KEY TAKEAWAYS

ILV surged 70% to a six-month high of $21.36, breaking out of a falling channel and flipping resistance into support.

A positive Price–DAA divergence and net exchange outflows point to sustained upside for the Illuvium crypto price.

Despite an MFI near 100, an inverse head and shoulders pattern may keep ILV’s uptrend intact, with support at $17.95.

ILV, the native token of the GameFi project Illuvium, has exploded to its highest level in six months after a stunning 70% surge in the past 24 hours.

At press time, the Illuvium crypto trades at $21.36, the price it last touched on Feb. 5.

Despite the massive breakout, ILV shows no apparent signs of giving up its recent gains.

Strong technical momentum, rising trading volume, and renewed GameFi sector interest combine to keep the rally alive. Here’s why ILV’s price could have more room to run.

Illuvium Falling Channel Breakout Holds

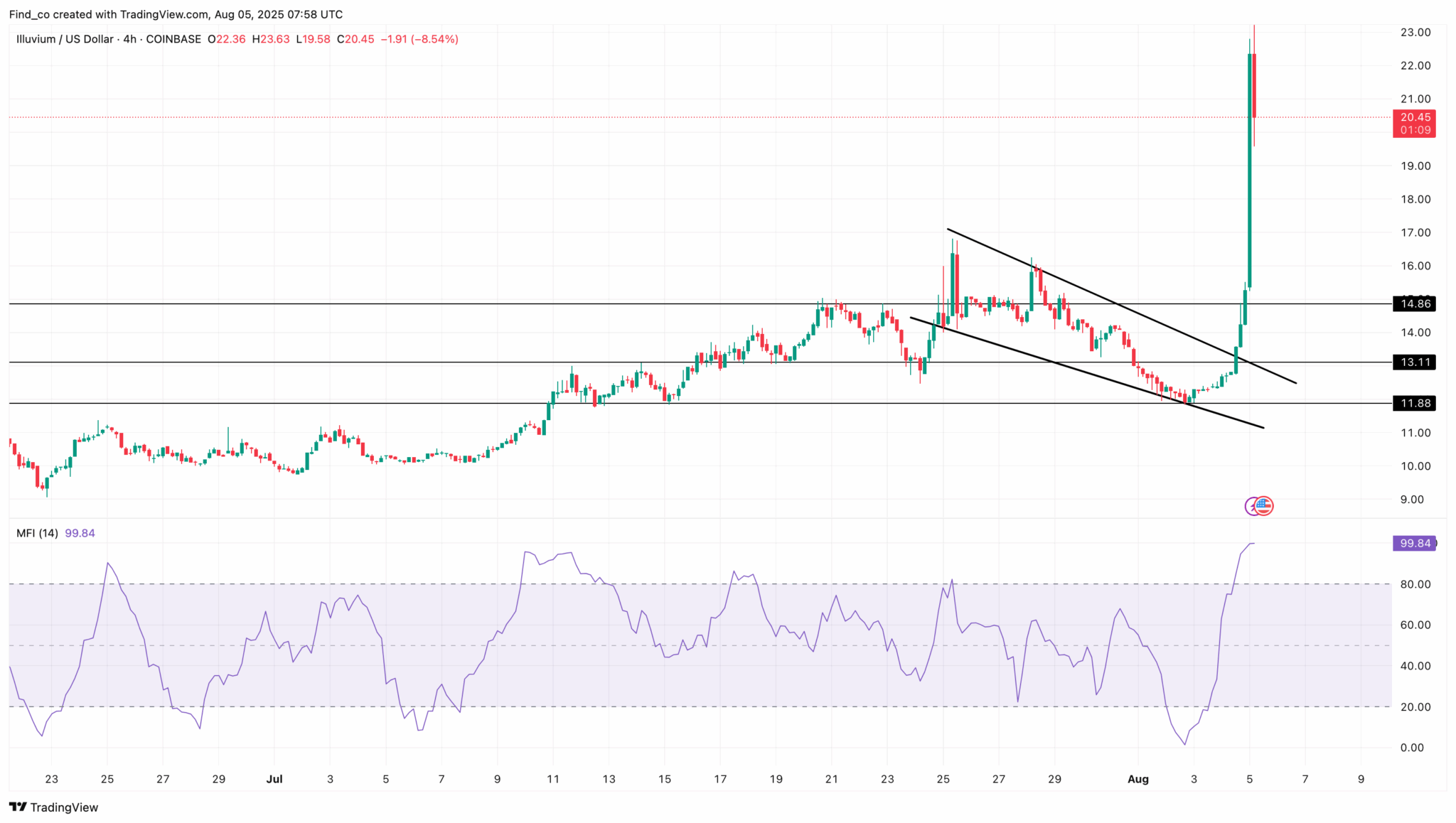

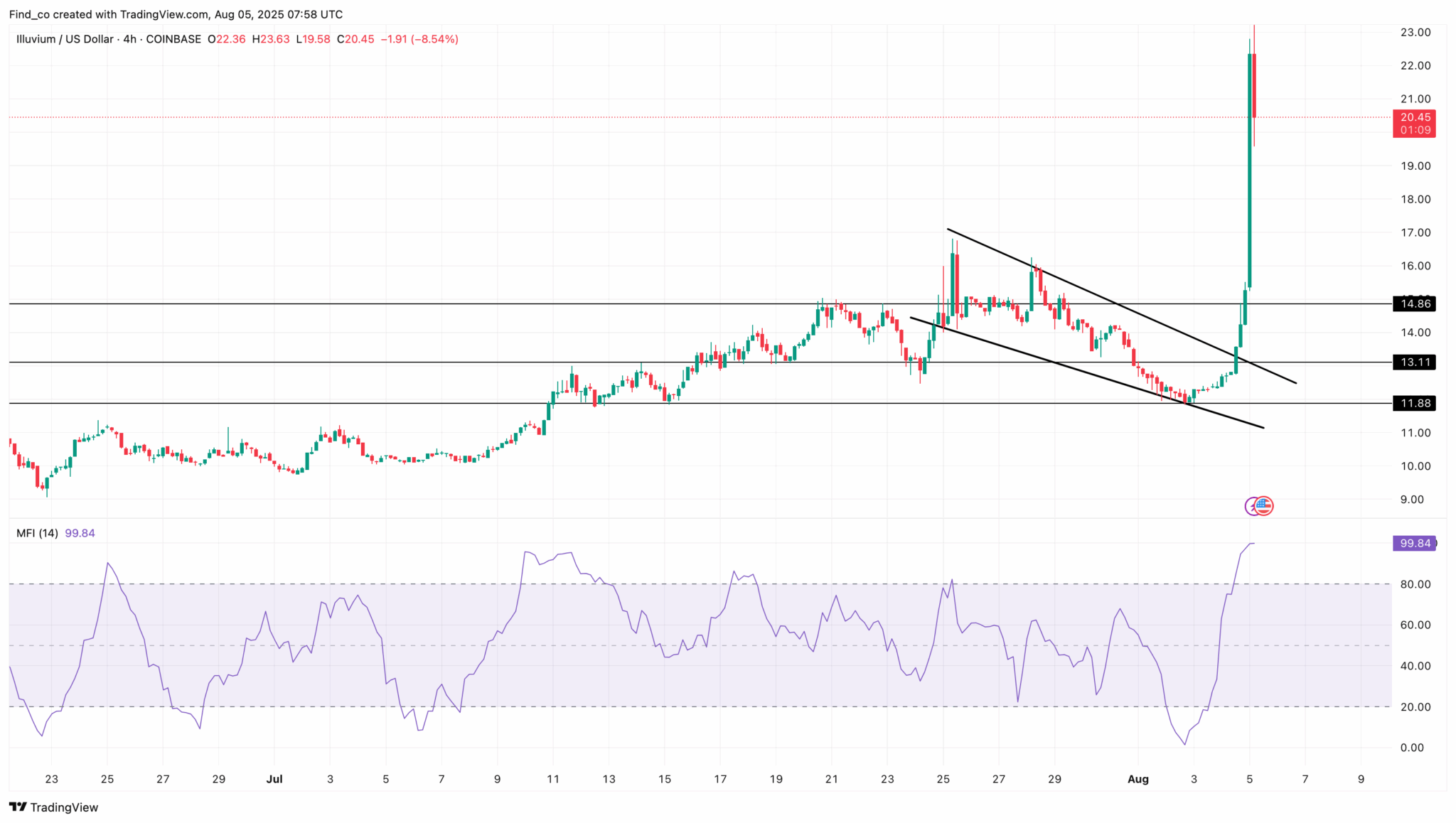

On the 4-hour chart, ILV’s price surged past $20 after breaking out of a falling channel. This bullish reversal pattern signaled the end of a downtrend.

