Potential Solayer Airdrop: Guide to Restaking on Solana

Solayer is a restaking protocol on Solana with future plans to launch a native token. You can start exploring Solayer and potentially qualify for an airdrop by restaking, delegating, and interacting with DeFi protocols.

Key Takeaways

Solayer is a restaking protocol on the Solana network that enables users to earn additional yield by locking up their staked SOL.

The project successfully raised $12 million in a recent funding round led by Polychain Capital with participation from Nomad Capital, Hack VC, and Race Capital.

Co-founder, Rachel Chu, announced that the newly acquired funds will be used to continue developing the restaking protocol which includes a native token launch in the future.

Users can now look forward to earning additional rewards and maximizing earnings on Solana. Solayer is introducing its restaking framework to the Solana ecosystem after taking cues from EigenLayer, a pioneering restaking protocol on Ethereum which has quickly gained traction. Restaking mechanisms allow users to lock up their staked assets again on Proof-of-Stake blockchains to secure a second layer of applications, often referred to as actively validated services (AVSs). These can include applications such as data availability layers, new virtual machines, oracle networks, and bridges. As a result, decentralized finance (DeFi) as a whole can become more efficient because it adds more utility to staked assets.

Built natively on Solana, Solayer is leveraging Proof-of-Stake principles and extending Solana’s base layer security towards other decentralized systems and applications. Users are able to participate in a decentralized validator network and contribute to the security and liveliness of the Solana ecosystem. Like EigenLayer, the Solana restaking platform was quick to receive support upon its launch to the mainnet and at the time of writing, it is currently the 13th largest protocol on Solana with over $196 million in TVL, according to DefiLlama.

However, Solayer is also able to set itself apart from other restaking platforms such as EigenLayer and Jito. These platforms initially focus on exogenous AVSs such as cross-chain bridges, oracles, and other non-mainnet systems, while Solayer is starting with native Solana on-chain decentralized applications. Native re-staking of SOL has been prioritized since its launch but Solayer is also aiming to introduce a unified liquidity layer across all delegates with sSOL, a liquid token that has a range of use cases including collateral and spot trading.

Solayer implements its restaking infrastructure through three main components which are the restaking pool manager, delegation manager, and stake pool. The restaking pool manager oversees the flow of assets into the protocol while the delegation manager handles stake distribution across AVSs and validators. Meanwhile, the stake pool manages validator selection as well as MEV-boosted returns.

In August 2024, Solayer Labs closed their first funding round which successfully raised $12 million and brought the restaking platform’s valuation to $80 million. The funding round was led by Polychain Capital and involved other investors including Big Brain Holdings, ABCDE, Nomad Capital, Hack VC, and Race Capital. It was structured as a simple agreement for future equity with token warrants.

Alongside this seed round, Binance Labs, the venture capital and incubation arm of Binance, announced its investment in Solayer with the investment amount remaining undisclosed. With newly secured funds in place, Solayer is planning on expanding its team, integrating new protocols, and preparing for phase two. Solayer co-founder, Rachel Chu, has also previously shared with The Block that there are plans to launch a native token in the future with its design already in the works. Given its growing popularity, the opportunities for earning more yield, and plans to continue developing, now is a great time to get familiar with Solayer!

However, do take note that the Solayer team have not made any official announcements regarding a token airdrop at the time of writing. Therefore, following the steps below and interacting with Solayer does not guarantee a future token airdrop allocation.

