Ordinals (ORDI) is an innovative Web3 framework that lets users store NFTs on the Bitcoin (BTC) blockchain. The system tags “satoshis” with NFT data (such as images, audio, and video), and the network records permanent ownership on the Bitcoin ledger.

Our beginner’s guide shows you how to buy Ordinals tokens with the lowest fees. Read on to discover the top places to invest in ORDI, where to store your tokens, and what safety best practices to follow.

Learn more about the Ordinals protocol and why the trending project could drive long-term price growth.

Key Takeaways on Ordinals

While the Bitcoin blockchain lacks NFT support, the Ordinals protocol provides an innovative workaround. It includes NFT tags within individual satoshis, which represent one hundred-millionth of a BTC.

Within an Ordinals NFT, users record real asset ownership on the Bitcoin network. Media use cases include videos, music, and images.

The project’s native token, ORDI, uses a unique BRC-20 standard. The tokens technically operate on the Bitcoin blockchain because BTC blocks can include JSON ordinal inscriptions.

To mirror BTC, the maximum ORDI supply is 21 million tokens. Exchange data confirms that 100% of tokens circulate in the public float.

While some analysts rate ORDI as a top cryptocurrency to buy, the tokens have no use cases or purpose. Instead, ORDI is a speculative bet on the Ordinals protocol.

How to Buy ORDI: Summary

This beginner-friendly guide explains what Ordinals (ORDI) are and how to buy ORDI tokens safely, where to store them, and what investors should know before gaining exposure to the Bitcoin Ordinals.

How to Buy Ordinals in 4 Easy Steps

The following step-by-step explains how to buy Ordinals in under five minutes:

Join an Exchange That Lists ORDI: Open an account with a reputable crypto exchange that supports ORDI. Binance, the world’s largest exchange, is the overall best option. Input your personal information and complete know-your-customer (KYC) verification.

Deposit Funds: Binance supports crypto and fiat deposits. Traditional payment methods include debit/credit cards, as well as Google Pay and Apple Pay. Use the instant buy feature to purchase Tether (USDT), which you swap for ORDI in the next step. For additional payment methods, use Binance’s peer-to-peer (P2P) platform.

Go to the ORDI/USDT Market: To buy Ordinals, search for the ORDI/USDT spot market. Set up a market or limit order, and trade USDT for ORDI. Once Binance executes the trade, it adds ORDI to your spot exchange balance.

Transfer ORDI to a Secure Wallet: Transfer ORDI tokens to a secure crypto wallet that supports the Ordinals protocol. Trust Wallet, a non-custodial wallet for iOS, Android, and web browsers, is a popular choice. Store ORDI in the wallet safely until you decide to sell.

How to Buy Ordinals: Step-by-Step Instructions

Buying ORDI is slightly more challenging compared with standard cryptocurrencies. Here is a more comprehensive guide that shows beginners how to invest in Ordinals. We also explain where to store the purchased ORDI tokens safely.

Open an Account With an Ordinals Exchange

As the original BRC-20 token, the best Bitcoin exchanges list Ordinals, including Coinbase, Gate.io, Bybit, and Kucoin. Binance is our overall top pick, as it attracts the largest trading volume on the ORDI/USDT pair. Binance offers deep liquidity, competitive fees, and a fast account opening process, along with support for both cryptocurrencies and fiat currencies.

Visit the Binance exchange and click “Sign Up” to open an account. Add a mobile number or email address, then enter the verification code.

Binance requires new customers to complete a KYC process before they deposit funds. The exchange asks for personal information and a government-issued ID, such as a driver’s license or passport. It also requires a recently issued proof of address and an automated video call for facial recognition. Most users complete KYC verification in minutes.

