Key Insights

Caldera has become a leading rollup platform within the Ethereum ecosystem, powering over 52 rollups with a combined $412 million in total value locked. Caldera supports a range of rollups, including Manta Pacific, ApeChain, and B3.

Caldera raised $24 million to simplify rollup deployment and operations, with support from firms including Founders Fund, Sequoia, and crypto-native funds like Dragonfly and Ethereal Ventures.

Caldera’s Rollup Engine turns rollups into programmable infrastructure and gives developers full control over upgrades and integrations. It supports major stacks like OP Stack, Arbitrum Nitro, and ZK Stack.

The Metalayer makes every Caldera-powered rollup interoperable from launch by providing shared messaging, liquidity, and crosschain intent execution. It eliminates the need for custom bridge integrations and creates a unified layer for applications.

Together, the Rollup Engine and the Metalayer form a modular operating system for Ethereum scaling, enabling developers to launch specialized rollups without sacrificing interoperability.

Introduction

In 2020, Ethereum began its transition toward a rollup-centric roadmap, which shifted the burden of transaction execution to a growing ecosystem of Layer-2 (L2) rollups. That vision has largely materialized, with rollups now handling the majority of EVM execution. Caldera has helped with this transition by building a platform that makes it easy to launch and maintain application-specific rollups, while enabling interoperability from day one.

Caldera was founded in 2022 by Parker Jou and Mathew Katz to tackle Ethereum’s persistent scalability challenges. Through the years, Caldera raised $24 million across four funding rounds. The company has attracted support from Founders Fund and Sequoia Capital, complemented by crypto-native funds like Dragonfly, Ethereal Ventures (established by Ethereum co-founder Joseph Lubin), and the web3 accelerator, Alliance DAO.

Caldera introduced Spark in February 2023, a testnet version of their no-code rollup deployment platform. In September 2023, Manta Pacific became one of the first Caldera-supported mainnets to launch. In October 2024, ApeChain launched a gaming-focused L3 built for the ApeCoin and Yuga Labs communities.

In 2025, Caldera introduced two major developments: an evolved version of the Rollup Engine and a new interoperability layer called the Metalayer. The updated Rollup Engine redefined Caldera’s core offering by turning rollups into programmable services rather than static infrastructure. Developers gained full control over their Caldera-powered rollups. Node software could be upgraded, offchain components integrated, and rollups managed with flexible tooling for customization and control.

The Metalayer launched alongside the new Rollup Engine. The Metalayer is an interoperability layer across the Caldera ecosystem. Rollups deployed using the Rollup Engine now automatically connect to the Metalayer. The connection brings access to crosschain messaging, shared liquidity, and partner integrations such as Espresso's finality layer or alternate data availability solutions. Together, the Rollup Engine and Metalayer support horizontal scaling through application-specific rollups that work together rather than operate in silos.

As of June 16, 2025, Caldera’s ecosystem comprises 31 publicly announced Caldera-powered rollups, with an additional 21 live on testnet. Cumulatively, Caldera’s rollups have processed more than 753 million transactions, secure over $377 million in total value locked, and serve more than 27 million unique addresses. Caldera’s growth has been driven by high-throughput use cases like gaming, real-world assets, and DeFi. These sectors benefit from custom execution environments and chain-level performance tuning. With the Rollup Engine and Metalayer now tightly integrated, Caldera is becoming a unified operating system for modular rollups.

Caldera Technology

Rollup Engine

Rollups are secondary networks that operate on top of a primary Layer-1 (L1) network, most commonly Ethereum. Rollups are designed to offload transaction execution and reduce congestion by processing transactions offchain, where a sequencer orders and executes them before submitting transaction batches back to the parent chain. Since computation and state transitions take place outside of the L1, transactions are processed faster and at lower transaction fees. After transaction execution, rollups periodically submit transaction batches to the base layer, sometimes accompanied by cryptographic proofs. This process maintains the security guarantees of Ethereum while lowering costs and improving scalability.

Two dominant rollup models exist:

Optimistic Rollups, such as those created using Arbitrum Nitro and OP Stack, assume transactions are valid by default. This model increases scalability as additional fraud proofs are only required if a sequencer is suspected of acting maliciously and is challenged. Optimistic rollups offer high throughput and are secured by economic incentives and challenge periods.

