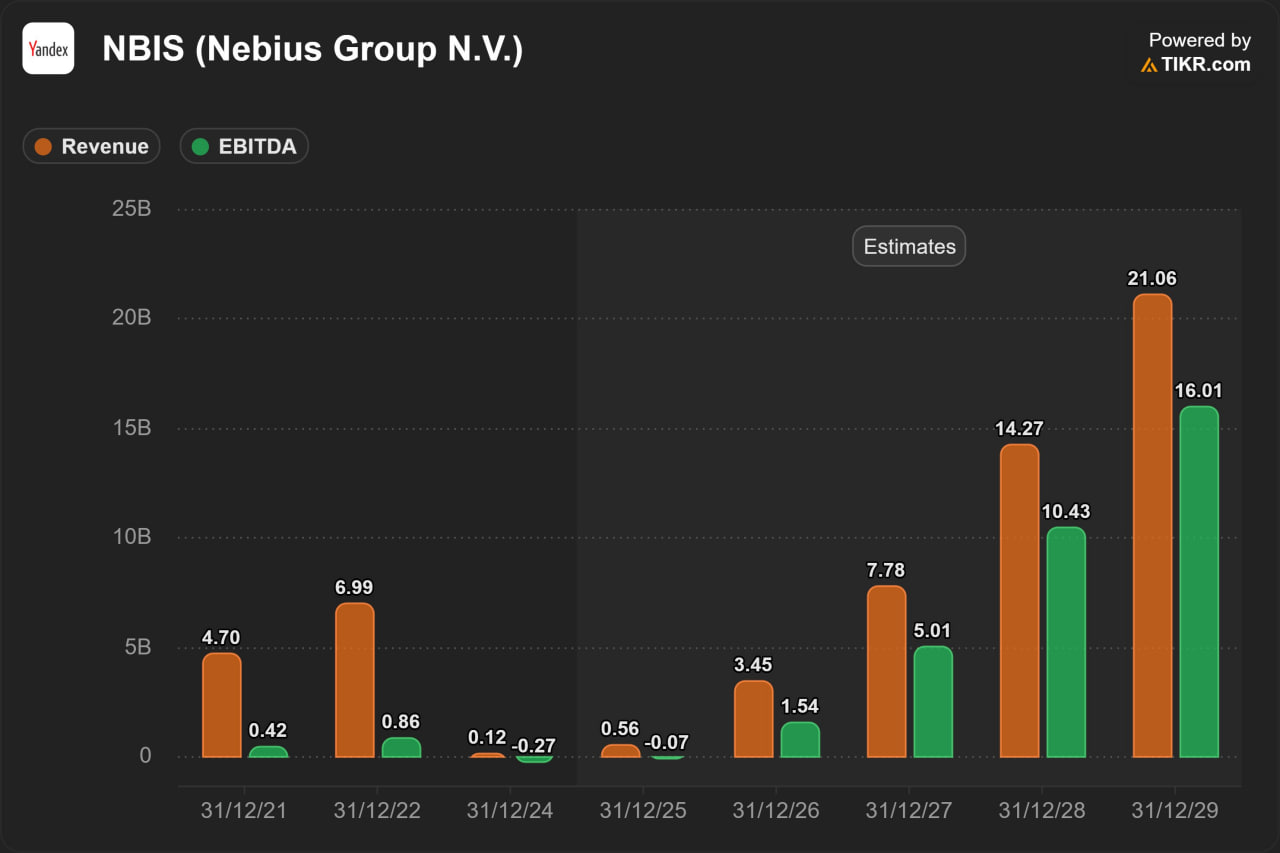

Nebius is emerging as one of the fastest-scaling AI-native cloud providers globally. The company raised its contracted power target from 1 GW to 2.5 GW by 2026, more than doubling prior guidance. New data centers are ramping across the U.K., Israel, Finland, and the U.S., with additional facilities under letters of intent in both the U.S. and Europe.

Most of Nebius’s 2026 capacity is already sold out, making supply – not demand – the primary constraint. Revenue is projected to grow more than 500% in 2026, while annual recurring revenue could increase between 7x and 12x year over year, marking one of the fastest ramps ever seen in enterprise infrastructure.

Beyond compute, Nebius operates Toloka AI, which provides human-annotated data for large language models, and Mindrift, a platform that has onboarded more than 5,000 specialized experts since launching in 2024. Multi-year hyperscaler contracts, including large deals with Meta and Microsoft, are reinforcing Nebius’s positioning as a rising Tier-2 hyperscaler with a pure AI focus.

