BNB has been one of the best-performing layer-1 altcoins in the market over the past year. Thanks to its ecosystem, which is closely tied to the large user base of the world’s leading crypto exchange, BNB may continue to sustain this performance.

Several on-chain indicators and trading data suggest that even during market corrections, BNB is unlikely to experience a sharp decline.

Three Strong Demand Drivers Supporting BNB’s Price in 2026

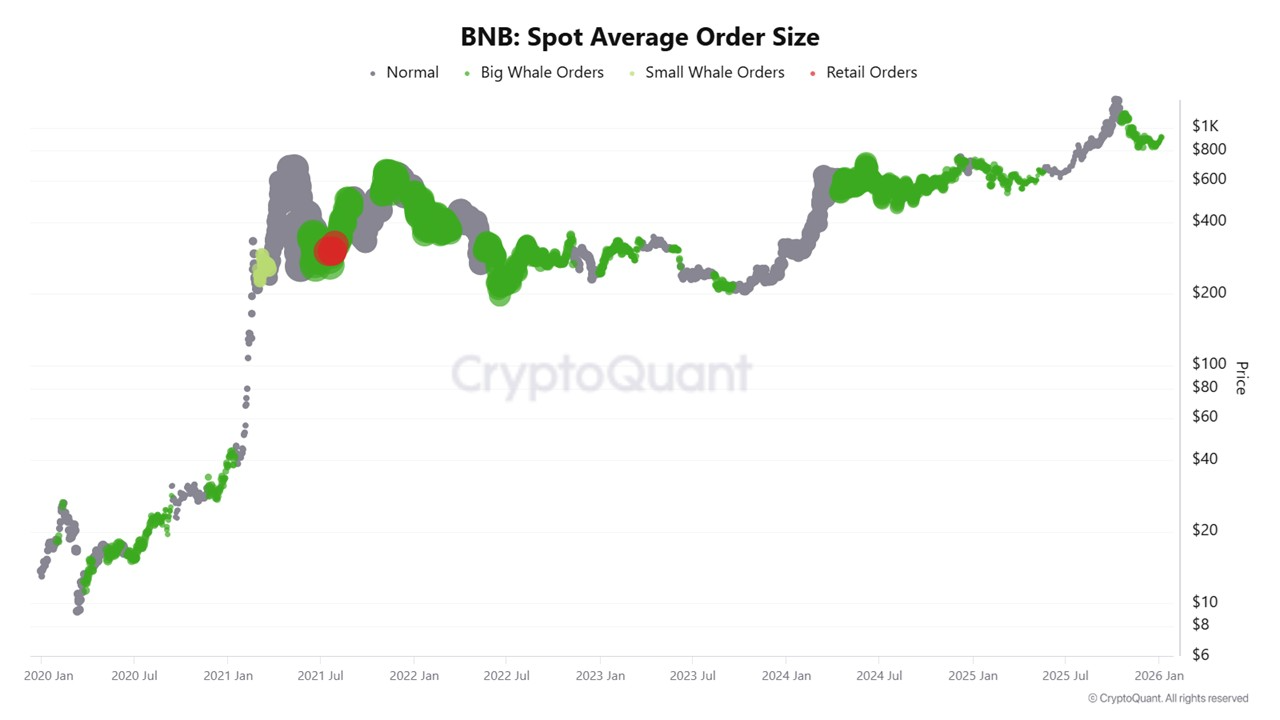

First, one of the most important indicators demonstrating BNB’s price stability is the average spot order size.

According to data from CryptoQuant, the average order size has remained relatively large.

BNB Spot Average Order Size. Source: CryptoQuant

The chart shows that for most of the time, price zones are marked by orders ranging from normal to whale size. This reflects consistent participation from large investors.

“Average spot order sizes remain relatively large, indicating steady participation by utility-driven or larger holders rather than speculative retail flows,” analyst XWIN Research Japan at CryptoQuant said.

With this level of liquidity, BNB benefits from strong downside support provided by whale orders during price declines. As a result, BNB has a higher ability to hold its value under fearful market conditions.