A closer look at the chart shows that an influx of buying pressure also helped drive Illuvium’s price to its highest since February. CCN observed this surge through the Money Flow Index (MFI), which has now climbed to an extreme 99.84.

An MFI reading near 100 signals intense capital inflows, typically pointing to overbought conditions. While this level confirms the strength of the current rally, it also warns that ILV may be due for cooling or consolidation before sustaining another leg higher.

While the cryptocurrency has seen a slight pullback from its local high, the technical setup suggests it will unlikely face a prolonged correction.

Key reasons include strong support zones at $11.88 and $13.11, historically absorbing selling pressure.

ILV recently broke through resistance at $14.86, flipping it into a new support level.

Demand Rises as Exchange Supply Drops

Beyond the technical setup, on-chain metrics also support the possibility of an extended Illuvium crypto rally.

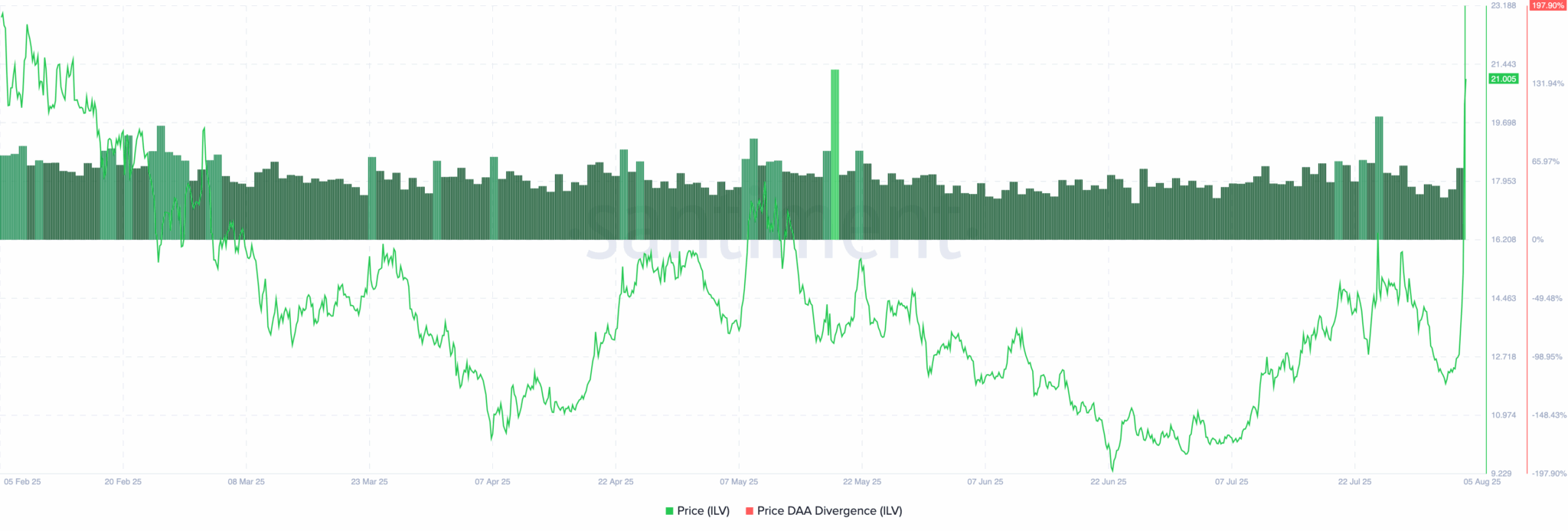

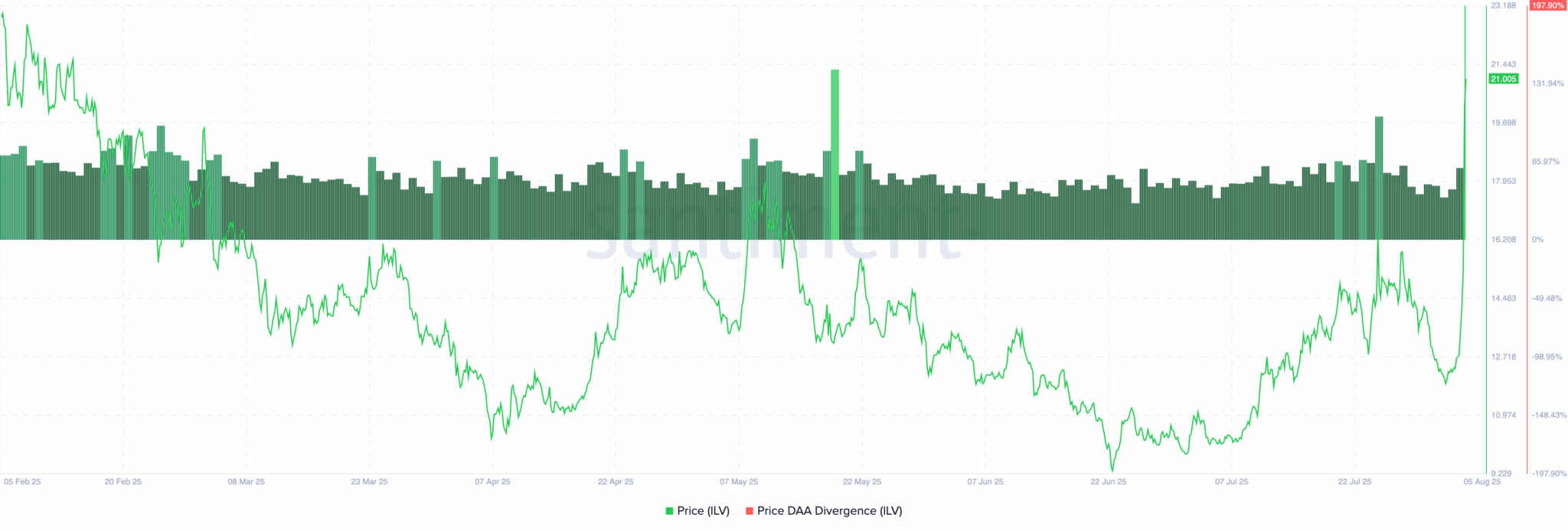

According to Santiment, ILV’s price-to-Daily Active Addresses (DAA) divergence has stayed positive for several weeks.

A positive DAA divergence means that network activity is growing in line with or faster than price.

This alignment between rising user engagement and market value signals that a rally has fundamental strength behind it.

If the trend holds, ILV could continue attracting capital, supporting its move toward higher price targets in the coming weeks.

