XRP’s price action has transitioned into a falling phase after a multi-day rally at the start of the year, but technical analysis implies this may be part of a bullish structure.

After climbing from below $2 on January 1 to $2.41 on January 6, the market has begun digesting those gains. Now, the outlook is whether short-term Fib price levels can hold as momentum resets, with the next directional move expected to define XRP’s near-term trajectory.

XRP’s Rally Sets Context For Current Pullback

XRP’s current price action in the past 24 hours is tracing out a downward retracement. Notably, this retracement follows a strong upward move that began at the start of the week. To put this in context, XRP opened in January 2026 at around $1.85, but shot up to as high as $2 on January 6, equating to a 30% increase within that timeframe.

On January 4, XRP was trading roughly between $2.01 and $2.12 before demand accelerated. By January 5, intraday price action expanded into the $2.09 to $2.36 range, reflecting a clear pickup in momentum. The rally extended into January 6 and 7, when XRP briefly pushed above $2.41 before sellers began to step in.

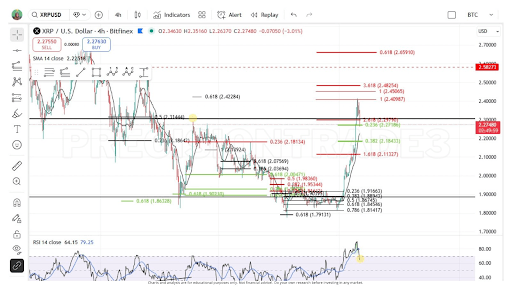

According to technical analysis shared on X by TARA, the pullback pushed the XRP price to the 0.236 Fibonacci retracement, which comes in around $2.27. This level has quickly turned into an important area of interest, as it represents the first meaningful support following the recent impulse higher. The chart accompanying the analysis shows price reacting cleanly around this zone, with XRP falling in one quick sweep on the 4-hour candlestick timeframe.

What To Expect Next For XRP

Momentum indicators on the chart suggest that the correction is still unfolding, but not in a way that signals structural weakness. The 14-SMA is rising toward price and might act as dynamic support, which often helps limit downside during healthy retracements.

According to the analyst, XRP needs to revisit the $2.30 to $2.33 area during this corrective wave. That region previously acted as resistance and may now determine whether the pullback remains shallow or extends further.

If XRP fails to reclaim that zone, the analysis points to a deeper but still technical retrace toward the 0.382 Fibonacci level around $2.18. Even in that scenario, the move would remain consistent with a strong trend cooling off, rather than a breakdown of bullish structure.

Despite the ongoing correction, the broader outlook outlined in the analysis is optimistic. XRP is likely to return to its previous highs once the retrace finds a confirmed low. Based on the current structure, upside targets are projected in the $2.49 to $2.66 range, but adjustments are expected depending on where the correction ultimately bottoms.