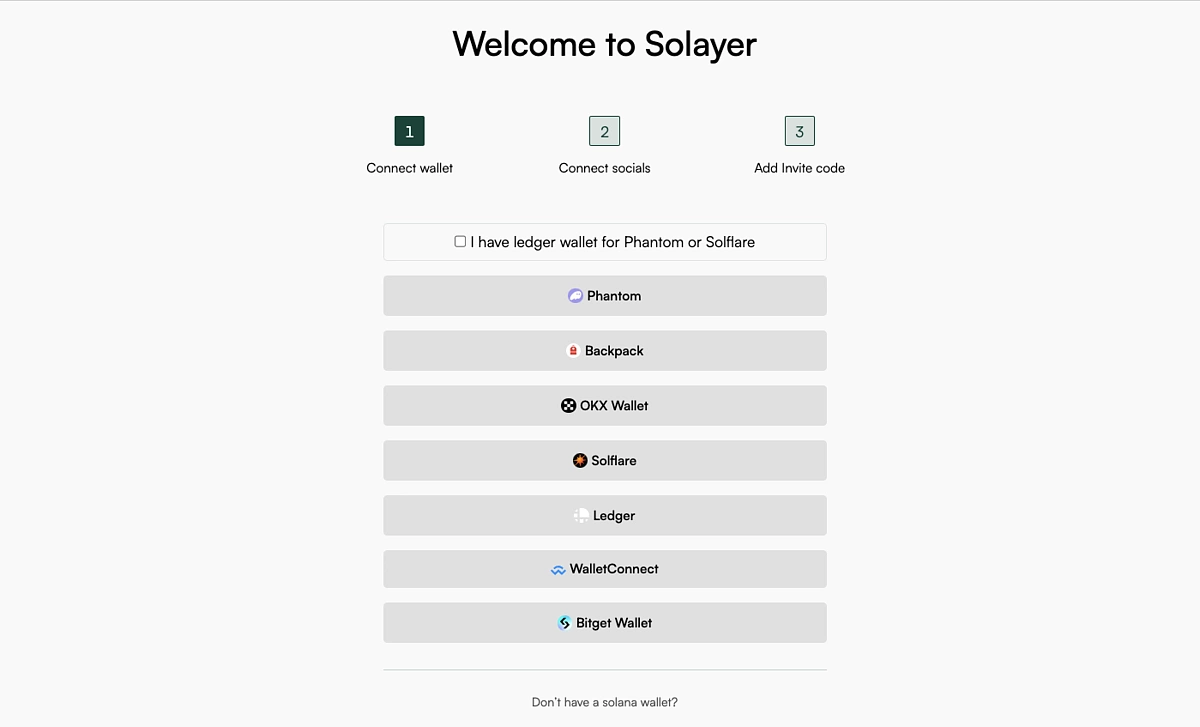

Step 1: Connect Wallet

First, head over to https://app.solayer.org/dashboard/invite and choose which Solana wallet you want to connect. In this guide, we are using a Phantom wallet.

