Spot Bitcoin ETFs in the US opened 2026 with a burst of cash that surprised some market watchers and encouraged others.

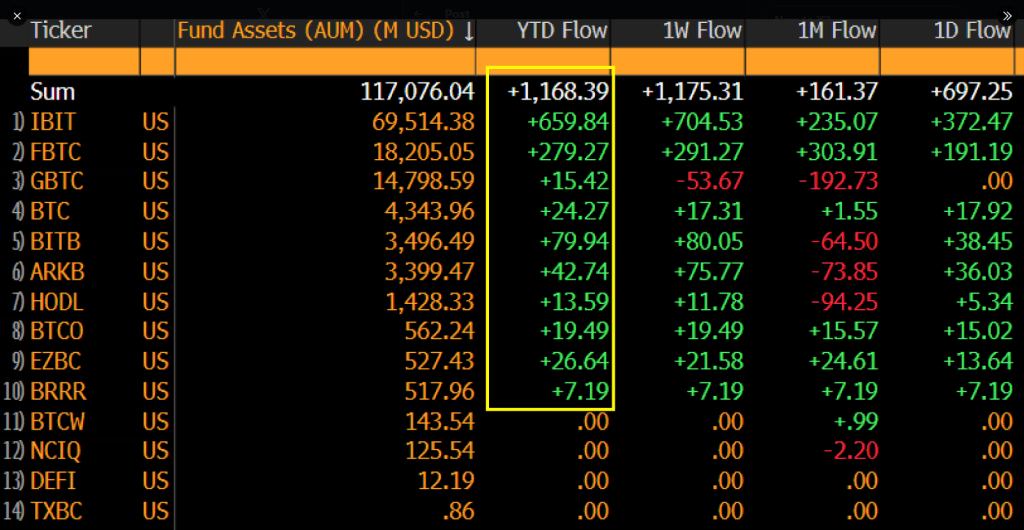

According to Bloomberg’s senior ETF analyst Eric Balchunas, more than $1.2 billion flowed into those funds during the first two trading days of the year.

He estimated that if that pace held, annualized inflows could reach about $150 billion — roughly 600% higher than the total for 2025.

The spot Bitcoin ETFs are “coming into 2026 like a lion,” Balchunas said.

ETF Flows Surge Early

According to reports, nearly every major spot Bitcoin ETF saw money coming in during those opening sessions. Balchunas calls this inflow as broad-based.

The WisdomTree Bitcoin Fund (BTCW) was one of the few exceptions that did not register the same demand. BlackRock’s iShares Bitcoin Trust (IBIT) was reported to have taken a large share of last year’s buying.

Traditional Measures Fell Short Last Year

Last year, spot Bitcoin ETFs recorded net inflows of over $21 billion. That was down from $35 billion in 2024. Yet Monday’s single-day net inflow of $697 million was the biggest daily intake in three months, and it came as Bitcoin traded back above the low $90,000s. Trading volume rose and some positions that had bet on a price drop were closed, which added to the move.

Institutional Moves And New Filings

Reports show Morgan Stanley filed with the SEC to offer both Bitcoin and Solana ETFs, a step that puts a major wealth manager alongside established issuers.

Balchunas pointed out Morgan Stanley manages about $8 trillion in advisory assets and has already cleared its advisors to allocate to such products.

The firm’s proposed Bitcoin trust, according to the filing, would track the spot price and avoid leverage or derivatives.

Analysts say ETF demand is likely to soak up circulating Bitcoin supply. If sustained, that dynamic could change how much liquidity is available to traders and might reduce the amount of BTC offered on exchanges.

There was an early sign of unevenness: preliminary figures showed a large outflow from one Fidelity fund on Tuesday, which raised the chance of a net outflow for the day once all data were in.

Bitcoin Price Amid Geopolitical Noise

Meanwhile, Bitcoin’s price held its ground after geopolitical headlines involving Venezuela and the capture of its leader, Nicolas Maduro, by US special forces. The top crypto asset kept its composure around the low $90,000s and climbed past $93,000 at moments.

Traders and analysts pointed to short position liquidations and a rebound in other risk assets as reasons for the lift. Some on-chain observers flagged accumulation by larger holders, while others said markets were treating the news as concluded rather than as a fresh shock.

Featured image from Unsplash, chart from TradingView