HIGHLIGHTS

ZKJ token price crashed over 83% in hours, wiping out nearly $500M in market cap.

Abnormal on-chain transactions and whale-driven liquidity withdrawal crashed the ZKJ and KOGE.

The upcoming 15.5M ZKJ unlock and allegation of pump and dump could crash the Polyhedra token further.

The Polyhedra Network token ZKJ price crash has left the crypto industry awestruck as it lost almost $500M in hours. CoinMarketCap reports revealed that the token plunged over 83% on June 15 and bottomed at $0.3073, creating an all-time low. The impact of which resulted in wiping out millions from its market cap and liquidity. Let’s discuss what went wrong.

Why did Polyhedra’s ZKJ Token Price Crash Today?

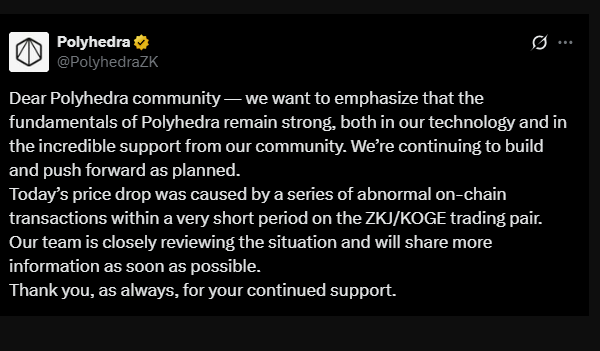

The ups and downs are nothing new for investors, and just days ago, the entire crypto market crashed, wiping out billions in liquidation. However, the Polyhedra’s ZKJ token price crash is not directly part of that. Polyhedra claims that a series of “abnormal on-chain transactions” caused the crash.

According to the official announcements, a series of uncommon transactions involving the ZKJ/KOGE trading pair triggered the mishap. Binance claims it to be a liquidity cascade, where the larger holders pull tokens out from the liquidity pool.

As a result, the Polyhedra token collapsed 60% (from $1.92 to $0.076) within just one and a half hours around 2:32 UTC. The crash continued and even made a recovery in between, but cracked again. It is currently trading at $0.3322 after an 83% crash with the market cap at $92.28M. From its prime, the token is down 91%.

Breakdown of ZKJ Token Price Crash

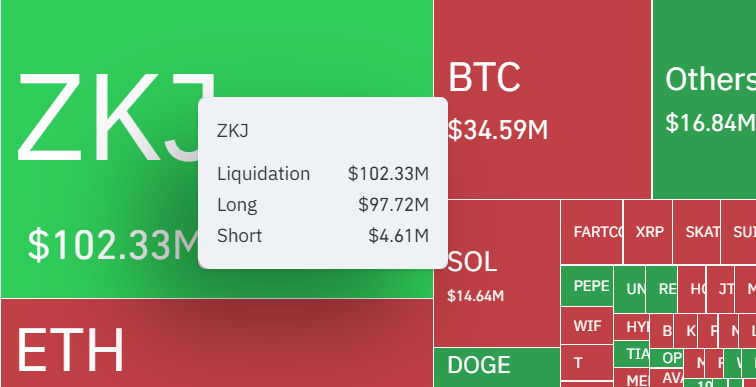

An on-chain analytics platform, Lookonchain, reported that six whales dumped 5.23M Polyhedra token, initiating the crash. These whales first withdrew liquidity from ZKJ and KOGE, and swapped the latter for ZKJ before mass dumping it. Along with the liquidity drain, $102M was lost in liquidation.

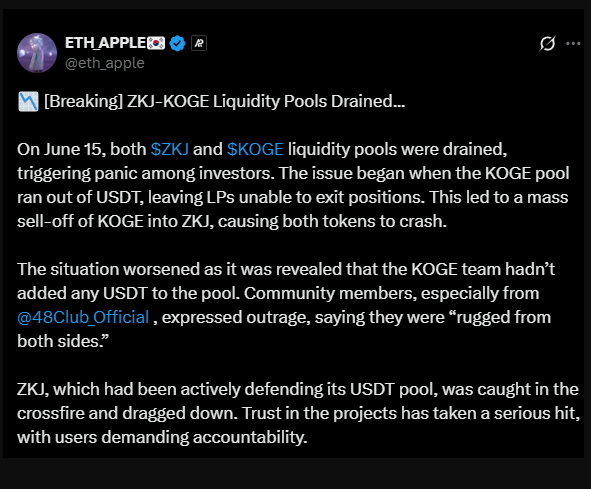

Notably, the KOGE token price also crashed with the ZKJ. ETH APPLE on X claimed:

“The issue began when the KOGE pool ran out of USDT, leaving LPs unable to exit positions… This led to a mass sell-off of KOGE into ZKJ.”

CoinGlass liquidation data reveals that $97.72M longs were liquidated along with $4.61M shorts. Six traders lost $1 million each, and the remaining holders faced significant losses.

The crypto community also associated the upcoming token unlocks as the driving reason behind the crash; others alleged that it was a planned pump and dump.

What’s Next?

Such a massive crash has left holders in shock. While some await recovery, others fear further downfall amid the upcoming token unlocks. A 15.5M ZKJ unlock is scheduled for June 19, which could create massive selling pressure, crashing the crypto price further.

Besides, the image of the platform is under scrutiny. If not fixed, it could create long-term damage. However, no official resolution has yet been revealed, so uncertainty around this token is higher.