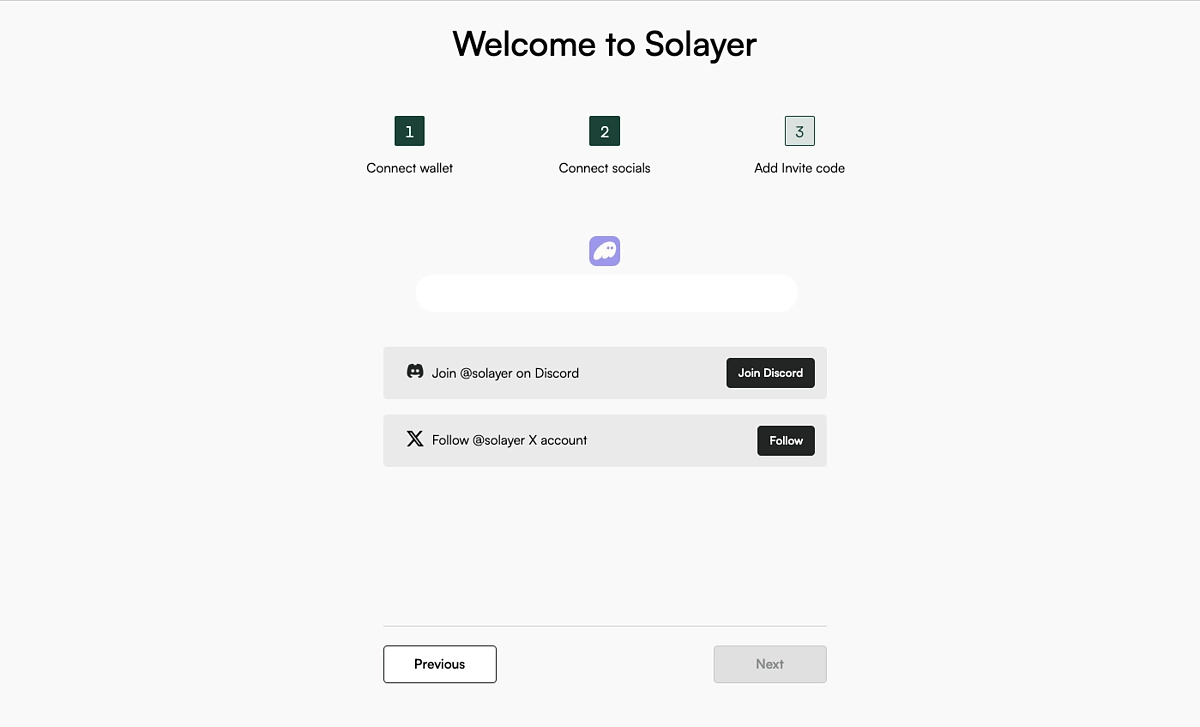

After that, join the official Solayer Discord channel and follow Solayer’s X account.

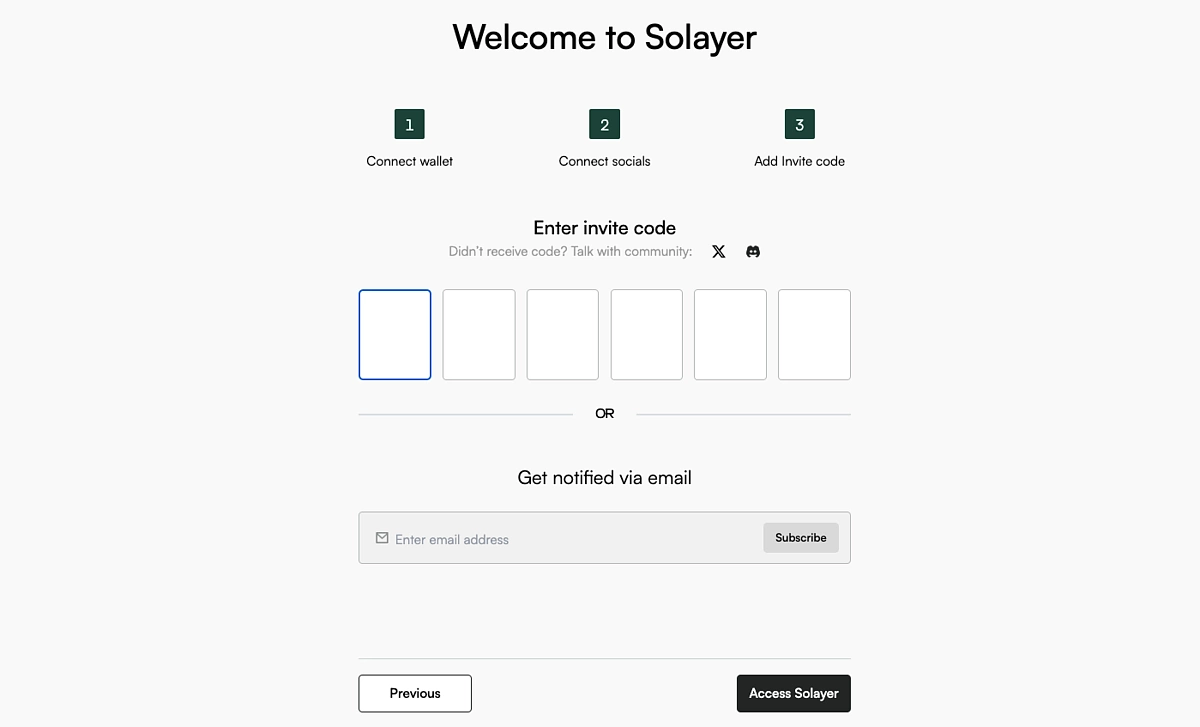

You can then enter an invite code if you have any but this is not necessary. If you do not have a code, you can still proceed to Access Solayer.

