XRP price has struggled to sustain recovery attempts in recent sessions. The token managed to rise this past week but is facing some bearishness at the moment.

The driving factor is the short-term selling as well as the underlying skepticism among investors, which could flare up if the broader market conditions worsen.

XRP Is Back In Profit

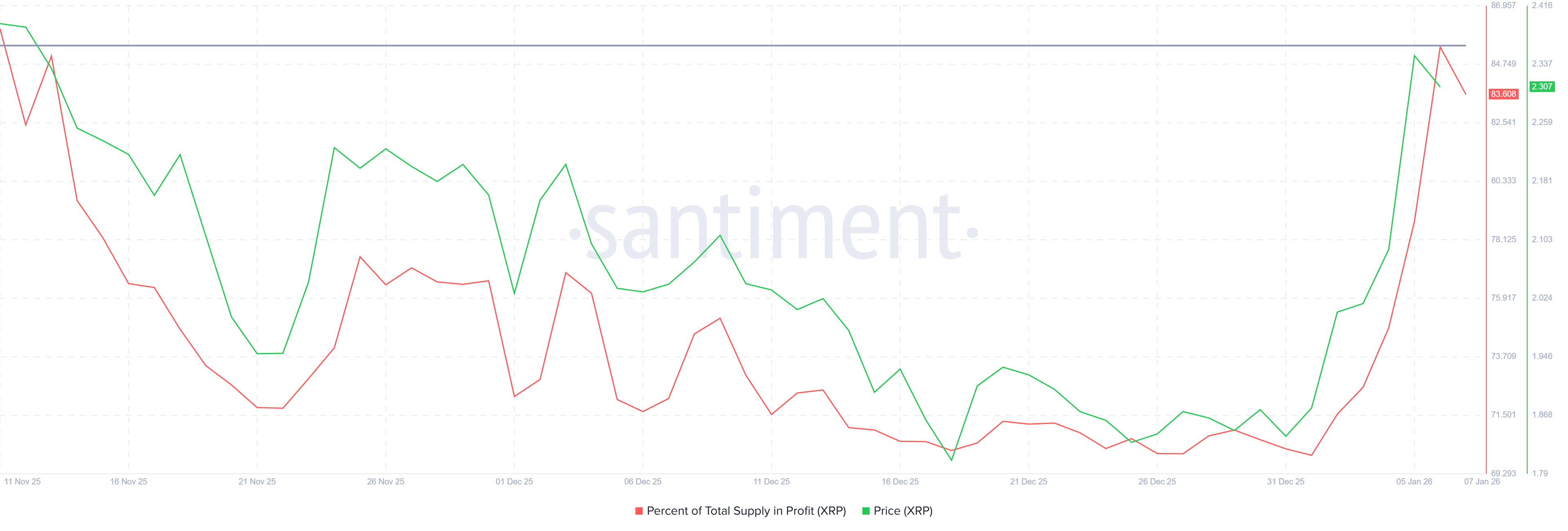

On-chain data shows that roughly 83% of XRP’s circulating supply is back in profit. This figure briefly climbed to 85% over the past 24 hours before easing slightly. The level marks a one-and-a-half-month high, signaling widespread profitability among holders.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply In Profit. Source: Santiment

Rising profitability often changes investor behavior. When a large share of supply turns profitable, selling pressure typically increases. Many participants choose to lock in gains, especially after extended consolidation. This dynamic introduces headwinds for XRP as supply-side pressure builds near resistance levels.

