Hedera price has surged in recent sessions, lifting HBAR toward a critical resistance zone. The move briefly raised hopes of recovery.

However, the altcoin once again stalled near a barrier it has failed to overcome for weeks, putting bullish traders at risk as downside pressure builds.

HBAR Traders Face Losses

HBAR traders have leaned heavily bullish, opening long positions in anticipation of a breakout. Derivatives data show optimism remains high. However, this positioning may be premature given the technical barriers still intact.

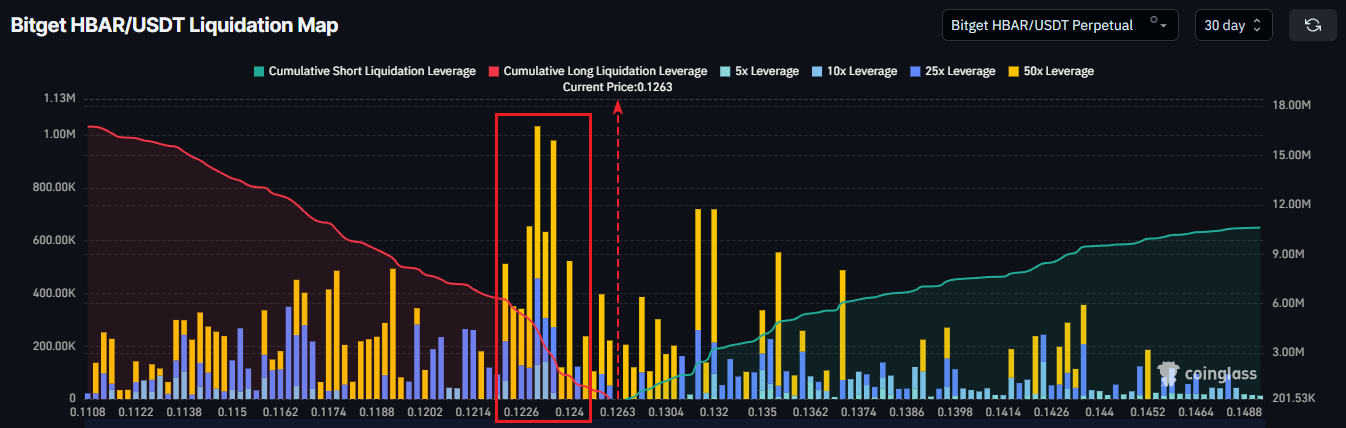

Liquidation heatmap data highlights a concentration of risk between $0.124 and $0.122. If price slides toward the lower bound, approximately $6.23 million in long positions could be liquidated. Such an event would likely intensify selling pressure and erode bullish conviction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Liquidation Heatmap. Source: Coinglass

Forced liquidations often accelerate declines. As leverage unwinds, price weakness feeds into further downside moves. This setup leaves HBAR vulnerable if demand fails to absorb selling near current levels.