Zero-Knowledge (ZK) Rollups, including ZKsync’s ZK Stack, generate cryptographic validity proofs for every transaction batch. This provides stronger finality guarantees than optimistic rollups. However, ZK rollups require more complex infrastructure, and proof generation can be computationally expensive, which limits scalability relative to optimistic rollups.

By leveraging these models, rollups have become the backbone of Ethereum’s scaling journey, with TVL on L2s surpassing $35 billion and transaction volumes exceeding those of Ethereum mainnet itself.

Caldera’s Rollup Engine is best understood as the “AWS for rollups:” a programmable infrastructure layer that abstracts away the complexity of rollup deployment and operation. The platform offers developers:

Multi-Stack Support: Deploy rollups on leading frameworks, including OP Stack, Arbitrum Nitro, ZK Stack, and soon, Solana’s SVM, tailoring to each application’s needs.

Dynamic Infrastructure Management: Upgrade node software, scale computational resources, and integrate new features on demand, all via a unified API or dashboard.

Plug-and-Play Integrations: Enable custom data availability options (Celestia, Avail, Eigen, Arbitrum AnyTrust), decentralized sequencing (Espresso), and Guardian Nodes for block verification.

Interoperability by Default: Every rollup launched with the Rollup Engine is connected to the Metalayer, Caldera's interoperability solution, facilitating seamless crosschain liquidity, messaging, and composability.

Security and Reliability: Rollup contracts are governed by multisigs, infrastructure is dual-authorized and hosted with high-availability, and rollup deployments include real-time status monitoring.

Developers benefit from one-click deployments, streamlined contract porting, and a system designed to scale both horizontally (spin up more rollups as needed) and vertically (add features, increase performance). The Engine also enables technology partners to offer their solutions across Caldera’s ecosystem, further expanding the available feature set.