XRP Holders Stay True To Their Nature

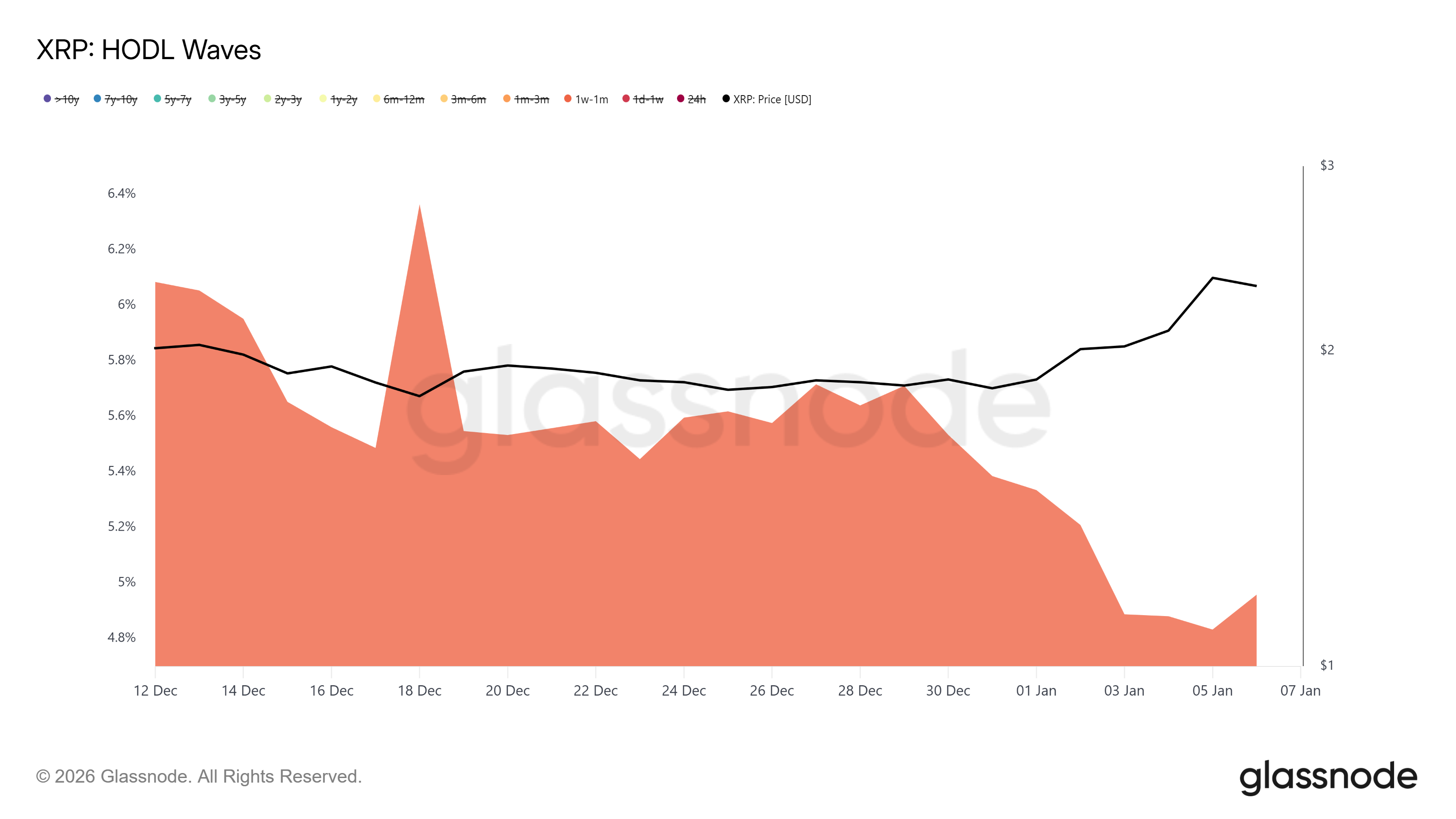

Short-term holders appear to be acting on these incentives. Wallets that accumulated XRP over the past week and the past month have reduced their holdings noticeably. Their share of supply fell from 5.7% to 4.9% within seven days.

These investors are among the most reactive market participants. They tend to sell quickly once positions turn profitable. The ongoing reduction in short-term holder balances suggests continued distribution, which may persist if price attempts another push higher without stronger demand.

XRP HODL Waves. Source: Glassnode

Such behavior limits upside potential. When short-term holders dominate selling, rallies often lose momentum quickly. XRP now faces the challenge of absorbing this supply without triggering deeper retracements.

