Solana Mobile is set to launch its SKR token on 21 January [UTC]. This marks the next phase of an experiment that goes beyond hardware and into network-level adoption.

After the conclusion of its first Seeker Season, the SKR launch will test whether mobile-first distribution can translate into sustained onchain activity — and, by extension, long-term demand for the Solana network itself.

Seeker Season, which concluded this week, garnered participation from over 100,000 users across 265 decentralised applications. It generated roughly 9 million transactions and $2.6 billion in volume.

Source: Solana Mobile/X

While the campaign demonstrated Solana Mobile’s ability to attract users and developers, SKR is designed to answer a more difficult question: whether that engagement persists once incentives move from campaigns to protocol-level economics.

From distribution to retention

Seeker Season functioned primarily as a measurement phase, giving Solana Mobile a data-backed view of how users interact with onchain apps in a mobile-native environment.

The SKR token introduces the mechanism intended to keep that activity anchored to the network.

Rather than positioning SKR as a standalone asset, Solana Mobile has framed it as an incentive layer for ongoing participation across its app ecosystem.

That design choice matters for Solana because sustained mobile usage would translate into more transactions, higher fee generation, and stronger developer demand.

Solana SKR tokenomics signal a user-heavy launch

SKR’s tokenomics suggest an emphasis on early user participation rather than tight initial supply control.

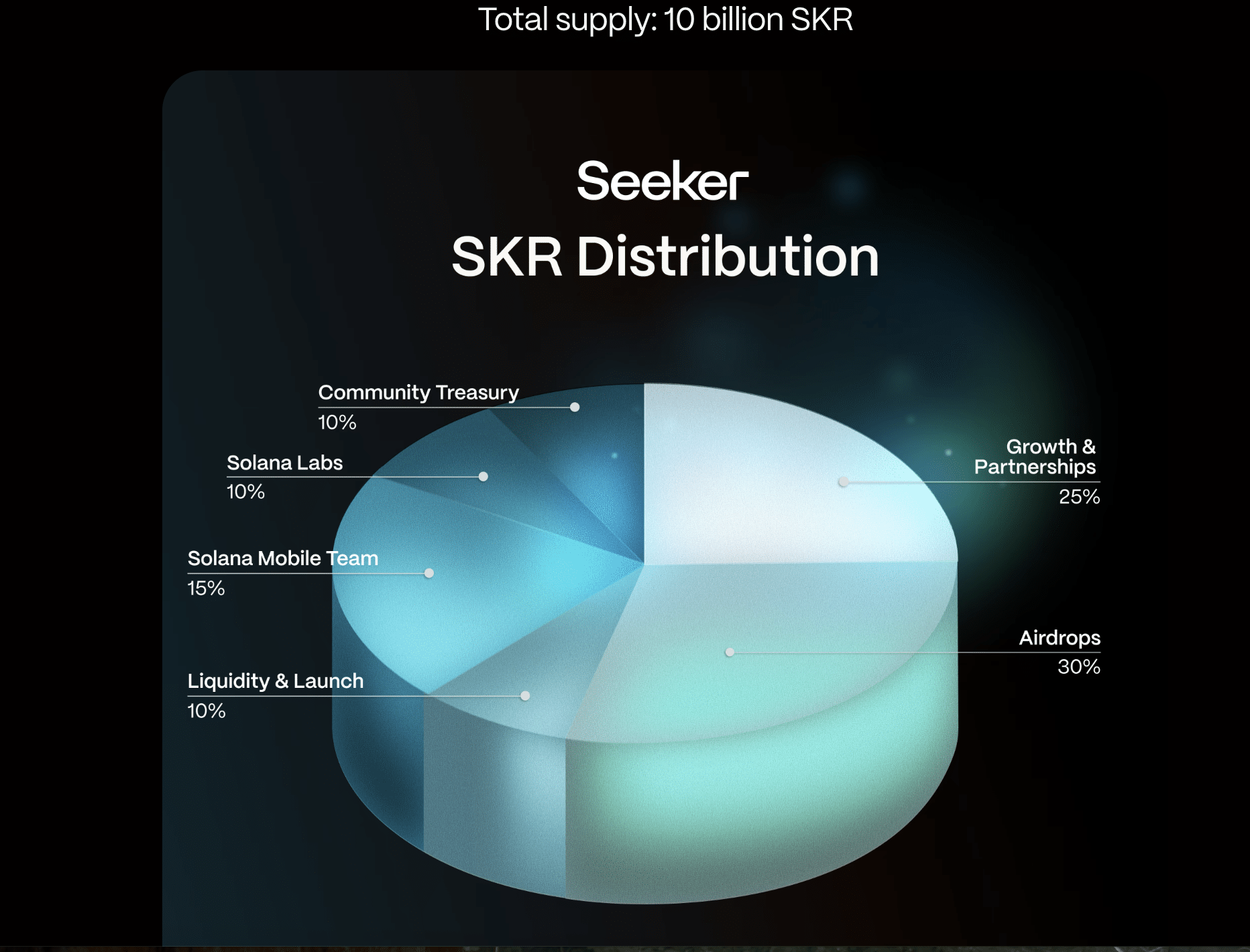

Of the 10 billion total SKR supply, 30% is allocated to airdrops and unlocked at launch, with a further 10% reserved for liquidity and launch-related purposes.

Source: Solana Mobile

Together, that places roughly 40% of supply into circulation from day one, largely through user-facing channels.

By contrast, allocations to the Solana Mobile team [15%] and Solana Labs [10%] are subject to a 12-month cliff followed by a 36-month linear vesting schedule.

Growth and partnerships account for 25% of supply. Only a portion is unlocked at launch, and the remainder will be released linearly over 18 months. The community treasury, which holds 10%, is unlocked but governed onchain.

Inflation designed for early engagement

SKR also employs a linear inflation model aimed at bootstrapping participation before tapering toward longer-term sustainability.

Inflation starts at 10% in the first year, equivalent to 1 billion SKR, and decays by 25% annually until reaching a terminal rate of 2%.

This approach front-loads incentives to encourage early engagement while limiting perpetual dilution over time.

For Solana, the implication is that early transaction growth is explicitly rewarded. However, the system is not designed to rely indefinitely on high emissions to sustain activity.

Why this matters for Solana

The significance of SKR lies less in the token itself and more in what it represents for Solana’s growth strategy.

If SKR succeeds in keeping Seeker participants active across Solana-based applications, it would strengthen the network’s usage profile. Also, it would reinforce SOL’s economic role.

If activity fades once early rewards are absorbed, it would underscore the limits of token-driven engagement, even with hardware-level distribution.

What to watch after launch

The weeks following SKR’s launch will be critical.

Metrics to watch include whether transaction volumes remain elevated, whether participating dApps retain users beyond initial incentives.

Also, whether new applications continue to onboard through the mobile channel.

Rather than price action, the telling signal for Solana will be whether mobile-originated activity becomes a durable source of onchain demand.

Final Thoughts

SKR’s launch turns Solana Mobile’s Seeker Season from a one-off campaign into a live test of whether mobile-first distribution can deliver durable onchain activity.

The outcome will matter less for SKR’s price than for Solana’s ability to convert consumer usage into sustained network demand.