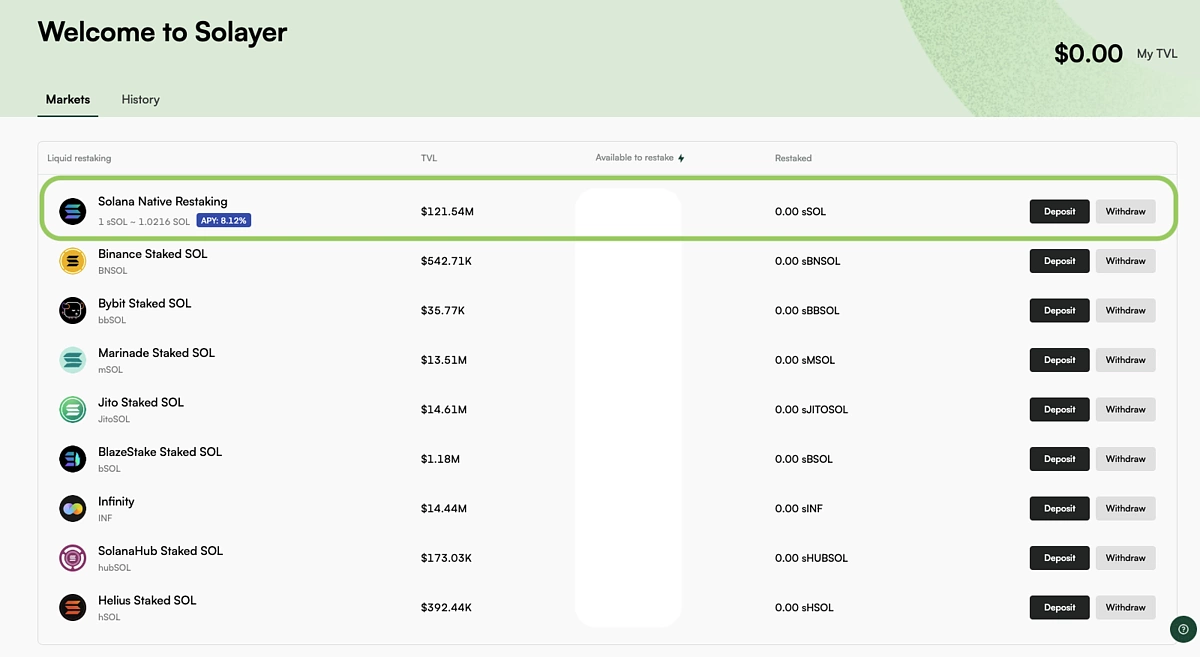

Step 2: Start Restaking

You will immediately be directed to the home page where you can start restaking. We recommend restaking SOL tokens because you will receive sSOL which is needed for the next two steps. Restaking SOL also allows you to earn additional yield with an annual percentage yield (APY) of 8.12% at the time of writing.

However, do take the time to also explore the other liquid restaking options and see if there are any other tokens you wish to restake.

