As the US weighs the creation of a national strategic Bitcoin reserve, Greenland is emerging as an unlikely but potentially pivotal player.

US Secretary of State Marco Rubio is set to meet Danish leaders next week, reaffirming Washington’s commitment to President Donald Trump’s objective of controlling the Arctic Island.

Greenland Offers a More Practical Bitcoin Strategy Than Overseas Reserves

Polymarket bettors are already wagering on different possibilities ahead of Rubio’s meeting with Danish leaders. Advocates say the move could position the US as a dominant force in Bitcoin mining.

The general sentiment is that Greenland’s extreme climate and abundant energy potential present key advantages. Bitcoin mining requires massive computing power and cooling systems to prevent overheating.

Greenland’s year-round sub-zero temperatures could serve as a natural refrigeration system, dramatically reducing energy costs. Additionally, oil drilling and hydroelectric power could provide cheap and reliable electricity for large-scale mining operations.

The idea has also attracted attention from unconventional commentators. Social media personality Andrew Tate argued that Greenland’s climate makes it the optimal location for a cost-effective US Bitcoin reserve.

“Greenland will be conquered by the USA and used as permanent refrigeration for BTC mining operations. This will allow the US government to build a BTC strategic reserve cost-effectively,” Tate said.

The concept has precedent in Iceland, where Bitcoin mining has flourished due to the country’s abundant renewable energy sources.

Geothermal and hydroelectric power plants provide miners with surplus electricity, which serves as a flexible load that helps balance the national grid. Notably, however, the Nordic island nation’s presence in the Bitcoin mining sector was controversial, amid concerns over food security and energy sustainability.

The World Economic Forum notes that Iceland’s cold climate and renewable energy infrastructure make it a popular destination for crypto mining operations. Greenland could replicate this model, creating a new strategic frontier for U.S. cryptocurrency ambitions.

From Untapped Frontier to Strategic Reserve: Greenland’s Bitcoin Promise

Currently, Greenland hosts no Bitcoin mining activity, leaving it an untapped resource. For the US, securing the island could serve dual purposes:

Energy and climate advantages for mining, and

Strategic positioning in global cryptocurrency markets.

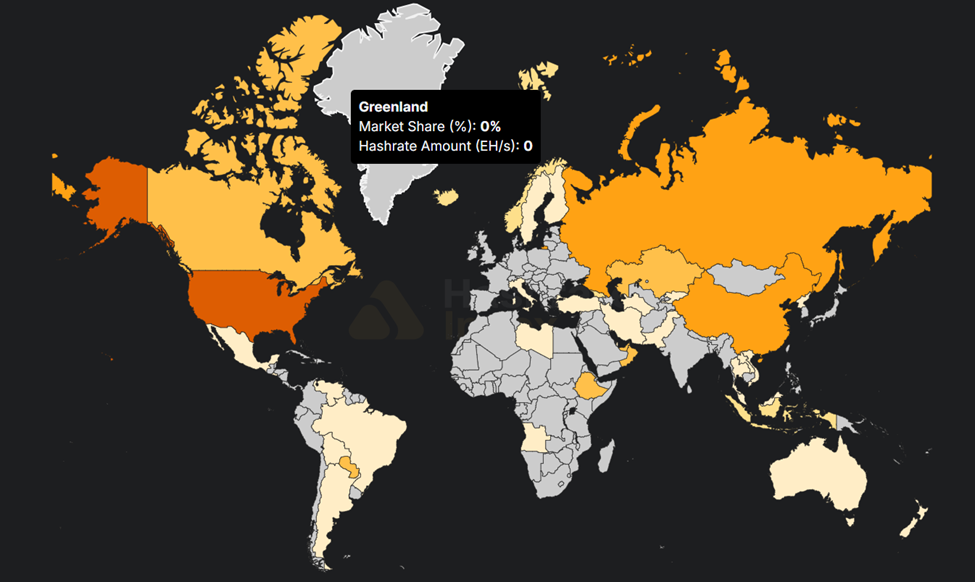

Global Hashrate Heatmap. Source: Hashrate Index

Experts suggest that by developing large-scale mining facilities, the US could produce Bitcoin at a fraction of the global cost, potentially accumulating a significant national reserve.

This strategy aligns with a broader trend in the US interest in fortifying its own Bitcoin reserves. Recently, BeInCrypto reported on Venezuela’s alleged $60 billion Bitcoin holdings, which remain unverified and largely inaccessible due to legal and jurisdictional constraints.

Analysts noted that even if the US could freeze or seize such reserves, logistical and legal hurdles make it a far more complicated prospect than building domestic, or Arctic-based, mining operations.

Nonetheless, the Greenland scenario could be transformative for crypto markets. By creating a highly efficient mining hub, the US could produce Bitcoin on an unprecedented scale, potentially impacting global supply dynamics and establishing a form of strategic leverage previously unavailable to any nation.

The potential reserve would also provide a buffer against market volatility, echoing similar discussions around gold and foreign currency reserves.

As Secretary Rubio prepares for his talks in Denmark, the world will be watching whether Greenland becomes a new center of American economic and technological ambition.

If the US moves forward, the Arctic island could soon shift from a remote outpost to the heart of the world’s most valuable digital asset.