What is Maverick Protocol (MAV)?

Decentralized Finance has revolutionized trading with the introduction of the Automated Market Maker (AMM) model, which provides individuals a permissionless and efficient way to engage in trading without relying on financial institutions. However, this concept also faces several challenges, including liquidity constraints, impermanent loss, and other related issues.

Maverick Protocol is a DeFi platform that aims to address these challenges through a Dynamic AMM model, offering more liquid markets and gain opportunities for traders and liquidity providers (LPs). Its novel AMM model has three main features: custom LP distributions, low maintenance and gas fee for LPs, and reconcentration of liquidity for increased capital efficiency. MAV is the native token of Maverick protocol to empower users with governance voting rights and a say in the development and improvement proposals of the protocol.

| Launch Date | 2023 |

| Founder | Bob Baxley and Alvin Xu |

| Blockchain Protocol | Ethereum blockchain |

| Native Token | MAV |

| Market Cap | $92.41 million |

| Token Type | Utility and Governance |

| Circulating Supply | 250 million |

| Total Supply | 2 billion |

| Consensus Method | Proof of Stake (PoS) |

Who are the Founders of Maverick?

Maverick Protocol is the innovation of Alvin Xu and Bob Baxley, who have been developing protocols for over one year with a team of developers, marketers, and others. It was launched in March 2023 on the Ethereum blockchain to eliminate the challenge faced by decentralized exchanges and promote the growth of the DeFi industry.

How does Maverick Protocol (MAV) work?

Maverick’s AMM model is based on the concept of Directional Liquidity Providing (LPing), which improves capital efficiency and gives more capital control to liquidity providers.

Directional LPing: The novel concept of Directional LPing in AMM enables LPs to make directional bets on asset prices and earn excess returns if their prediction is correct. This allows LPs to align their price prediction with their liquidity provision strategy.

Liquidity Concentration: LPs can stake liquidity in one or more price bins (price range) and specify how that liquidity should move as the price changes. This dynamic distribution of liquidity helps improve capital efficiency and enables LPs to express directional price beliefs.

Staking Modes: Maverick Direction LPing offers four pool modes for LPs to choose from:

Static Mode: where liquidity remains fixed and does not move with price changes, similar to existing range AMMs.

Right Mode: Liquidity shifts to the right as the price of tokens increases, enabling LPs to make bullish price predictions.

Left Mode: The liquidity direction moves to the left as the price of the token decreases, allowing LPs to make bearish price predictions.

Both Mode: Liquidity shifts as the direction of price changes and re-concentrates it in the range which is closer to the price, offering extremely high capital efficiency.

What makes MAV Unique Use Cases?

Maverick protocol’s design automatically shifts liquidity with trading to offer efficient pricing and lower price slippage to traders.

Its active liquidity strategies automate the process of liquidity movement, so LPs don’t need to manually adjust their liquidity positions and can save on time and gas fees.

MAV holders can stake their tokens to generate non-transferable veMAV for contribution to governance proposal and future direction of protocol.

Maverick (MAV) Price Analysis

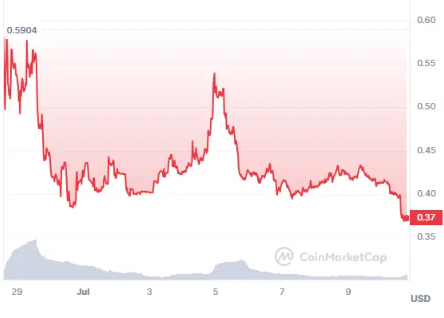

Source: CoinMarketCap

MAV’s price today is trading at $0.3699, with a 24-hour trading volume of $20.22 million. In the last 24 hours, The MAV price has seen a drop of about 10.93%. MAV market cap is $92.41 million as of July 10, 2023.

Looking at the 4-hour trading chart, the market sentiment of MAV price seems bearish, and its support is at $0.384; if MAV price manages to pull back above this level, it might possibly go upto $0.42.

| MAV Price Today | $0.3699 |

| Price Change (7 days) | -16.6% |

| Market Dominance | – |

| Market Rank (as per CMC) | 248 |

| Market Cap | $92.41 million |

| Fully Diluted Market Cap | $746.56 million |

| ATH | $0.78 |

| ATL | $0.3692 |

How to Buy MAV Tokens in India?

To buy MAV Token in India, just follow the below-mentioned steps:

Download the CoinDCX App.

Enter the details for registration.

Complete KYC

Once your profile is verified, fund your wallet and buy MAV Tokens.