IREN Limited

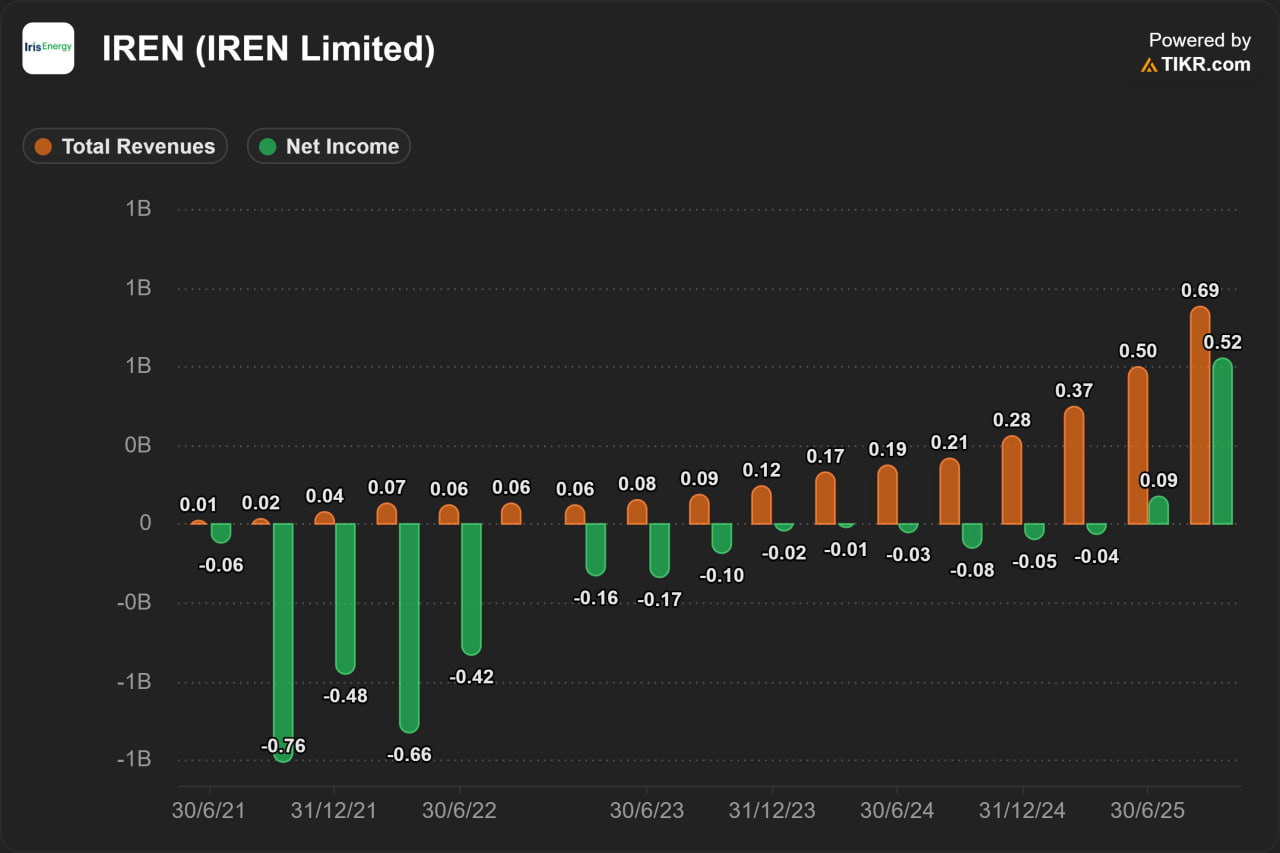

IREN is transitioning from Bitcoin mining into a power-first, vertically integrated digital infrastructure platform. Unlike off-grid miners, its grid-connected facilities reduce downtime and curtailment risk while providing higher reliability for AI and data center workloads.

The company owns its land, renewable power infrastructure, and data centers end to end, an increasingly difficult model to replicate as grid interconnection queues tighten globally. With only around 16% of its 3 GW power base currently utilized, IREN retains significant long-term optionality across AI cloud, high-performance computing, and energy-adjacent services.

IREN recently reached positive net income for the first time and is expected to sustain profitability as utilization increases and AI workloads scale across its infrastructure.