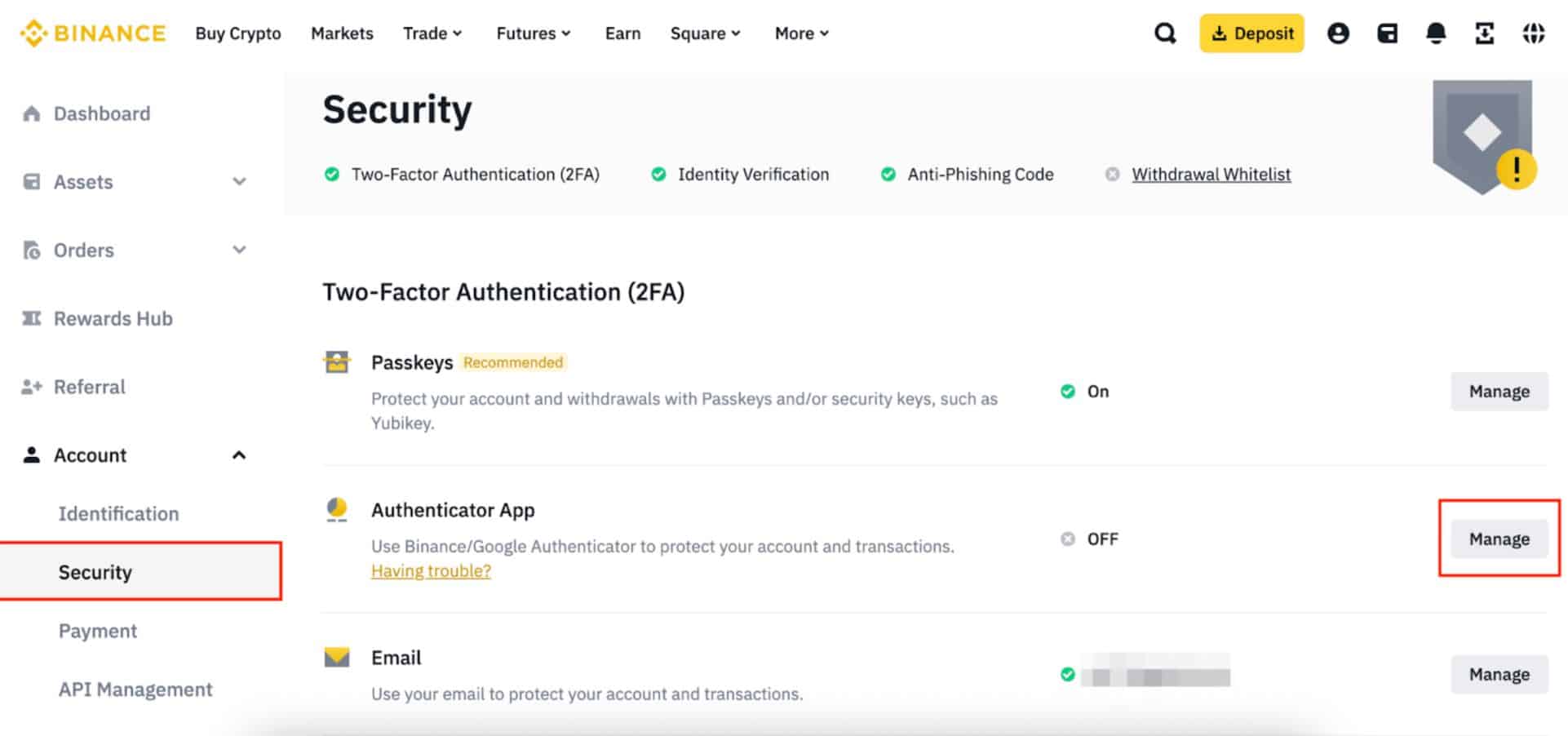

Secure the Exchange Account

We recommend activating account security features to protect your Binance account from unauthorized access. In the “Security” area of your account dashboard, set up two-factor authentication via Passkeys or Google Authenticator. Once activated, you must enter a verification code to access the exchange account.

Enable email verification as well, which adds an extra layer of security. If you access Binance from a new device or IP address, the platform requires two-step verification via the registered email address.

Deposit Funds

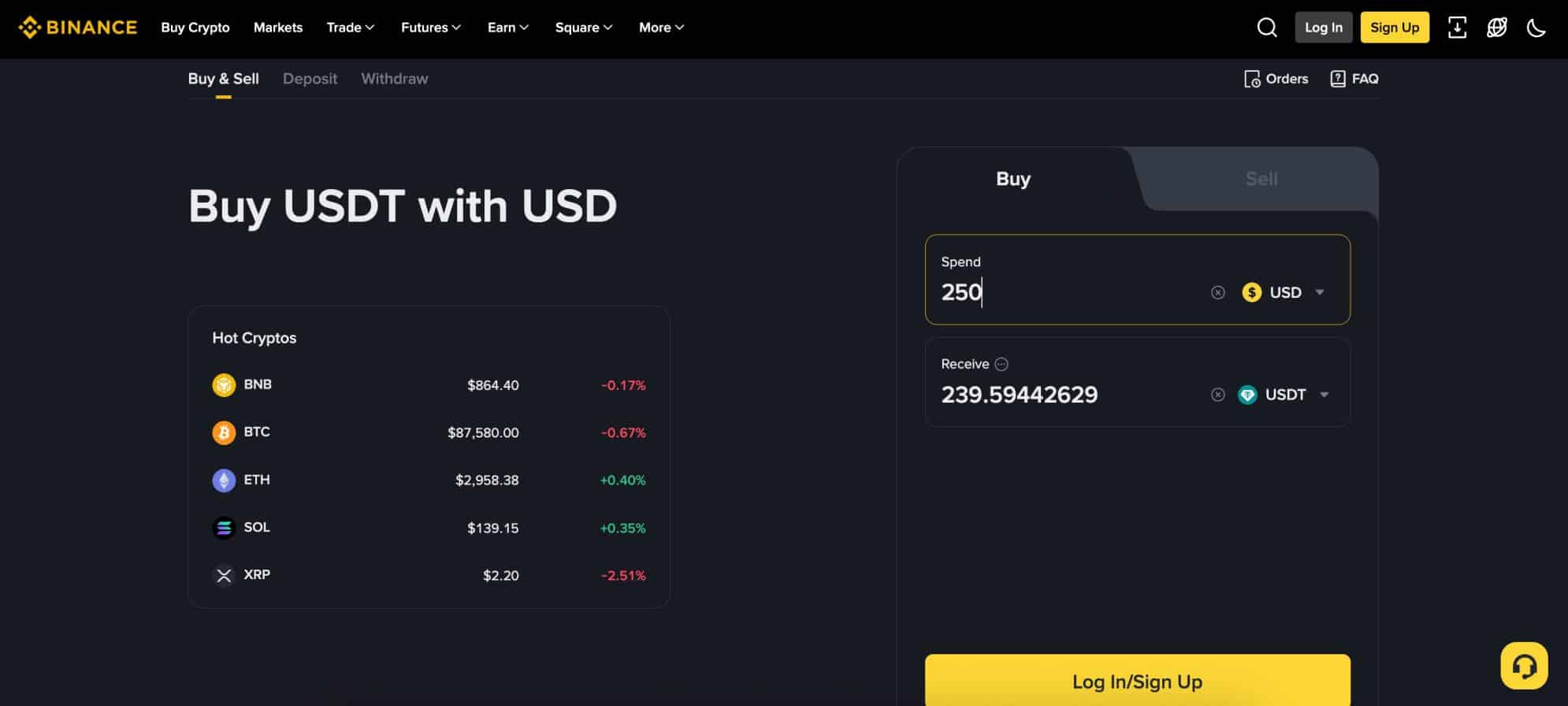

You need to deposit funds into the Binance account before you can buy ORDI. If you already hold crypto in a private wallet, Binance provides a unique deposit address for each supported asset. The platform accepts BTC and hundreds of top altcoins, including Ethereum (ETH), Solana (SOL), and BNB (BNB).

If you want to buy Ordinals with fiat money, supported payment methods vary by country. Europeans deposit EUR via SEPA, while U.S. clients transfer USD through ACH (on the Binance.US website). The exchange also accepts instant debit/credit card and Google/Apple Pay payments, although you need to buy cryptocurrencies rather than fund the account with fiat.