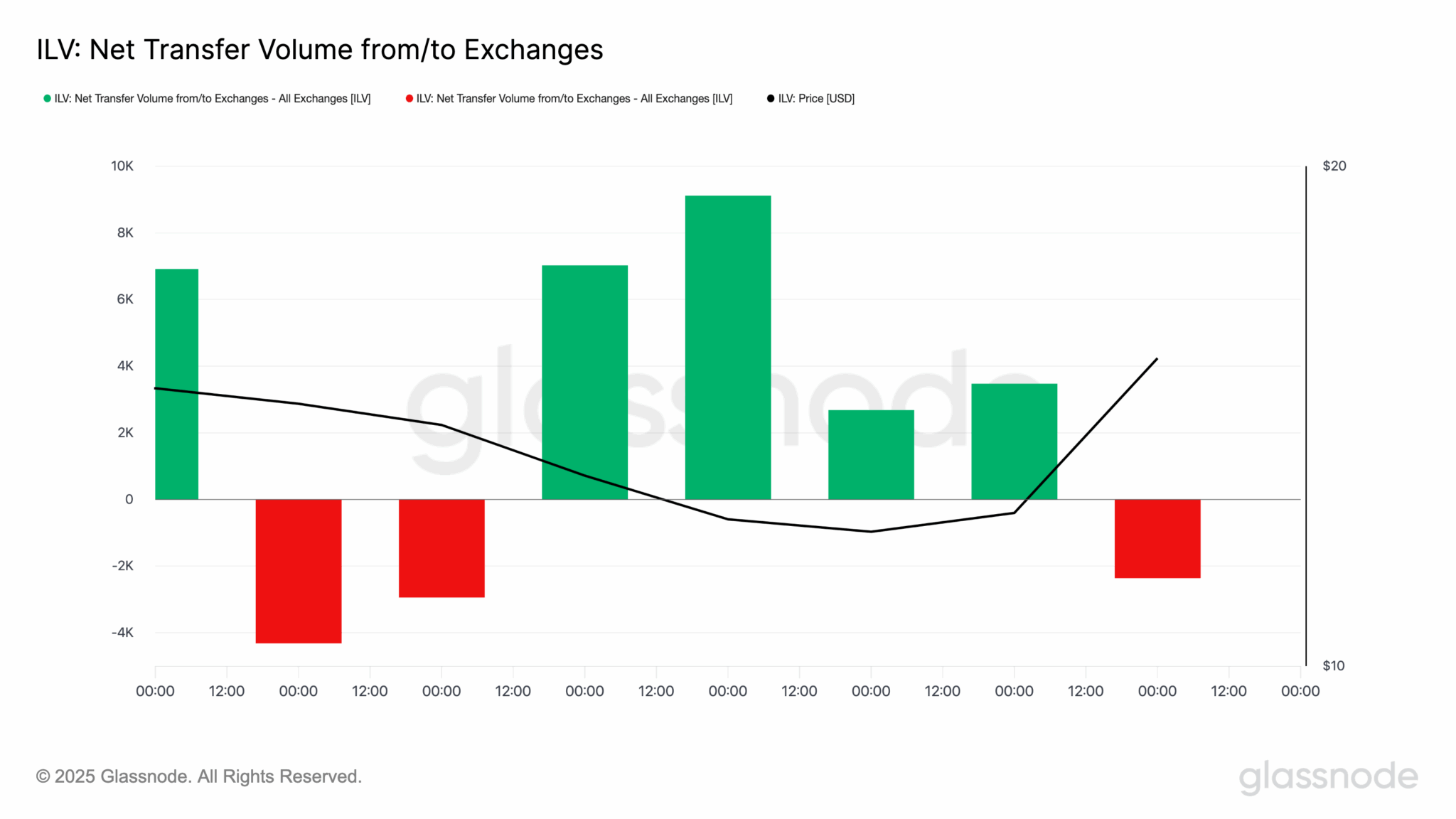

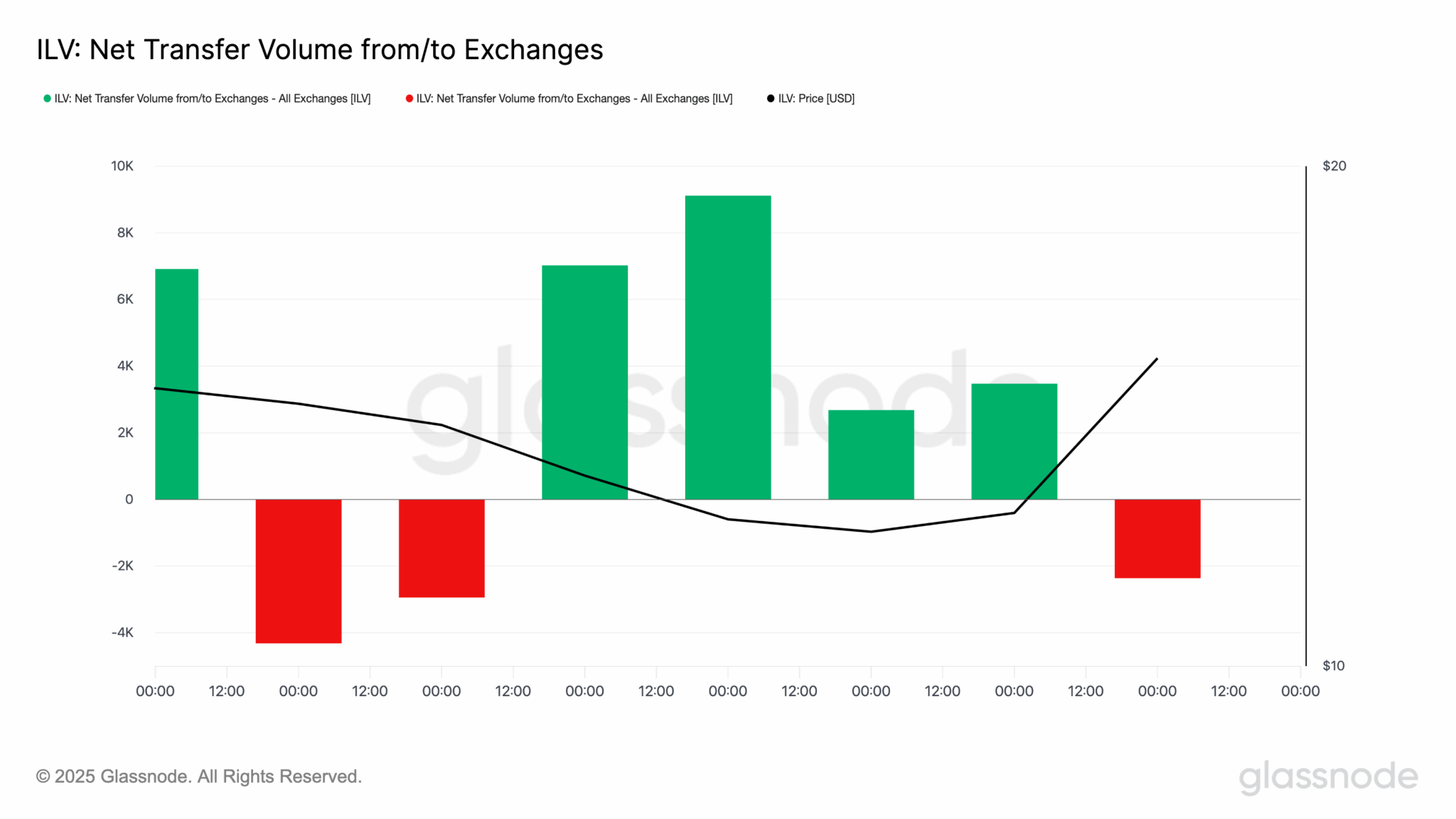

Furthermore, ILV’s net exchange volume recently closed at -2,357, indicating that more tokens left than entered exchanges.

This negative netflow suggests that holders are moving ILV into cold storage or staking, reducing the amount available for immediate selling.

If sustained, this could tighten supply on trading platforms and support further ILV price appreciation as long as demand remains steady.