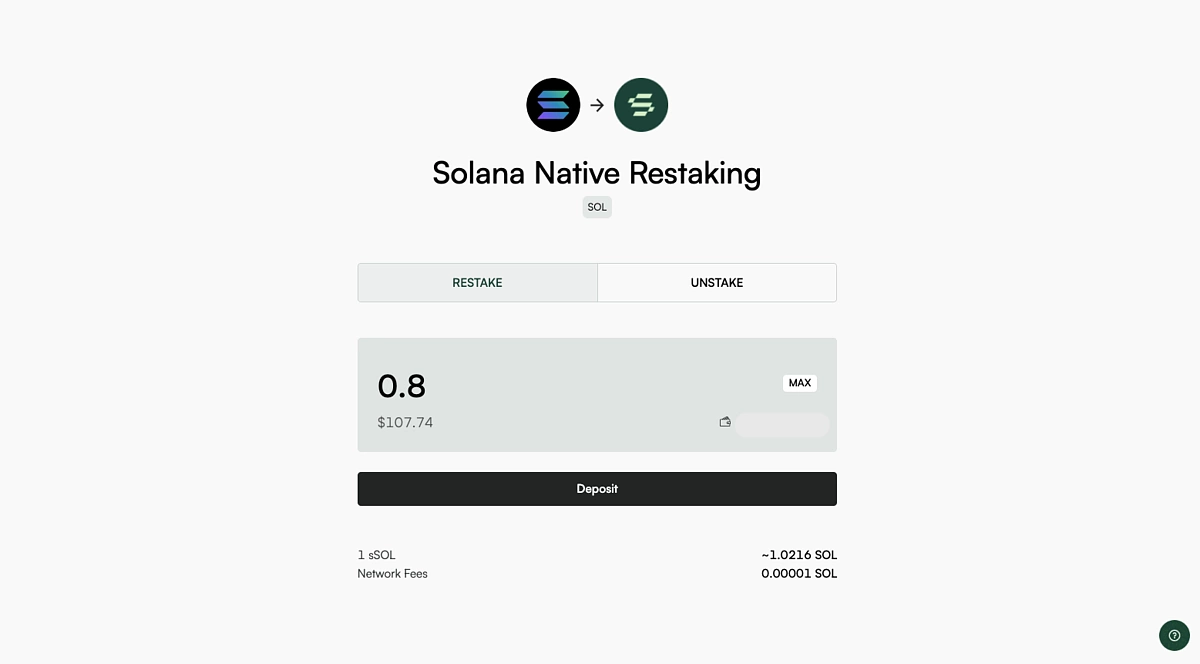

Go to Deposit your SOL.

Here, input the amount you want to restake and then Deposit and confirm the transaction in your wallet.

