The total net assets of US Solana ETFs surpassed $1 billion in early 2026. However, SOL has fallen more than 50% over the past year and now trades near levels last seen two years ago. This outcome has likely disappointed many holders.

Beyond SOL ETFs, the Solana network has recorded multiple milestones that highlight its appeal to institutional investors. Still, these developments have not been enough to satisfy retail investors.

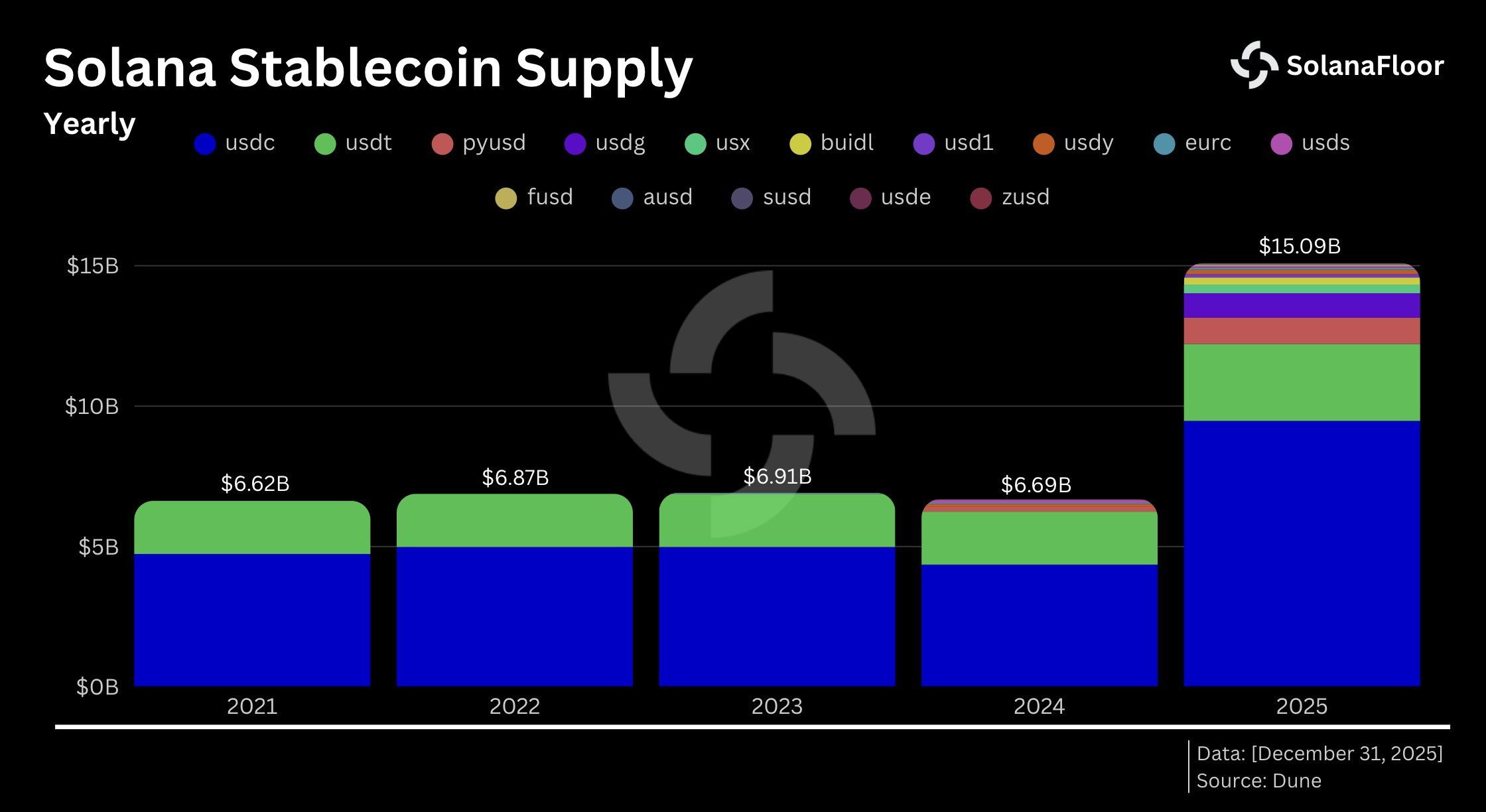

Stablecoin Demand Grows on Solana in Early 2026

The Wyoming Stable Token Commission recently launched the FRNT stablecoin on the Solana blockchain. This move marked the first time a US public authority issued a stablecoin with reserves managed by Franklin Templeton.

Earlier, Jupiter introduced the JupUSD stablecoin on Solana in partnership with Ethena Labs. About 90% of its reserves consist of USDtb backed by BlackRock’s tokenized BUIDL fund, while the remaining 10% is held in USDC.

Following these developments, The Kobeissi Letter reported on January 8 that Solana’s stablecoin supply surged by more than $900 million within 24 hours. The report suggested this spike could signal the return of crypto capital inflows.

