ZenChain Price Prediction 2026: Future Outlook And Expert Forecasts

A blockchain that blends the security of Bitcoin with the flexibility of EVM, and at the same time launches with a limited supply, extensive exchange listings, and effective tokenomics, takes place.

The inquiry now leads us to ZenChain ($ZTC), which quite boldly has made its presence felt with the official roll-out of its Token Generation Event (TGE) and listings on the leading crypto exchanges Bitget and KuCoin.

Besides the mounting excitement surrounding its scarcity model and cross-chain usage, investors are keen to see the extent of the price surge for $ZTC.

What is ZenChain ($ZTC)?

ZenChain is an advanced blockchain network aiming to bridge the Bitcoin-EVM ecosystems in a secure way. It offers no-charge and no-conflict technologies for cross-chain transfer, liquidity movement, and DApps interoperability all at the same time.

The ecosystem of the project revolves around ZTC—the crypto token, which is the major utility token. ZTC is responsible for network security, validator rewards, transaction fees, and ecosystem participation, which in turn keeps it vital for ZenChain’s long-term development.

$ZTC Exchange Listings Fuel Strong Market Confidence

With the $ZTC exchange listings, the project enters the market with a very strong position and market confidence. Besides, the exchange listings at Bitget and KuCoin account for a rare occurrence that a new project achieves such a milestone.

The trading pair was started on Bitget on January 7, 2026, at 12:00 PM UTC, and trading was also open by that time.

KuCoin issued a world premiere listing at the same time, and ERC-20 deposits had already been allowed.

In addition, MEXC has announced a new airdrop and listing, offering zero trading fees, scheduled to go live on January 7, 2026, at 12:00 UTC.

This dual listing will significantly enhance the global exposure, access to liquidity, and investor trust, thus laying a strong foundation for price discovery.

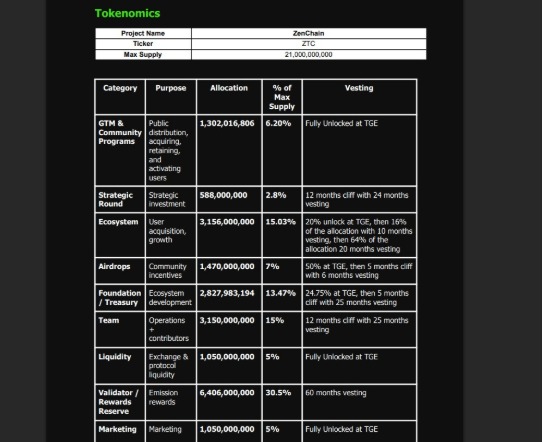

$ZTC Tokenomics: A Rare Case with Bitcoin-like Feature

ZenChain follows the model of Bitcoin with its token ecosystem and sets for itself the maximum scarcity at 21 billion, for which no inflation and no future minting policy will be implemented.

ZenChain Token Distribution Breakdown

Validator & Rewards Reserve (30.50%) – The network is secured

Ecosystem Growth (15.03%) – Financial support for dApps and tools

Team & Core Contributors (15%) – Long time period for the allocation that is locked

Foundation & Treasury (13.47%) – The future development is guaranteed

ZenChain Airdrop (7%) – The first community users are the beneficiaries

GTM & Community Programs (6.20%) – User retention and growth

Exchange & Protocol Liquidity (5%) – Full TGE transparency

Marketing (5%) – Full TGE transparency, Strategic Investment

(2.80%) – 12 months cliff, 24 months vesting

This well-balanced distribution minimises the sudden sell-off pressure and consequently ensures the long-term price stability.

ZenChain Price Prediction at Listing (Short-Term Outlook)

Upon launch, only a small percentage of tokens enter the market, which sometimes leads to the initial strength of the price being supported.

Expected Listing Price Range

$0.008 – $0.015

Though the initial trading may be a bit erratic on account of the airdrops and liquidity unlocks, the Bitcoin-like narrative of fixed supply could create a very strong buying interest in the market during the debut phase.

ZenChain Price Prediction: 3–6 Months Outlook

The move of the token beyond the launch period will bring in several factors that can contribute to its growth:

Activation of validator rewards

Deployment of ecosystem funds

Users joining through the community and GTM programs

Early dApp development on ZenChain

Expected Price Range (3–6 Months)

$0.02 – $0.035

In case the market scenario remains unchanged, the demand for network usage and staking might push upwards smoothly.

ZenChain Long-Term Price Prediction (2–4 Years)

The long-term value entirely relies on actual adoption, frequent usage, and network activities. The token has a solid basis for long-term appreciation with no inflation, strict vesting, and an increasing validator ecosystem.

Expected Long-Term Price Range

$0.08 – $0.15

The major reasons for the upside could be the wider utilization of Bitcoin-EVM interoperability, higher cross-chain liquidity, and the development of successful dApps.

Is ZenChain going to be the major bridge between the Bitcoin and EVM networks, and is it going to reward the early believers? The market will decide soon enough.