ILV Price Prediction: Higher Targets

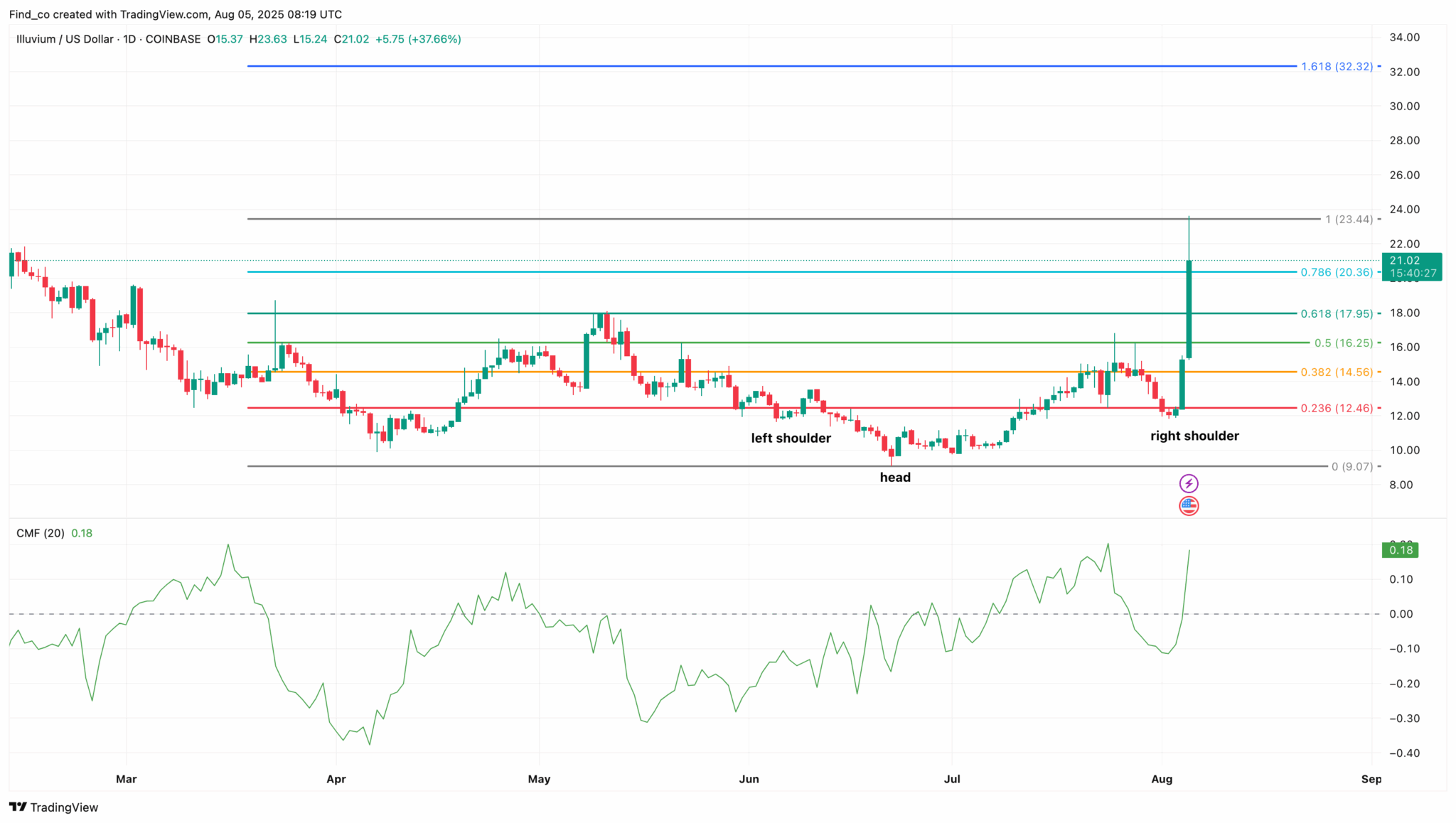

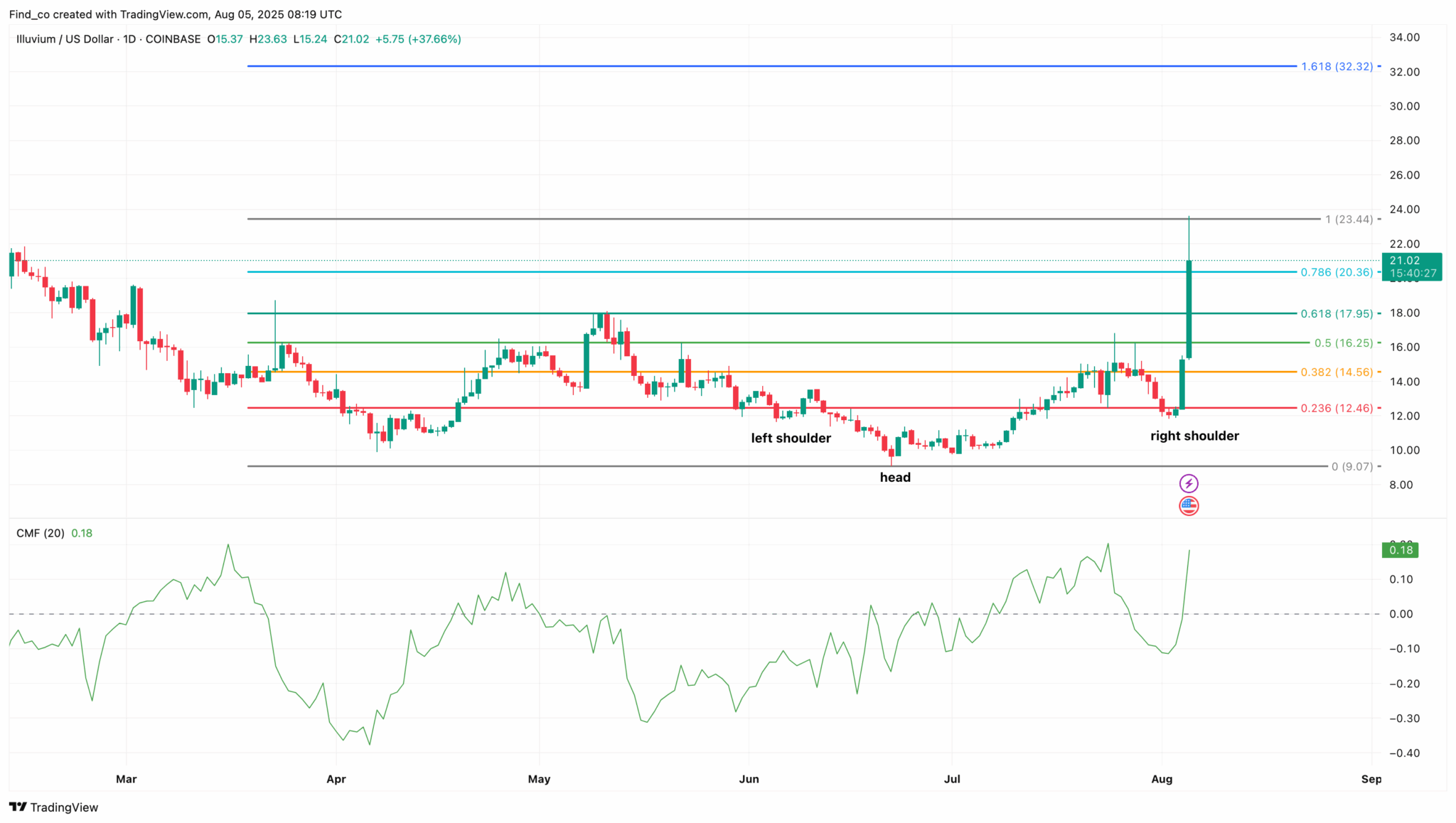

On the daily chart, the Illuvium crypto has formed an inverse head-and-shoulders pattern. This structure suggests that selling pressure has been absorbed and buyers are regaining control.

Adding to the bullish case, the Chaikin Money Flow (CMF) has climbed above the zero signal line, indicating net capital inflows into ILV. With accumulation outpacing distribution, ILV’s price might rise to the highest point of the wick at $23.44.

If buying pressure intensifies at this level, the altcoin’s value might jump to $32.32. However, once ILV becomes overbought and selling pressure increases, this prediction might not happen.

In such a scenario, ILV might decline to $17.95 at the 0.618 golden ratio level. In a highly bearish case, it could slide to $14.56.

ILV, the native token of the GameFi project Illuvium, has exploded to its highest level in six months after a stunning 70% surge in the past 24 hours. At press time, the Illuvium crypto trades at $21.36 — a price it last touched on Feb. 5.

Despite the massive breakout, ILV shows no apparent signs of giving up its recent gains. Strong technical momentum, rising trading volume, and renewed GameFi sector interest combine to keep the rally alive.

Here’s why ILV’s price could have more room to run.

Illuvium