Explore Binance’s P2P section for additional methods. It supports hundreds of local payment methods and over 100 currencies, and some sellers offer exchange rates below the global spot price.

If you use the instant buy or P2P feature, ensure you purchase USDT. Like most crypto exchanges, Binance offers the ORDI/USDT pair.

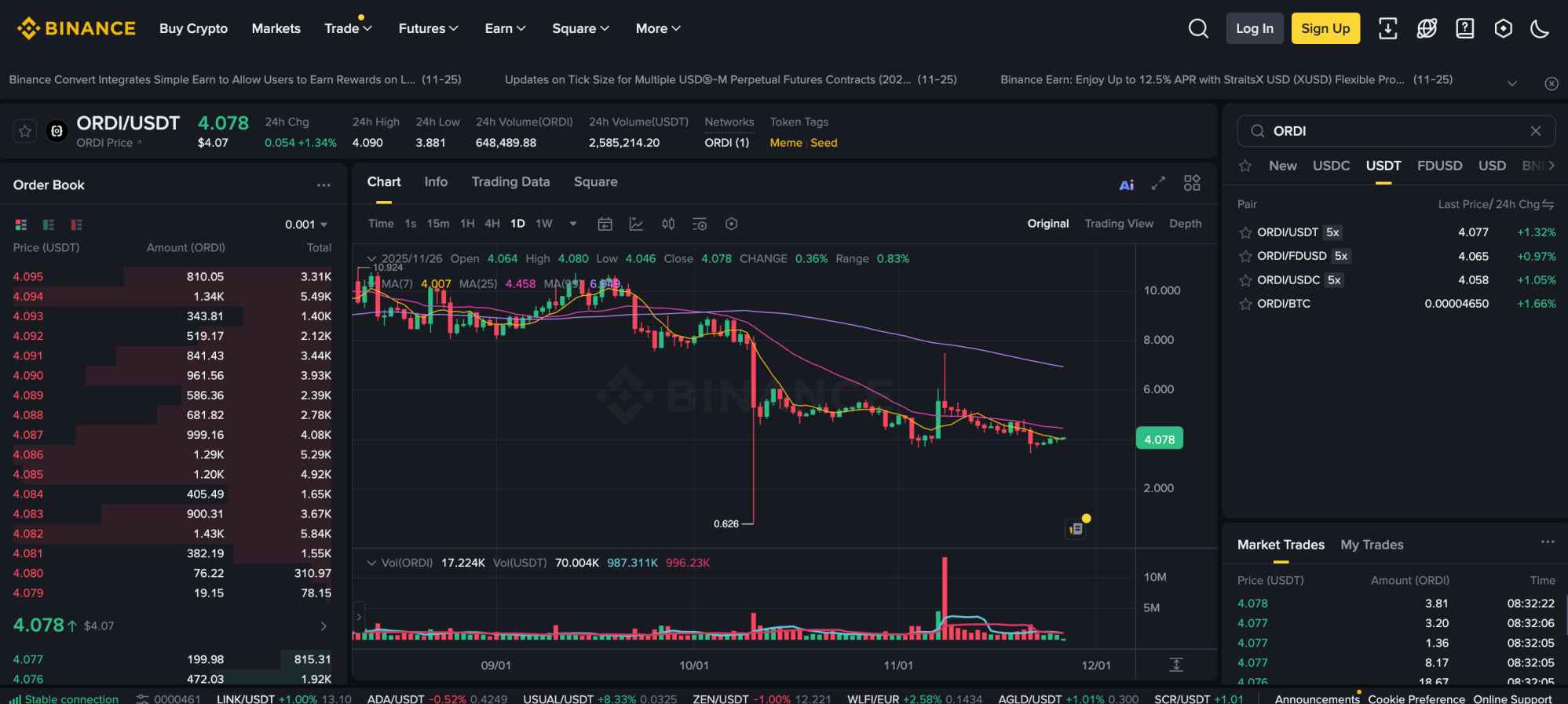

Search for the ORDI/USDT Market

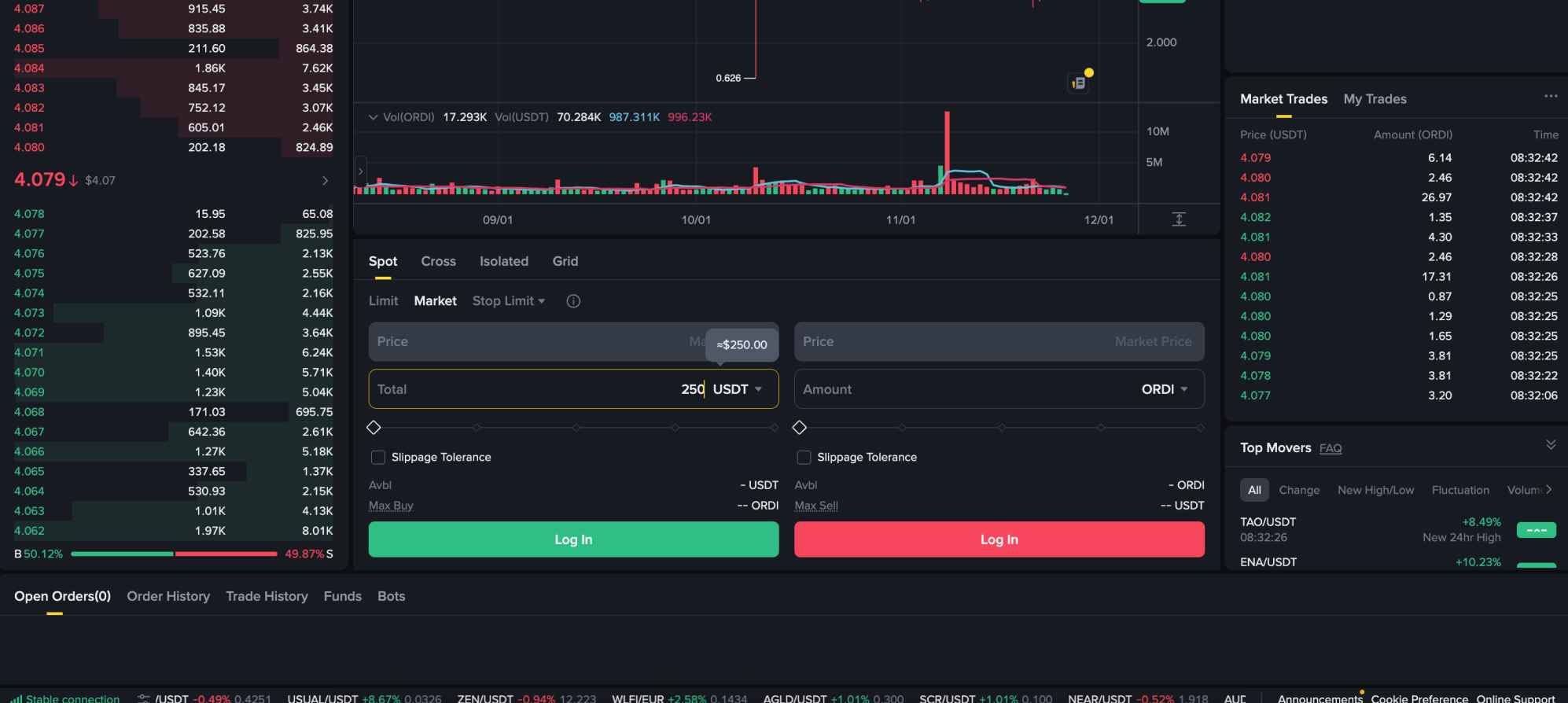

Hover over “Trade” from the top menu bar and select “Spot”. This takes you to Binance’s spot exchange, which lists hundreds of markets. The search box is located to the right of the pricing chart. Input “ORDI” and select the “ORDI/USDT” market.

You are now on the Ordinals trading page, which displays vast market data. Use the ORDI chart to analyze price movements, deploy indicators to explore trends, and review the order book to assess existing exchange orders.

Set up an Order to buy Ordinals

