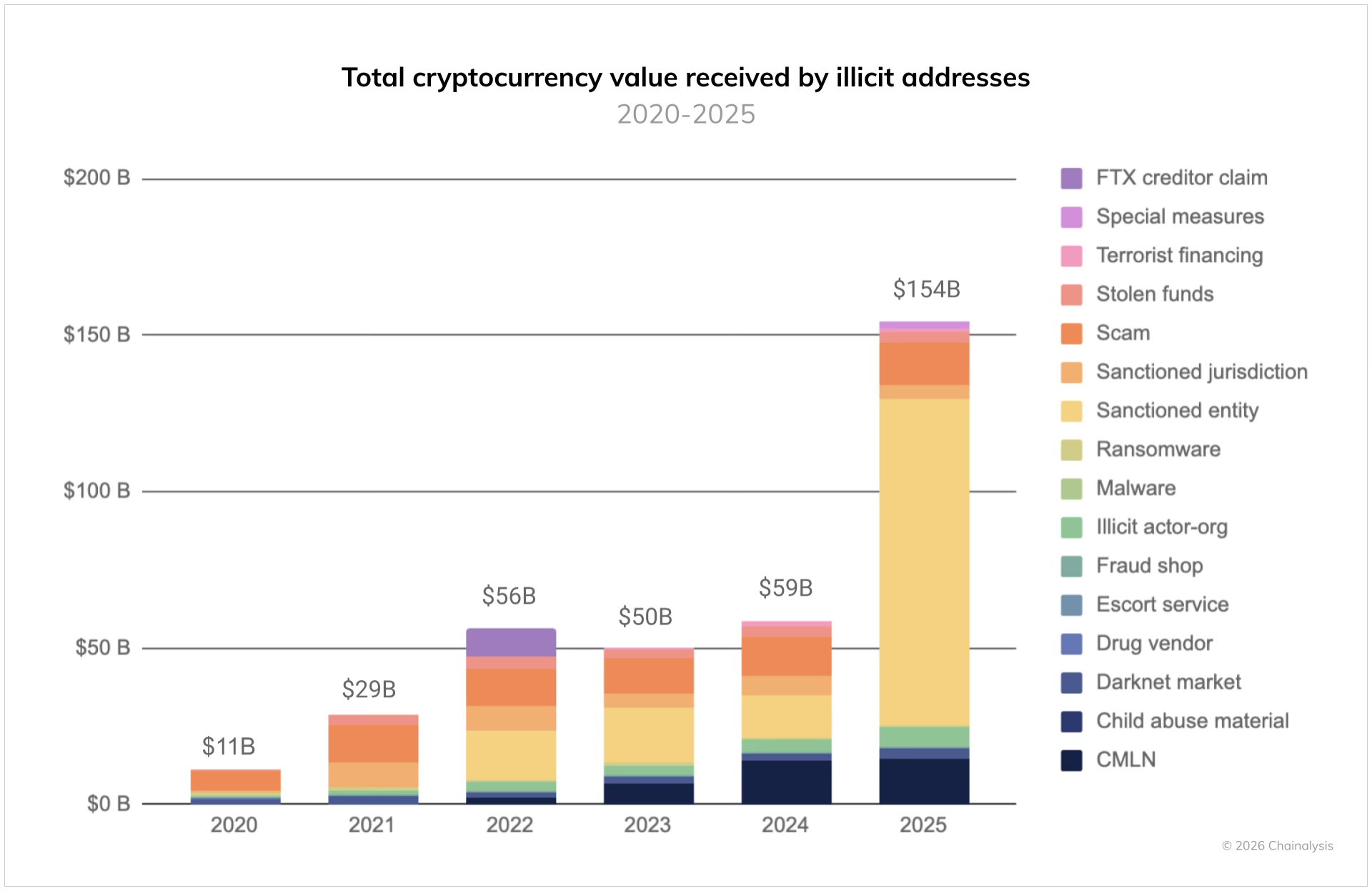

Cryptocurrency crime reached an all-time high in 2025, with illicit addresses receiving at least $154 billion—a 162% surge from the previous year, according to a new report from blockchain analytics firm Chainalysis.