The Metalayer

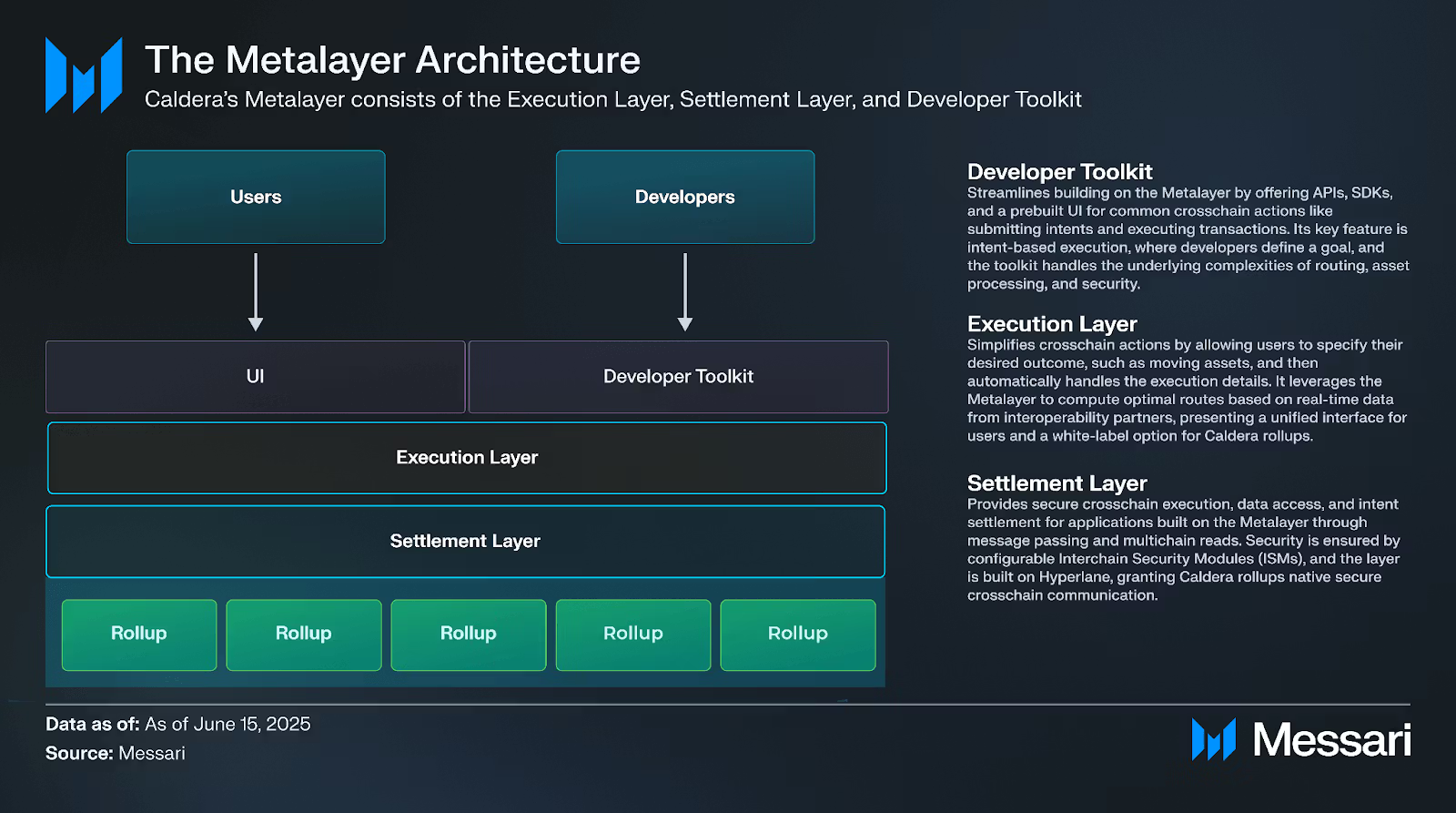

The Metalayer’s architecture consists of three interconnected layers that work in concert:

Execution (Intents) Layer: An intent-based execution engine and routing system for crosschain actions.

Settlement Layer: A crosschain messaging and finality framework (built on Hyperlane) that ensures secure delivery and atomic settlement of intents.

Developer Toolkit: SDKs, APIs, and UI components that abstract away complexity and let developers integrate the Metalayer’s functionalities easily.

Every rollup launched via Caldera comes with Metalayer support. The Metalayer’s contracts and services are automatically deployed on each Caldera-powered rollup (L2 or L3) from day one. This means any new rollup instantly joins the Metalayer network and can interoperate with all other connected rollups. Notably, the Metalayer is framework-agnostic and works across any supported tech stack. It’s also being rolled out on major L1/L2s (Ethereum, Arbitrum One, Base, OP Mainnet, ZKsync Era) to bridge Caldera appchains to the broader EVM ecosystem.

Intents Execution Layer

The Metalayer centers on the Intents Engine, a high-level execution layer that turns crosschain user actions into declarative “intents.” Instead of manually orchestrating a crosschain token bridge, a user (or developer) simply specifies what they want to achieve (the intent) and lets the Metalayer handle the rest. For example, a user’s intent might be “move 100 USDC from Network A to Network B.” The Metalayer will automatically find the best way to execute that transfer. This intent-based model abstracts away the multi-step complexity of crosschain operations.

