KEY TAKEAWAYS

Momentum (MMT) had its Token Generation Event (TGE) yesterday.

The MMT price has broken out from a descending wedge pattern.

How will the price of MMT fare throughout the rest of the year?

Momentum Finance (MMT), a new decentralized finance platform built on the Sui blockchain, officially launched its token generation event (TGE) on Nov. 4.

Backed by major investors including OKX Ventures, Coinbase Ventures, and Circle, Momentum is designed to serve as the Sui ecosystem’s central hub for liquidity and governance.

The project runs on Sui’s high-speed Move architecture, offering faster and more efficient DeFi operations.

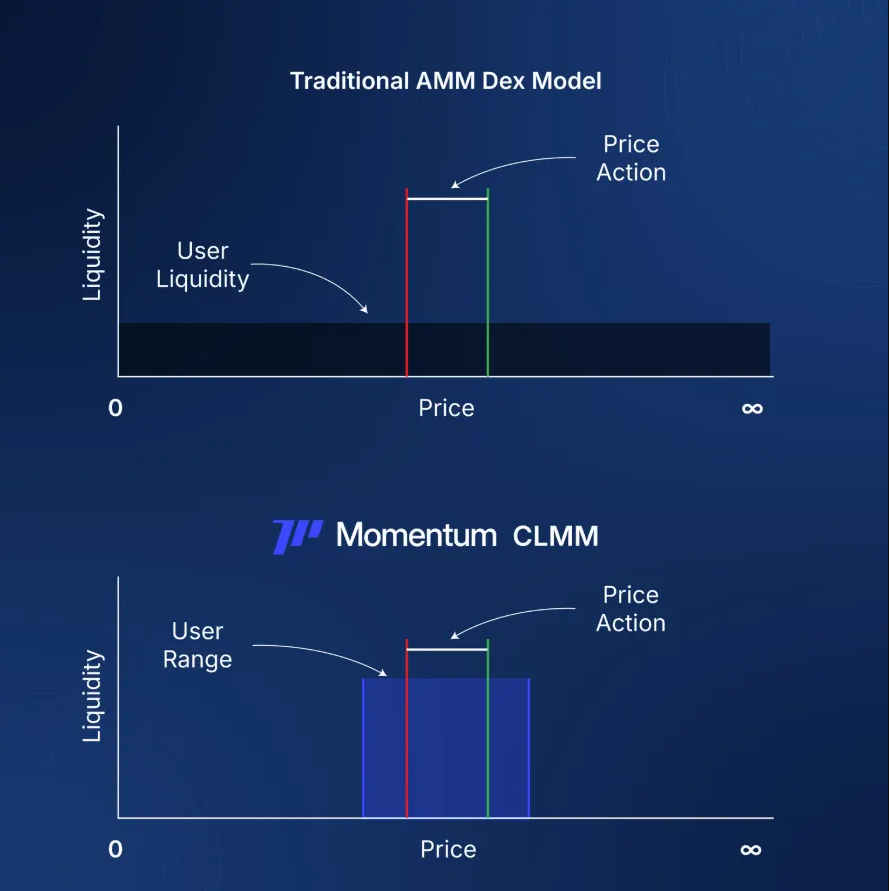

Momentum brings together decentralized exchange (DEX) trading, yield generation, and cross-chain participation through integrations such as Wormhole.

Shortly after its debut, MMT secured listings on several major centralized exchanges, including Upbit, Gate, KuCoin, and Binance.

Momentum’s Successful TGE

Momentum’s MMT token launched yesterday, marking the most crucial step in the platform’s growth.

Users can use MMT through ecosystem integrations, starting with Binance’s HODLer Airdrops, which reward users via retroactive BNB Simple Earn subscriptions.

MMT serves as Momentum’s governance and incentive token, allowing holders to bond tokens into vested MMT (veMMT) to gain voting rights, boost rewards, and gain early access to new yield opportunities.

This system reflects Momentum’s adoption of the “ve model,” which is designed to reward long-term holders while decentralizing governance and more efficiently directing DEX emissions.

Momentum will transition fully to the ve model post-launch.

It will introduce a reward system where veMMT holders earn a share of DEX trading fees based on their lock duration, aligning incentives for long-term supporters.

A dedicated platform for MMT and veMMT holders is also in development. This platform will enable users to bond, vote, and track rewards seamlessly.

The Momentum team notified users that the allocation is in veMMT, which will be visible in the next few days.

Momentum Title Deed holders will receive their airdrops three days later instead of at TGE.

While the reaction to the airdrop has mostly been positive, not all are satisfied with the allocation.

One of the biggest objectors is Ronin, who claims he was deemed ineligible despite depositing more than $100,000 in the HODLER program and onboarding over 1,000 users.

MMT’s Price Movement

The price of MMT surged immediately after launch, rallying by more than 4,000% to a new all-time high of $4.47.

While the rally was substantial, the price of Momentum did not sustain it. Instead, it created a lower high and has since fallen by 70%.

Momentum’s decline ended at the $1.20 horizontal support area, triggering an ongoing bounce.

Another positive sign is that the price has broken out of a descending wedge pattern that has existed since the all-time high.

The wedge breakout could trigger a significant MMT price increase, indicating that the correction is over.

MMT could reach the $2.80 horizontal and Fibonacci resistance area if that happens.

However, a close below the $1.20 horizontal support area could deepen the decline and lead to new lows.

In any case, MMT’s price history is less than 24 hours, so the technical analysis is likely to be less accurate.

Uncertain Trend Ahead

Momentum’s launch was a strong start, backed by major investors and a roadmap focused on veMMT governance.

Despite the sharp post-TGE correction, the recent breakout from the wedge suggests renewed bullish strength.

If buying pressure holds, a move toward $2.80 looks likely, though a drop below $1.20 could invalidate this recovery.