Pi Network tests the 20-day EMA near $0.2000, psychological support, following a nearly 2% decline on Wednesday.

Around 1.90 million PI were deposited into CEXs over the last 24 hours, suggesting increased selling pressure.

The technical outlook for PI remains bearish as bullish momentum wanes.

Pi Network trades above $0.2000 at press time on Thursday, following a nearly 2% decline the previous day. Centralized Exchanges (CEXs) have received 1.90 million PI tokens over the last 24 hours, suggesting risk-off sentiment among holders. The technical outlook for the PI token remains bearish, with a risk of a cross below the 20-day Exponential Moving Average (EMA).

Large deposits fuel selling pressure

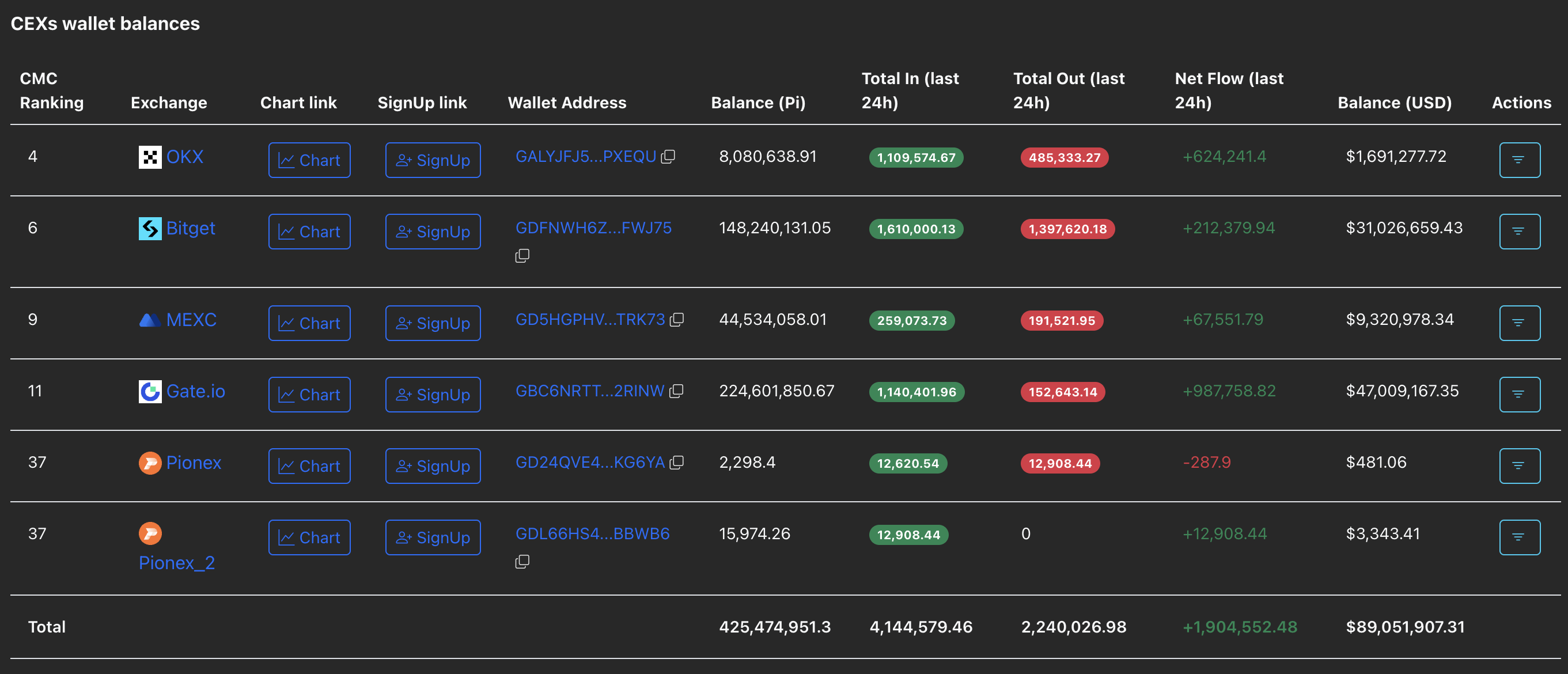

PiScan data shows over 1.90 million PI tokens were deposited on PI-listed CEXs, adding to the supply pressure. Typically, large deposits on CEXs are considered a sell-off move and indicate a decline in investors’ confidence. A steady inflow into CEXs could further intensify selling pressure.

Technical outlook: Could Pi Network extend its decline below $0.20?

Pi Network tests the 20-day EMA at $0.2092, reversing from the 50-day EMA at $0.2166, suggesting renewed supply pressure from the higher EMA. The Relative Strength Index (RSI) declines to 48, crossing below the halfway line, indicating dominant selling pressure and further downside potential before reaching the oversold zone.

Additionally, the Moving Average Convergence Divergence (MACD) takes a lateral shift as green histogram bars decline, indicating a decrease in bullish momentum. If MACD crosses below the signal line, it would indicate renewed bearish momentum.

If Pi Network declines further, the October 11 and September 22 lows at $0.1996 and $0.1842, respectively, could serve as support levels.

However, if PI clears the 50-day EMA at $0.2166, it could target the $0.2295 level, last tested on December 5.