Ethereum price has broken out of a two-month descending wedge, signaling renewed bullish momentum. ETH’s technical structure now points toward a potential rally after weeks of compression.

However, the upside narrative faces a challenge as large holders begin distributing into strength, raising concerns about whether whale activity could cap gains.

Ethereum Whales Exhibit Skepticism

Ethereum whales have turned into active sellers as the price pushed higher. Over the last three days, wallets holding between 100,000 and 1 million ETH sold roughly 300,000 ETH. At current prices, those sales exceed $971 million, representing a meaningful supply increase.

This behavior suggests skepticism among large holders regarding ETH’s ability to sustain its rally. Whales often distribute during breakouts to lock in gains. Their actions can slow upward momentum, especially if demand from other cohorts fails to absorb the added supply.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Whale Holding. Source: Santiment

Whale selling does not guarantee a reversal, but it raises near-term risk. Large transactions influence liquidity conditions and can pressure prices if repeated. Ethereum’s rally must now contend with this supply overhang.

ETH LTHs Could Stabilize The Price

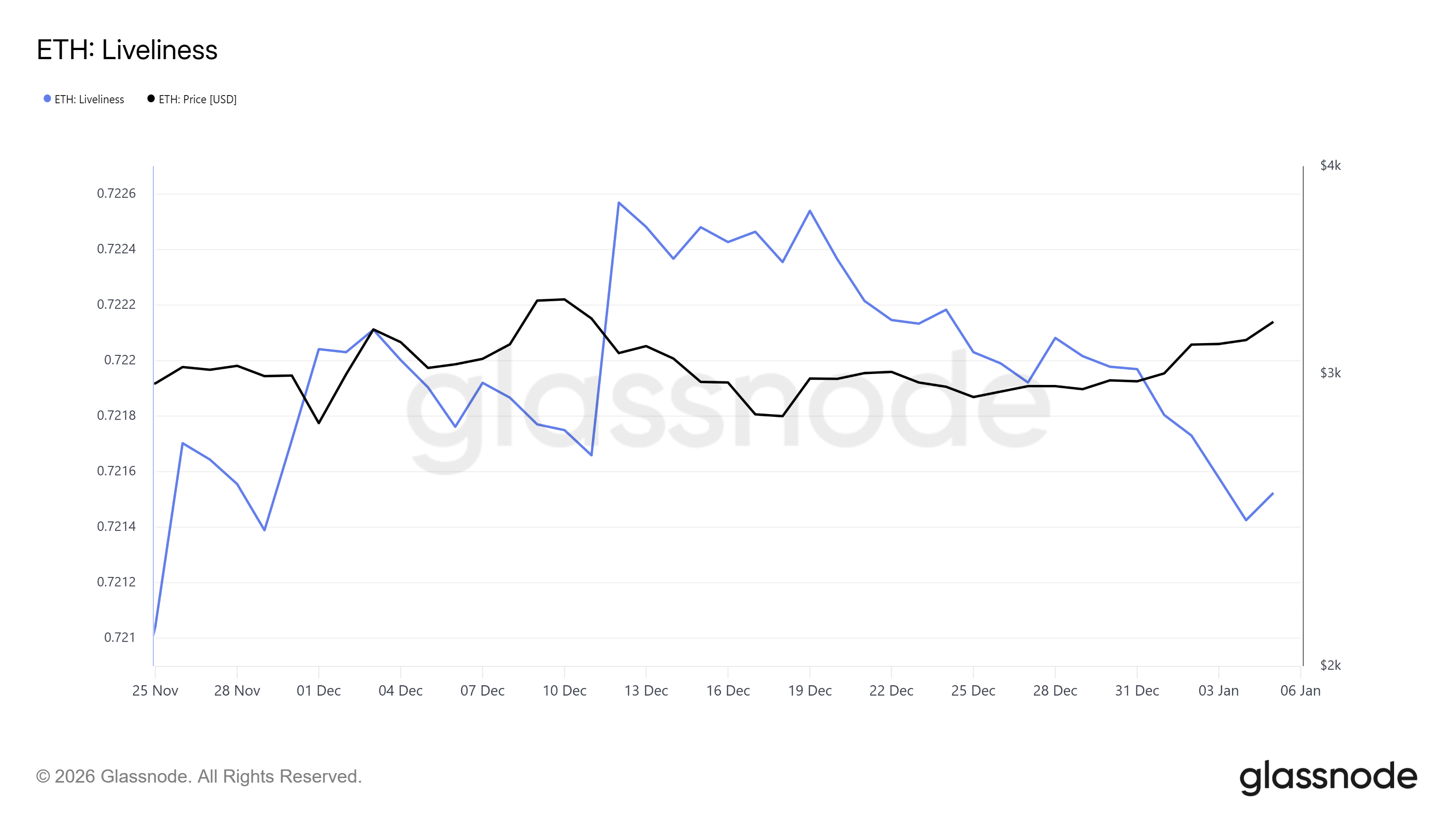

Long-term holder behavior provides a counterbalance to whale distribution. Ethereum’s Liveliness metric has declined sharply since late December 2025. This indicator tracks whether long-held coins are moving or remaining dormant.

A falling Liveliness reading signals that long-term ETH holders are choosing to hold rather than sell. This pattern reflects conviction among investors with longer time horizons. Their restraint can stabilize prices during periods of short-term distribution.

Ethereum Liveliness. Source: Glassnode

When long-term holders maintain positions, volatility often decreases. Their behavior reduces the circulating supply available for selling. This dynamic may help offset whale-driven pressure and support Ethereum’s broader bullish structure.

ETH Price Breakout Rally To Be Continued

Ethereum trades near $3,265 at the time of writing after confirming a breakout from its descending wedge. The pattern projects a potential 29.5% upside, targeting $4,061. Achieving that level would require sustained demand and reduced distribution.

A more realistic short-term objective sits lower. ETH could rise toward $3,447 if it secures $3,287 as support. Holding this level would confirm breakout strength and provide a base for a move beyond $3,607.

ETH Price Analysis. Source: TradingView

Downside risk remains tied to whale behavior. If selling intensifies, Ethereum could fall below $3,131. A deeper drop toward $3,000 or even $2,902 would invalidate the bullish thesis and negate the breakout, leaving ETH exposed to a corrective phase.