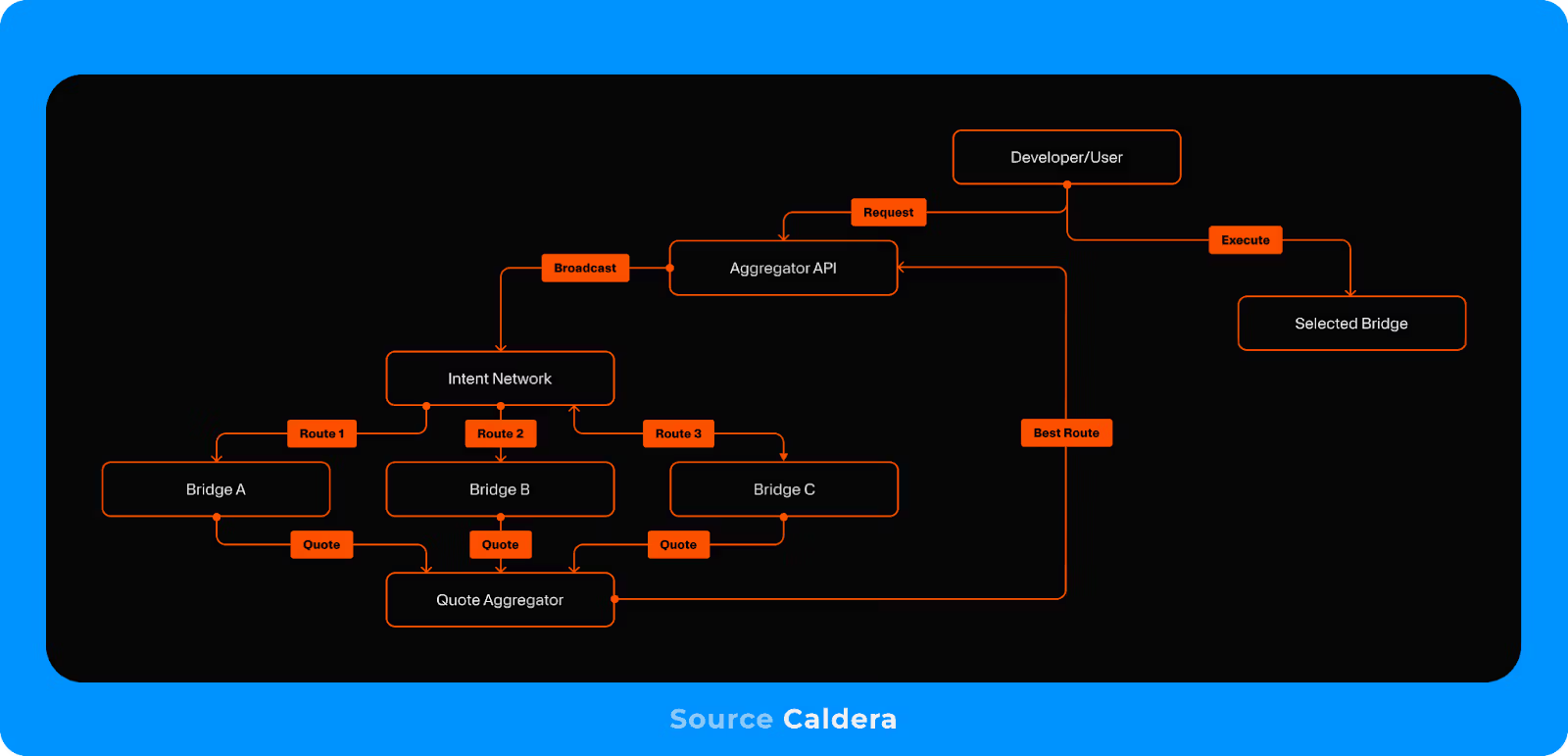

The execution layer includes a Routing API and Intents Aggregation System. When an intent is submitted (via API or SDK), the Metalayer broadcasts the request to a network of integrated bridges and liquidity providers. A built-in quote aggregator collects responses (possible routes) and compares them on metrics like cost, speed, and security. In the Metalayer Beta, cost minimization is the top priority for route selection. The system automatically selects the optimal route (e.g. which protocol or combination of protocols to use) and handles the transfers behind the scenes. This could involve using a solver network for speed or a direct canonical bridge for large transfers, the decision is made programmatically based on real-time quotes from partners like Across, Eco, and Relay.