Scroll below the ORDI/USDT chart to view Binance’s order form. Then choose between a market or a limit order, depending on your trading strategy.

Binance executes market orders instantly at the next best available price. The ORDI/USDT market offers sufficient liquidity, so you can place a market order without slippage risks.

To buy Ordinals at a specific price, select a limit order and enter the target price. Note that Binance executes limit orders only when another exchange participant matches that price.

Both order types require the total trade size, which you enter in USDT.

Review the order details to ensure accuracy and confirm. Once executed, Binance exchanges USDT for ORDI and adds tokens to your spot exchange account.

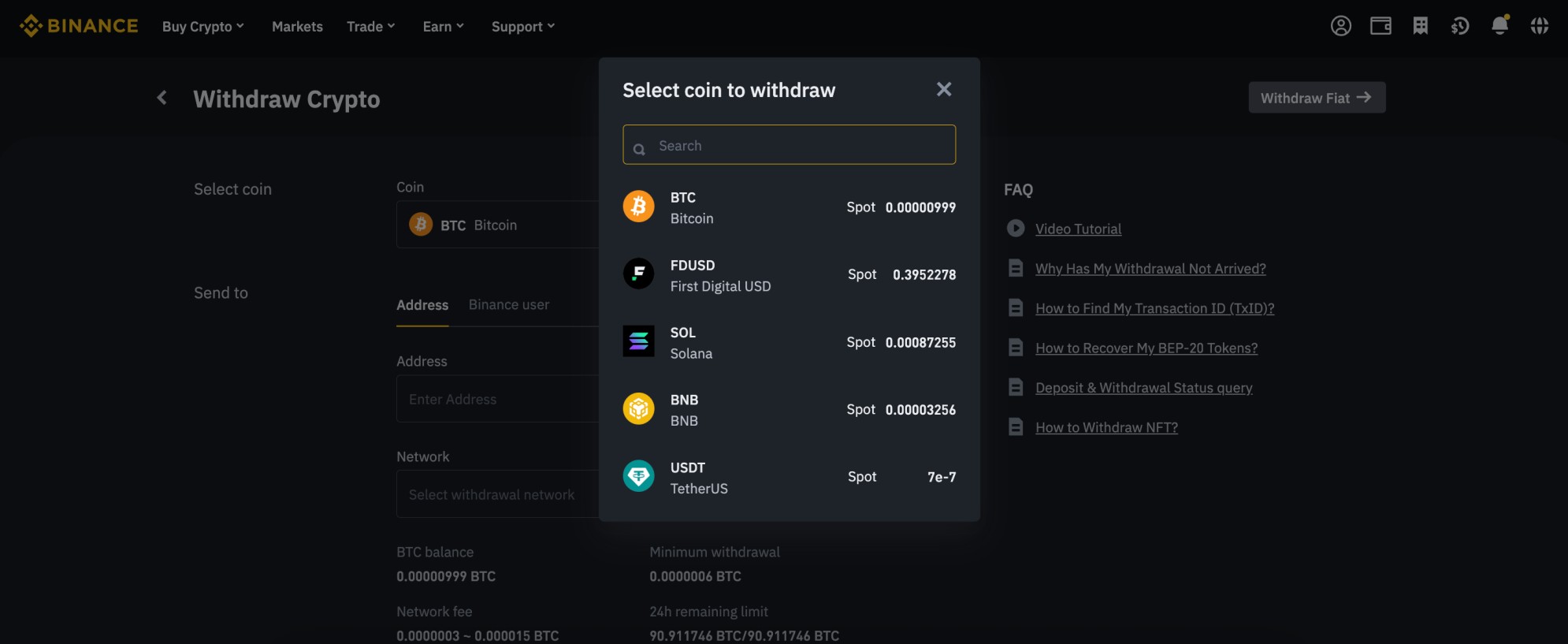

Withdraw Ordinals to a Private Wallet

Blockchain experts discourage storing cryptocurrencies in an exchange account. Binance controls your digital assets, which makes them vulnerable to cybersecurity threats or general counterparty risks.

