A Polymarket trader has resurfaced after a seven-month hiatus to wager on an Israeli strike against Iran. This has reignited market speculation over whether the activity reflects informed positioning or coincidence.

These actions echo recent controversies tied to Venezuela, where three wallets reportedly made more than $630,000 by betting on the arrest of President Nicolás Maduro.

Dormant Polymarket Trader Draws Scrutiny With Israel-Iran Bets

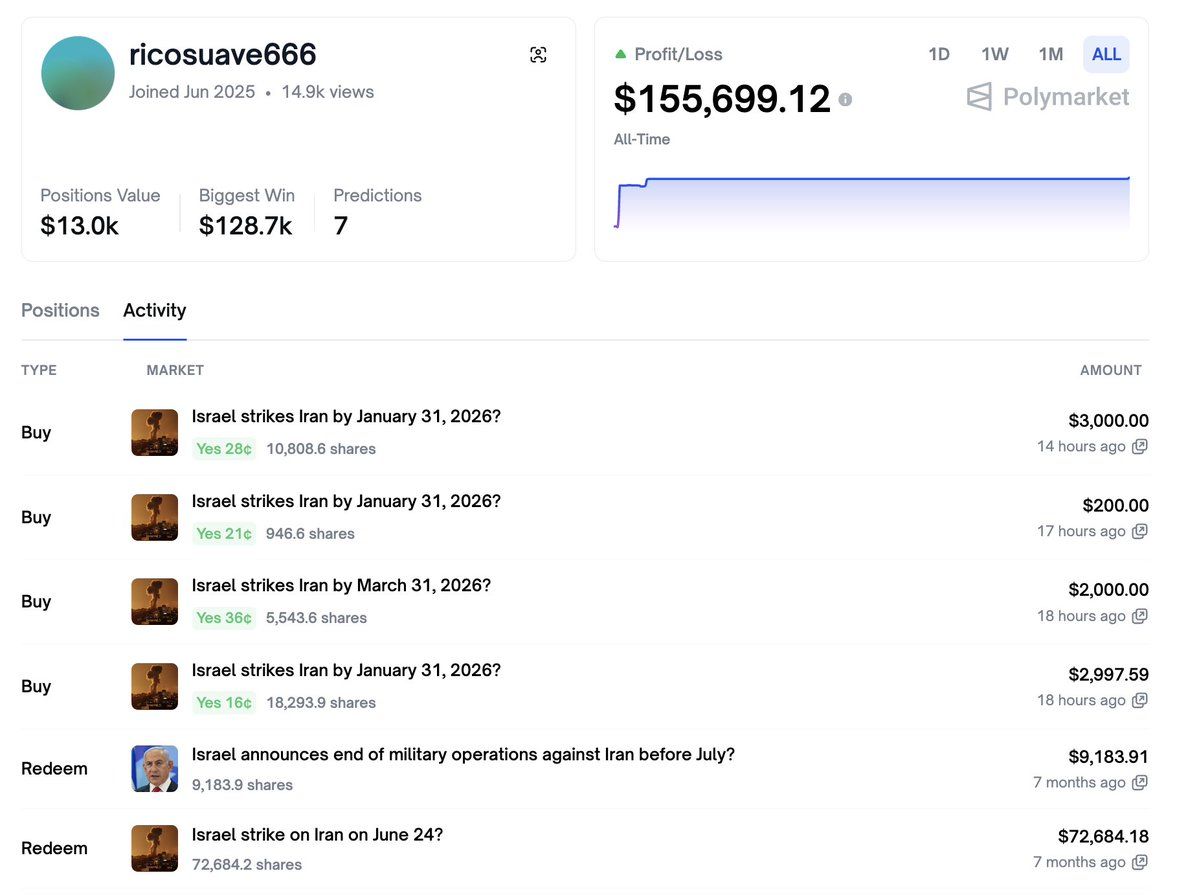

The trader, known as ricosuave666, has spent a total of $8,198 betting on potential Israeli military action against Iran. This user’s profile shows $155,699.12 in profits, with each past Israel-related position proving successful.

Blockchain analytics firm Lookonchain flagged the account’s activity, noting that the trader is betting on the likelihood of Israeli strikes occurring by January 31 and March 31, 2026.

“Notably, when ricosuave666 joined Polymarket 7 months ago, every bet he placed on Israel-related news was profitable. Is he an insider? Now he’s betting on Israel-related news again — will another strike happen?,” Lookonchain wrote.

Polymarket Trader ricosuave666’s Activity. Source: X/Lookonchain

As of the latest data from Polymarket, the odds of an Israeli military strike by January 31 are estimated at 38%. Looking further ahead, the likelihood rises to 54% for March.

Notably, the trader’s bets come amid escalating tensions across the Middle East. BeInCrypto recently reported that the sharp depreciation of Iran’s national currency against the US dollar has triggered protests since late December.

According to The Times of Israel, Israeli Prime Minister Benjamin Netanyahu expressed support for the demonstrations that have spread across Iran over the past week and continue to gain momentum. However, Iranian authorities accused Israel of attempting to “undermine its national unity.”

Amid the ongoing unrest, Iran has warned that it may consider preemptive military action against its enemies if it perceives concrete threats to its security. Iran’s National Defense Council did not explicitly name Israel or the United States.

“The long-standing enemies of this land… are pursuing a targeted approach by repeating and intensifying threatening language and interventionist statements in clear conflict with the accepted principles of international law, which is aimed at dismembering our beloved Iran and harming the country’s identity,” the statement read.

With regional tensions continuing to rise, the trader’s bets may reflect heightened geopolitical uncertainty rather than privileged insight. While the timing of the wagers has drawn attention, there is currently no concrete evidence to suggest insider trading, leaving the activity open to interpretation as either strategic speculation or coincidence.

Nevertheless, concerns surrounding potential insider activity are not without precedent. Recently, three wallets placed bets on President Maduro leaving office just hours before his arrest, drawing scrutiny over the timing of those trades.