Analytics firm Glassnode has highlighted how the Bitcoin Funding Rates have increased across the various exchanges, but still not to a high degree.

Bitcoin Perps Funding Rates Have Surged

In a new post on X, Glassnode has talked about the latest trend in the Bitcoin Funding Rates for the major perpetual futures markets. The “Funding Rate” is an indicator that measures the amount of periodic fees that traders on the futures market are exchanging between each other on a given derivatives platform.

When the value of this metric is positive, it means the long holders are paying a premium to the shorts in order to hold onto their position. Such a trend implies a bullish mentality is dominant in the market.

On the other hand, the indicator being below the zero mark suggests the shorts outweigh the longs and a bearish sentiment is shared by the majority of traders on the exchange.

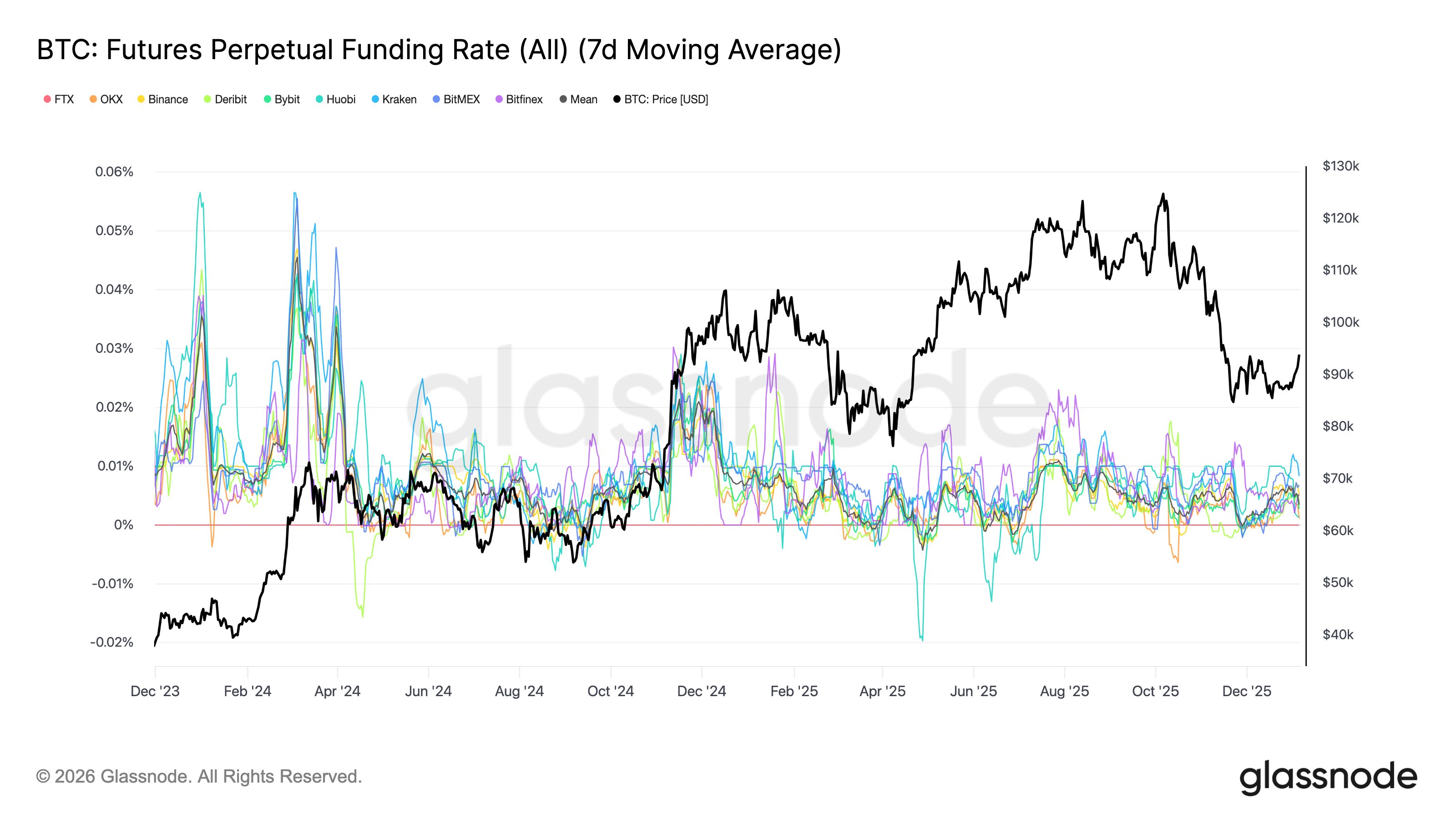

Now, here is the chart shared by Glassnode that shows the trend in the 7-day moving average (MA) of the Bitcoin Funding Rate for major exchanges over the last couple of years:

As displayed in the above graph, the Bitcoin Funding Rate has witnessed an increase across these platforms recently, indicating that investors have been setting up fresh bullish positions.

The mean Funding Rate for these exchanges dropped to the 0% mark back in November as the cryptocurrency’s price went through a crash. As the asset settled into its consolidation phase, investors gradually set up longs, culminating in the indicator recovering to 0.005%.

In the last 24 hours, however, the mean Funding Rate has retraced back to 0.003%, implying some investors have closed up their long positions after the latest recovery rally and/or others have set up shorts to bet against the bullish price action.

In the past, major rallies have tended to occur alongside notable positive Funding Rates on the different exchanges. According to Glassnode, the threshold has generally lied at 0.001%. Since the mean Funding Rate is still below this level, the analytics firm has noted, “current conditions remain supportive but not yet decisive.”

BTC Broke Above $94,000 Before Retracing Down

Bitcoin has seen the renewal of bullish momentum recently, with its price recovering as high as $94,700, but the past day has seen a setback for the digital asset as it’s now back at $92,100.

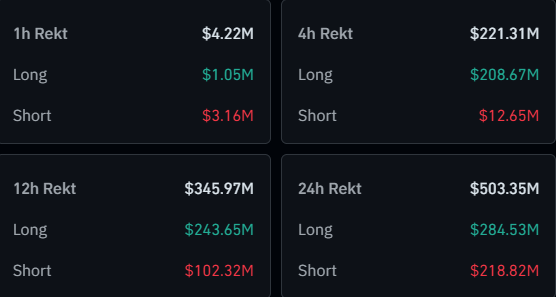

Other cryptocurrencies have also been volatile to varying degrees in the past day, which has resulted in liquidations of over $500 million on the derivatives exchanges, as data from CoinGlass shows. Out of these $503 million in liquidations, about $146 million of the positions involved were Bitcoin-related ones.