Withdrawing ORDI to a private wallet with non-custodial storage offers the best option. You fully control the wallet’s private keys and secure true ownership of your assets. We review the best decentralized crypto wallets for Ordinals later in this guide.

When you have a wallet, request a withdrawal from the Binance account. Please provide the BRC-20 wallet address and withdrawal amount. Once confirmed, you should receive the assets within 30 minutes.

What are Ordinals?

Launched in 2023, Ordinals is a Web3 project that unlocks additional use cases for the Bitcoin blockchain. The protocol lets people record digital ownership on the original Bitcoin network, which NFTs are permanently backed by on the public ledger. We have previously explored the background of Bitcoin Ordinals.

Unlike other Bitcoin solutions, which rely on Layer 2 sidechains or wrapped tokens, Ordinals include data within satoshis. Each BTC coin represents 100 million satoshis, so the framework enables up to 2,100 trillion individual NFTs.

What Makes it Interesting?

Ordinals are an interesting concept because they expand Bitcoin’s utility. The world’s largest digital asset lacks smart contract support, unlike Ethereum (ETH), Solana (SOL), and other Layer 1 blockchains. This limitation restricts BTC holders to price appreciation only.

With the Ordinals protocol, the Bitcoin ecosystem provides exposure to fungible tokens without relying on smart contract technology. It uses JSON inscriptions, which are processed via standard Bitcoin transactions that store data.

A simple example is Ordinal Punks, a popular NFT collection on the Ordinals protocol. NFTs back 100 unique digital artworks that resemble CryptoPunks (one of the most valuable NFT collections on Ethereum). Ordinal Punk holders verify ownership using individual satoshis on the real Bitcoin network.

Tokenomics

The Ordinals team created 21 million ORDI tokens, which aligns with the original BTC supply. They pre-minted all 21 million tokens, ensuring that 100% of the ORDI supply is in circulation.

As the project introduced a unique token standard called BRC-20, stakeholders send, receive, and transfer ORDI via specialist wallets (more on that shortly).

Community

On-chain data shows that there are over 27,500 ORDI holders, which is considerably fewer than top meme coin communities like Dogecoin (DOGE) and Shiba Inu (SHIB). Although data confirms that the largest wallet holds more than 37% of the ORDI supply, this likely relates to a major exchange, such as Binance.

The ORDI community has a limited presence on social media, yet the broader Ordinals concept has an active and growing ecosystem. Magic Eden, for instance, is a popular marketplace for Ordinals creations. One collection alone, the “Pizza Ninjas”, attracted 0.6477 BTC (approximately $88,000) in 24-hour trading volume.

Ordinals vs Ethereum NFTs: Key Differences Compared

Ordinals differ from traditional NFTs by storing digital assets directly on Bitcoin satoshis, while Ethereum NFTs rely on smart contracts to manage ownership and metadata.

| Feature | Bitcoin Ordinals (ORDI) | Ethereum NFTs |

| Blockchain | Bitcoin (BTC) | Ethereum (ETH) |

| NFT storage | Data inscribed directly on satoshis | Stored via smart contracts |

| Token standard | BRC-20 (for ORDI) | ERC-721 / ERC-1155 |

| Smart contracts | Not required | Required |

| Ownership record | Fully on Bitcoin ledger | On Ethereum blockchain |

| Typical use cases | Bitcoin-native NFTs, collectibles | Art, gaming, DeFi, metaverse |

| Ecosystem maturity | Emerging | Highly mature |

Why Buy ORDI?

ORDI is the original token on the BRC-20 standard, giving it a first-mover advantage over industry competitors. It also boasts the largest market capitalization and holds listings on multiple Tier 1 exchanges.

Because the project is a BRC-20 pure-play, ORDI holders gain direct exposure to the Bitcoin ordinals narrative. ORDI also trades at a significant discount from all-time high prices, which allows first-time investors to enter the market at a reduced cost.

Is Ordinals a Good Investment?

Consider the ORDI investment thesis when learning how to buy Ordinals. This section examines whether the BRC-20 concept is a worthwhile investment or if the market lacks sufficient fundamentals.

Low-Cap Entry on the Ordinals Narrative

While ORDI is the most traded project in the Bitcoin ordinals space, it holds a market capitalization of just $95,326,964 . This modest valuation presents a fair risk-reward profile.

At its peak, Ordinals reached a $1.7 billion valuation. A return to the all-time high offers a 20x upside.

Strong Pricing History

ORDI has demonstrated its ability to generate significant price gains.

The BRC-20 token dropped to lows of about $5.15 after its mid-2023 launch, only to hit all-time highs of $96.17 in March 2024. This price trend shows returns of over 1,700% in just nine months.

Rising NFT Volumes

On-chain research reveals rising interest in NFT trading. NFT marketplaces recorded over 18 million NFT sales in Q3 2025, resulting in $1.6 billion in volume.

Although Ethereum handles the vast majority of NFT activity, Ordinals’ unique BRC-20 concept could benefit from the industry’s revival.

Fair Token Dynamics

The founders created a fair and transparent ORDI supply, with no presale, venture capitalist (VC), or team allocation.

All 21 million ORDI tokens are in the public float, which protects holders from future dilution. Market forces determine the ORDI price exclusively.

ORDI Price Movements Loosely Align With BTC

When the BTC price pumps, ORDI often follows because it is a Bitcoin-native asset. Technical data highlights that ORDI increases at a much faster pace than BTC, as it holds a much smaller market capitalization.

Besides the BRC-20 narrative, ORDI holders aim for bigger gains as BTC appreciates over time.

Best Ordinals Wallets

Unlike the core Bitcoin blockchain, fewer wallets support ORDI. Holders require a specialized Bitcoin wallet that connects to the Ordinals protocol and enables users to interact with the BRC-20 standard. Sending ORDI to a non-compatible Bitcoin wallet address results in a loss of funds.

We reviewed the wallet market extensively to identify the best options for ORDI investors. Here are the three top Ordinals wallets for 2026.