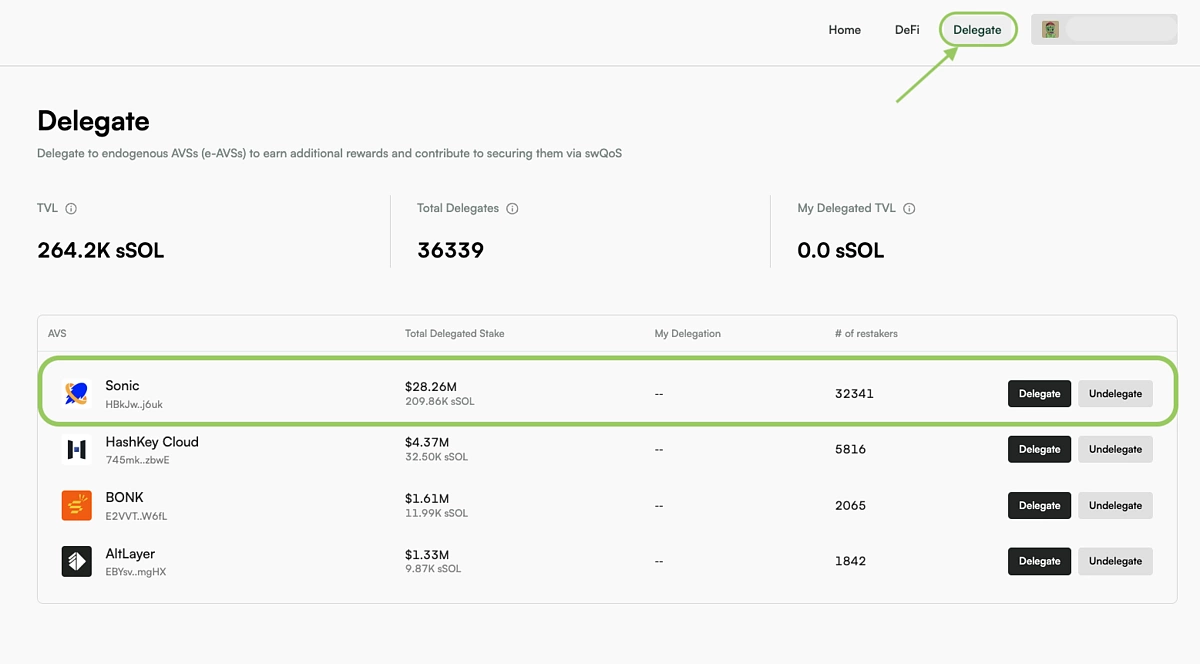

Step 3: Delegate

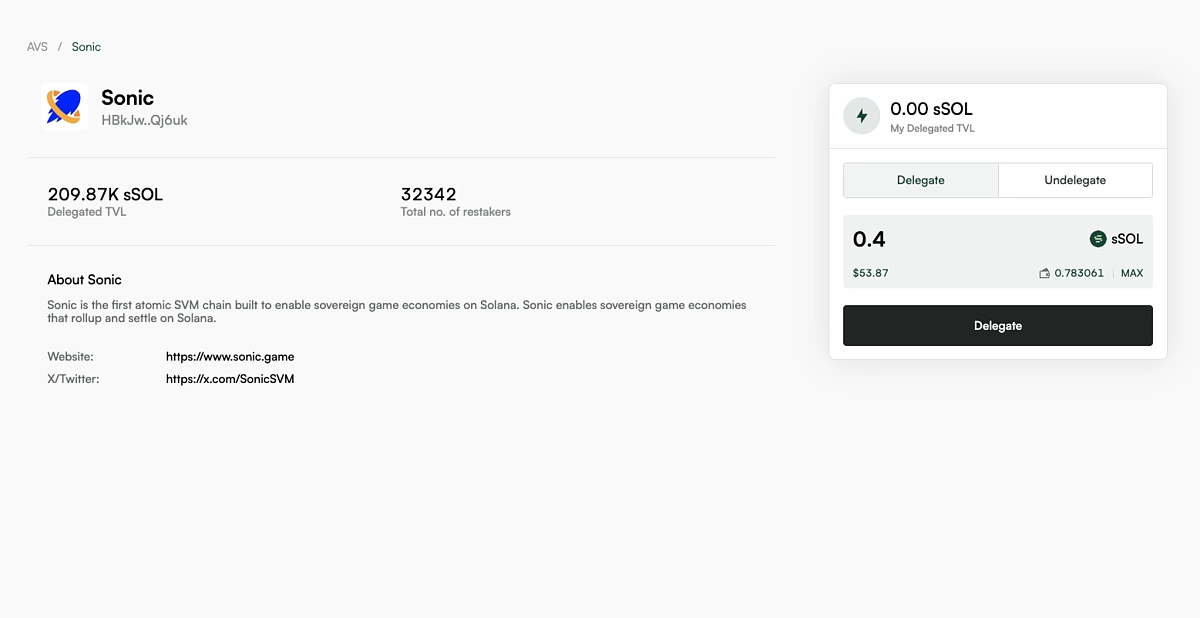

In the top bar, go to Delegate to see a list of endogenous AVSs that you can delegate sSOL to. We will proceed to delegate to Sonic, the first atomic Solana Virtual Machine Layer 2 solution for gaming.

You can then input the amount of sSOL and Delegate it by confirming the transaction in your wallet.

Step 4: Interact with DeFi Protocols (Optional)

