XRP has entered a short-term consolidation phase following a sharp rally at the start of 2026, mirroring a broader pause across the cryptocurrency market. The token rose nearly 28% after breaking a multi-month descending trend, placing it among the strongest performers within the top 10 cryptocurrencies before profit-taking set in near the $2.30 area.

JUST IN: CNBC says XRP is the "hottest" crypto trade of this year.

"It is not Bitcoin, it is not Ether." pic.twitter.com/kCJF6VOM10

— Watcher.Guru (@WatcherGuru) January 6, 2026

After failing to secure a decisive close above that level, XRP retraced modestly toward the $2.25 range. Despite the pullback, market participants continue to view the broader price structure as intact, supported by steady institutional engagement and improving technical signals.

Institutional Flows Support Market Confidence

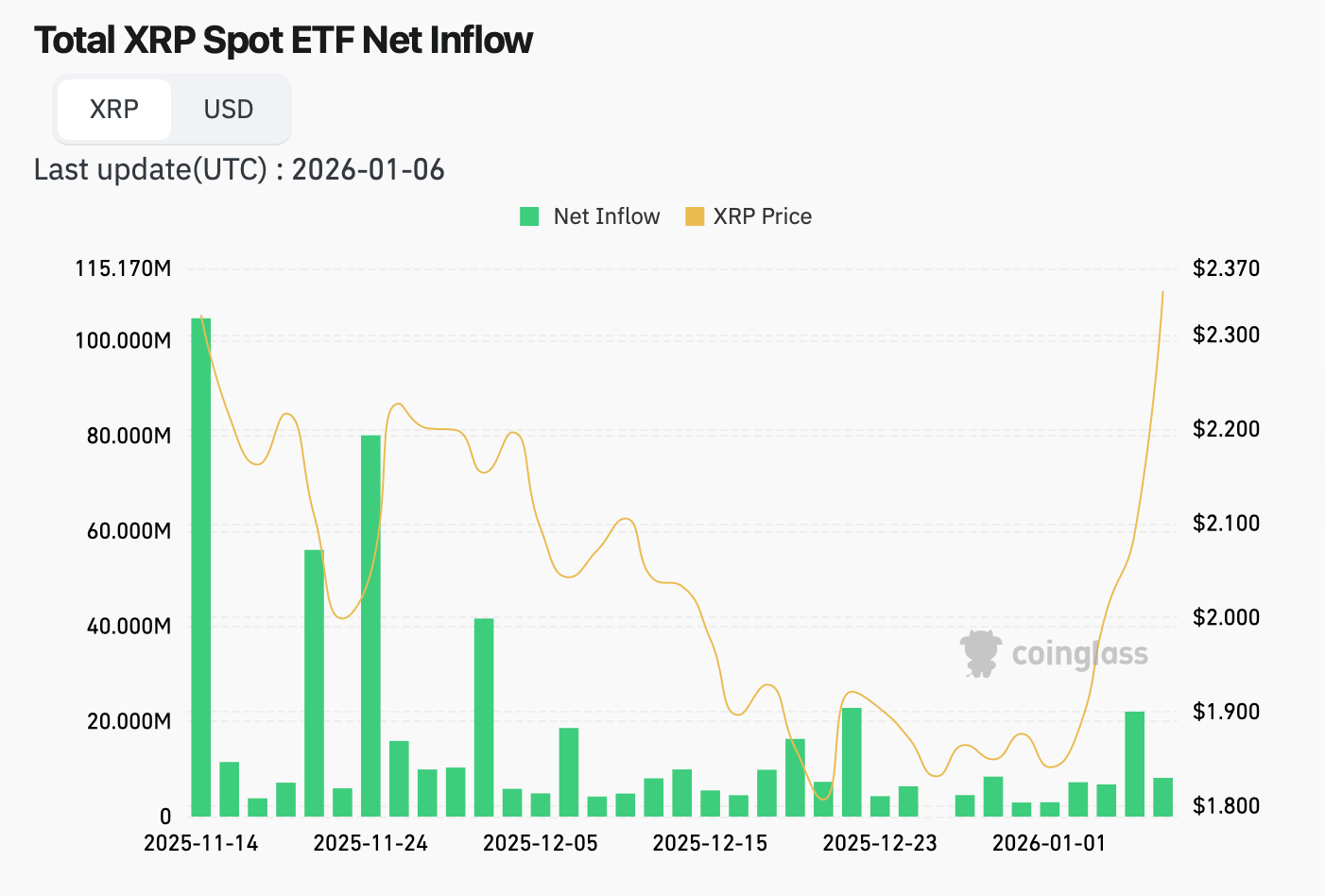

One of the key factors underpinning XRP’s resilience has been sustained institutional participation. Since the launch of XRP-linked exchange-traded fund (ETF) products, on-chain and fund flow data have shown consistent net inflows, with no recorded net outflows to date. This pattern contrasts with short-term price fluctuations and suggests allocation decisions driven by longer-term positioning rather than momentum trading.

Market observers note that ETF inflows have continued even during periods of consolidation, indicating that larger investors have not reduced exposure following the recent rally. This steady demand has helped anchor sentiment and reduce downside pressure during broader market cooling.

Image Courtesy: Coinglass

Technical Structure Remains Intact

From a technical perspective, XRP has shifted materially from its late-2025 downtrend. The asset previously traded within a declining structure after losing support between $3.00 and $2.75 in October, forming a series of lower highs and lower lows. That pattern has since been disrupted, with price breaking above the falling wedge that defined the prior trend.

While XRP has struggled to maintain levels above the $2.27–$2.30 zone, analysts Anne describe the recent move as a pause rather than a reversal. Price action has remained elevated relative to key moving averages, and volatility indicators suggest momentum has cooled without fully unwinding the broader uptrend.