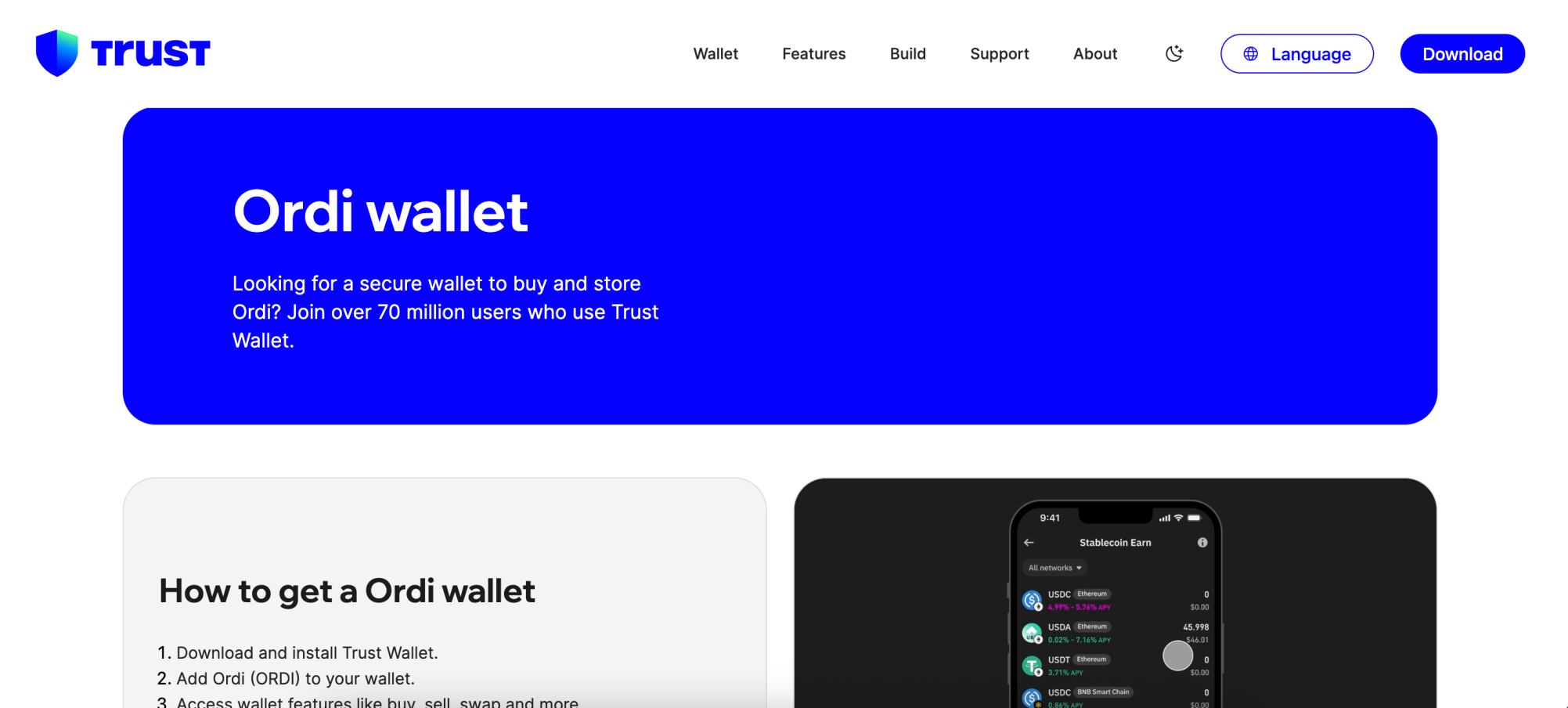

Trust Wallet

Trust Wallet is a popular non-custodial wallet for iOS and Android users. It also offers a browser extension, albeit with reduced functionality. Both versions support ORDI tokens and over 100 other blockchain standards, including Bitcoin, Ethereum, Base, Polygon, and Solana. The wallet’s comprehensive asset support enables users to store their entire crypto portfolio in one place.

Regarding safety, Trust Wallet users receive encrypted private keys and store them on their mobile device or desktop. Access requires a PIN or biometrics, yet the wallet lacks support for two-factor authentication. Trust Wallet provides real-time warnings when users attempt to send ORDI to suspicious addresses or connect with high-risk applications.

As a feature-rich wallet, ORDI holders access a wide range of additional tools. The non-custodial provider offers in-app staking yields, a decentralized exchange (DEX) with cross-chain swaps, and access to decentralized applications (dApps). Users may also connect to ordinals marketplaces like Gamma and Magic Eden, and trade BRC-20 NFTs.