KULR Technology Group

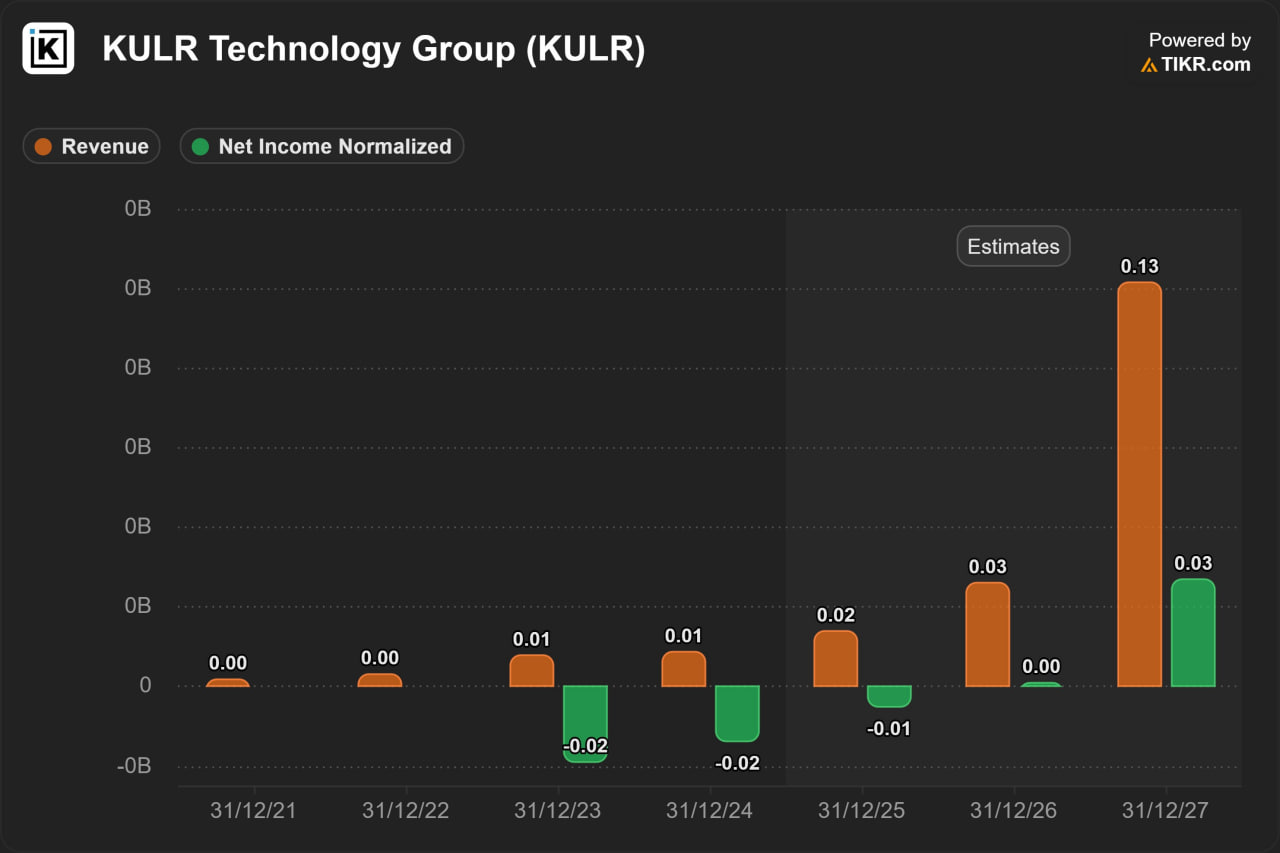

KULR was the weakest-performing stock among this group in 2025, with shares down roughly 90%, but its forward outlook has drawn renewed attention. Revenue is projected to grow nearly 900% in 2026, with net income potentially turning positive for the first time.

The company specializes in carbon-fiber thermal architectures designed to dissipate extreme heat and prevent thermal runaway in lithium-ion batteries, a critical issue for EVs, energy storage, aerospace, defense, and increasingly AI infrastructure. KULR holds a commercial license for NASA’s Fractional Thermal Runaway Calorimeter, one of the most advanced diagnostic tools for battery safety and thermal modeling.

KULR is also targeting data centers through its machine-learning-driven cooling systems, which dynamically optimize airflow and heat dissipation for AI clusters. As heat density becomes a binding constraint for AI deployments, thermal management is emerging as a non-obvious but critical bottleneck.

