Avici (AVICI) has recently gained attention in the crypto community for its innovative spend solutions and growing market performance. The project offers a crypto-linked credit card backed by Visa, allowing users to utilize their crypto assets for everyday purchases—bridging the gap between digital assets and real-world spending.

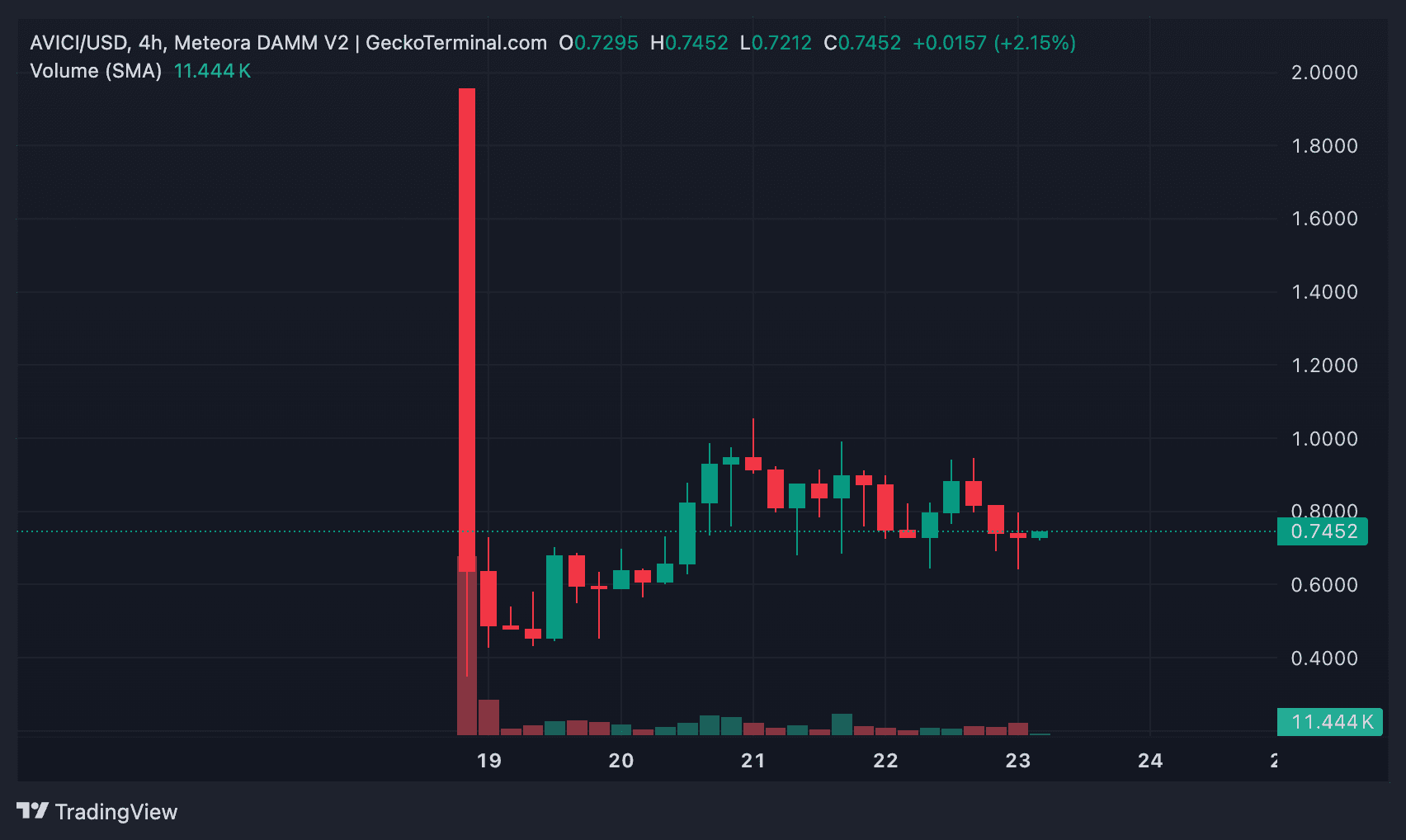

With a circulating supply of around 10 million tokens and a market cap near $9.67 million, Avici is still in its early stages but has shown significant potential. Investors are increasingly watching its steady upward trend and long-term growth forecasts.

Avici Crypto Overview

Avici operates on the Solana network, providing fast, low-cost transactions. Its platform focuses on improving crypto liquidity through a secured credit card system that connects crypto holders directly with payment networks.

Key metrics for AVICI include:

Market Cap: Approximately $9.67 million

Circulating Supply: 10 million AVICI

Historical High: Around $1.04 (late 2025)

Core Utility: Crypto spend and liquidity via Visa integration

This foundation gives Avici a practical use case, which often supports long-term token appreciation if adoption continues to grow.

Avici Price Prediction 2025–2030

Current forecasts for avici crypto show promising upside potential across the next five years.

October 2025: Price expected between $0.84 and $0.91

December 2025: Projected range around $1.57 to $1.83

2026 Average: Between $1.04 and $1.78

2027 Outlook: Average prices rising beyond $2

2028–2030 Long-Term Prediction: Could reach between $5.5 and $7.5 per token

In the short term, avici price prediction shows moderate volatility, with fluctuations between $0.84 and $0.97 through late 2025. However, sentiment across crypto forums remains optimistic, with social media estimates suggesting a steady climb through 2026.

Factors Influencing Avici’s Price Growth

Several elements could drive AVICI’s long-term price performance:

Adoption of Avici Visa Credit Card: Broader user adoption could increase demand.

Market Expansion: Growth of the Solana ecosystem and DeFi partnerships.

Limited Supply: Only 10 million tokens in circulation, adding scarcity value.

Crypto Market Recovery: Broader bullish momentum across altcoins by 2026–2027.

As with any emerging crypto, volatility remains a key factor, but Avici’s real-world utility positions it well for potential long-term growth.

Conclusion

Avici (AVICI) stands out as an early-stage crypto project combining payment utility with blockchain innovation. Forecasts suggest it could grow from below $1 in 2025 to potentially $5–$7 by 2030, driven by adoption and token scarcity. Investors should, however, consider both the upside potential and inherent volatility before making decisions.