Bitcoin is attempting to extend its recovery after reclaiming the $90,000 level, a move that has brought cautious optimism back into the market following weeks of consolidation and selling pressure. While price action alone still falls short of confirming a renewed uptrend, on-chain data suggests that underlying market conditions may be stabilizing beneath the surface.

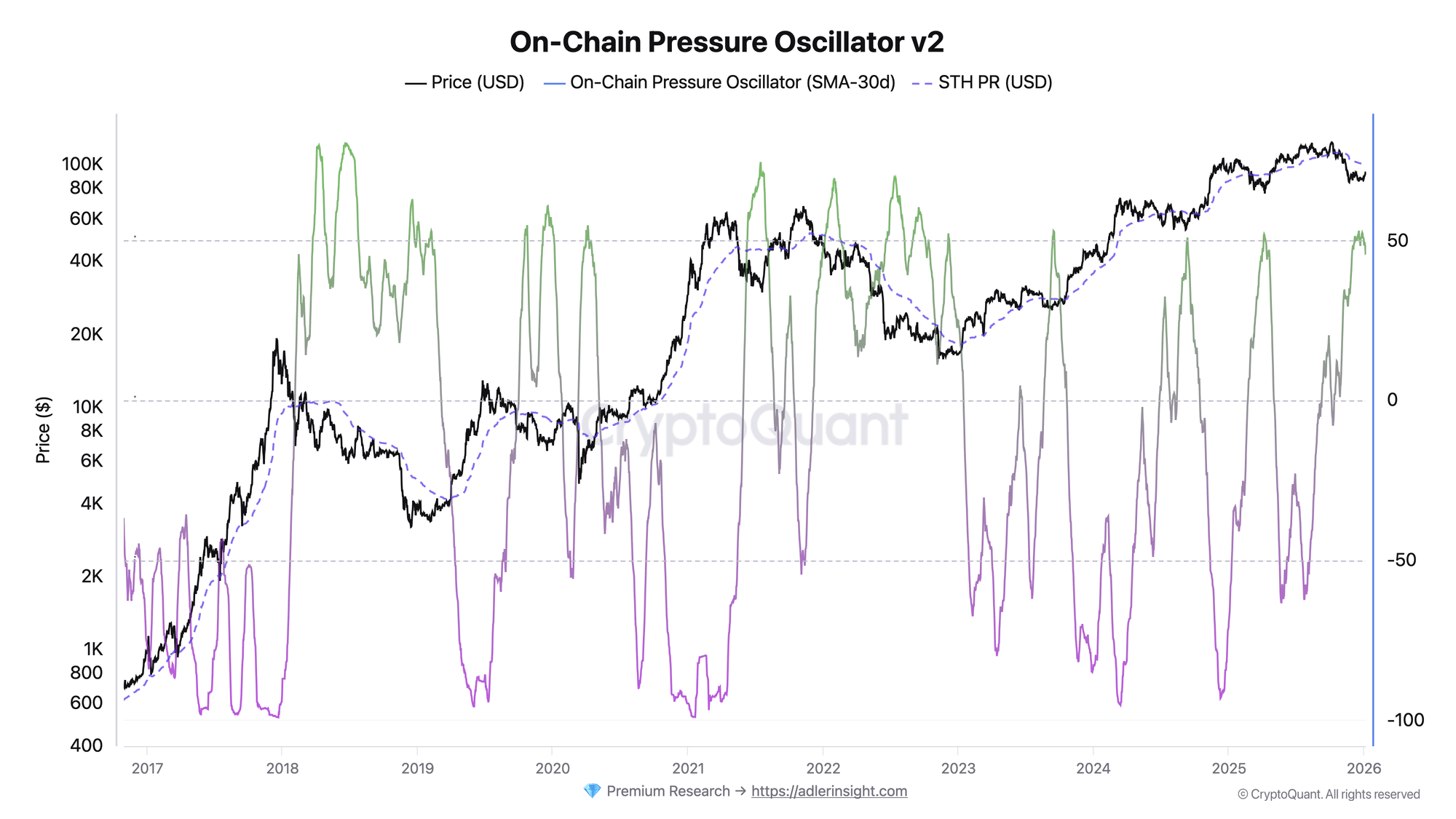

According to top analyst Axel Adler, the On-Chain Pressure Oscillator is offering an important lens into current market dynamics. The indicator, which aggregates exchange netflows, short-term holder realized profit and loss, and long-term coin spending into a single percentile-based signal, is currently sitting around the 46 level. Historically, this zone has been associated with accumulation phases rather than distribution.