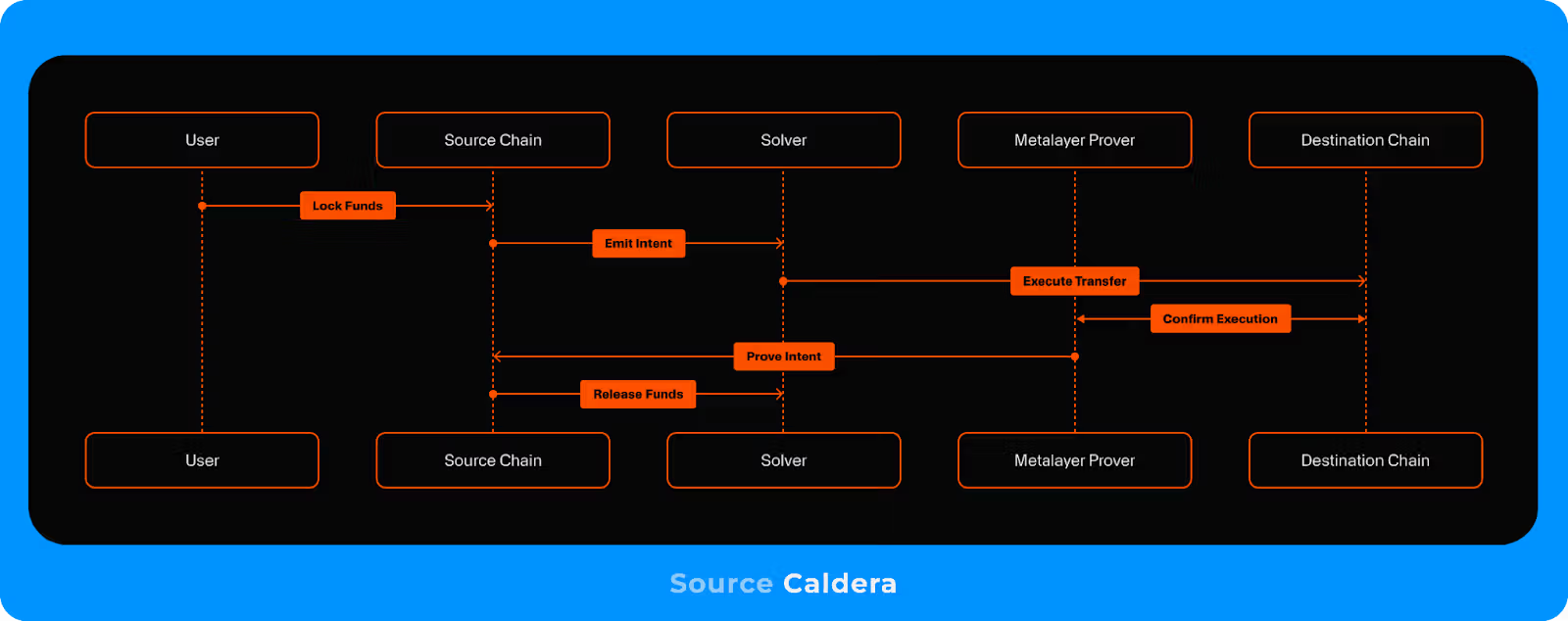

Under the hood, “solvers” (bridge agents or liquidity providers) fulfill user intents by fronting liquidity on the destination chain. For instance, a solver will send the user 100 USDC on Network B immediately, while the user’s funds on Network A go into an escrow. The Metalayer then handles settlement to reimburse the solver (see Settlement Layer below). This design lets users get funds within seconds rather than waiting for L1 finality. It also means developers launching a rollup do not need to bootstrap their own bridge or liquidity network. By standardizing the execution flow, Caldera eliminates the typical integration cost that rollups would typically spend to support multiple bridges and token versions.

The Metalayer offers both a Web UI and a programmatic API/SDK for interacting with the intents engine. The whitelabel UI lets end-users select routes, see fees and times, and track their transfer status in real time. Developers can customize this UI for their own applications or wallets, providing a branded experience while the Metalayer works under the hood. Using the API/SDK, developers can submit intents, retrieve bridging quotes, execute the chosen route, and receive callbacks or webhooks on completion. The SDK handles the heavy lifting of integration, so teams can focus on application logic rather than writing custom bridge adapters. Notably, because applications integrate at the high-level intent layer, any improvements to the Metalayer’s routing (e.g. new bridges or faster paths) automatically benefit the application without code changes.

Settlement Layer

Once an intent’s execution route is determined, the Settlement Layer ensures that all crosschain operations complete securely. This layer is built with the open-source Hyperlane interoperability framework, which Caldera deployed in a sovereign configuration for Metalayer. The settlement layer has two primary functions: message passing (sending arbitrary data/commands between chains) and intent settlement (finalizing bridged transfers or crosschain transactions).