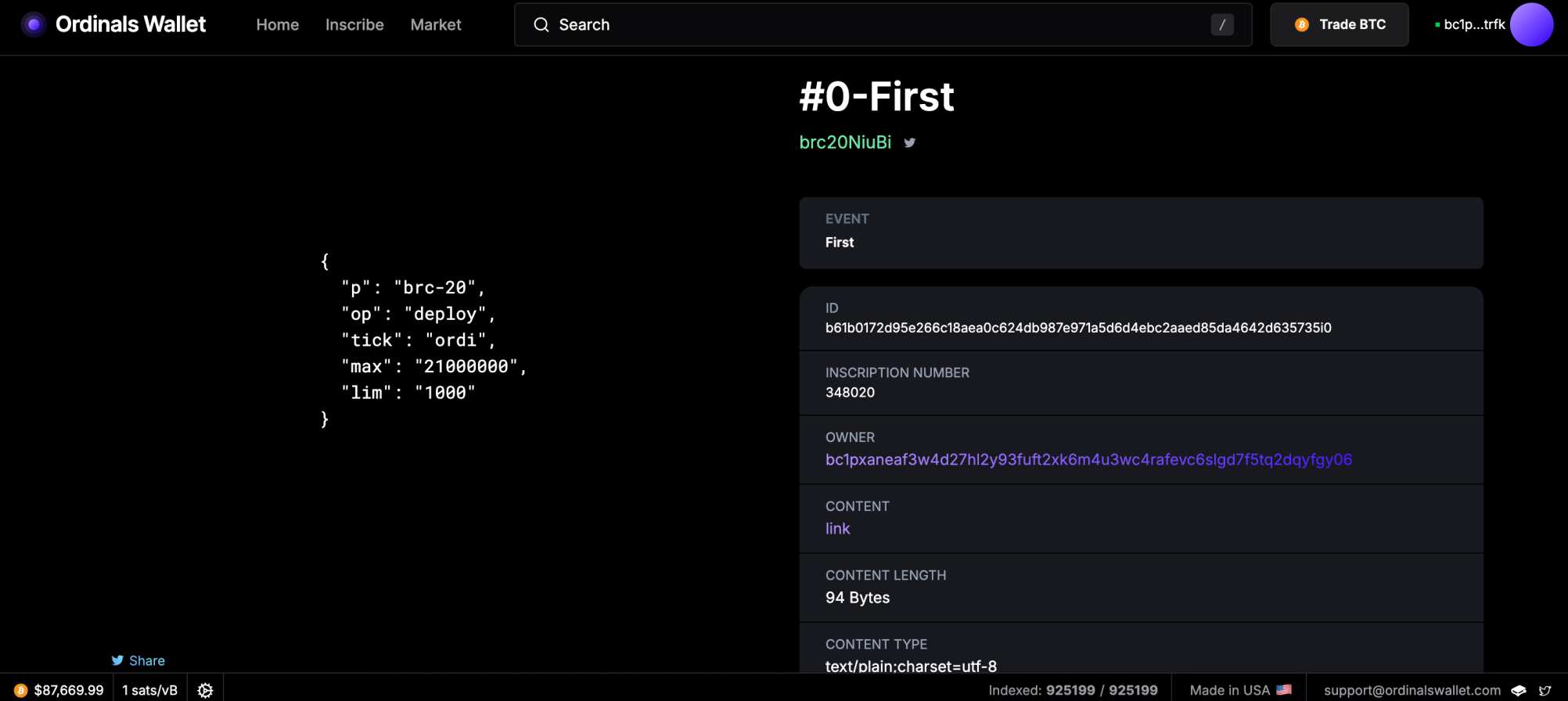

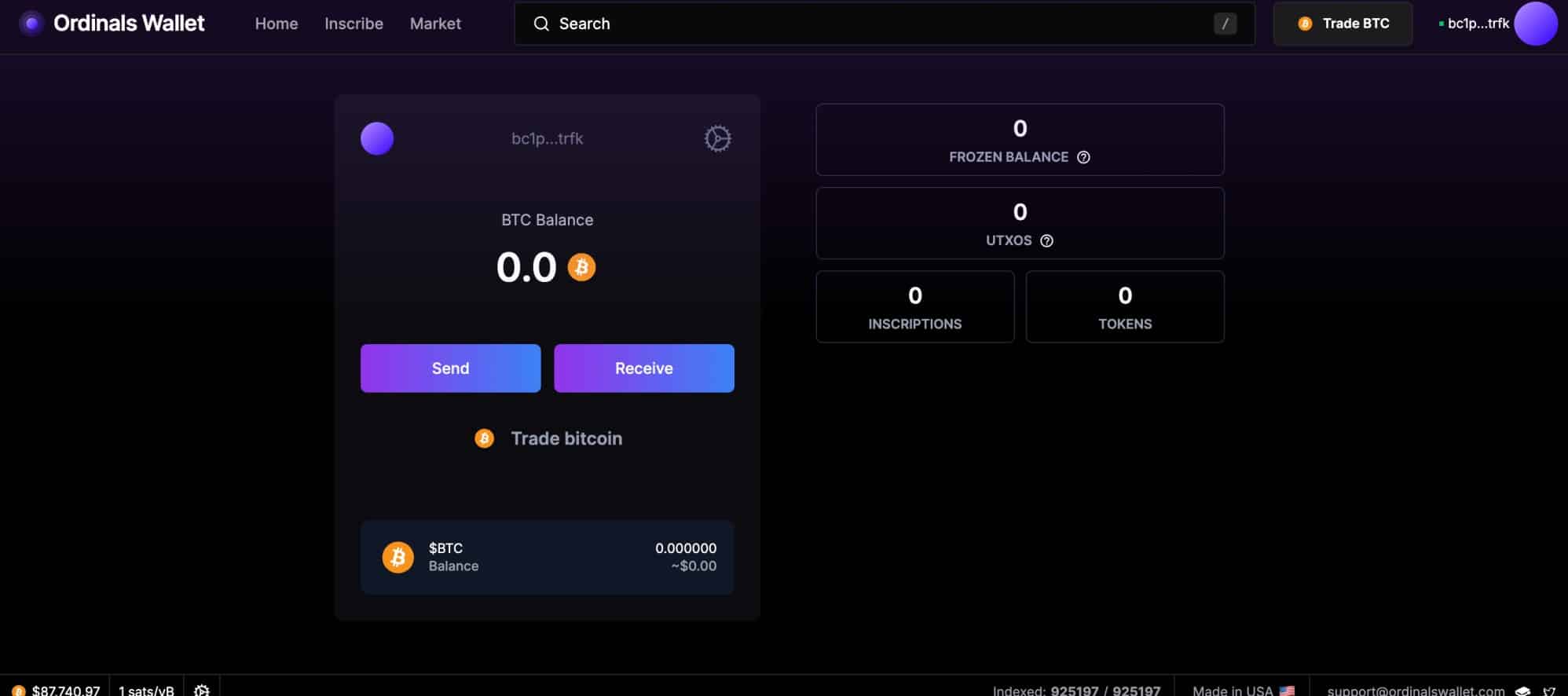

Ordinals Wallet

Ordinals Wallet is a specialized wallet for BRC-20 tokens, such as ORDI. While it also supports BTC, the wallet lacks support for altcoins. This drawback makes Ordinals Wallet unsuitable for investors who hold multiple cryptocurrencies and want to store them in a unified wallet.