After a prolonged downtrend, XRP's price has begun to stabilize and is showing early signs of forming a bottom. Holding this support level could open the door for a rebound. pic.twitter.com/X7VLPgeE1k

— Anne (@Crypto_Anne_) January 5, 2026

Indicators Point to Stabilization

Short-term momentum indicators show signs of stabilization. The stochastic RSI has moved toward oversold territory and appears to be resetting, while trading volume has picked up after a period of compression. This combination often reflects temporary exhaustion following rapid advances rather than structural weakness.

Technical analysts also point to the importance of the mid-range support area near the 20-day moving average, which has so far held during the retracement. As long as this level remains intact, XRP’s bullish bias is considered preserved.

Broader Market Implications

XRP’s recent performance highlights how institutional participation is increasingly shaping crypto market dynamics in 2026. While the broader market has entered consolidation after a strong start to the year, assets with visible institutional demand have shown greater stability during pullbacks.

For now, XRP’s ability to maintain support during periods of reduced momentum will be closely watched. Market participants are focused on whether the token can reclaim higher resistance zones in a sustained manner, a development that would further clarify its medium-term trend within an evolving institutional-led crypto landscape.

Bitcoin Hyper: Retail Looks for Early Exposure

Following XRP price analysis, which has been shaped by on-chain distribution trends and broader market liquidity conditions, attention has also turned to how investors are positioning during Bitcoin’s current period of consolidation below key resistance levels. In such environments, market data often shows increased interest in higher-risk, early-stage crypto assets alongside established majors.

Bitcoin Hyper (HYPER) has emerged within this backdrop as a Bitcoin-focused Layer-2 project aimed at enabling DeFi-style functionality through a secondary execution layer that settles back to Bitcoin. According to publicly disclosed figures, the Bitcoin Hyper presale has raised approximately $30.21 million out of a targeted $30.53 million, reflecting continued capital allocation toward BTCFi-related infrastructure during subdued broader market conditions.