What stands out in the current reading is the absence of aggressive sellers. Exchange inflows remain muted, indicating that investors are not rushing to move coins to trading venues. At the same time, older coins are largely dormant, suggesting that long-term holders are not capitulating despite recent volatility. Short-term holders remain under pressure, but their losses appear contained, limiting forced selling.

Together, these factors point to a market that is deleveraged and relatively balanced, with sell-side pressure constrained more by a lack of supply than by surging demand.

Short-Term Holder Stress Keeps Sell-Side Pressure Contained

Adler adds that recent movements in the On-Chain Pressure Oscillator reinforce the idea that Bitcoin is still locked in a consolidation regime. While the daily readings of the oscillator have softened over the past few sessions, the smoothed trend remains broadly stable.

Historically, similar configurations have tended to appear during pause phases, when the market digests prior moves before committing to a new direction. Importantly, this stability suggests that sell-side pressure from key cohorts remains muted, even as demand has yet to show a decisive expansion.

The main risk to this structure would be a sustained breakdown in the smoothed oscillator below neutral levels. Such a move would indicate a shift away from accumulation toward distribution, signaling that sellers are regaining control.

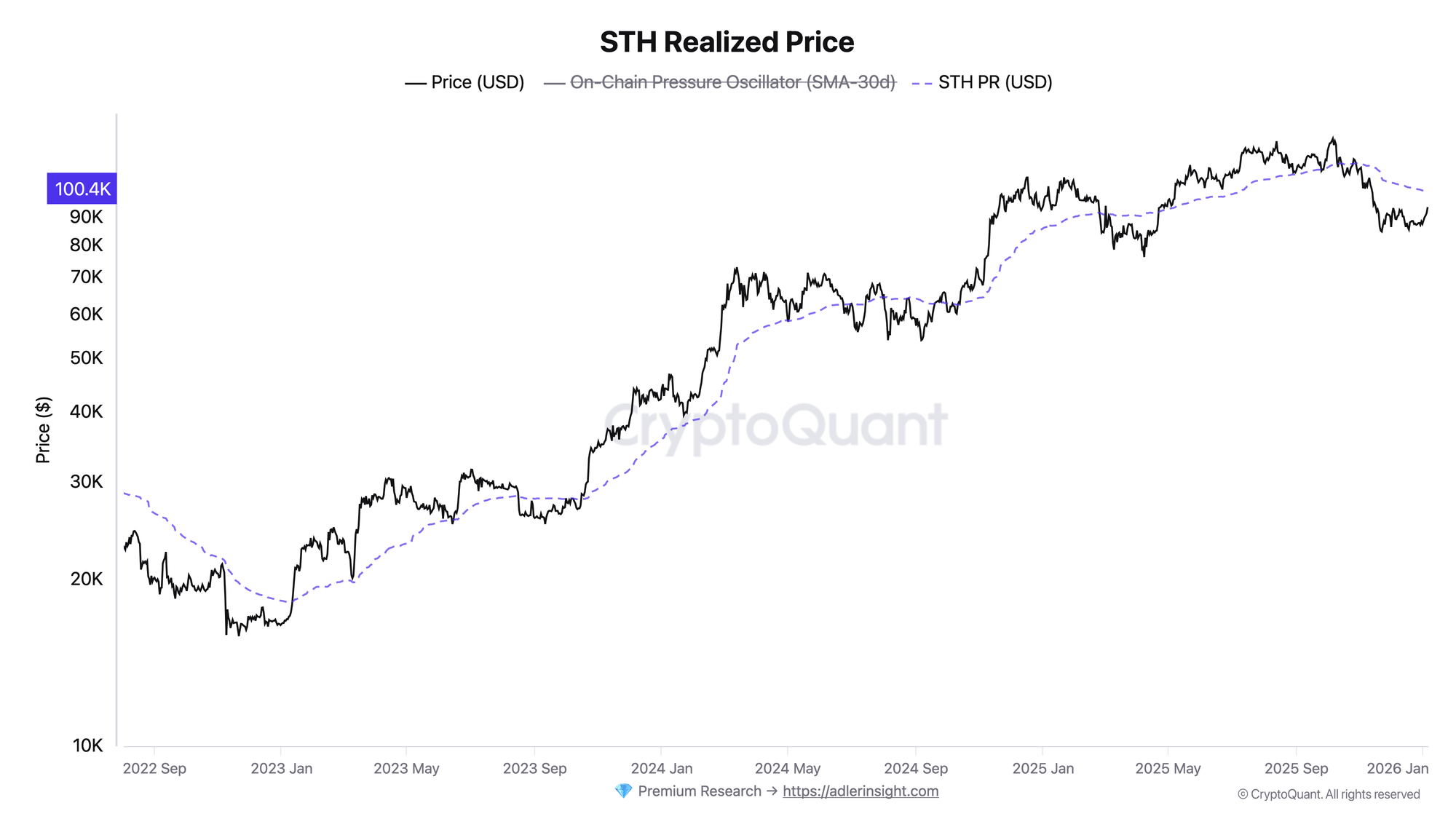

This dynamic is closely linked to Bitcoin’s position relative to the Short-Term Holder (STH) realized price. With BTC trading below the average cost basis of holders who entered within the last five months, most short-term participants are currently underwater. This limits their ability to take profits and reduces immediate selling incentives. As a result, sell pressure remains constrained despite recent price weakness.