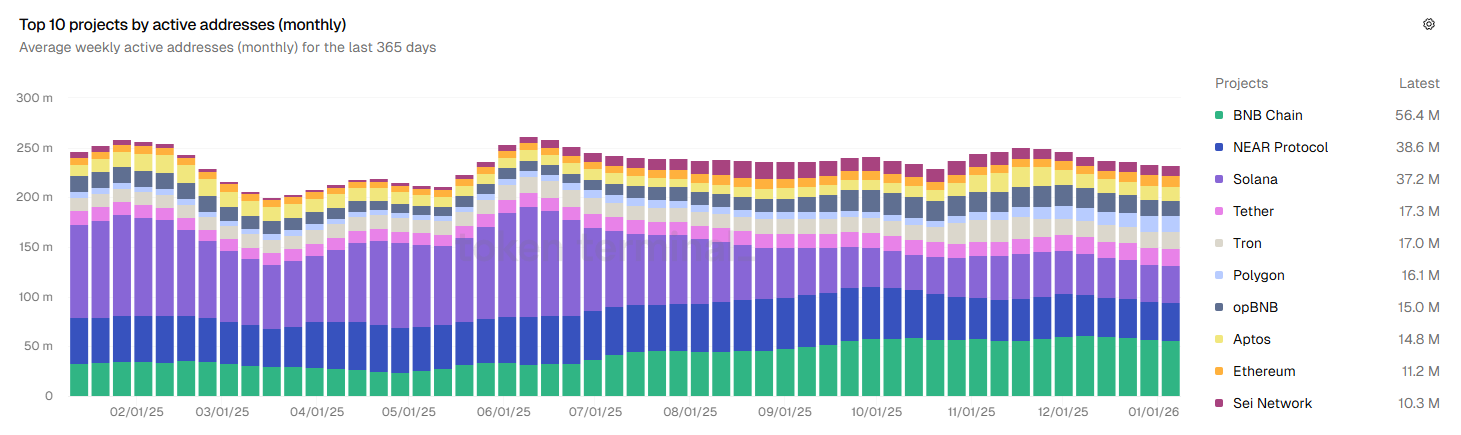

Retail investors appear less visible in spot market data. However, they remain actively engaged within the BNB Chain ecosystem. This activity has helped BNB Chain maintain its lead in weekly active users.

TOP 10 Chains by Active Address. Source: Token Terminal

According to Token Terminal, in early 2026, BNB Chain recorded an average of 56.4 million weekly active addresses. This figure significantly exceeds those of competitors such as NEAR Protocol (38.6 million), Solana (37.2 million), and Ethereum (11.2 million).

The chart shows a steady upward trend since last year, highlighted in green. This trend indicates that retail traders are increasingly seeking opportunities within the ecosystem. This dynamic contributes to BNB’s price stability and limits the risk of a deep decline.

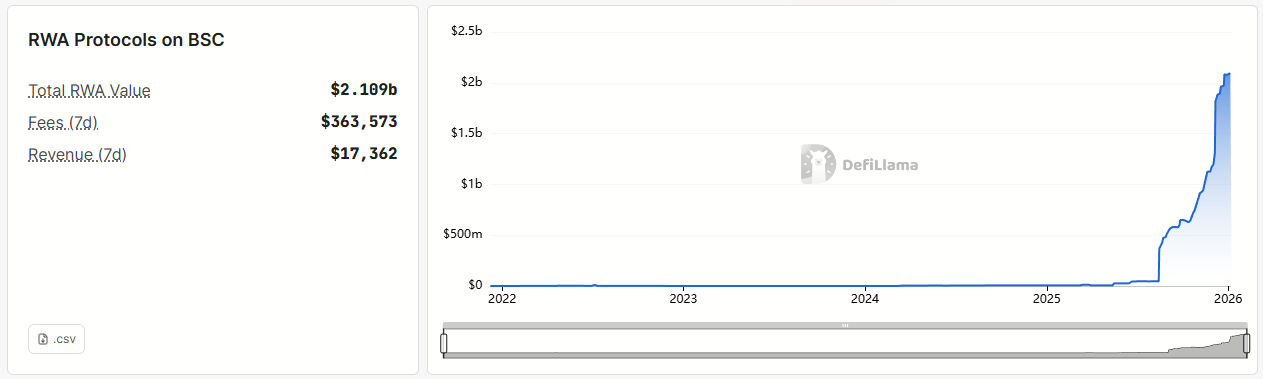

Additionally, the growth of Real World Asset (RWA) protocols on Binance Smart Chain (BSC) has reached new highs in terms of total value locked (TVL). This trend reflects rising institutional demand.

Total RWA Value on BSC. Source: DeFiLlama

According to DeFiLlama, RWA TVL on BSC has surpassed $2.1 billion. The chart shows a strong expansion from mid-last year to the present. Tokenized US Treasury assets from Hashnote, BlackRock, and VanEck account for the majority of this value.

With demand supported by whale trading activity, retail participation within BNB Chain, and institutional RWA adoption, many analysts expect BNB to reclaim the $1,000 level in the near future.