The dramatic increase was primarily driven by a 694% spike in funds flowing to sanctioned entities, marking, according to Chainalysis, a new era of “large-scale nation-state activity” in the crypto crime landscape.

From Cybercriminals to Nation-States

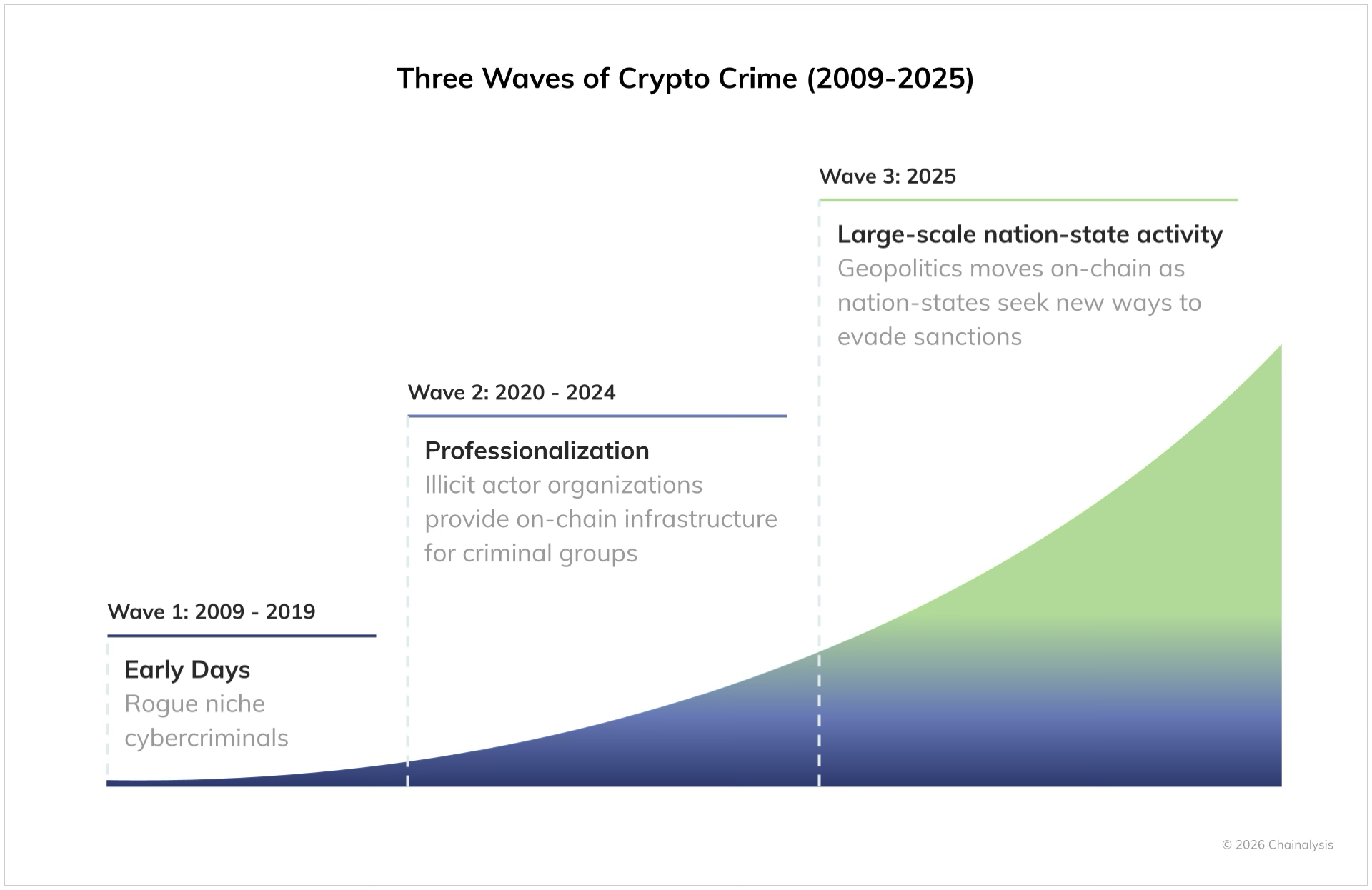

The report frames 2025 as the third wave of crypto crime evolution. The first wave (2009-2019) was characterized by rogue niche cybercriminals. The second wave (2020-2024) saw the professionalization of illicit organizations providing on-chain infrastructure for criminal groups. Now, the third wave has arrived: nation-states moving into the space at scale to evade international sanctions.

Source: Chainalysis

“As nation-states plug into the illicit crypto supply chains originally built for cybercriminals and organized crime groups, government agencies and compliance and security teams now face significantly higher stakes on both the consumer protection and national security fronts,” the report states.

Russia launched its ruble-backed A7A5 stablecoin in February 2025, with over $93.3 billion in transactions in less than a year. The move followed legislation introduced in 2024 specifically designed to facilitate sanctions evasion through cryptocurrency.

North Korean hackers had their most destructive year yet, stealing $2 billion in 2025 alone. The February Bybit exploit accounted for nearly $1.5 billion of that total, making it the largest digital heist in crypto history.

Iran’s proxy networks facilitated over $2 billion in money laundering, illicit oil sales, and weapons procurement through confirmed wallets identified in sanctions designations. Iran-aligned organizations, including Hezbollah, Hamas, and the Houthis, are now using cryptocurrency at unprecedented scales.

