Ethereum trades around $3,100 with $374B, showing technical strength across multiple indicators. CoinMarketCap believes that ETH has increased adoption in Layer 2, continued use of the DeFi, and institutional investment with spot ETFs.

XRP rallied to 2.25 and $136B (before dropping down to $2 level) due to institutional products and expansion of Ripple partnership. They both exhibit bullish momentum. But mathematical reality is cold-blooded.

To provide 100x such as that received by ETH of $374B would need $37T. XRP achieving 100x needs $13.66T. Not in the long run but unrealistic in the short run 100x returns. Pepeto at $0.000000176 offers what ETH and XRP provided during their earliest phases. Superior mathematical probability combined with comprehensive infrastructure, the Pepeto giveaway, and optimal timing.

Ethereum Strength and Limitations

Ethereum around $3,100 demonstrates remarkable resilience. Arbitrum and Optimism are layer 2 solutions that can increase throughput and be secure. Billions in the total value locked, DeFi protocols keep innovating. The markets with NFTs have stabilized following the 2022 correction. Blockchain platforms are still the most active in terms of developer activity.

The adoption at the institutions increases. Spot Ethereum ETFs bring traditional finance exposure. Major corporations explore blockchain integration using Ethereum infrastructure. The switch of proof-of-stake minimized energy issues as they allowed ESG-oriented institutional participation. These basics favor the appreciation persistence.

Scenarios that are realistic in 2026 postulate that ETH will be in the range of $6K-$8K, which is about 2x-2.5x returns. That would be good performance of large capitals. However, out of $377.2B the 100x shift that would involve $37.7T goes beyond what is plausible. The explosive growth phases that created early Ethereum millionaires occurred at much smaller valuations.

XRP Institutional Momentum

The fact that XRP has travelled to $2.25 is a testament to institutional adoption. The new access channels were created through the introduction of ETF products. Recent transactions indicate that XRP investment products are recording all-time high daily inflows of more than $46M. Systematic exposure accumulation with the traditional finance proves the thesis of utility in Ripple.

The post-SEC case regulatory transparency gives other cryptocurrencies a lack of assurance. Ripple has been collaborating with financial institutions in cross border payments. The benefits of blockchain efficiency are getting more and more acknowledged by banks. The underlying scenario is a source of long-term appreciation.

Conservative estimates show that XRP will hit between $5-8, providing approximately 2x and 3.5x returns. All-time high with XRP. Of this amount, 100x is attainable at $13.66T of market capital. That is even beyond realistic capital inflow situations when the bull markets are strongest.

Why Pepeto Offers Superior 100x Upside

Pepeto (PEPETO) at $0.000000176 operates under entirely different mathematics. It would need about 100x or $300M to $400M market cap. That’s under 0.2% of XRP’s valuation and 0.1% of Ethereum’s. The calculation of the probability is self-evident. Smaller market caps require exponentially less percentage gains capital.