The Metalayer extends Hyperlane’s message-passing protocol to allow any Caldera-powered rollup to invoke contracts on another chain and include crosschain state queries in those messages. Each rollup has a Metalayer Router smart contract (an enhanced Hyperlane router) that applications can call. For example, a contract on Network A can call the router dispatch function to send a payload to a target contract on Network B. Under the hood, Hyperlane relayers transport the message across rollups. On Network B, the Metalayer router delivers the message to the specified contract, triggering a handler function. This general messaging supports use cases like crosschain governance (e.g. token holders on multiple rollups voting on an Ethereum proposal via messages) and crosschain contract coordination.

A powerful extension is Crosschain Reads. When dispatching a message, a contract can request the Metalayer to fetch read-only data from one or many other chains and include those results in the delivery. For instance, a contract on Network A could ask the Metalayer to retrieve the price of an asset from five different DEXs on five other rollups within the same call. The Metalayer relayers will perform the RPC calls on the specified rollups, aggregate the data, and supply the results to the destination contract as part of the message payload. It effectively gives developers a form of shared state or synchronized data across rollups, expanding what multichain applications can do.

The settlement layer is also the security backbone of the Metalayer. It is responsible for validating crosschain operations and providing finality guarantees. Every message or intent goes through an Interchain Security Module (ISM) on the destination network, which verifies that the message is authentic and authorized. The Metalayer’s default ISM uses a multi-signature model (inherited from Hyperlane’s model) where a quorum of independent validators observe the source network’s events and sign attestations for each message. The Hyperlane Mailbox contract on the destination chain checks these signatures to confirm the message's validity before forwarding messages to the destination contract. This provides a configurable trust model: developers can choose the validator set or even swap in a different ISM (e.g. optimistic validation, economic security modules, etc.) depending on security needs. All Caldera-powered rollups use this unified messaging security, which solves the typical problem where new networks lack any reliable message-passing system.

The Metalayer supports two modes of finality for crosschain actions:

Soft Finality (Optimistic): Validators quickly confirm that the source chain’s sequencer has included the intent transaction in a block, allowing the message to be relayed and acted upon within seconds. This mode assumes the validators honestly report the sequencer’s data and that the sequencer won’t revert the transaction (an acceptable risk for most use cases). It provides near-instant settlement for users with ~10 second latency.

Finalized Mode (Secure): This mode executes intents only after the rollup’s state is finalized on its parent chain. For ZK-rollups, this means waiting for a proof to be posted. For optimistic rollups, finality is determined when a finalized block tag appears on the RPC, which typically happens about 15 minutes after the L1 batch is posted. Finalized mode provides protection against reorgs or invalid state transitions, making it suitable for high-value transfers. It uses the same validator quorum as other modes and includes the L1 finality checkpoint as an additional trust-minimized layer. Validator signatures are published to a public S3 bucket, which provides a transparent record of finalization checkpoints.

Developers or users can choose either mode per operation, balancing speed versus security. Importantly, the Metalayer is future-proof, meaning as rollup technologies introduce native interoperability or shared sequencing with stronger guarantees (e.g. Optimism’s planned fault-proof mesh, or ZKsync’s native L2-to-L2 proofs), the Metalayer will automatically upgrade to use those when available. In fact, an intent in “finalized” mode today is effectively getting the benefit of future trust-minimized interop as those mechanisms come online. This design ensures Caldera-powered rollups can benefit from cutting-edge interoperability (like validity-proof bridges) without needing any redeployments or code changes.

The settlement layer guarantees that multichain intents resolve atomically across all involved rollups. Using the earlier example: if a solver paid a user on Network B, the Metalayer will only release the escrowed funds on Network A to the solver once the crosschain message (from B back to A) is validated, ensuring the user was indeed paid. If any step fails or the message is not confirmed, the escrow on A can revert to the user. This protects against a scenario where, say, a user sends funds out but doesn’t receive anything in return. The bridge integration logic in the Metalayer works with third-party bridges’ contracts to optimize these settlement paths, especially for high-value transactions. The Metalayer essentially standardizes the “trade confirmation” across chains.