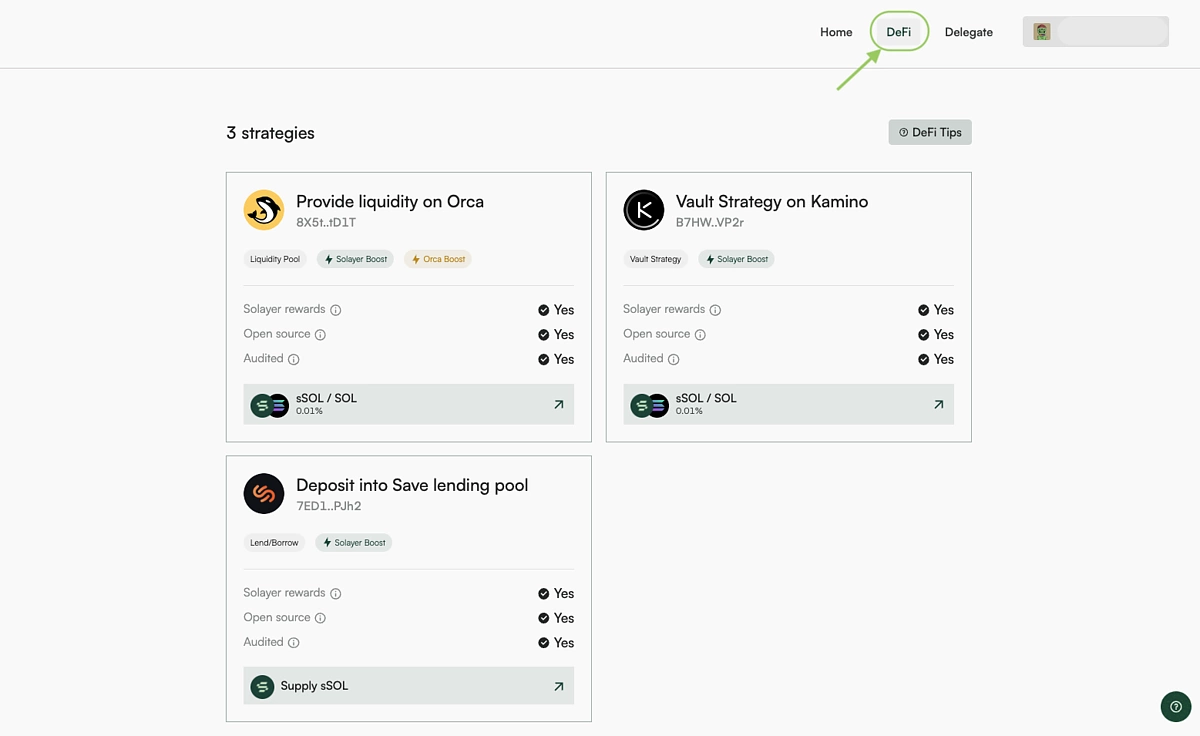

This step is optional because it requires you to connect your wallet and interact with a third-party project. In the top bar again, go to DeFi to see the three available strategies.

We will Deposit into Save lending pool in this optional step example.

