The Rain Protocol (RAIN) price surged after its KuCoin listing, briefly breaking out of a major reversal pattern. The token is up about 13% over the past seven days, 8% since yesterday, and more than 200% over the last three months.

But while the breakout itself was real, on-chain activity and momentum data now suggest the move may struggle to restart soon. What followed the listing looks less like sustained demand and more like a short-lived momentum burst.

KuCoin Listing Sparked the Breakout, but Follow-Through Faded

RAIN’s rally accelerated after its KuCoin listing, which pushed the price through an inverse head-and-shoulders pattern on the 12-hour chart.

This structure typically signals a trend reversal, and the breakout projected a move of roughly 31%, placing the upside target near the $0.011 area.

Bullish Breakout: TradingView

Price moved quickly toward that zone but failed to hold momentum. Within hours of setting a new high, RAIN pulled back close to 10%. That pullback matters because strong breakouts usually attract follow-up buyers. In this case, demand cooled almost immediately after the initial push.

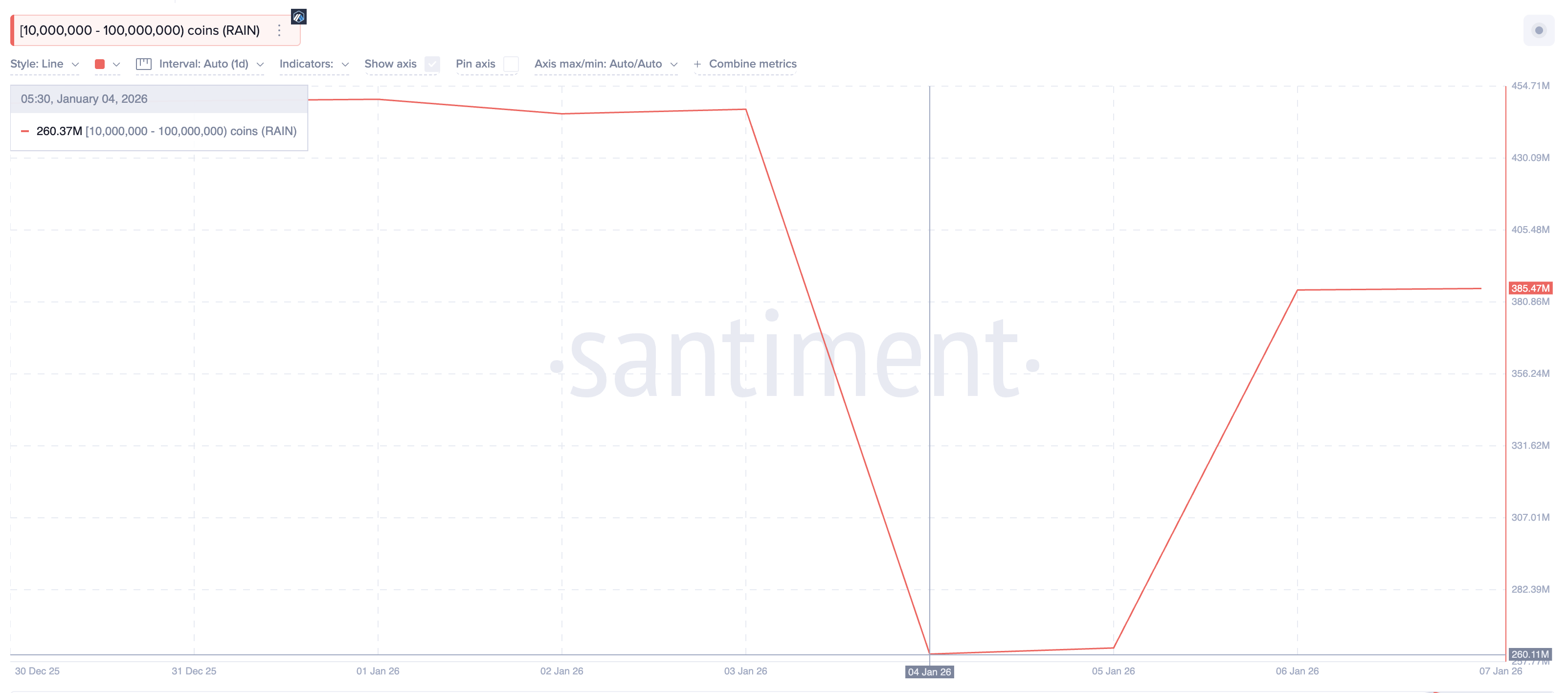

Whale positioning explains why the rally started, and why it slowed. Wallets holding between 10 million and 100 million RAIN tokens increased their holdings from roughly 260.85 million tokens to about 385.47 million tokens. That is an addition of around 124.6 million RAIN, worth roughly $1.1 million at current prices.

Whales Adding RAIN: Santiment

This accumulation began before the listing and helped push the price through resistance. But after the breakout, whale balances stopped rising. When large holders pause instead of adding, rallies often lose momentum.

Profit-Taking Replaced Buying as On-Chain Activity Spiked

On-chain data shows that selling, not accumulation, dominated the post-breakout phase. The Spent Coins Age Band, which tracks how many tokens move on-chain across all holder groups, surged sharply during the rally (between January 5 and January 6). Around the breakout, spent coins jumped from roughly 28 million tokens to more than 58 million tokens, an increase of over 100%.

This tells us that holders across multiple age groups used the price strength to move or sell tokens, rather than hold or add. That behavior is typical after event-driven rallies, especially following exchange listings.

Coin Activity Surges Then Drops: Santiment

What matters next is what happened after the pullback. Spent-coin activity later dropped back to around 23.8 million tokens. That decline suggests profit-taking has largely finished, meaning the cohorts are not exactly expecting more upside in the near term.

Momentum Signals Point to Pullback Risk, Not Continuation

Momentum indicators reinforce the idea that RAIN needs a reset.

The Relative Strength Index, or RSI, flashed a bearish divergence on the 12-hour chart. Between late November and early January, RAIN’s price made a higher high while RSI made a lower high. RSI measures momentum strength, and this bearish divergence pattern often signals exhaustion rather than trend continuation.

Bearish Divergence: TradingView

The Money Flow Index adds further caution. MFI tracks whether money is flowing into or out of an asset. Between December 29 and January 6, when the RAIN price rose, MFI trended lower, indicating that dip buying weakened rather than strengthened. When both RSI and MFI diverge from price, rallies often struggle to extend without fresh demand.

RAIN Dip Buyers Not Present: TradingView

From here, the RAIN price direction depends on whether buyers return. A strong 12-hour close above $0.010, a new price peak, would reopen the path toward the $0.0110 to $0.0120 range. Without that, downside risks remain active. Support sits near $0.0083, and a break below that level could expose $0.0075 and even $0.0067 in a deeper pullback.

RAIN Price Analysis: TradingView

RAIN’s recent move was driven by clear catalysts — the growing popularity of prediction markets and early whale positioning.

The slowdown that followed reflects profit-taking and fading momentum, not collapse. The trend is not broken, but the rally may need time before it can try again.