However, this balance may change if Bitcoin approaches the $100,000 area. A return to breakeven for short-term holders could unlock supply and create resistance. A healthier signal would be price reclaiming the STH realized level while the oscillator strengthens, confirming renewed demand rather than mere absence of selling.

Bitcoin Rebounds From December Lows but Faces Heavy Overhead Resistance

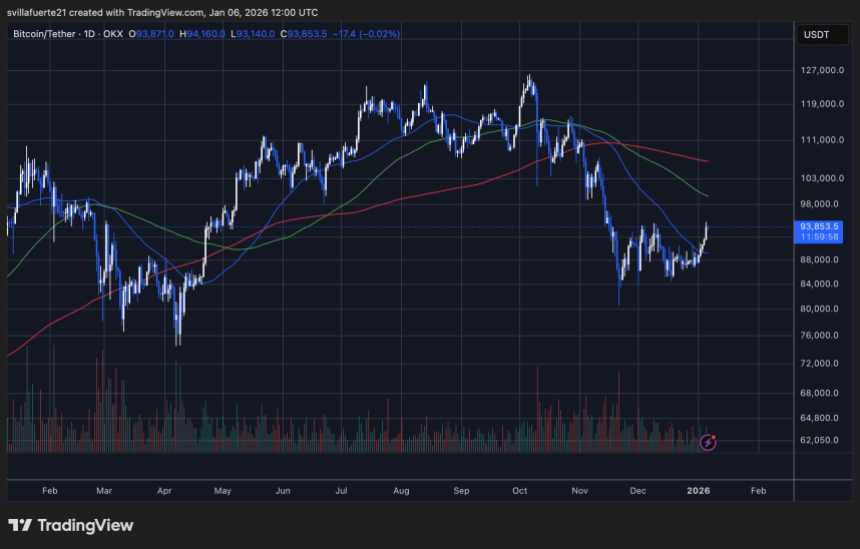

Bitcoin is trading near the $94,000 area after rebounding sharply from the December lows around $82,000–$84,000. The chart shows a clear recovery leg following a steep corrective phase that unfolded after the October peak near $125,000. While the bounce has restored short-term momentum, the broader structure remains technically constrained.

Price is currently reclaiming the short-term moving average, which has started to curl upward and act as dynamic support. This is a constructive development, suggesting that downside momentum has eased and buyers are regaining some control.

However, Bitcoin remains below the mid- and long-term moving averages, which are still sloping downward. These levels, clustered between roughly $100,000 and $105,000, represent a significant overhead resistance zone that bulls must clear to reestablish a bullish trend.

Selling pressure peaked during the November–December breakdown, while the current rebound has occurred on more moderate volume, indicating stabilization rather than aggressive accumulation.

Structurally, the market appears to be transitioning from a sharp sell-off into a consolidation and recovery phase. Holding above the $90,000–$92,000 region is critical to maintain this constructive setup. A failure to defend this zone would expose Bitcoin to renewed downside risk, while a sustained move above the declining moving averages would signal a more durable shift in market direction.

Featured image from ChatGPT, chart from TradingView.com