These moves occurred as Solana’s total stablecoin supply exceeded $15 billion, setting a new all-time high.

“That represents new liquidity entering the network. Solana’s low fees and fast finality allow that liquidity to be deployed quickly. In practical terms, more stablecoins on SOL means more capital available for trading, settlement, and application activity,” analyst Milk Road commented.

Solana Stablecoin Supply. Source: SolanaFloor

Even so, the $15 billion figure remains small compared with Ethereum’s stablecoin supply of over $181 billion and Tron’s more than $81 billion, according to Token Terminal.

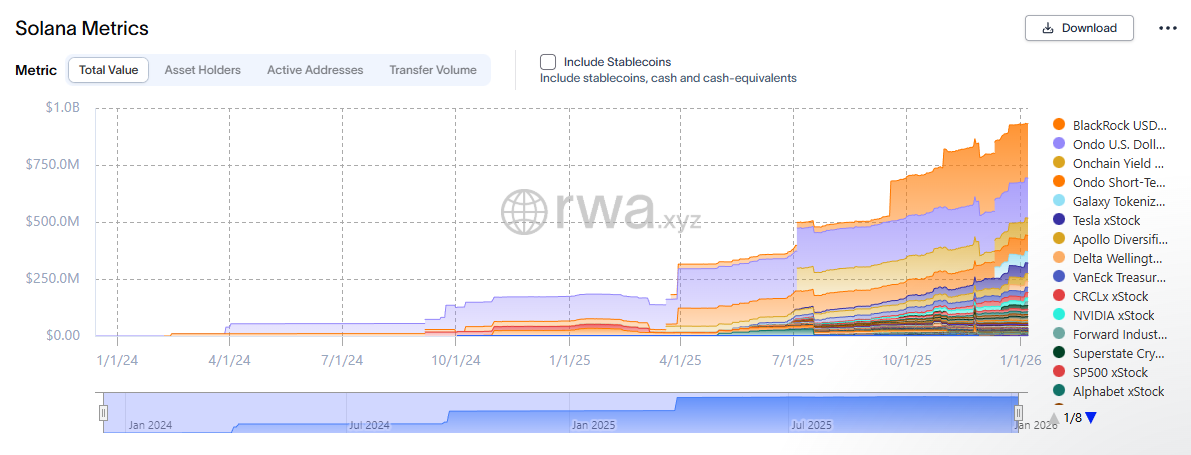

RWA on Solana Rises, But Still Lags Behind Competitors

Data from RWA.xyz indicates that the total value of real-world assets (excluding stablecoins) on Solana has reached a new high, surpassing $931 million.

Demand for tokenized assets from BlackRock and VanEck, as well as tokenized shares of Tesla and NVIDIA, has driven this trend.

Total RWA Value on Solana. Source: RWA

However, Solana is not the top choice for institutions. RWA data shows that Ethereum and BNB Chain remain the leading blockchains for asset tokenization. Their total RWA values stand at approximately $12.7 billion and $2 billion, respectively.