On the 4-hour chart, ILV’s price surged past $20 after breaking out of a falling channel. This bullish reversal pattern signaled the end of a downtrend.

A closer look at the chart shows that an influx of buying pressure also helped drive Illuvium’s price to its highest since February. CCN observed this surge through the Money Flow Index (MFI), which has now climbed to an extreme 99.84.

An MFI reading near 100 signals intense capital inflows, typically pointing to overbought conditions.

While this level confirms the strength of the current rally, it also warns that ILV may be due for cooling or consolidation before sustaining another leg higher.

While the cryptocurrency has seen a slight pullback from its local high, the technical setup suggests it will unlikely face a prolonged correction.

Key reasons include strong support zones at $11.88 and $13.11, historically absorbing selling pressure.

ILV recently broke through resistance at $14.86, flipping it into a new support level.

Demand Rises as Exchange Supply Drops

Beyond the technical setup, on-chain metrics also support the possibility of an extended Illuvium crypto rally. According to Santiment, ILV’s price-to-Daily Active Addresses (DAA) divergence has stayed positive for several weeks.

A positive DAA divergence means that network activity is growing in line with or faster than price.

This alignment between rising user engagement and market value signals that a rally has fundamental strength behind it.

If the trend holds, ILV could continue attracting capital, supporting its move toward higher price targets in the coming weeks.

Furthermore, ILV’s net exchange volume recently closed at -2,357, indicating that more tokens left exchanges than entered.

This negative netflow suggests that holders are moving ILV into cold storage or staking, reducing the amount available for immediate selling.

If sustained, this could tighten supply on trading platforms and support further ILV price appreciation as long as demand remains steady.

ILV Price Prediction:

On the daily chart, the Illuvium crypto has formed an inverse head-and-shoulders pattern. This structure suggests that selling pressure has been absorbed and buyers are regaining control.

Adding to the bullish case, the Chaikin Money Flow (CMF) has climbed above the zero signal line, indicating net capital inflows into ILV.

With accumulation outpacing distribution, ILV’s price might rise to the highest point of the wick at $23.44.

If buying pressure intensifies at this level, the altcoin’s value might jump to $32.32. However, once ILV becomes overbought and selling pressure increases, this prediction might not happen.

In such a scenario, ILV might decline to $17.95 at the 0.618 golden ratio level. In a highly bearish case, it could slide to $14.56.