After a strong start to 2026, Ethereum (ETH) is facing downside pressure, with its price dropping nearly 3% over the past 24 hours.

Amid this, an analyst highlighted a key bearish signal that Ethereum must overcome before a confirmed breakout above the $3,300 level becomes likely.

Ethereum Encounters a Critical Test as Market Conditions Weaken

BeInCrypto Markets data showed that ETH closed 2025 down 10.9%. Nevertheless, green candles mostly dominated the chart at the beginning of the new year, with the altcoin rising 11.3% between January 1 and January 6.

However, since Wednesday, ETH has reversed its trajectory. Over the past day, the second-largest cryptocurrency has declined around 3%.

At the time of writing, it traded at $3,113. This move is part of a broader market decline, which saw the total cryptocurrency market capitalization fall by over 2.2%.

Ethereum (ETH) Price Performance. Source: BeInCrypto Markets

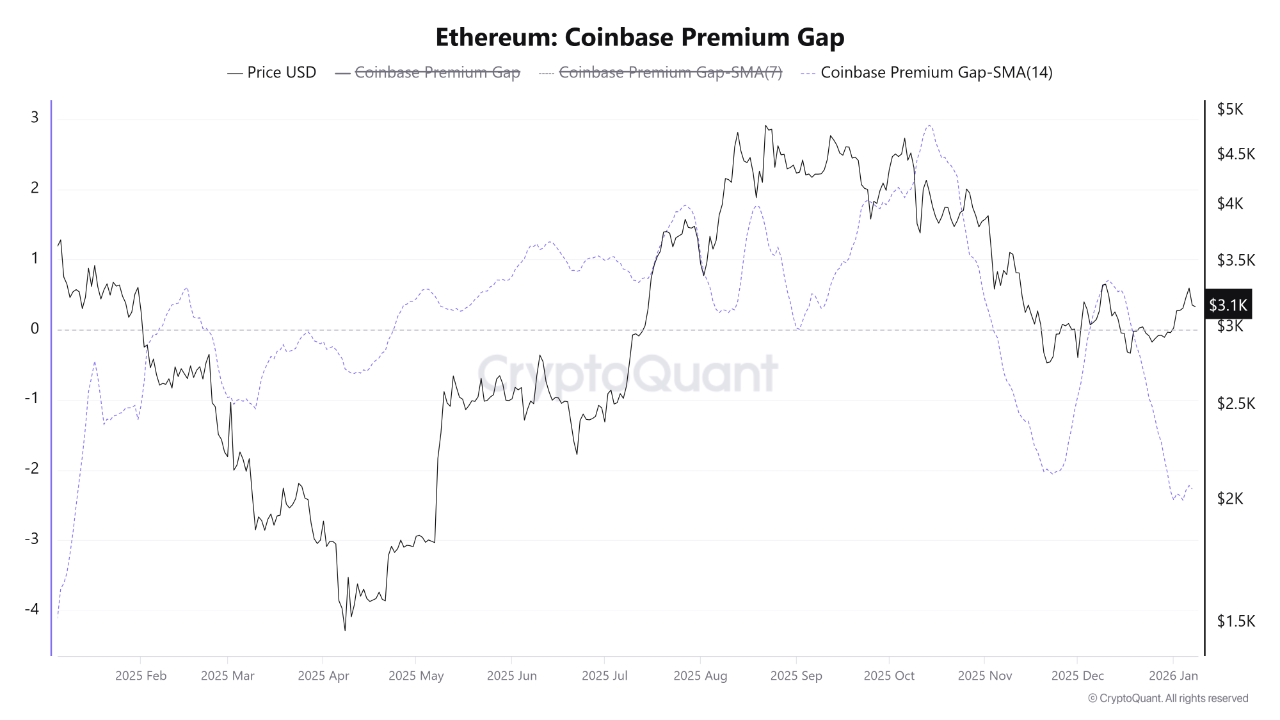

In a recent assessment, CryptoOnchain highlighted a notable bearish divergence between Ethereum’s price action and its underlying on-chain demand. The analyst noted a sharp deterioration in the Coinbase Premium Gap.

Its 14-day simple moving average has fallen to -2.285, the lowest level recorded since early February 2025. According to CryptoOnchain, this signals weakening demand from US institutional investors.

The Coinbase Premium Gap tracks the price difference between Coinbase, often used as a gauge of US institutional sentiment, and Binance, which reflects broader global retail activity.

“This sustained negative gap clearly indicates that selling pressure—or, more precisely, a lack of buying interest—is significantly stronger on Coinbase compared to Binance,” the post read.

Ethereum Coinbase Premium Gap. Source: CryptoQuant

The analyst added that historically, sustained Ethereum rallies have coincided with a positive premium on Coinbase. The current negative reading suggests that institutional buyers are largely staying on the sidelines at current price levels.

“This on-chain weakness is emerging while Ethereum continues to struggle below the heavy resistance zone at $3,300….Until the price gap between Coinbase and Binance returns to positive territory and genuine demand reappears in the US spot market, the probability of a confirmed breakout above the $3,300 resistance remains low,” CryptoOnchain stated.

Persistent outflows from Ethereum spot ETFs further highlight the slow demand. The ETFs recorded their largest monthly outflow in November, totaling $1.42 billion. This was followed by an additional $616.8 million in outflows in December.

On January 7, the ETFs posted their first outflow of 2026, with $98.45 million exiting the products according to SoSoValue data. This was mirrored by outflows from Bitcoin and XRP ETFs on the same day, reinforcing sector-wide weakness.

Bullish Signals Emerge Despite Weak Institutional Demand

While demand appears subdued, investor interest has not disappeared entirely. BeInCrypto reported that on January 6, Morgan Stanley filed an SEC Form S-1 for a spot Ethereum ETF, following earlier ETF applications tied to Bitcoin and Solana.

Furthermore, from a technical standpoint, several market watchers expect further upside in ETH. An analyst observed a hidden bullish divergence on the ETH chart, with a valid support. This condition can lead to further upward price movement if it holds. Another trader pointed to tightening Bollinger Bands, an indicator that a large move could be looming.

The contrast between bearish institutional metrics and technical bullish signals creates uncertainty. While the Coinbase Premium Gap and ETF outflows suggest institutional caution, technical setups indicate that Ethereum could rise. Which factor ultimately proves decisive will become clearer in the coming days.