HBAR Is Overbought

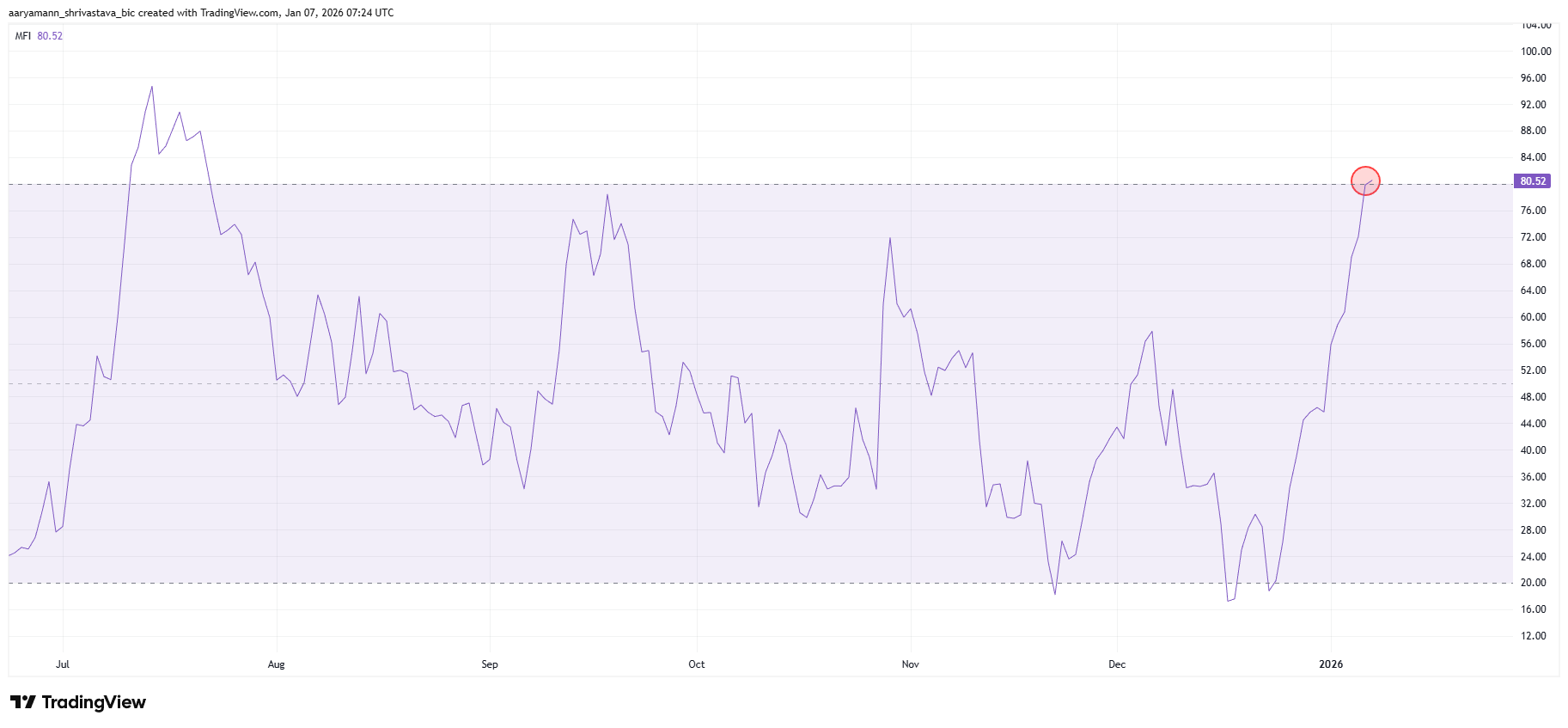

Momentum indicators reinforce caution. The Money Flow Index is moving deeper into overbought territory, recently crossing above the 80.0 threshold. This level often signals stretched conditions rather than sustainable strength.

MFI combines price and volume to gauge buying and selling pressure. When readings remain elevated, markets frequently experience pullbacks as buyers lose control. For HBAR, this suggests the recent rally may be nearing exhaustion rather than continuation.

HBAR MFI. Source: TradingView

Overbought conditions do not guarantee immediate reversals. However, they increase the probability of corrective moves, especially when paired with strong resistance and heavy leverage on the long side.

Can HBAR Price Escape Its Downtrend?

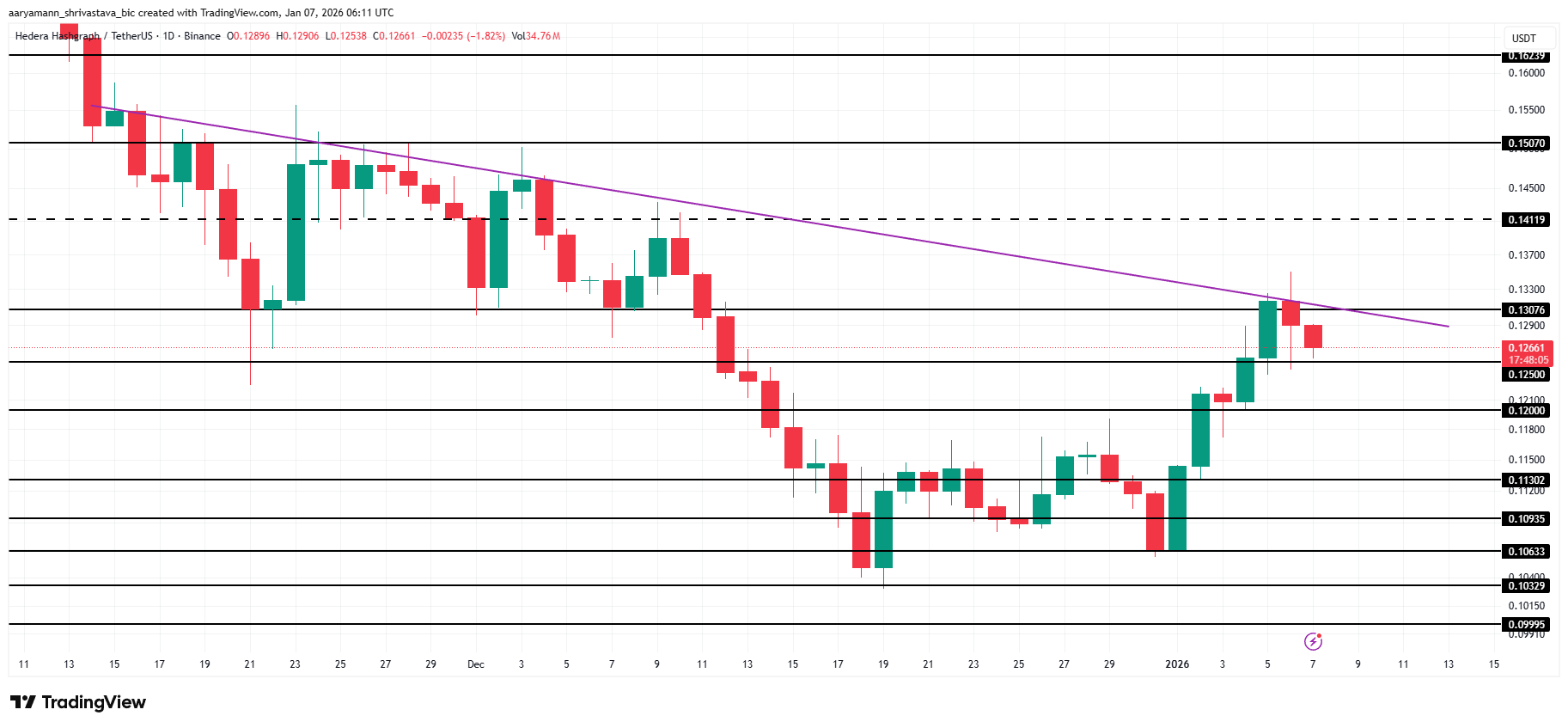

HBAR trades near $0.126 at the time of writing, sitting below the $0.130 resistance. Price has also failed to break the six-week downtrend line that has repeatedly capped rallies. This combination limits bullish follow-through.

Given current sentiment and leverage positioning, another rejection appears likely. A downside move could push HBAR below $0.125. Under this scenario, the price may fall toward the $0.120 support, triggering long liquidations and accelerating losses.

HBAR Price Analysis. Source: TradingView

A bullish alternative remains possible if conditions shift. Strong spot demand or broader market improvement could lift HBAR above $0.130. Escaping the downtrend would allow a move toward $0.141, invalidating the bearish outlook and restoring recovery hopes.