TradingKey - Following the release of the ADP employment data, the likelihood of a Federal Reserve rate cut decreased, and Bitcoin could briefly fall below the $90,000 mark.

On Thursday (January 8), Bitcoin's price plunged nearly 2%, nearing the $90,000 threshold, falling to a low of $90,713. As of press time, Bitcoin's price weakness persists, with the current price at $90,830.

Bitcoin Price Chart, Source: CoinMarketCap.

Since the start of 2026, Bitcoin's price had risen for five consecutive days, climbing from approximately $87,000 to around $95,000 and touching its December 2025 rebound high. However, on Monday, Bitcoin's price encountered resistance at that level and retreated, while expectations for the Federal Reserve to maintain interest rates held steady continued to rise, triggering a further decline in Bitcoin's price.

The 'mini non-farm payrolls' data released on Wednesday showed that U.S. ADP employment in December increased by 41,000, falling short of market expectations of 47,000. While ADP employment figures falling below expectations typically indicate a slowdown in private sector employment momentum, which would usually heighten market expectations for rate cuts, this time was different.

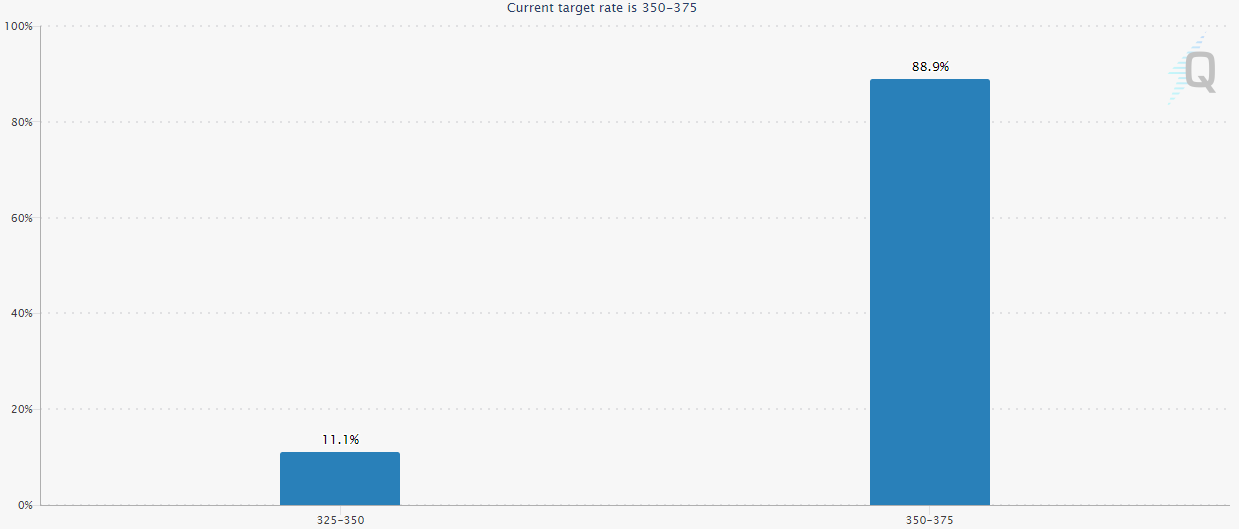

Following the release of the ADP employment data, the probability of a Federal Reserve rate cut in January decreased, while the likelihood of rates remaining unchanged increased. According to data from January 8, the probability of the Federal Reserve cutting rates by 25 basis points in January was 11.1% (down from 18.3% the previous day), while the likelihood of maintaining unchanged rates surged to 88.9% (up from 81.7% the previous day).

Market Expectations for Federal Reserve January Rate Cut, Source: CME.

This Friday, the U.S. will release its non-farm payrolls data, but the market has already begun pricing in the policy meeting outcome, opting to sell Bitcoin in anticipation of potential risks. Currently, Bitcoin's price may lose the support of rate cut expectations; however, its technical rebound structure remains intact, still forming an ascending triangle, which is a bullish signal. Nevertheless, a brief drop below $90,000 before an upward breakout cannot be ruled out.

Bitcoin Price Chart, Source: CoinMarketCap.

January 28 marks the Federal Reserve's first policy meeting of 2026, and a rate cut is unlikely then; however, Federal Reserve officials believe rate cuts will still occur this year. Specifically, Federal Reserve Governor Milan stated that the Fed should cut rates by over 100 basis points this year, and newly appointed Fed voting member Paulson also claimed that 'further rate cuts may be possible later this year'.

Furthermore, Wall Street investment banks lean towards the Federal Reserve continuing rate cuts in 2026. For instance, Barclays anticipates two 25-basis-point rate cuts by the Federal Reserve, in March and June, respectively. Citibank is more aggressive, projecting 25-basis-point cuts in March, June, and September.

In other words, the expectation of a March rate cut provides significant support for Bitcoin's price. Another factor not to be overlooked is that, following the U.S. arrest of Venezuela's president, U.S. President Trump attempted to intervene in Greenland and Colombia, a move that could spark global shock and panic, injecting new upward momentum into Bitcoin's price.