Overall Sentiment Is Still Concerning

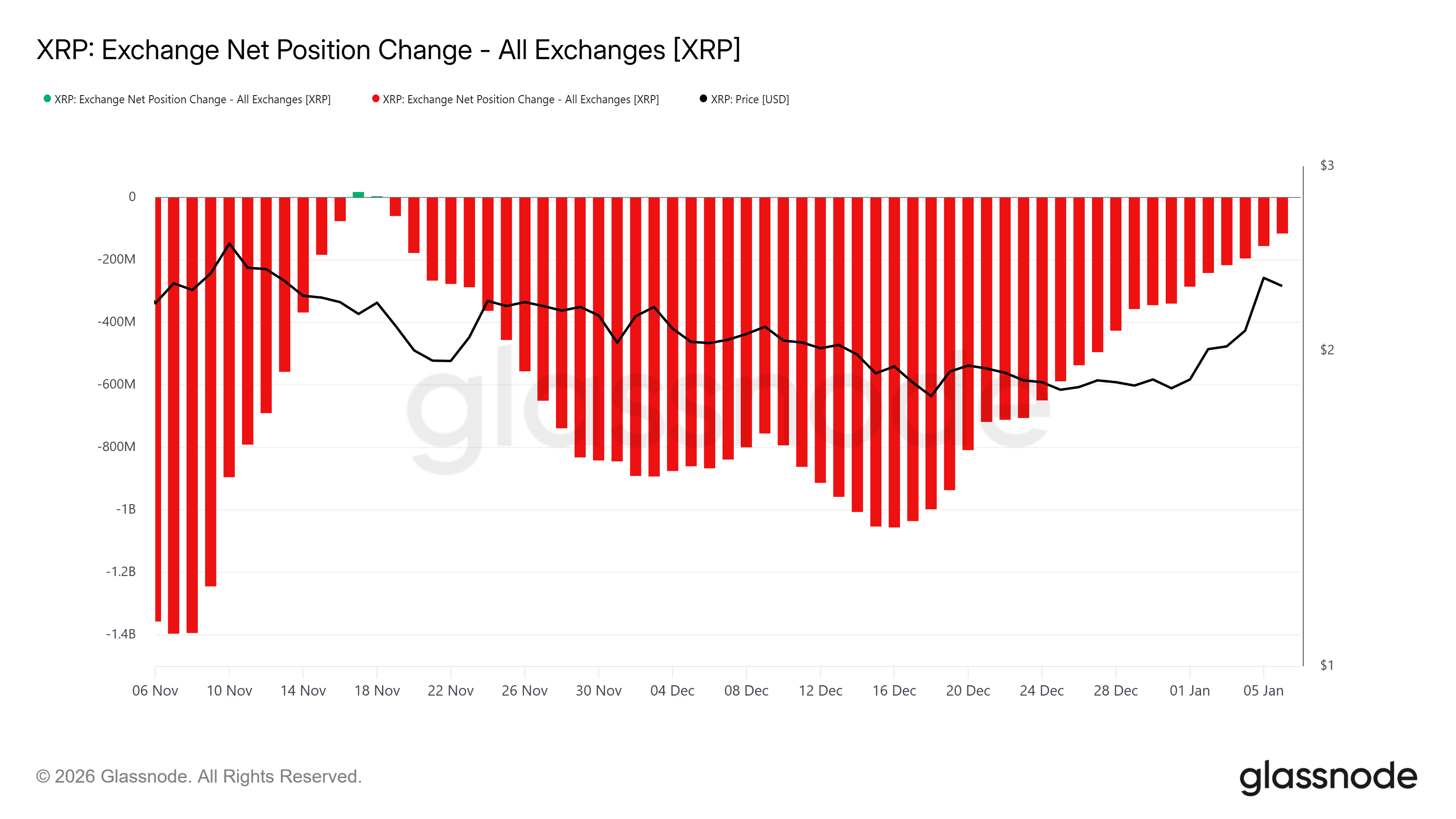

Macro indicators reinforce the cautious outlook. Exchange net position change data shows that outflows have remained active for XRP. While the pace of outflows slowed recently, inflows never fully overtook them.

This imbalance suggests sellers still hold influence. If exchange inflows increase again, selling pressure could accelerate. XRP’s structure remains vulnerable under these conditions, especially if market sentiment weakens or volatility rises.

XRP Net Position Change. Source: Glassnode

Persistent exchange activity often precedes price corrections. Without a clear shift toward accumulation, XRP may struggle to establish higher support levels in the near term.

XRP Price Could Repeat History

XRP trades near $2.25 at the time of writing, sitting just below the $2.36 resistance. The Money Flow Index indicates overbought conditions. This metric combines price and volume to assess buying and selling pressure.

With MFI crossing above the 80.0 threshold, historical patterns point to increased correction risk. Even if XRP holds briefly, the price may slip below $2.19. A deeper move could test $1.80, a support level validated in previous pullbacks.

XRP Price Analysis. Source: TradingView

The bearish outlook would change if selling subsides. Should investors refrain from distributing, XRP could bounce from $2.19. A decisive break above $2.36 would open a path toward $2.64, invalidating the bearish thesis.