The decentralized wallet provides web access only, so users log in with a traditional password. They receive a 12-word seed phrase when setting up the wallet, which enables them to access ORDI from any device. To add digital assets, users scan a unique QR code and manually transfer them to the full BRC-20 address.

The Ordinals Wallet is also one of the best platforms for trading BRC-20 NFTs. It lists digital collectibles like TAP GIB, Runestone, and TAP TROLL, and platform users discover NFTs by volume, price, and category. When you sell NFTs on the marketplace, Ordinals Wallet automatically transfers BTC to the connected wallet address.

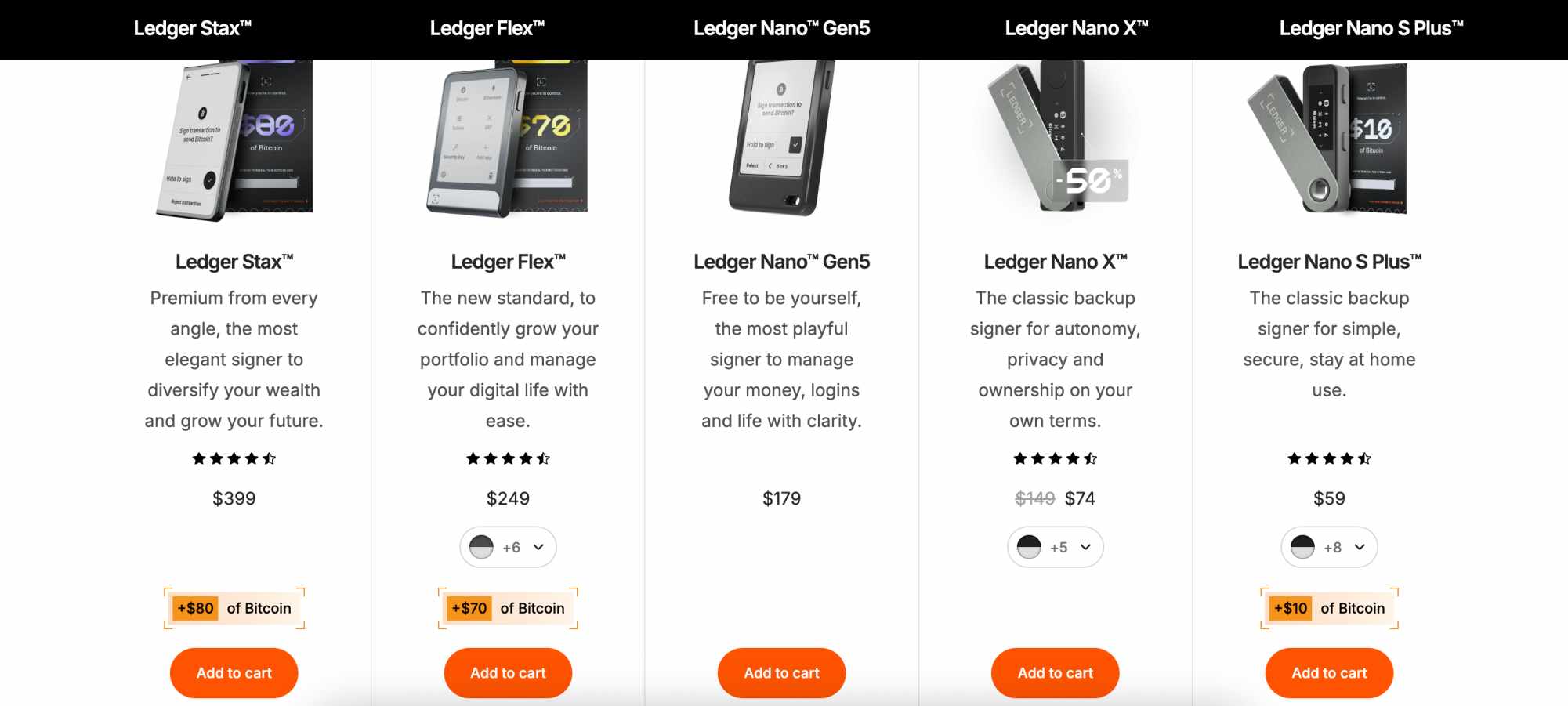

Ledger

Ledger is one of the best hardware wallets for asset safety, particularly for those who purchase significant amounts of ORDI. The wallet offers cold storage facilities, storing private keys offline. Users approve wallet transactions on the physical device only. This security framework helps ORDI holders protect themselves against internet threats, such as hacks and phishing.

Although Ledger supports the BRC-20 standard, users must complete additional steps for full functionality. You initially add the BTC app to the Ledger companion application and connect to a third-party software wallet with BRC-20 compatibility (Ledger recommends Xverse). The final step requires users to confirm the ORDI deposit on the Ledger hardware.

In terms of pricing, Ledger offers various models to suit all budgets. Ledger Nano S Plus remains the most affordable device at just $59. The premium option is Ledger Stax. Costing $399, Stax offers an E Ink® touchscreen, more durable materials, wireless charging, and connections via Bluetooth, NFC, and USB-C cable.

What to Do with ORDI Tokens You Buy?

ORDI tokens have no ecosystem utility. People buy Ordinals as a speculative investment, as the ORDI price rises and falls like any other digital asset.

Since ORDI is the first Bitcoin Ordinals initiative, BRC-20 adoption helps fuel demand.

Conclusion: Is Ordinals (ORDI) Worth Buying?

ORDI’s low market capitalization and first-mover advantage position it as an appealing BRC-20 pure-play. It enables access to the Bitcoin NFT narrative at a fair price, since the recent market correction has shed almost 95% from ORDI’s all-time high.

To buy Ordinals safely, use a reputable Tier 1 exchange, such as Binance. The platform offers deep liquidity and low trading commissions. Fiat payment methods include Visa, MasterCard, and Google Pay/Apple Pay. To secure true asset ownership, withdraw ORDI to a compatible BRC-20 wallet after purchasing tokens.

Remember to conduct independent research before you buy ORDI and explore other Web3 narratives to avoid overexposure.