Morgan Stanley has taken a decisive step deeper into digital assets, signaling a broader institutional shift toward crypto exposure.

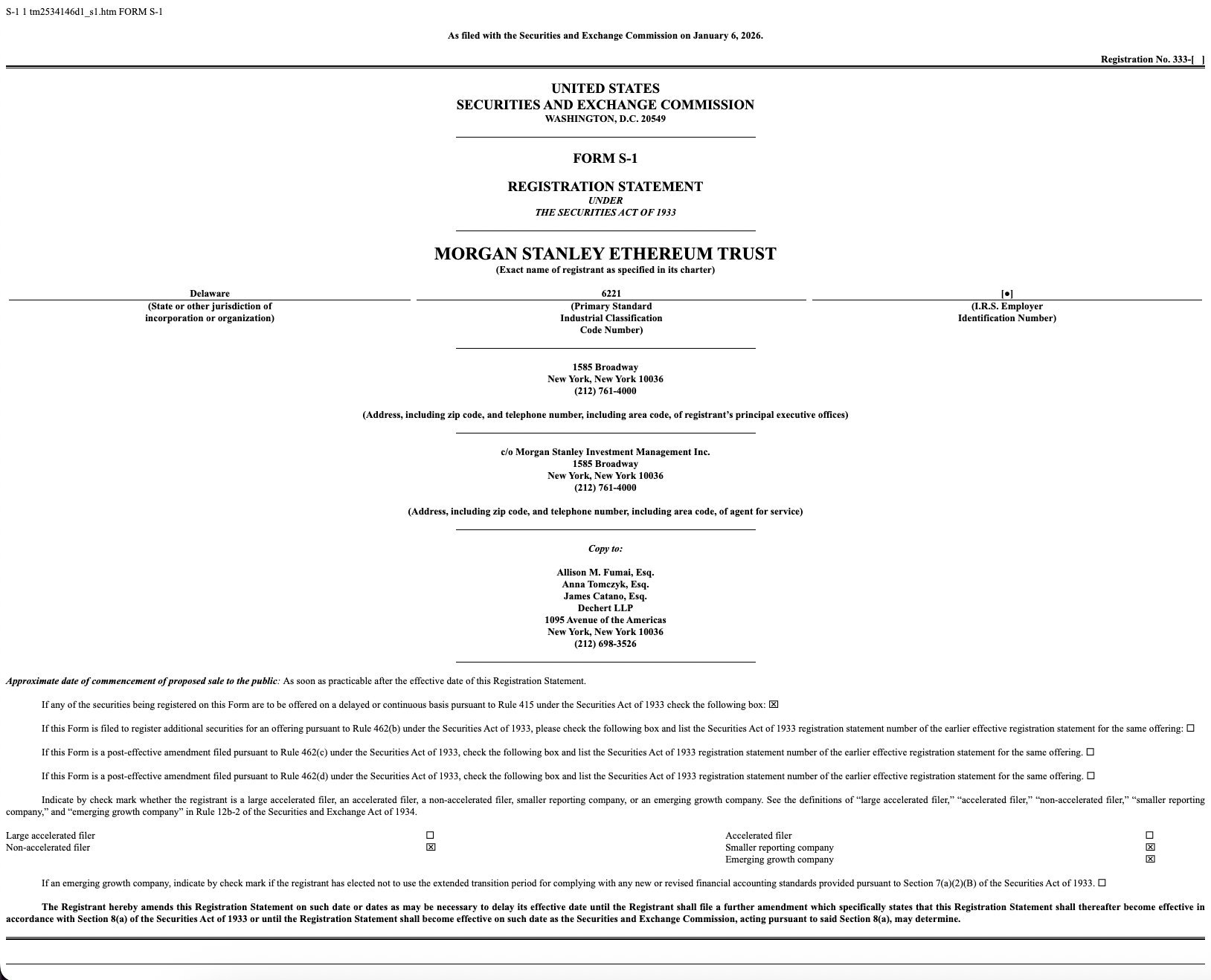

The Wall Street giant has filed an S-1 registration statement with the U.S. Securities and Exchange Commission for a spot Ethereum Trust, marking one of its most direct moves yet into the crypto market.

Key Takeaways

Morgan Stanley has filed an S-1 for an Ethereum Trust, following Bitcoin and Solana trust filings a day earlier

The firm manages approximately $1.3 trillion, giving its crypto expansion significant institutional weight

Ethereum price action remains constructive, with recent consolidation occurring above key support levels

The filing follows recent submissions made just a day earlier, when Morgan Stanley sought approval to launch separate Bitcoin and Solana trusts. Together, the back-to-back filings suggest a coordinated push to establish regulated, multi-asset crypto vehicles rather than a single, isolated product.

A major balance sheet behind the crypto push

Morgan Stanley oversees roughly $1.3 trillion in assets under management, giving these filings far more weight than similar applications from smaller players. Rather than testing the waters, the firm appears to be positioning itself for long-term participation in digital assets through traditional investment wrappers designed for institutional and high-net-worth clients.

By covering Ethereum, Bitcoin, and Solana in quick succession, the bank is effectively targeting the three most actively traded and institutionally discussed blockchain ecosystems, signaling confidence in their continued relevance within portfolios.

Ethereum price action reflects growing anticipation

Ethereum’s market behavior aligns closely with the timing of the filing. ETH has been trading near the $3,200 region, following a strong multi-week recovery from December lows. The latest pullback on the 4-hour chart appears corrective rather than structural, with price consolidating after a sharp advance toward the $3,300 area.

Momentum indicators show mixed but constructive signals. RSI recently pushed into overbought territory before cooling, suggesting buyers remain in control despite short-term exhaustion. MACD, while flattening, remains elevated compared to prior consolidation phases, indicating that bullish momentum has not fully unwound.

This price structure points to a market that is digesting gains rather than exiting positions, a setup that often appears when investors are reassessing upside catalysts such as institutional product launches.

More than a single product launch

What stands out is not just the Ethereum filing itself, but the sequencing. Filing for Bitcoin, Solana, and Ethereum products within days suggests strategic intent rather than opportunistic timing. For a firm of Morgan Stanley’s size, these moves are typically months in the making, reinforcing the idea that crypto exposure is becoming a core offering rather than a fringe allocation.

While regulatory approval is not guaranteed, the breadth of filings strengthens the narrative that large financial institutions are preparing for sustained client demand across multiple digital assets, not just Bitcoin alone.

If approved, these products would further blur the line between traditional finance and crypto markets, reinforcing Ethereum’s position as a core institutional asset rather than a speculative alternative.