Bitcoin price prediction models are being challenged as a surprising new macro signal emerges in early 2026: BTC is now tightly correlated with the Japanese yen. That’s not just a shift in narrative – it’s a potential disruption to how traders interpret Bitcoin’s independence as “digital gold.”

As of January 7, Bitcoin trades at $92,686, down 0.57% in 24 hours. And while short-term price targets show a potential return above $100K, analysts warn the recent macro decoupling is already reshaping expectations.

Bitcoin Hyper ($HYPER) is one of the few tokens rising in response, with its presale crossing $30.2 million.

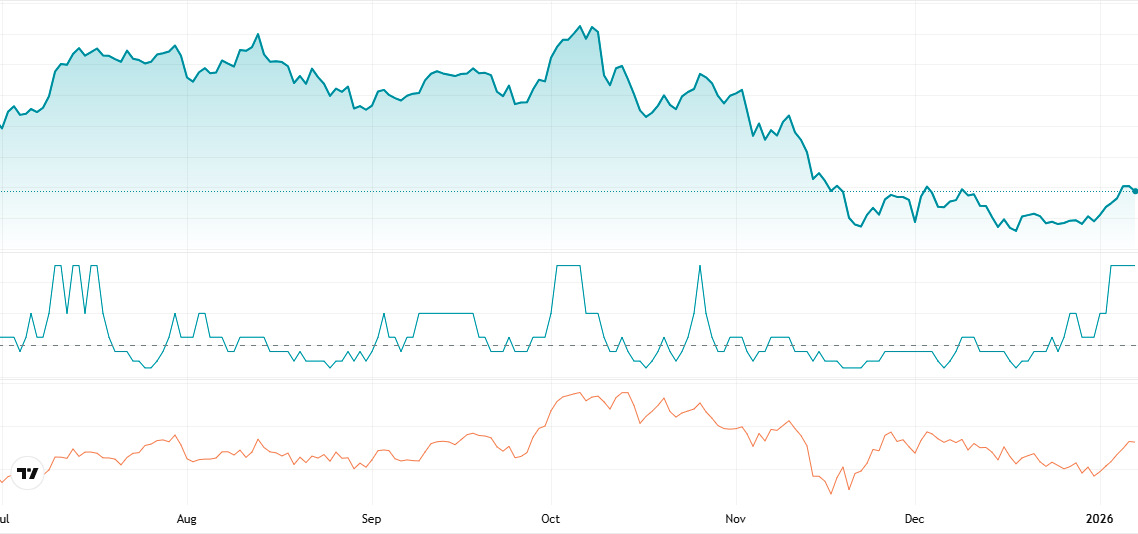

BTC and the Yen: A Surprising 0.86 Correlation

Over the past 90 days, Bitcoin and the Japanese yen (via Pepperstone’s JPY Index) have been moving in near lockstep. The correlation coefficient now sits at 0.86 – the highest level ever recorded according to TradingView.

That means 73% of Bitcoin’s price movement can now be statistically explained by changes in the yen, as confirmed by the coefficient of determination.

This is a major shift. Bitcoin has long been framed as an asset decoupled from fiat currencies. But since October 2025, BTC has tracked the yen so closely that it now rises and falls with Japan’s monetary narrative.

The current cycle is forcing a rethink in how traders frame Bitcoin. Once valued for its uncorrelated strength, BTC is now behaving like a currency derivative – one that’s tethered to Japan’s monetary policy more than its own fundamentals. That raises serious questions about its role in diversified portfolios and its usefulness as a hedge.

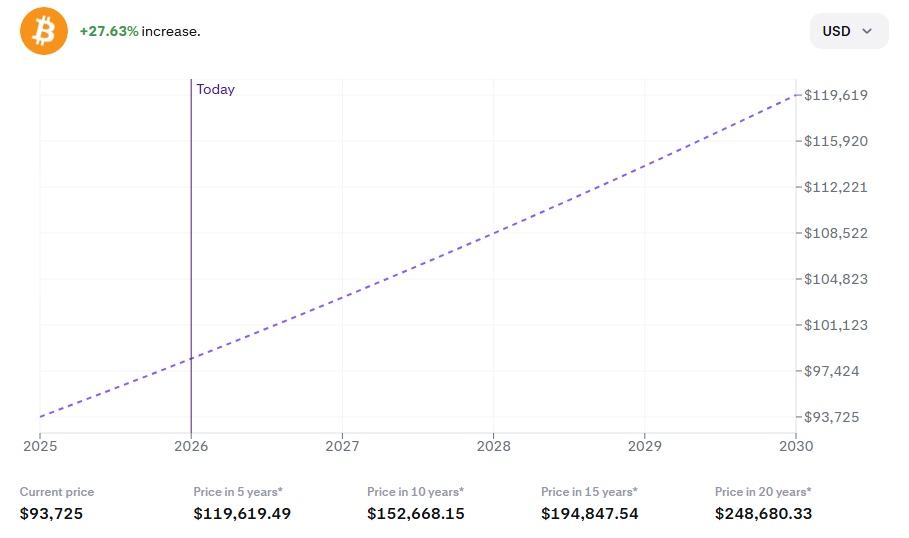

Short-Term Outlook: $101K in Play, But Volatility Ahead

According to predictive models, Bitcoin could rise to $101,062 by January 12, with near-term daily targets moving from $93,718 (Jan 8) to $98,699 (Jan 10). These represent strong short-term gains of 6–9%, aligning with investor optimism after a holiday-season dip.

But the volatility is far from over. Bitcoin tried to break out above $95K on January 7 during early U.S. trading, only to fade by midday.

That kind of intraday whipsaw shows the market remains fragile. While volume has picked up – $53.64B in the past 24h, up 14.4% – the pullback suggests profit-taking and macro hesitation.

The support zone now sits near $91,500, while resistance remains strong at $95,000. If BTC fails to retest that range soon, sentiment may flip bearish quickly – especially if the yen continues its downward slide and drags BTC with it.

Long-Term Forecast: $105K in February or Reversal Coming?

Looking ahead to February and March 2026, long-term models still show BTC pushing toward new local highs. The projected max price for February is $105,000, a potential gain of 13.18%. March targets also remain bullish, with a projected max of $103,514.

But that optimism doesn’t extend through the full year. Starting in August, models show average price declines of 2–12% per month, with December 2026 forecasting a bottom near $74,425. That would erase all gains from Q1 and return BTC to levels last seen in early 2025.

The key variables behind this projected reversal? Macro instability in Asia, potential U.S. rate hikes, and BTC’s fading ability to detach from foreign currency movements. Until those decouple, the forecast may continue to shift away from pure crypto metrics – and deeper into macro modeling.

Traders Watch Bitcoin Hyper as a Non-Correlated Bet

While BTC navigates currency entanglements, some investors are pivoting to altcoins with cleaner narratives. Bitcoin Hyper ($HYPER) is one standout. The token has just crossed $30.2M raised, with only $400K left before the next price jump.

At a current price of $0.013545, $HYPER is positioned as a speculative bet on momentum – unlinked to traditional asset correlations.

With Bitcoin’s macro story getting tangled in yen volatility, Hyper’s appeal lies in its simplicity: no FX correlation, no geopolitical drag. Just a rising presale, capped supply, and retail traction. Traders looking for exposure without macro baggage are clearly taking notice.