UiPath

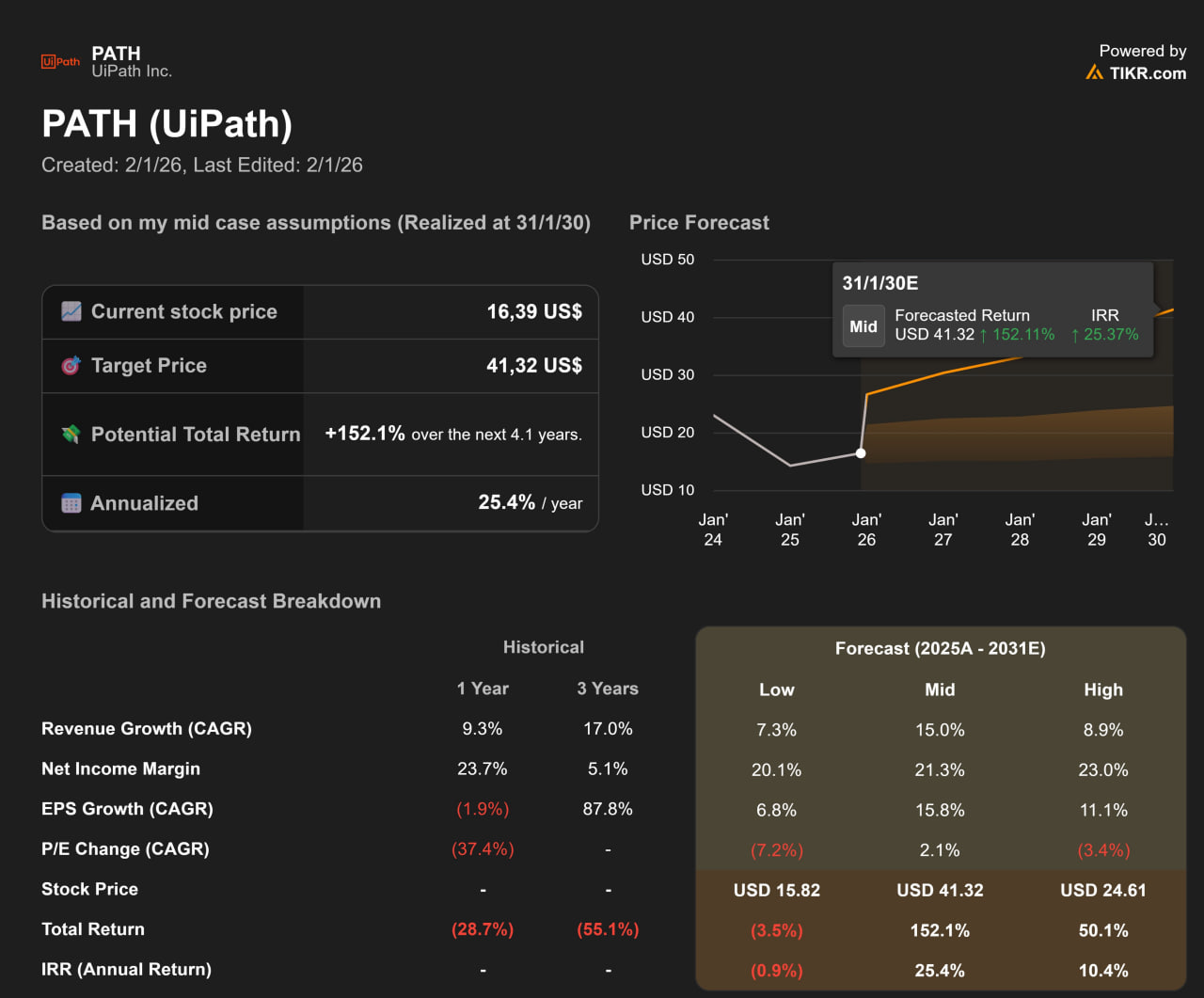

UiPath is regaining momentum after years of underperformance, despite still trading well below its 2021 highs. In 2025, the stock advanced as revenue growth stabilized and AI-powered automation adoption accelerated across enterprises.

UiPath offers a full automation lifecycle under a single platform and now supports hundreds of thousands of AI agent deployments. Its ecosystem includes more than 2.5 million community users and over 11,000 pre-built automations integrated with major enterprise systems, significantly reducing deployment times and customer risk.