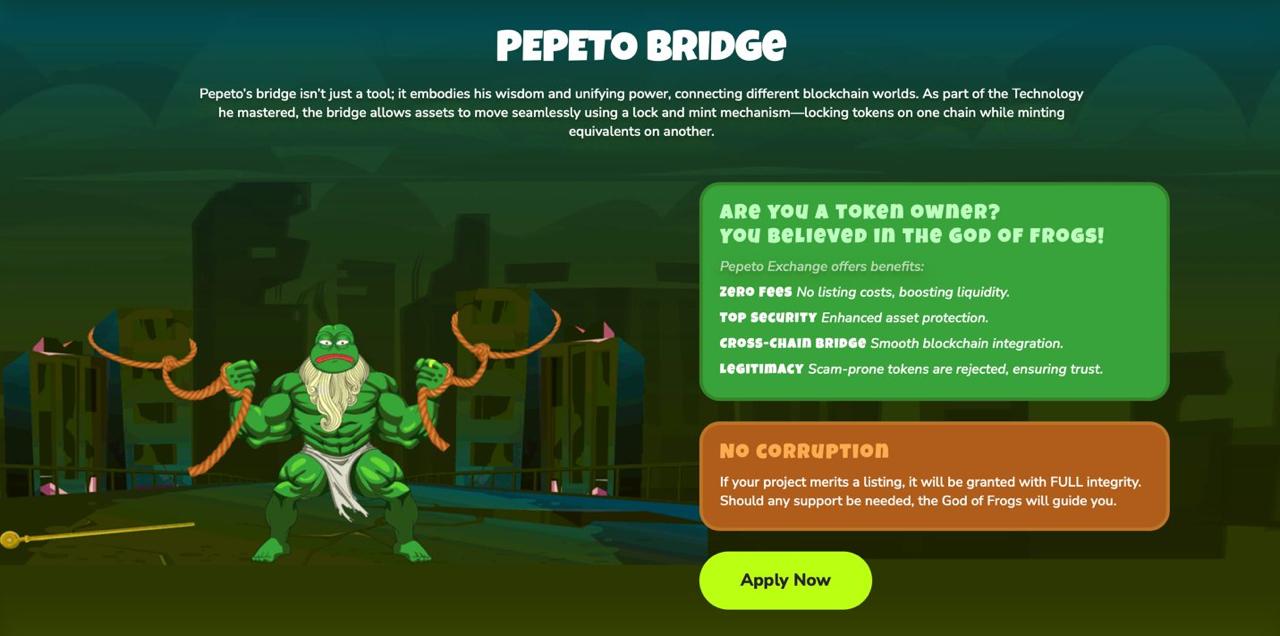

The traction of raising $7.14M pre-sale, constructing 100K+ community, as well as attracting 850+ applications to its platform, portrays ambitious targets. Infrastructure including PepetoSwap, cross-chain bridge, zero-fee exchange, and 216% staking creates sustained demand drivers beyond speculation.

Reality justifies possibility. PEPE is keeping $2.56B, SHIB has $5.13B, DOGE is at $23.7B. Memecoin category has a sustained value of tens of billions. Pepeto capturing 1% to 2% of that sector achieves 100x targets. That is no moonshot speculation. This is mathematical probability in proven category.

Complete Infrastructure Benefit

While Ethereum and XRP serve as infrastructure and payment layers, Pepeto targets specific memecoin ecosystem needs. PepetoSwap optimizes for memecoin trading specifically rather than generic DeFi. The cross-chain bridge solves fragmentation between networks in which memecoins are launched. The free exchange is offered to new project launches that have 850+ in the queue.

Operating on Ethereum at $374B provides automatic compatibility with largest DeFi ecosystem. Pepeto inherits security and established infrastructure without custom blockchain development. Such strategic advantage allows to concentrate resources on the innovations on the application layers.

Pepeto Giveaway Enhancement

The Pepeto giveaway adds dimension ETH and XRP lack. This is an automatic entry program into a community rewards program by the presale participants. The building generates more value than token appreciation. Such incentives maximize gains when the company is going through growth stages as they heighten community identification and lessen the pressure to sell.

This shows that it is highly community-building. Rather than relying purely on price speculation, Pepeto combines infrastructure development with systematic rewards. The giveaway is also a complement to fundamental thesis, which gives tangible incentives to early believers.

The Final Takeaway

Ethereum around $3,100 and XRP was at $2.25 showed impressive strength supporting 2x to 3.5x returns. But 100x gains are mathematically impossible with valuation of $374B and $136B. Pepeto at $0.000000176 offers superior probability requiring just $300M to $400M. The project has generated $7.14M in finance, constructed 100K+ community and 850+ applications on the platform.

Infrastructure including PepetoSwap, cross-chain bridge, zero-fee exchange, and 216% staking creates sustained value drivers. Pepeto giveaway rewards presale participants beyond token appreciation. With Bitcoin at $91,243.14, favorable market conditions, and proven memecoin category maintaining billions, Pepeto positioned optimally for 100x probability while ETH and XRP deliver solid but limited returns.