Solana benefits from rising institutional interest in RWAs and stablecoin deployments. Still, the network has yet to narrow the gap with its main rivals.

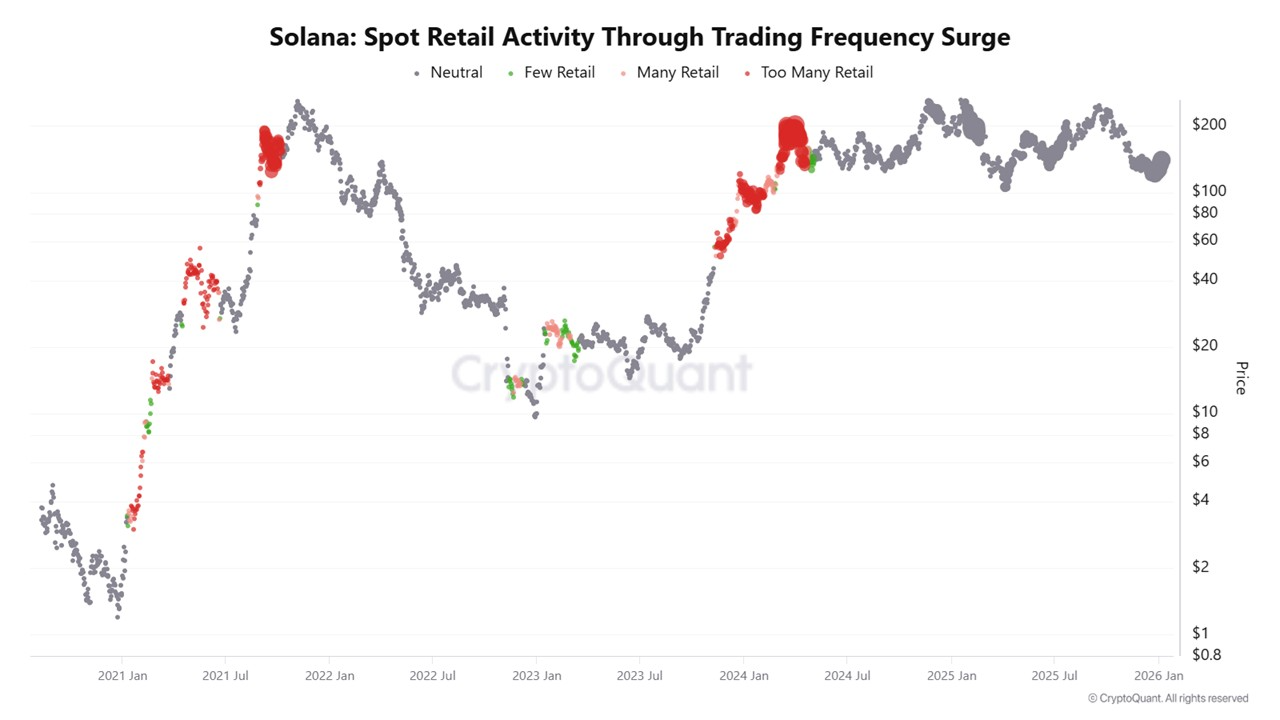

Lack of Retail Participation Has Capped Price Performance

While the growth of stablecoins and RWAs reflects surging institutional demand, spot trading data points to weak retail participation. This gap helps explain why SOL’s price has not kept pace with the improvement in on-chain fundamentals.

According to CryptoQuant’s Solana spot retail activity data, major SOL rallies in 2021 and 2024 coincided with strong retail trading activity. These periods appear as red zones on the chart.

Solana Spot Retail Activity. Source: CryptoQuant.

Exchange data, however, shows a prolonged absence of retail participation above the $100 price level over the past two years. This trend helps explain why SOL has yet to break out.

If broader market conditions change and retail investors return, their participation could align with that of institutional investors. Such a shift could trigger a new bullish cycle for SOL.