Revenue is projected to rise steadily through the end of the decade, supported by improving margins, recurring enterprise contracts, and a developer ecosystem that strengthens long-term customer stickiness.

Amazon

Among the Magnificent Seven, Amazon delivered the weakest stock performance in 2025, rising only modestly despite AWS maintaining its position as the world’s largest cloud provider with over 30% market share.

AWS remains a core beneficiary of generative AI demand, supported by Amazon’s proprietary Trainium chips, which offer materially better price-performance than Nvidia GPUs for certain workloads. Demand for AI services continues to outpace supply, reinforcing AWS’s long-term strategic position.

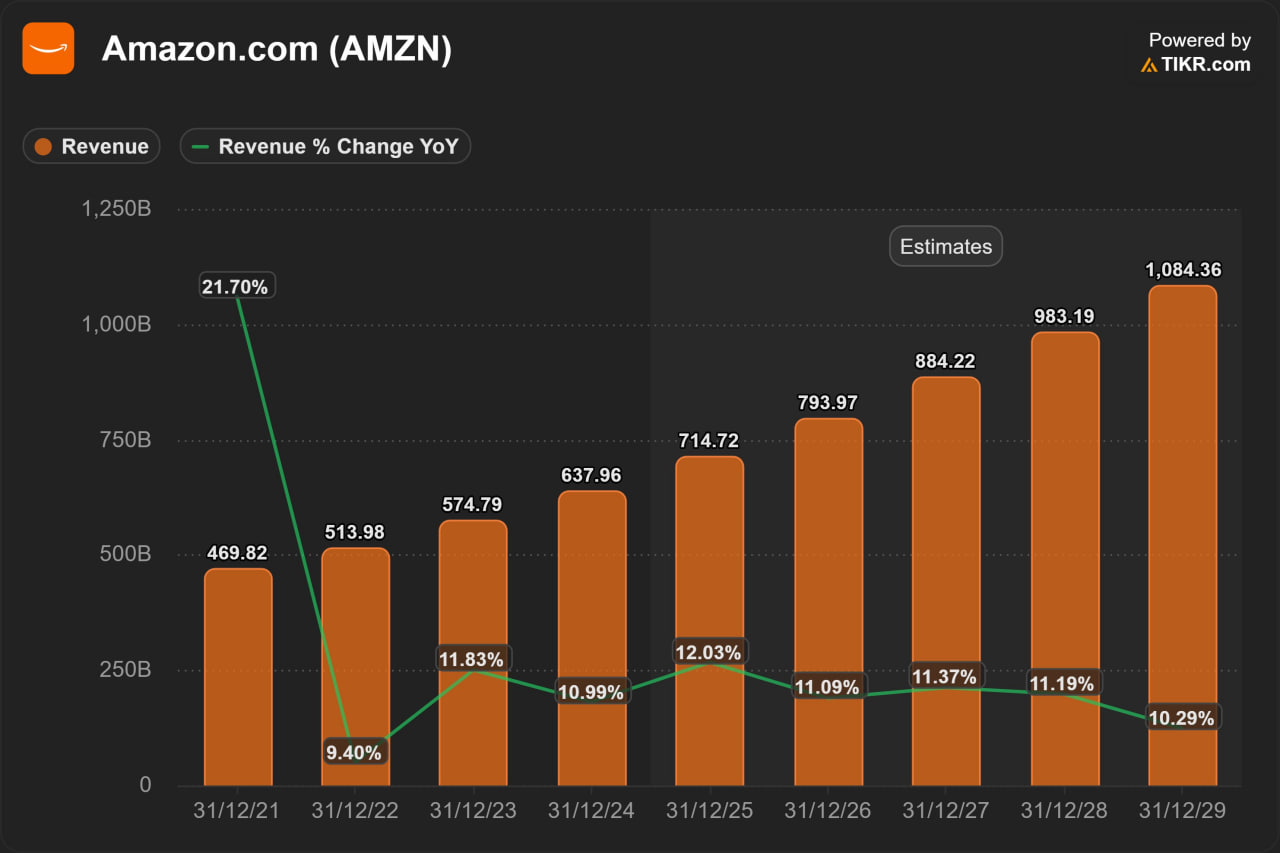

Beyond cloud, Amazon’s diversified ecosystem spanning logistics, advertising, grocery, and Prime continues to drive customer lifetime value. With more than 250 million Prime members globally, revenue growth is expected to exceed 10% in 2026 as AI, cloud, and consumer services reinforce one another.