Caldera Ecosystem

As of June 16, 2025, the Caldera ecosystem includes over 31 live mainnets and 21 testnets, serving more than 27 million unique addresses and processing over 753 million cumulative transactions. Total value locked across Caldera-powered rollups exceeds $377 million. Activity across the ecosystem has been driven by several leading rollups:

Manta Pacific: Launched in September 2023, Manta Pacific is a general-purpose L2 built with the OP Stack and Celestia DA. It serves as a hub for ZK-enabled applications and is transitioning toward a modular zkEVM architecture. The rollup supported over 200,000 addresses and more than 20 DeFi applications. For more information, see Messari’s recent reports on Manta Pacific.

Kinto: Kinto is a “modular exchange” L2 that combines CeFi usability with DeFi composability. Built with Arbitrum Nitro, Kinto features KYC-compliant DeFi, fiat onramps, gasless UX, and integrations with protocols like Aave, Uniswap, and Lido. As of June 16, 2025, it supported over 157,600 addresses and held more than $14.4 million in total value secured.

ApeChain: Launched by Yuga Labs and ApeCoin DAO, ApeChain is an Arbitrum Orbit L3 focused on gaming and NFTs. It uses the APE token as its native gas token and launched with features like native yield on idle assets, account abstraction via Yuga ID, and LayerZero bridging.

B3: Rolling up to Base and built with the OP Stack, B3 is a gaming-focused L3 with several blockchain games like basement.fun. By March 2025, B3 had processed over 261.9 million transactions and reached 6.6 million unique addresses, with over 1.5 million addresses earning rewards through its open gaming ecosystem.

zkXPLA: zkXPLA is a high-performance ZK rollup launched by XPLA using zkSync’s ZK Stack and deployed through Caldera. It supports gasless gaming and application-specific customization. The rollup expands XPLA’s gaming and content ecosystem onto Ethereum while maintaining connections to its Cosmos-based L1.

inEVM: Deployed by Injective, inEVM brings Ethereum compatibility to the Cosmos ecosystem using a sovereign rollup design with Celestia DA. It connects Ethereum, Cosmos, and Solana via Hyperlane and LayerZero, giving Solidity developers access to the Inter-Blockchain Communication (IBC) liquidity and Injective’s order books.

RARI Chain: Built for creator royalties, RARI Chain enforces NFT royalty payments at the protocol level and supports low-cost NFT minting. It is an L2 launched in partnership with Rarible and thirdweb, built with Arbitrum and AnyTrust DA.

ZERO Network: Developed by Zerion and built on ZKsync’s ZK Stack, ZERO Network is a ZK rollup offering a gasless user experience through account abstraction and paymaster sponsorship.

Towns: Towns is an onchain group chat protocol that blends end-to-end encryption with token-gated governance. The L2 is built with the OP Stack and Celestia, and enables user-owned communities to manage membership, moderation, and content rules entirely onchain.

Ozean: Developed by Clearpool, Ozean is an OP Stack L2 focused on real-world assets like tokenized credit and yield-bearing stablecoins like ozUSD. The chain hosts DeFi protocols like Ozean Port and Oxygen, and supports KYC-gated access for institutional investors.

Closing Summary

Caldera is an infrastructure provider that helps developers launch customizable, application-specific rollups that are interoperable from day one. Its Rollup Engine abstracts away the complexity of rollup deployment and operations, while the Metalayer enables crosschain messaging, shared liquidity, and intents-based routing. These tools support Ethereum by enabling horizontal scaling through modular, dedicated execution environments. Caldera supports major rollup frameworks including OP Stack, Arbitrum Nitro, and ZK Stack, allowing for plug-and-play integration of sequencing, data availability, and crosschain messaging solutions.

Caldera’s architecture has gained traction, and is used to power rollups that support high-throughput use cases such as gaming, real-world assets, and DeFi. In June 2025, the Caldera ecosystem includes over 50 rollups across testnet and mainnet, 753 million cumulative transactions, and more than 27 million unique addresses. Leading chains built on Caldera include Manta Pacific, B3, ApeChain, and Kinto, each tailored to their domain while benefiting from shared infrastructure. The Metalayer connects these rollups into a unified network that allows developers to launch chains without having to bootstrap interoperability tooling.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Caldera. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.