Stablecoins: The New Currency of Crime

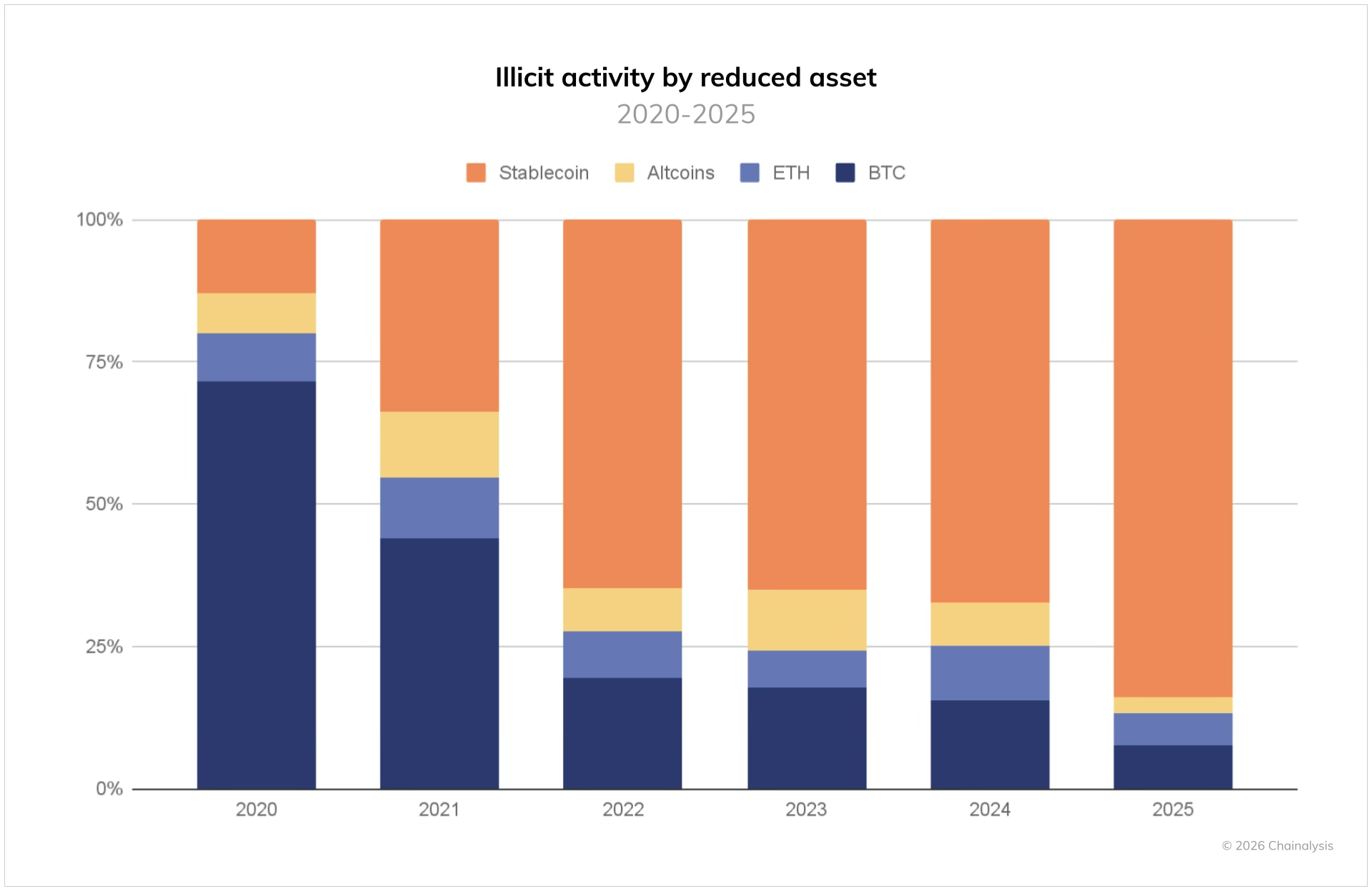

Perhaps the most striking shift revealed in the data is the dramatic change in which assets criminals prefer.

In 2020, Bitcoin accounted for roughly 70% of illicit transactions, while stablecoins accounted for just 15%. By 2025, those positions have completely reversed: stablecoins now represent 84% of all illicit transaction volume, while Bitcoin has shrunk to approximately 7%.

Source: Chainalysis

Chainalysis attributes this shift to stablecoins’ practical advantages: ease of cross-border transfers, lower volatility, and broader utility. The trend mirrors legitimate crypto activity, where stablecoins have grown to occupy an increasingly large share of overall transaction volume.

Chinese Money Laundering Networks Emerge

The report highlights the emergence of Chinese Money Laundering Networks (CMLNs) as a dominant force in the illicit ecosystem. Building on frameworks established by operations like Huione Guarantee, these networks now offer “laundering-as-a-service” and other specialized criminal infrastructure.

These full-service operations support everything from fraud and scams to laundering North Korean hack proceeds, sanctions evasion, and terrorist financing.

Chainalysis also warns of growing connections between on-chain activity and violent crime. Human trafficking operations have increasingly leveraged cryptocurrency, while “physical coercion attacks”—in which criminals use violence to force victims to transfer assets—have risen sharply, often timed to coincide with cryptocurrency price peaks.

Source: Chainalysis

Context and Outlook

Despite the record figures, Chainalysis notes that illicit activity still represents less than 1% of all attributed crypto transaction volume. The firm also cautions that the $154 billion figure is a “lower-bound estimate” based on illicit addresses identified to date.

Historical data shows crypto crime doesn’t always rise: volumes actually declined from $56 billion in 2022 to $50 billion in 2023 during the crypto winter. The 2025 explosion, however, represents a fundamental shift in the threat landscape.

“While the overall percentage of illicit activity remains small relative to legitimate crypto usage, the stakes have never been higher for maintaining the integrity and security of the cryptocurrency ecosystem,” Chainalysis concluded, calling for increased cooperation among law enforcement, regulators, and crypto businesses.