Bitcoin price extends its correction, slipping below $90,000 on Thursday after rejection from a key resistance level.

US-listed spot ETFs recorded an outflow of $486.08 million on Wednesday, the highest single-day withdrawals since November 20.

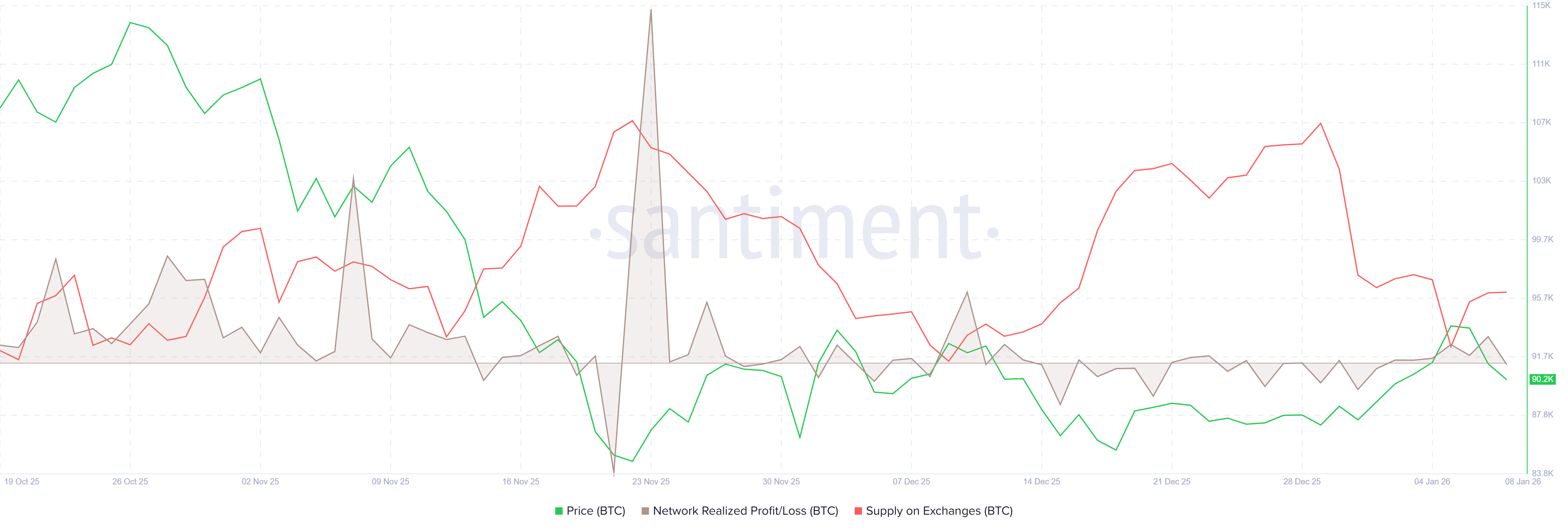

Santiment data show that BTC holders are realizing profits, slightly increasing selling pressure.

Bitcoin (BTC) slips below $90,000 on Thursday after a failed rejection at a key resistance level earlier this week. Bearish sentiment is strengthening as institutional demand fades, with spot Bitcoin Exchange-Traded Funds (ETFs) recording outflows. In addition, on-chain data indicate rising profit-taking among traders, suggesting a short-term correction in the largest cryptocurrency by market capitalization.

Fading institutional demand

Institutional demand for BTC has weakened so far this week. SoSoValue data show that Bitcoin spot ETFs recorded an outflow of $486.08 million on Wednesday, the second consecutive withdrawal this week and the largest single-day outflow since November 20. If these outflows continue and intensify, BTC could extend the ongoing correction.

Some holders realized profits, increasing the downward pressure

Santiments’ Network Realized Profit/Loss (NPL) metric indicates that some BTC holders are realizing gains.

As shown in the graph below, the NPL experienced spikes on Monday and Wednesday, the highest profit booking activity since December 12. These spikes indicate that holders are, on average, selling their bags at a significant profit, thereby increasing selling pressure.

Bitcoin Price Forecast: BTC could extend pullback if it closes below $90,000

Bitcoin price closed above the upper consolidation range of $90,000 on Saturday. BTC rose nearly 4%, retesting the 61.8% Fibonacci retracement level (drawn from the April low of $74,508 to October's all-time high of $126,199) at $94,253 on Monday. However, the rally paused as BTC restested this level on Tuesday, and the price declined 2.54% the next day. As of Thursday, BTC is slipping below $90,000.

If BTC continues its pullback and closes below $90,000 on a daily basis, it could extend the decline toward the next support level at $85,569.

The Relative Strength Index (RSI) on the daily chart is poised to slip below the neutral 50 level, signaling a fading bullish momentum. If the RSI remains below the neutral level, BTC could correct sharply.

However, if BTC finds support around the $90,000, it could extend the recovery toward the key resistance level at $94,253.