Intriguing traders who are pursuing 100x returns do not waste time on sentiment. They consider figures, facilities and time. Bonk sits at $0.00001177 with $1.04B market cap.

It is liquid, provenand established. Pepeto ($PEPETO) enters at $0.000000176, bringing fresh positioning and utility infrastructure.

When experienced traders consistently choose Pepeto over Bonk for their high-conviction 100x plays, there are specific, calculable reasons driving that decision. This analysis breaks down exactly why the smart money moves toward Pepeto.

The Mathematical Reality: How To Gain 100x Returns In 2026 ?

Start with the basics. To be 100x of $1.04B, Bonk will need about $104B of market cap. Let’s put that in context. According to CoinMarketCap, that would place Bonk above Ethereum’s current $377B, approaching Bitcoin territory. Not theory but would need market conditions never experienced to a memecoin.

Pepeto hitting 100x from $0.000000176 needs roughly $300M to $400M market cap depending on circulating supply at launch. This is less than 0.4% of what Bonk would require in the same returns. Under 15% of PEPE’s current $2.7B. The computation of the probability becomes easy. Per cent gains need exponential less capital in smaller market caps.

Arithmetic is an intuitive business issue to traders. In putting money in asymmetric returns, you desire the lowest plausible entry point and highest chances of a high growth of the market cap. Pepeto offers that combination. Bonk offers stability.

Infrastructure Comparison: Pepeto Vs Established Coins

Bonk built decent features. Basic DEX functionality is offered by BonkSwap. The supply is controlled by burning mechanism. Gaming integrations bring in certain utility. On Solana, that is a good job of a memecoin. However traders who seek 100x opportunities require over respectable. They require the infrastructure that will spur a long-term demand than speculation.

Pepeto’s platform components tell a different story. PepetoSwap optimizes specifically for memecoin trading with features addressing common pain points. The cross-chain bridge resolves practical issues of transfer of assets between networks without complexity or failure. The free exchange platform focuses on new launches of memecoin only, and it was already been appliedby more than 850 projects. That is pre-public demand of ecosystem.

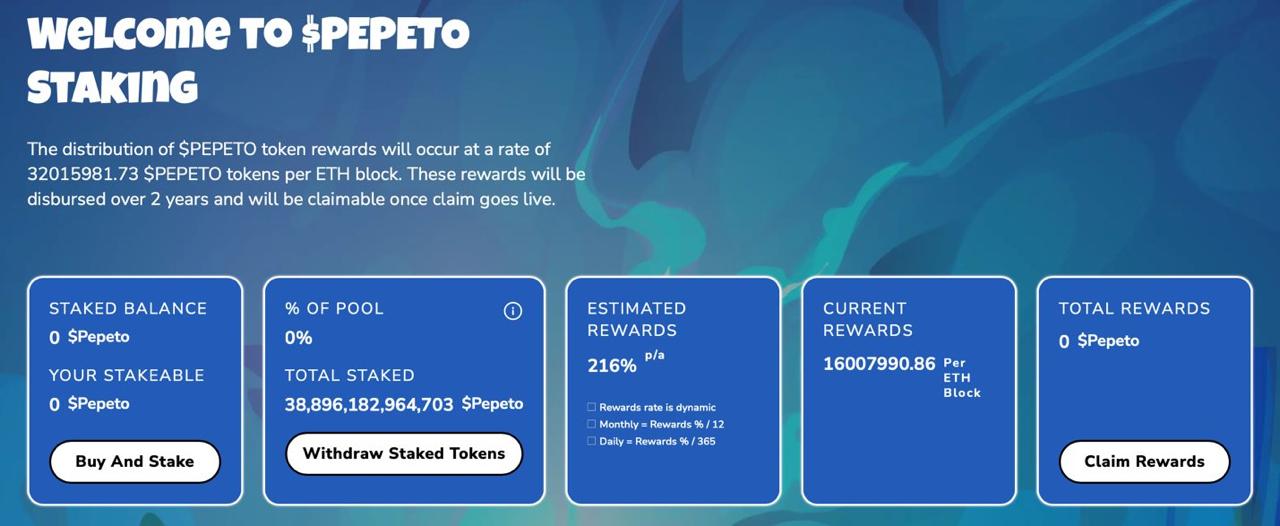

Traders especially should pay special attention to the staking mechanism. Pepeto (PEPETO) offers 216% annual yields. The early participants have an opportunity to place stake upon purchase and earn rewards. This forms game theory which is favorable to long term holders. The system mitigates the selling pressure in volatile times. Bonk does not provide similar yields on stakes, which when compared influence the conduct of the traders and commerce stability in varying ways.

Chain selection is important with respect to traders. Bonk runs on Solana that offers quick transactions but compromises DeFi composability. Pepeto runs on Ethereum, automatically plugging into the largest DeFi ecosystem. More liquidity sources. Further integration opportunities. Better alignment with current trading facilities.

Presale Performance Indicators

Presale metrics are monitored by traders. They show actual demand prior to marketing hype commencement. Pepeto has raised $7.14M during presale. The community has more than 100K+ participants. These aren’t vanity metrics. They represent thousands of individual capital allocation decisions favoring Pepeto.

The 850+ project applications for the Pepeto exchange tell traders something important. Here in particular are the projects of Memecoin that will be listed. That equates into future volume of trade. Volume drives token demand. Price appreciation is facilitated by token demand. The ecosystem demand will be in place when the platform has not yet gone public.

Compare it to Bonk post-launch statistics. This viral community coordination and just-in-time made Bonk successful. Yet that was a chance already taken. The traders aiming to get 100x returns should find similar patterns prior to its occurrence, not after.

Market Context and Timing

Bitcoin trades around $91,000 with $1.82T. Ethereum sits around $3,100 with $377.$2B. Both demonstrating power generate environments in which capital is directed into speculative ways of using it to get exaggerated returns. This macro environment is biased towards earlier stage projects and not mature ones.

The memecoin sector demonstrates sustained interest with billions in market value across Dogecoin around $25B, Shiba Inu around $5B, and PEPE around $2.7B. The category isn’t dying. It’s evolving. The projects which provide utility and meme appeal may gain market shares.

Traders recognize patterns. The attributes of successful memecoins are initial traction, expanding communities, and infrastructure building. Pepeto demonstrates all three. Bonk has illustrated them in the past. Return potential is determined by timing difference.

Accessing Pepeto Investment

Traders can access the presale through Pepeto.io. Connect an Ethereum wallet like MetaMask or Trust Wallet. The payment is by ETH, USDT, BNB, or by credit/debit cards on Web3Payments. Purchased tokens can be staked immediately to start gaining yield 216% waiting to be listed on exchange.

Conclusion

Traders choose Pepeto over Bonk for 100x opportunities because the mathematics support it. The relatively stable Bonk at $1.$04B needs 100x returns of $104B. Pepeto at $0.000000176 needs just $300M to $400M for similar gains. Beyond arithmetic, Pepeto provides superior infrastructure through DEX optimization, cross-chain bridge, zero-fee exchange with 850+ applications, and 216% staking.

The project has raised $7.14M, built 100K+ community, and operates on Ethereum for maximum DeFi compatibility. The rationale is clear when the smart-money traders play at high conviction high frequency with a project of choice chosen by them consistently across different projects. Pepeto offers what Bonk provided during its early stages but can no longer deliver at current valuations.