Bitcoin (BTC) is trading at $92,733 as of this writing, continuing a recovery rally after weeks below $90,000. However, the pioneer crypto now faces a major test: the US Supreme Court’s ruling on President Trump’s global tariffs, scheduled for January 9.

The decision could force the Treasury to refund $133–$ 140 billion to importers, triggering volatility across cryptocurrency, equity, and bond markets.

Crypto Investors Brace for Potential Shock on January 9

The case centers on whether Trump exceeded his authority in imposing tariffs that he says generated roughly $600 billion in revenue.

Justices return from a four-week break to release opinions at 10:00 A.M. ET on Friday. A ruling against the tariffs would create immediate fiscal stress and policy uncertainty.

High Probability of Invalidated Tariffs

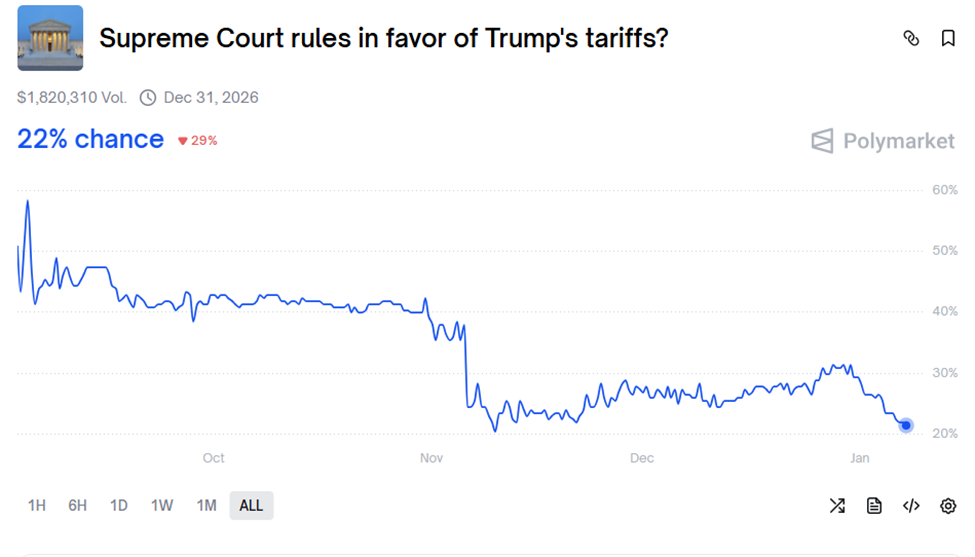

Prediction markets highlight the perceived risk, with Polymarket showing a 22% chance of upholding Trump’s tariffs. This means a 78% chance the Supreme Court will strike down the tariffs.

Odds of Supreme Court Ruling in Favor of Trump Tariffs. Source: Polymarket

“This Friday will be the worst day of 2026! Trump claims that tariffs have generated around $600 billion. So if the court nukes the tariffs, the market instantly starts asking one thing. How much gets refunded, and how fast? That’s not “clarity”. That’s chaos… and markets reprice all of it at once. …This is a volatility bomb landing at the worst time,” said trader Wimar.X, emphasizing the potential for sharp repricing across multiple asset classes.

The implications go beyond refunds, with a sudden reversal potentially amplifying volatility across traditional and digital markets. Bitcoin, highly sensitive to macro and policy shocks, may face pronounced price swings.

Macro Conditions Amplify Risk for Bitcoin

Current market conditions leave crypto and broader financial markets vulnerable. Equity valuations are stretched, corporate spending remains high, and passive investment flows have concentrated risk in major indices.

Against this backdrop, a major policy shock could force quick adjustments, affecting both institutional and retail participants.

Bond rates could spike, equities could drop, and crypto could follow, the analyst alluded, with other analysts pointing out that Trump losing the case is one of the largest underpriced risks in markets today.

The ruling may also have wider consequences for trade, inflation, and cross-border flows. Tariff changes could impact import costs, corporate margins, and the liquidity available for decentralized finance (DeFi) platforms and tokenized assets that rely on international capital flows.

Bitcoin’s rally, while technically significant, now faces a highly uncertain environment as January 9 could mark a pivotal moment for both crypto and broader financial markets.