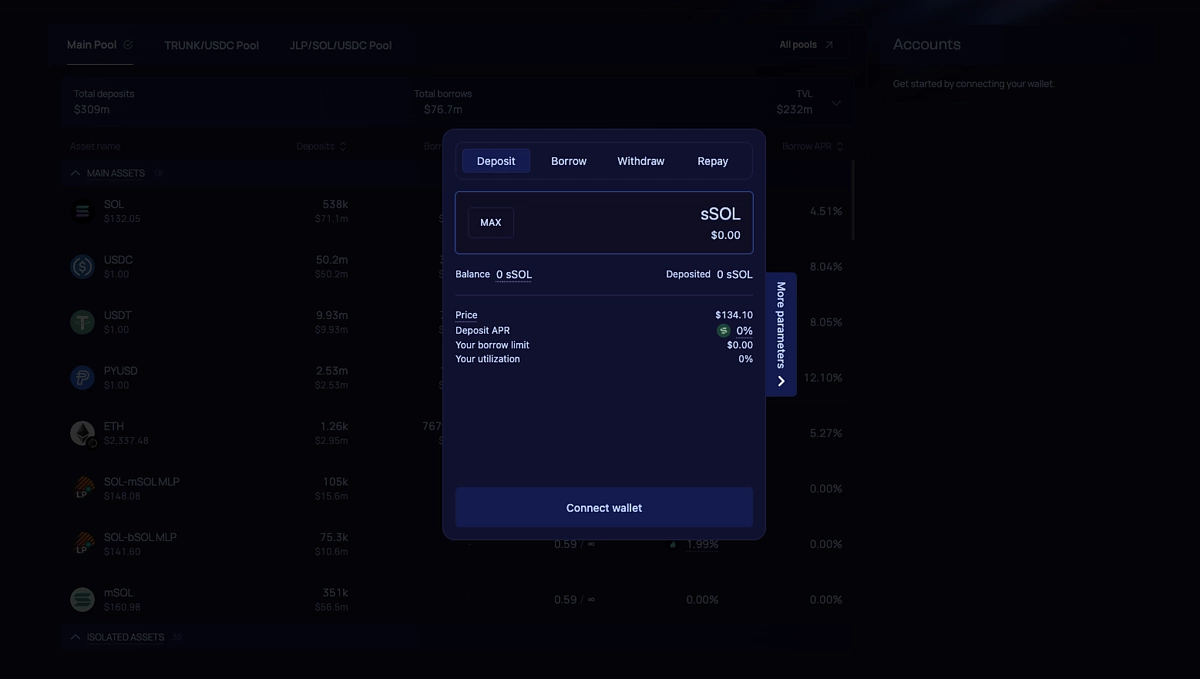

After clicking on Supply sSOL, you will be redirected to the Save Finance page where you can proceed to Connect Wallet.

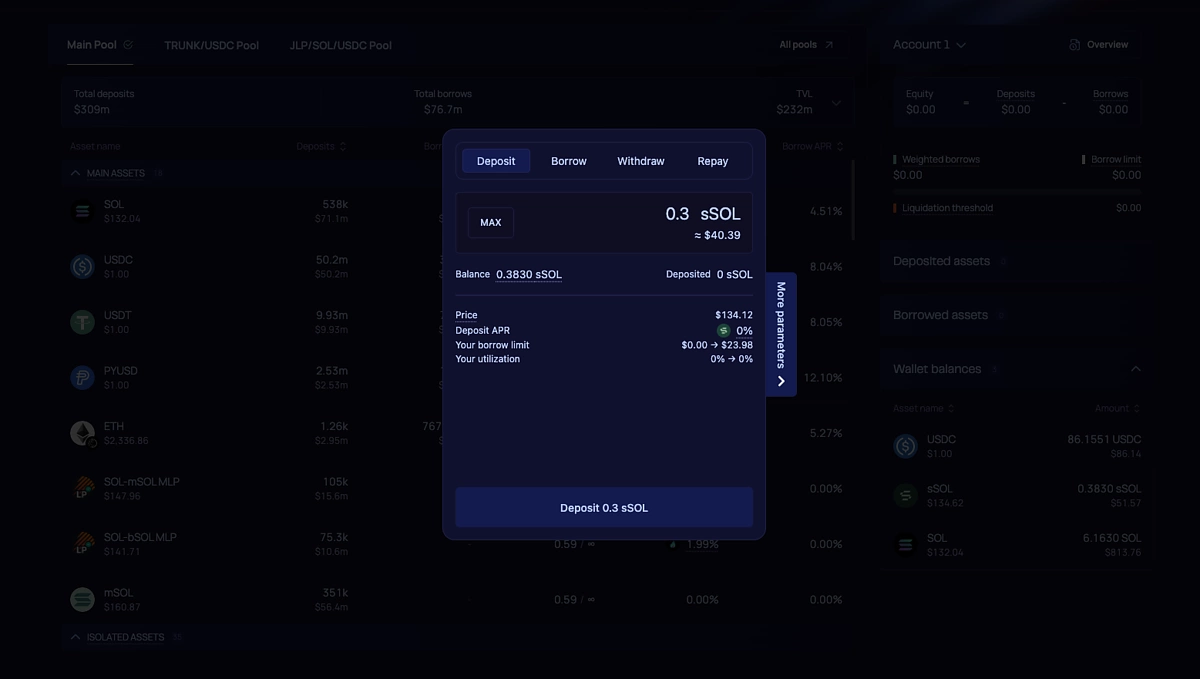

Then input the sSOL amount to Deposit and confirm the transaction in your wallet.

Conclusion

Solayer is introducing its restaking framework to the Solana ecosystem to encourage users to put their staked SOL to use. By restaking their assets, users are able to earn more yield while contributing to the security and liveliness of Solana. The project has recently received funding from notable investors including Binance Labs and aims to continue developing the restaking platform which includes the launch of a token in the future. Users can now explore and interact with Solayer to be part of Solana’s first restaking movement.

Always do your own research before depositing your assets into any protocol, and note that airdrop farming is highly speculative. This article is only for educational and informational purposes and should not be taken as financial advice.